School was supposed to be back in session today, but we found out last night it was cancelled. Although some districts across the country have gone back to virtual learning, our school district cancelled school due to a "winter storm warning", not the result of COVID concerns. This is our 5th winter in Virginia after 20 years in Arizona. Growing up in Colorado I still have to laugh how the whole state will shut down due to the threat of 1-5 inches of snow.

It would be hard to blame schools for wanting to show a little caution. Our church went to virtual services this past weekend because so many staff members and volunteers were sick. Many with COVID, but others with severe colds, flu, and other illnesses. It's hard to find families who weren't sick the past few weeks (including ours). With our older kids, doctors encouraged us to take our newborns out in public as often as possible after leaving the hospital. Their logic was to expose their immune systems to the wide range of viruses out there as soon as possible. When the twins were born, the guidance had shifted to protecting newborns by not taking them out in public for several months.

I'd venture to guess the broad swath of illnesses is the result of our immune systems getting weak and now that it is winter, we've been indoors with large groups of people, and most of us are fatigued with all the COVID precautions our immune systems are getting hit from all sides. We'll let the data tell us whether or not this will have more intermediate-term impacts.

As one of our twins said yesterday, "welp, we're in the third year of the pandemic. Hopefully it's the last one."

This marks the third year of "Monday Morning Musings". To start the year, we'll return to its roots – a random dump of things that came up as I prepared for the week ahead. I apologize for the length, but there is a lot of data to sort through this morning! I did try to include quite a few charts to make it easier to digest.

A great, but volatile year for stocks

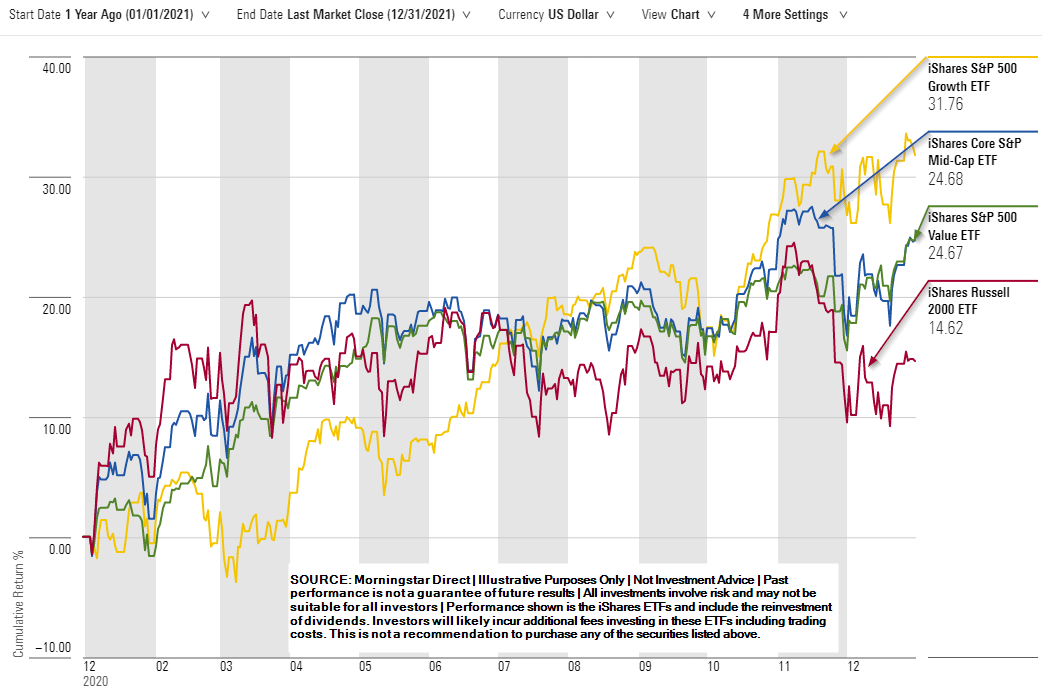

In 2019 & 2020 we pointed out how "narrow" the stock market was, with the bulk of the returns coming from just a small fraction of stocks. Large cap growth was the place to be. Any sort of diversification or risk management hurt. Looking at the final 2021 numbers, this was again the case. What made the year especially difficult was the hard rotations we saw out of large cap growth and into those "unloved" segments during the year and then a rotation back the other way.

These rotations did cause some difficulties with our "core rotation" systems which are designed to rotate to areas of strength. Despite this, our 'strategic' growth models, which include risk management strategies to take money off the table when the market turns both had very strong years. The estimated performance for both AmeriGuard-Growth and Cornerstone-Growth is for returns over 20% (after all fees). For comparison the Vanguard Total World Stock Market index fund was up 18%. The Vanguard LifeStrategy Growth index fund was up just 14%.

We prefer using these broader based funds as benchmarks as they represent a truly diversified portfolio. As we've mentioned countless times the past decade, as fiduciaries we cannot justify having the very high allocations to a handful of stocks for very many of our clients. The risks are simply too high.

Don't get used to this

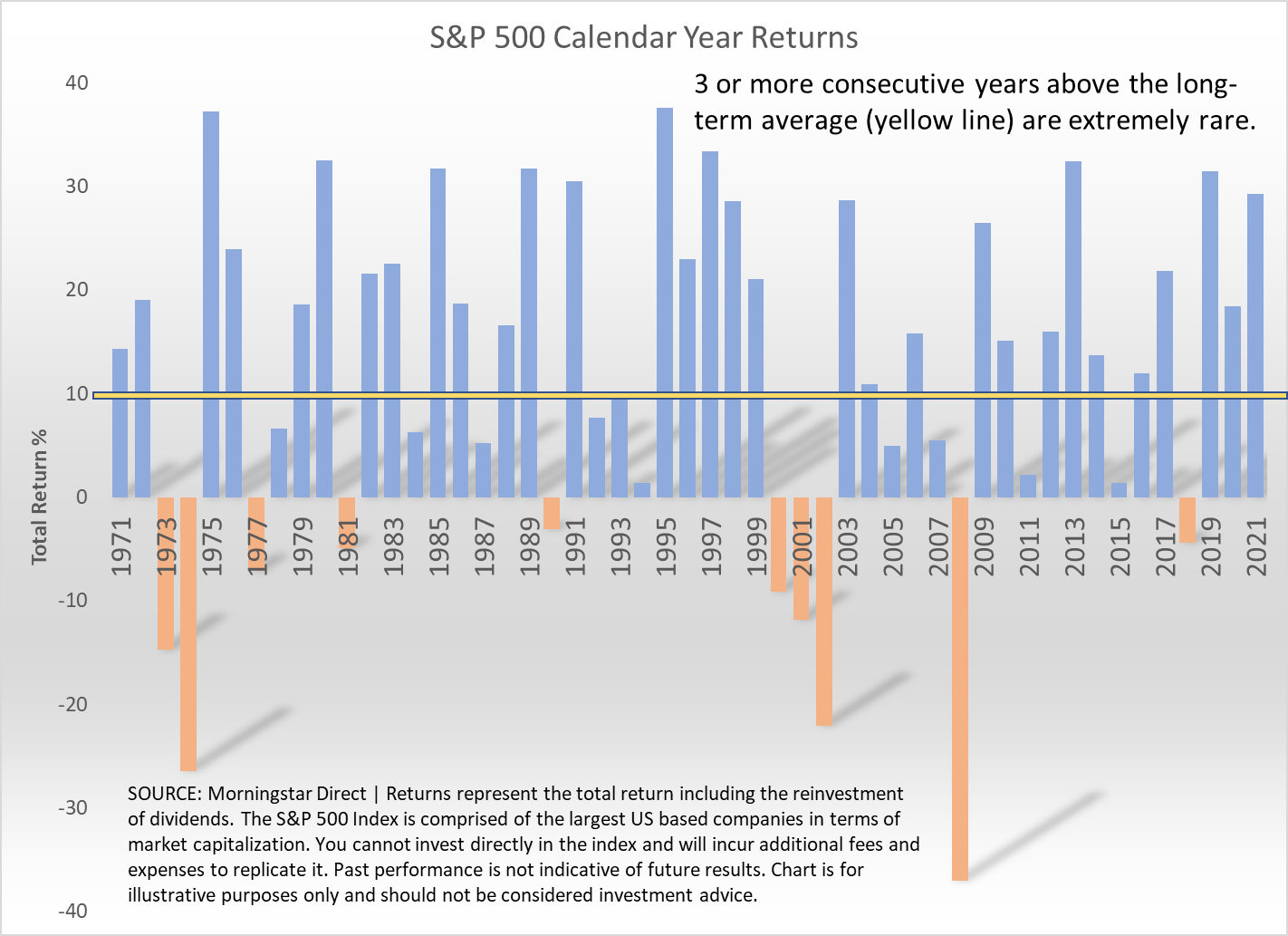

Our quarterly newsletter posted this morning (click here to read it). One of the online bonus content articles showed this chart.

Regardless of what happens with the economy this year a fourth consecutive above average year is not as likely as a below average (or losing year). The market is a mean-reverting mechanism meaning that the more time it spends above the mean the more likely we're going to spend time well below the mean. At a minimum a rebalance of your portfolios back to your target allocations is probably mandated. I'd also encourage people to look at their overall risk tolerance levels. Just because stocks have had a solid three years doesn't mean it's going to continue.

A tough year for bonds

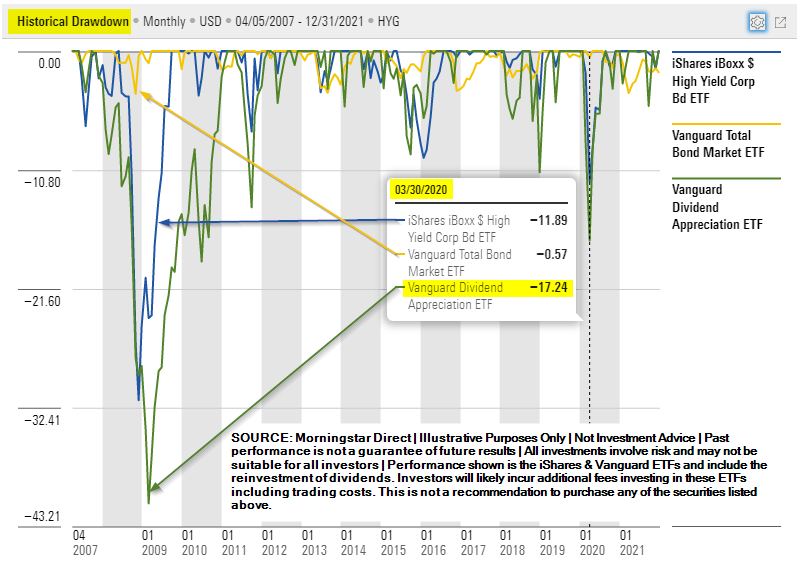

For over a decade I've heard financial experts advise dumping bonds and using dividend stocks for income. Their argument was interest rates were so low bond yields had to rise, which would cause large drops in bond prices. In 2021 they were finally right. With the Aggregate Bond Market Index losing 1.6% for the year and dividend stocks gaining more than 20%. I've countered their argument for the past decade by reminding everyone who will listen the risks and overall role in the portfolio for these two asset classes are completely different.

Simply looking at the drawdowns it is easy to see the tremendous risks you take when you reach for income using high yield bonds or dividend stocks. Even in the quick sell off in March 2020, the role of bonds is clear – to provide a buffer from losses. It is especially clear when you look at the 2008 financial crisis losses. You don't want a portfolio where everything goes up and down at the same time.

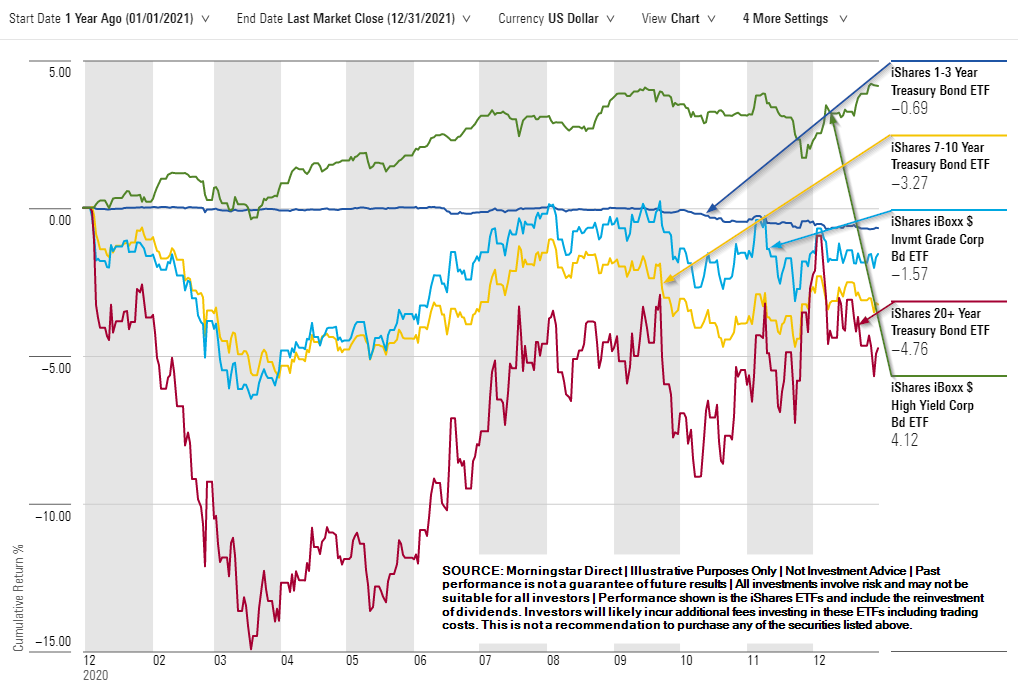

Turning to just the actual bond market, we can see the huge difference and volatility in bonds. The bond sector ETFs are ranked from least to most risky (in terms of volatility). High yield "junk" bonds, which can lose over 20% during a downturn had the best returns at a little over 4%. Every other sector was negative.

For our part, our actively managed bond models all posted positive returns. Cornerstone Bond & Income, which have a narrower investment set due to their Biblically Responsible Investment (BRI) mandate had the strongest year (up an estimated 3% & 8% respectively. The rest were up between 1-2% net of all fees. While we do not enjoy highlighting "relative" performance the fact our income models were up in a down year is something we are pleased with.

[It should be noted we have a 'Core-Bond' model which was set-up for some of our advisors seeking a more tax friendly, less active portfolio to assist with financial planning needs. It was down for the year, but less than the overall bond market.]

Combining our "growth" and "income" models into a typical 60/40 "balanced" portfolio would have resulted in estimated returns net of all fees of 13% (+/- a few tenths.) By comparison, the Vanguard LifeStrategy Moderate Growth portfolio was up 10%. Again, given our risk focused mandate these are results we are quite pleased with.

Are there opportunities in bonds?

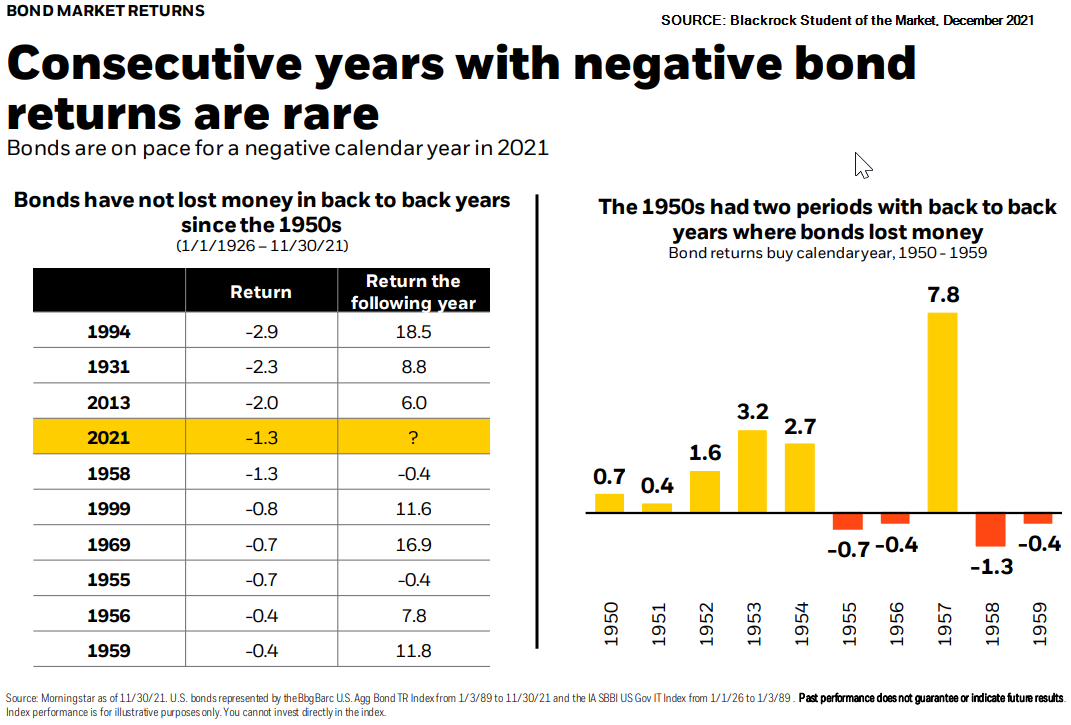

In our quarterly newsletter we shared some research from Blackrock regarding losing years for the bond market. Their data shows back-to-back years of negative bond returns are extremely rare.

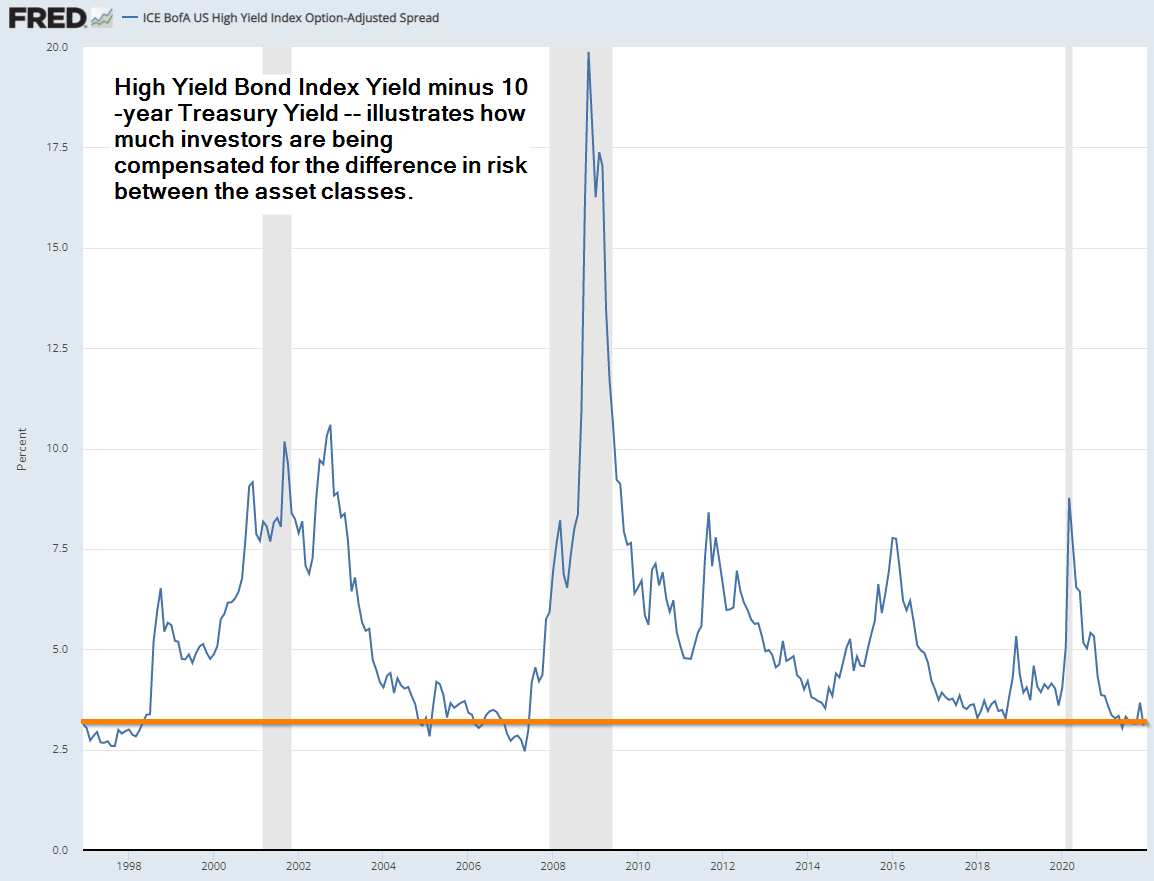

On the other hand, the spread between High Yields & Treasury Bonds is getting close to historic lows. This doesn't mean high yield bonds cannot rally, but it does mean the risks are much higher for this segment of the bond market.

High yield bonds have a much higher correlation to stocks than bonds. The overall bond market can and will have positive years even when high yields are down. This most often occurs when the economy stumbles. Again, at a minimum this would be a great time to rebalance your portfolio back to your original mandates.

What about the Fed?

One of the biggest concerns of 2022 will be what the Federal Reserve does to reign in stimulus. Many people falsely believe that the Fed raising interest rates will be bad for bonds, but historically this has been incorrect. Too many times the Federal Reserve raises short-term rates too far, too fast which causes the economy to slow down. This leads to long-term rates to actually fall while short-term rates rise. A sharp rise in short-term rates could derail the economy enough to also cause a sell-off in high yield and other riskier bonds.

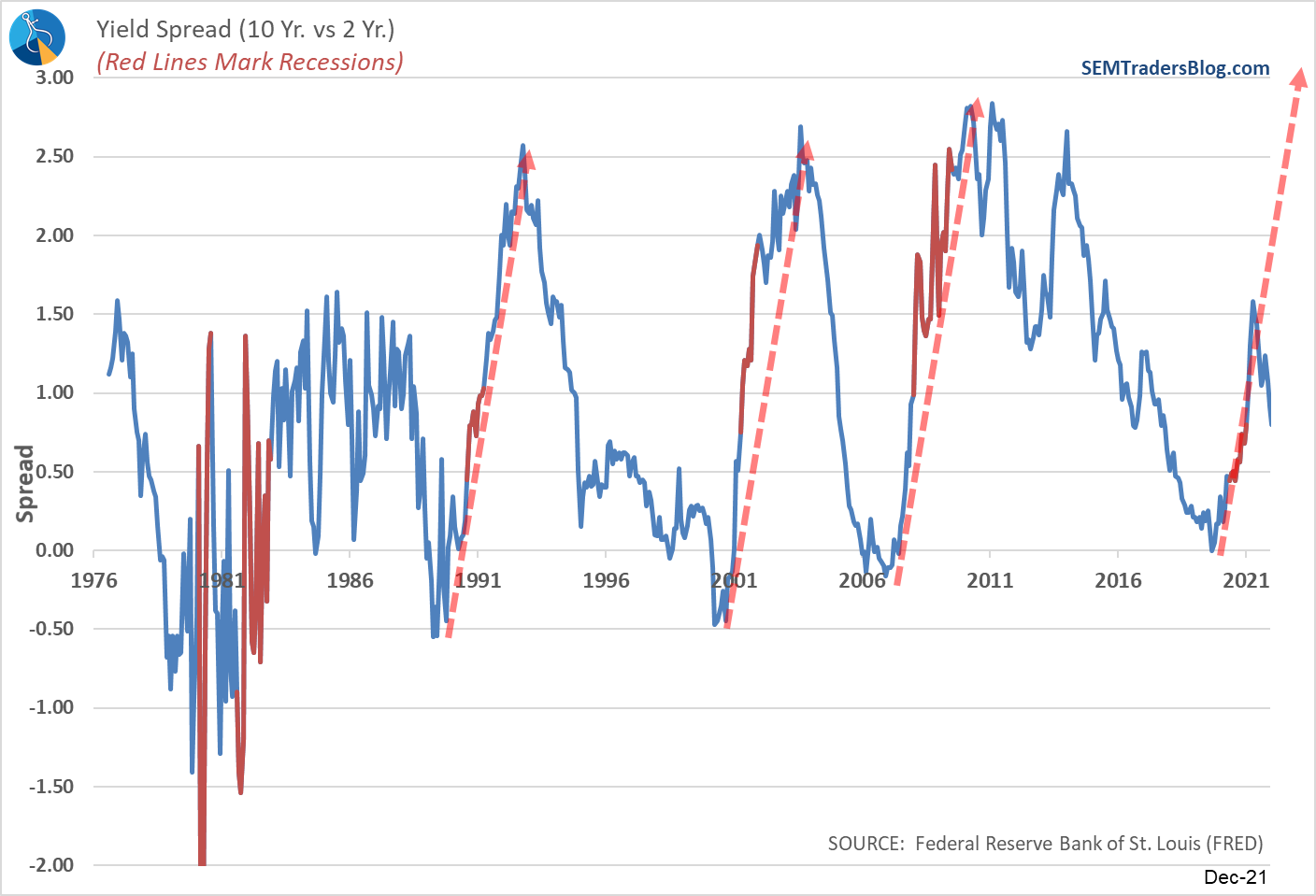

I shared this chart at the beginning of 2021 showing the 10-year to 2-year yield spread. I also drew a line showing the huge spike we typically saw during the expansion cycle. The fact we are already seeing the spread decline is a warning the Fed may once again be raising rates too fast and too soon. Time will tell.

Economic Questions

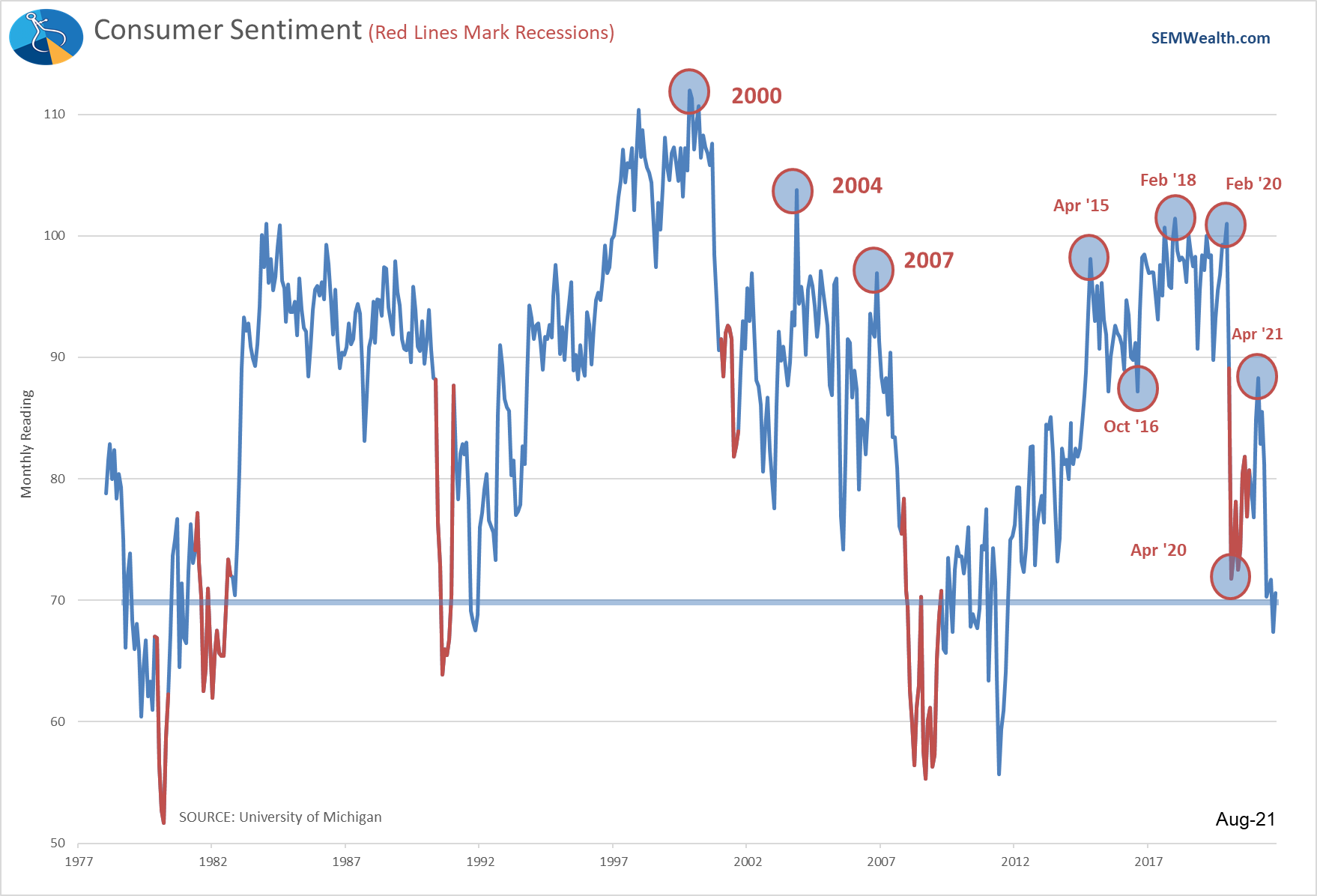

On Friday we'll get our December economic model updates. The model shifted to neutral in October and literally could go either way (or stay the same). We've mentioned one of the key indicators over the past few months has been Consumer Sentiment. It has risen off its lows, but still remains below the depths of 2020.

I also highlighted this chart in our Newsletter.

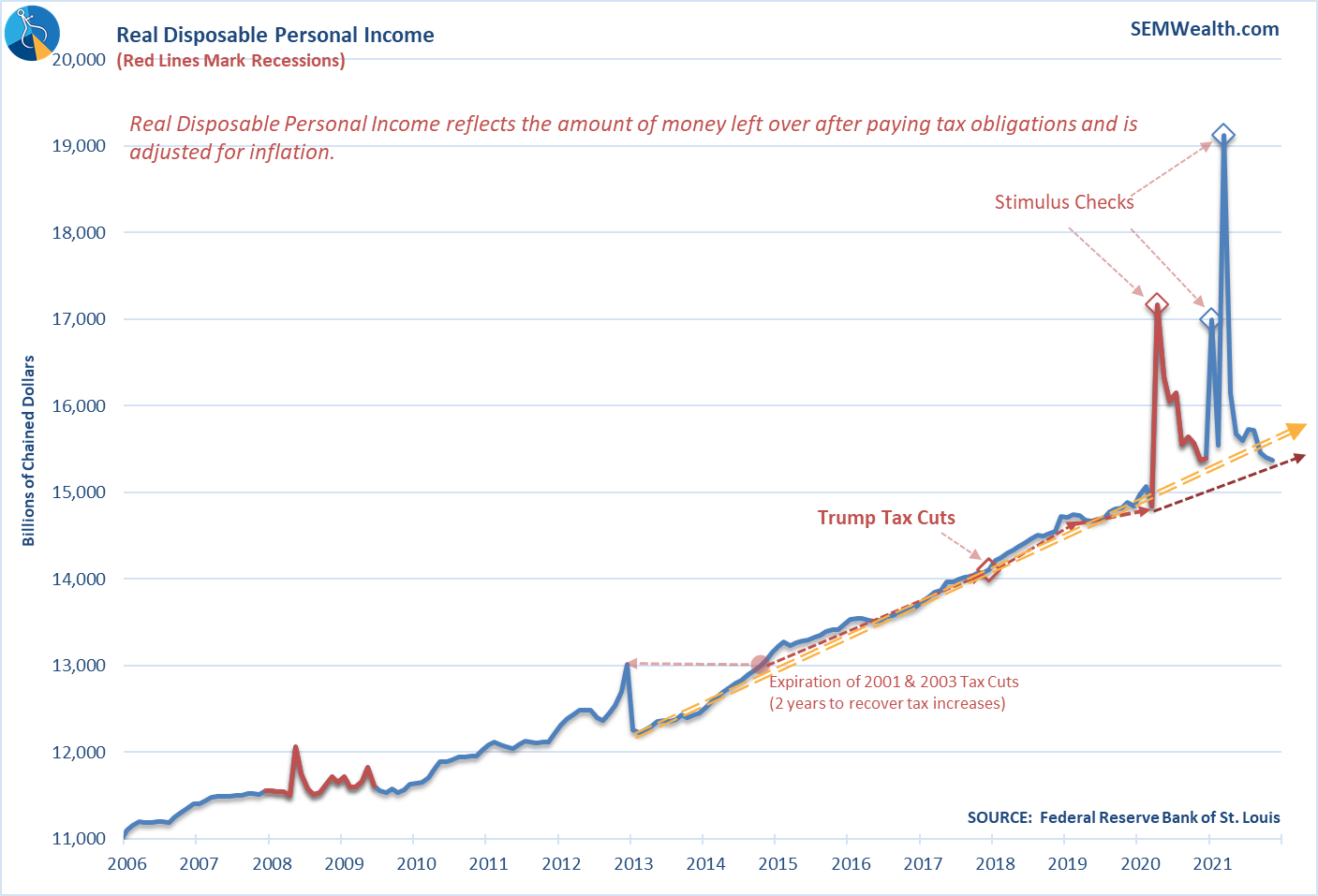

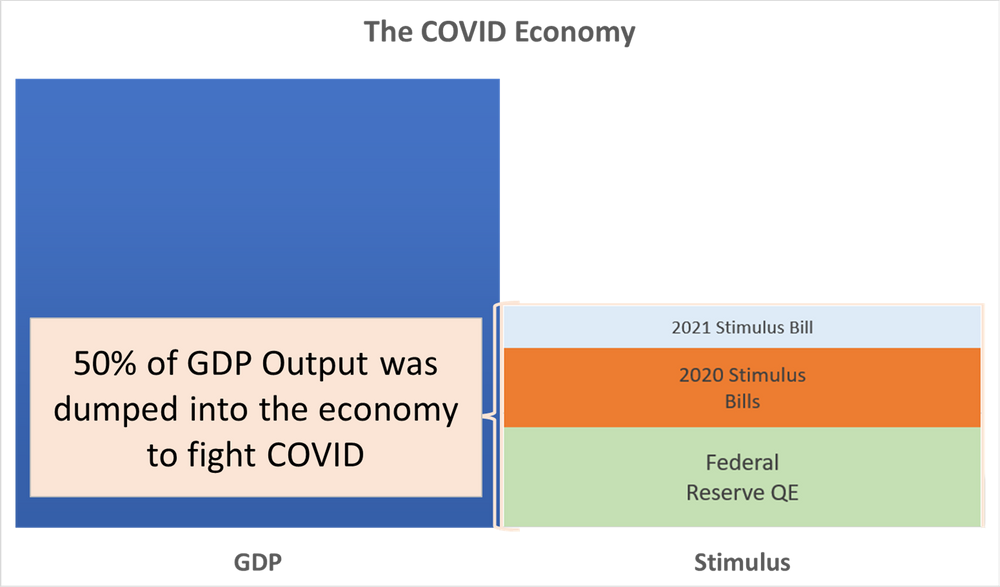

I think the story of 2022 will be whether or not the economy can actually stand on its own. I've said for several months the spike in inflation is likely temporary and the result of the unprecedented and previously unimaginable amount of money dumped into our economy.

According to the academics the economic concept of stimulus is to "jump start" a stalled economy. The purpose is to get it going enough to let the engine run long enough to charge itself. Unfortunately, if you watch how the stimulus was put together, I think too many of our "leaders" followed this advice.

I've argued that the "solutions" could create much bigger problems, especially given how little the leaders actually understood what was happening inside the economy.

30 Years and Counting

SEM is entering our 30th year. One of the key reasons behind our success has been our ability to focus only on the data. Our opinions do not factor into our investment decisions. We study market history to determine what indicators matter and which ones are simply noise. This doesn't mean every indicator is right nor does it mean we have it all figured out. We invest heavily in on-going investment research and are constantly looking for ways to improve.

Another key to our success is our broad line-up of investment models. Each is designed to overcome the natural behavioral tendencies we all have at times. Over the very long-term we believe the stock market will continue to move higher. The problem is market history has shown us very few people have the ability or willingness to withstand the swings the stock (and bond) market will go through during each cycle.

Regardless of what the year ahead looks like, we plan on being here watching the markets on a daily basis so our advisors and clients can focus on other things.