The Year Everything Went Right

This is the time of year where we will see a plethora of summaries about the past year along with predictions on what we should expect in the year ahead. SEM has always taken the stance that these exercises serve little purpose and typically do more harm than good. Over the shorter-term stocks go up when more people buy than sell and go down when more people sell than buy. Human behavior takes over during these shorter periods of time and can lead to large moves that seem to defy logic (even though the financial “experts” will attempt to find reasons to justify the moves).

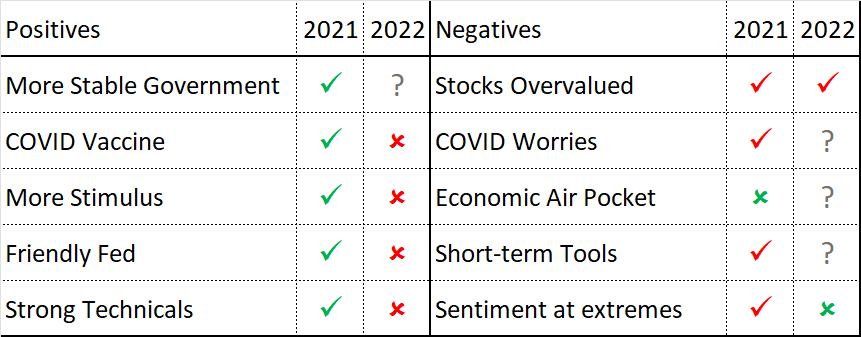

Over the intermediate to longer-term stocks will track the overall trend in economic growth. The short-term fluctuations are often the result of market participants trying to get ahead of the economic trend. At the end of 2020 we put together a list of potential positives and negatives which could impact the market in 2021. We looked back at this in the Traders Blog at the end of December (go to tradersblog.semwealth.com/mmm2-50 for the full discussion). Pretty much everything that could have gone right in 2021 did, enough so to wipe out the negatives. Looking ahead to 2022 it is not as easy to see many positive catalysts, but it is clear there are a lot of negatives stocks will have to overcome. This doesn’t mean stocks cannot continue to rally. It does mean it will be harder to justify chasing stocks without strong economic growth to support the already high prices.

At SEM we spent most of the year close to maximum investment. This led to a solid year for all of investment models which utilize stocks in their allocations (see ‘What about bonds?’ on the next page for the rest of the story.) We ended the year close to maximum invested across the board. The key difference is we can adjust rather quickly should the negatives lead to more sellers than buyers.

Can the economy stand on its own?

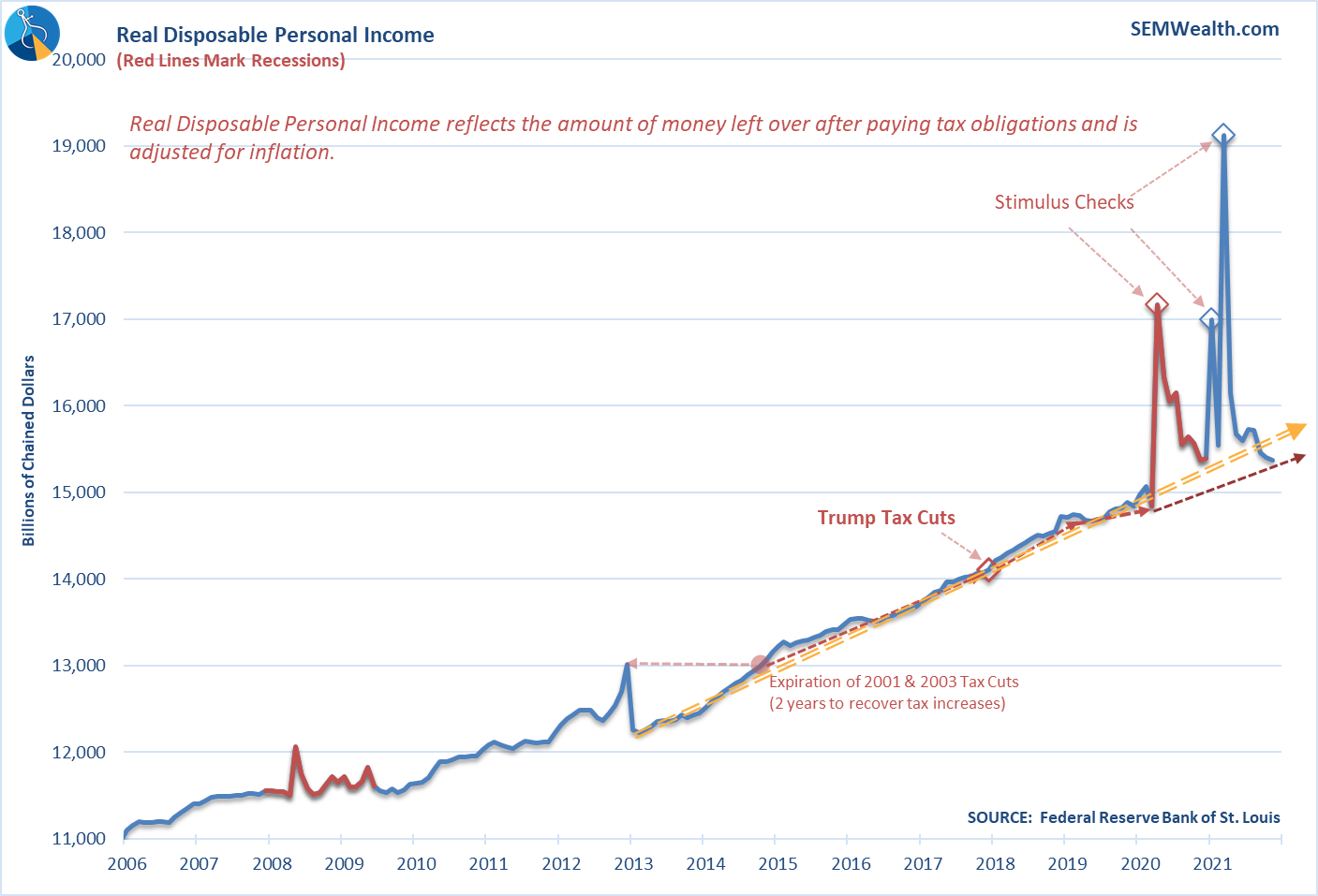

It is easy to forget the unprecedented steps Congress and the Federal Reserve took to boost the economy during the pandemic. Going into 2022 not only are we not likely going to see any more stimulus, the Federal Reserve has said they plan on pulling back theirs.

The question will then be whether or not the economy can stand on its own. One indicator we are watching closely is Disposable Income. The orange line on the chart below shows it is now running BELOW the trend going all the way back to 2015. If Disposable Income growth slows, consumer spending and thus economic growth will likely follow.

What about bonds?

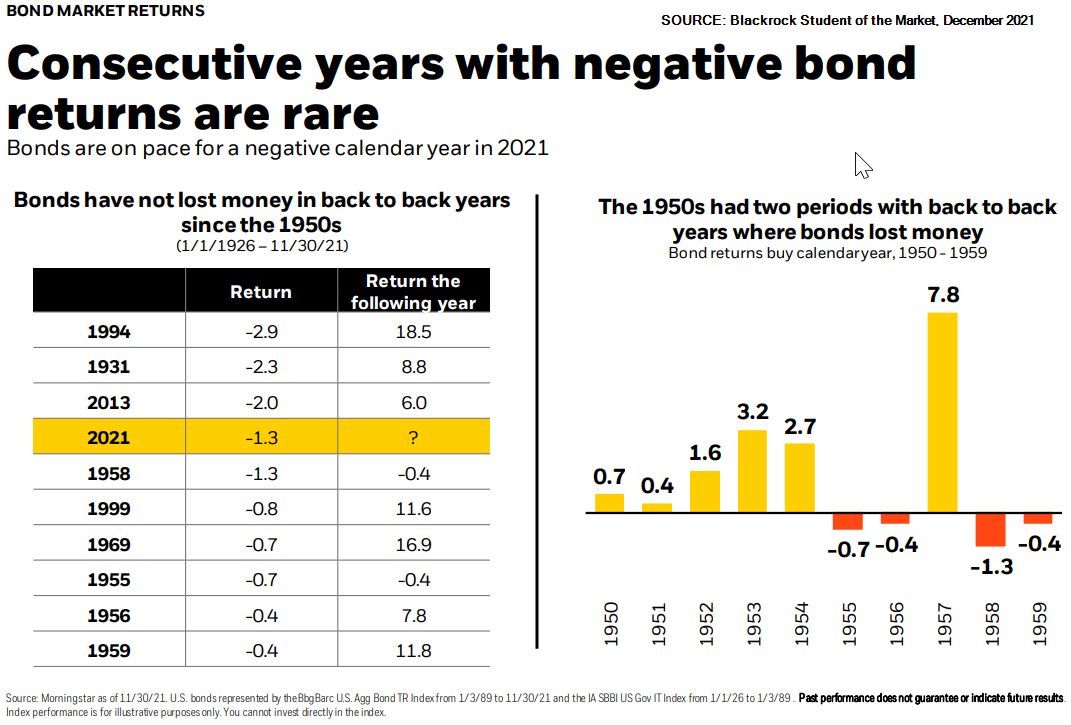

Following a third consecutive above average year for stocks, many investors may be asking themselves, “why even bother with bonds?” The Barclay’s Aggregate Bond Index ended the year with negative returns. While SEM’s actively managed fixed income based models finished ahead of the overall bond market we understand years like 2021 lead to questions about the role these models play in a portfolio.

First, we must understand most investors cannot stomach a 35-50% drop in their investment portfolios which will occur at times if you only invest in stocks. Therefore, other assets need to be used to lower the risk in the overall portfolio. Secondly, bond returns often move in opposite directions of stocks. This provides a nice buffer when stocks decline. Finally, as shown in the table to the right, it is quite rare for bonds to decline for two consecutive years.

When investing it is important to not let the recent past influence our decisions. The recent weakness in bonds could be an opportunity to readjust portfolios that may be significantly overweight stocks.

Subscribe to TradersBlog.SEMWealth.com for more details on economic developments in the months ahead and how we are positioning our portfolios.

Bonus Content: Can the streak continue?

[Due to space limitations the following did not appear in the printed version of this quarter's newsletter.]

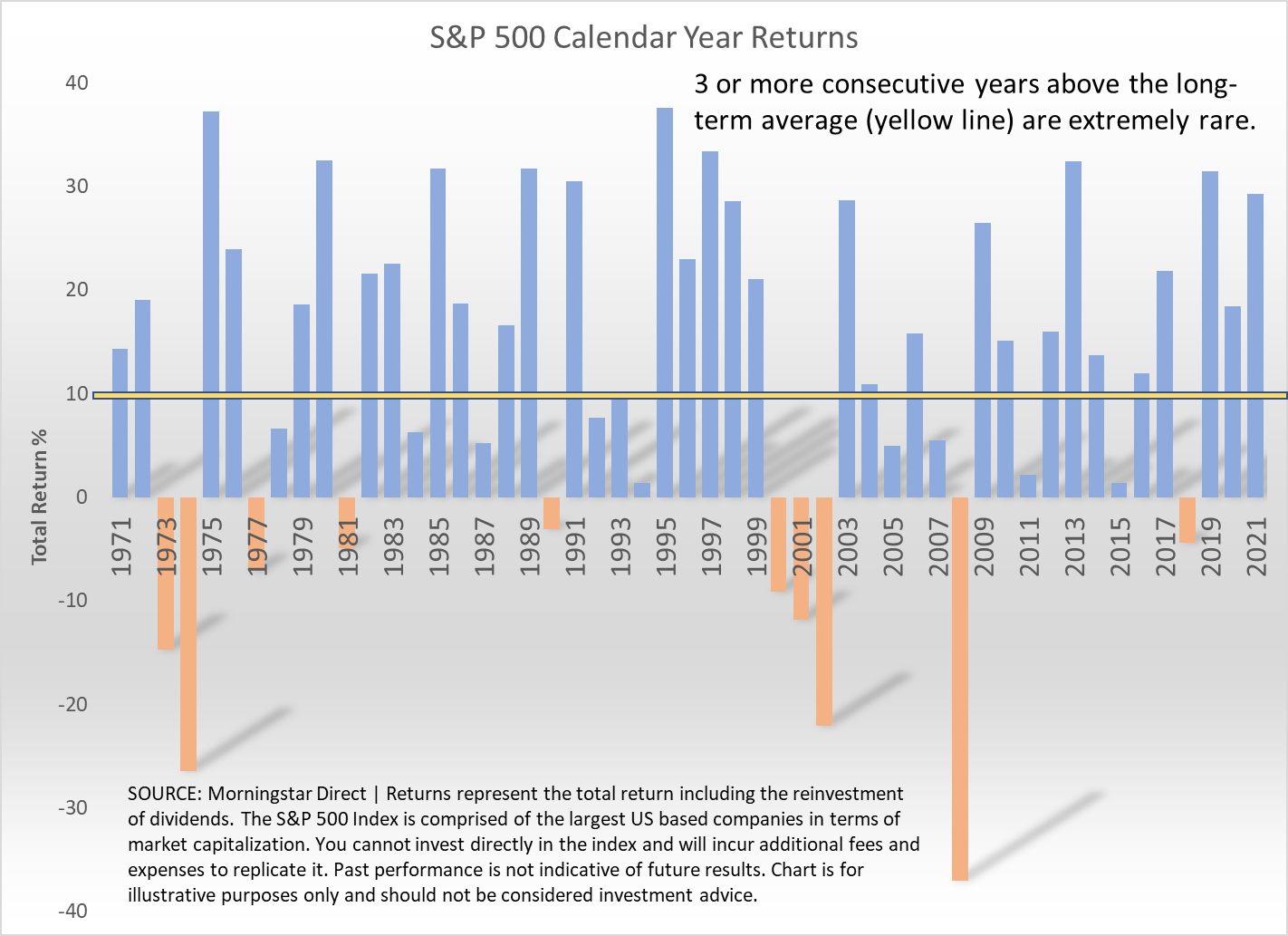

Stocks have had an impressive 3-year run, even with the temporary drop during the early weeks of the COVID panic. Stocks have posted returns twice as high as the long-term average each of the past 3 years. This is extremely rare. Over the last 50 years the S&P 500 has only exceeded its long-term average 3 years in a row twice. In the mid-1990s the S&P 500 went on to enjoy two more years doubling the long-term average (before going through a 3-year crash). The three-year streak from 2012-2014 was ended with a break-even year in 2015 as the Federal Reserve worked to unwind their Financial Crisis stimulus programs.

Whatever happens next, it is clear investors need to not become accustomed to the returns we've enjoyed the past three years. Regardless of what happens to the economy, stocks are due for a below average or even a negative year.

News & Notes:

2021 Year-End Tax Statements—what to watch for early 2022:

For taxable accounts, federal law requires your custodian to mail your IRS Form 1099 to you by January 31. Due to the increasing amount of reclassified mutual fund distributions, Axos Advisor Services has had this extended to February 15, 2022.

SEM strongly recommends you do not make your tax appointment until after February 15.

The 2021 Consolidated 1099 mailings to you includes cost basis and sales proceeds for investments sold during 2021. This provides essential information needed to complete your Federal Tax Filing Form 1040 Schedule D and Form 8949. Please wait until you receive Axos’s 2021 Consolidated 1099 prior to completing your taxes.

For those clients that consolidated taxable accounts from another custodian to Axos, you will receive forms from both custodians.

SEM will be posting additional information on the tax reports on our website:

SEMWealth.com/tax-information

Download / Print version of the newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.