I'm not sure where 2021 went. Plenty will be written this week and next in the various financial publications about the year, with plenty more written about what the next year will look like. I won't waste your time looking at either of those things this week. One because a lot of that is a wasted mental exercise. More importantly, very few of our advisors are working this week so I know not many people will be seeing this blog.

I think as we close out the week it's important to keep in mind over the short-term stocks go up because more people buy than sell. That's what happened in 2021. There was plenty of excess money floating around and everyone (mostly) felt good about the rapid return to "normal" our economy was experiencing. This can quickly reverse, especially when you consider over the intermediate-to-longer-term stocks go up and down based on the trends in economic growth.

A few weeks back I re-visited a list I made at the end of 2020 which looked at what could go right and wrong in 2021. Pretty much everything I thought could go right did – enough to wipe out any negatives from the "bad" side of the ledger. It was easy to make the positive list a year ago.

Click here for the full discussion of the table above.

Going into 2022 I'm having a hard time finding things that can get even better. This doesn't mean stocks can't shoot higher once again. Momentum, the fear of missing out, and general greed can drive stocks higher far longer than it makes sense to those who study economic fundamentals. I've done this for 25 years and have lived through enough of these manias to know you cannot fight them.

I've also done this long enough to know when the mania ends it is often when market participants realize it is virtually impossible for economic growth to justify the valuations in the stock market. After 20 months of unprecedented stimulus, it is clear we are going to see how strong the economy is as the Federal Reserve pulls back their stimulus programs at the same time most of the COVID relief payments and programs are going away to start the year.

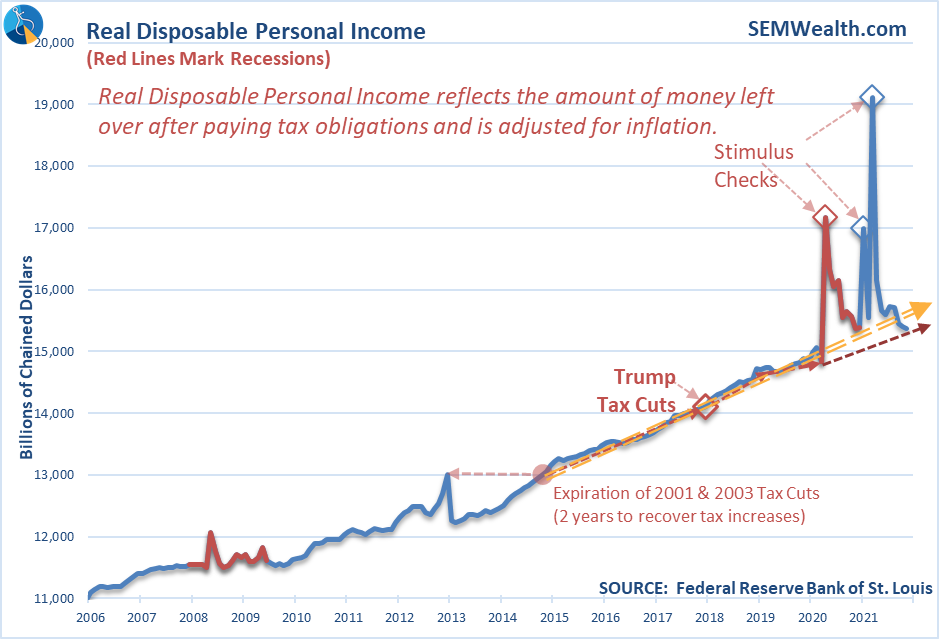

Will the economy be solid enough to keep cranking or will we see how fragile the growth we saw in 2021 actually was? One data point I'll be watching that may be a warning for those chasing stocks higher is Disposable Income (money left over after paying taxes). I marked the huge spikes we saw thanks to the stimulus checks, but I also drew a longer-term trend line going back to the last economic dip in 2015/2016 (after the economy had absorbed the expiration of some of the Bush tax cuts in 2012).

The fact that personal income is now running BELOW that longer-term trend line should be a concern for anybody jumping into stocks or using a buy and hold strategy. After 3 consecutive years of returns well above the long-term average, the market may resolve that excess to the downside in the coming year.

Of course that is just a guess and not something we base our decisions on here at SEM. As I discussed last week, the 'Santa' rally typically starts around the 17th and runs into the first week of the new year. I also included several resources and links to help with your 2022 planning.

For those of you working this week, I hope you are able to still take time to focus on what's truly important in life.