Happy Tuesday after a 3-day weekend! I hope everyone had a happy and safe 4th of July. My neighbors certainly had a happy 4th of July, to the dismay of my dogs. What the long weekend might have distracted us from, is that we reached the halfway mark in what I’m sure most of us were hoping would be a return-to-normal year. The first full year of a fully open economy has led to a number of concerns, including high inflation, hardly affordable housing, just in time to go into another election season (that I’m sure we’re all looking forward to)! I know it hasn’t been easy for some of us, so congrats on making it through the first half, and hopefully the second half will be better for the market. (Click here to read our first half recap in our client newsletter.)

Last week, I spoke about how eager we were to ignore the bad and try to force it to go away. It looked like the market was trying to do that. Our models didn’t get sucked into the euphoria following the previous week’s gains, and it’s a good thing they didn’t. Besides the market losing all the prior week’s gains, there wasn’t a ton of news or new data to analyze (what little bit there was is summarized by Jeff below). This week will be different, however. We will have new data to use in our Dynamic, AmeriGuard, and Cornerstone programs at the end of this week. As far as updates, it’s too early to tell what will happen, but we will continue to avoid personal speculation and simply read the data for what it is.

Jeff's Walk through the Charts

I know the "story" has been that the Federal Reserve has been tightening the reigns, which is having a big impact on risky assets (such as stocks). "Don't fight the Fed" certainly works in both directions.

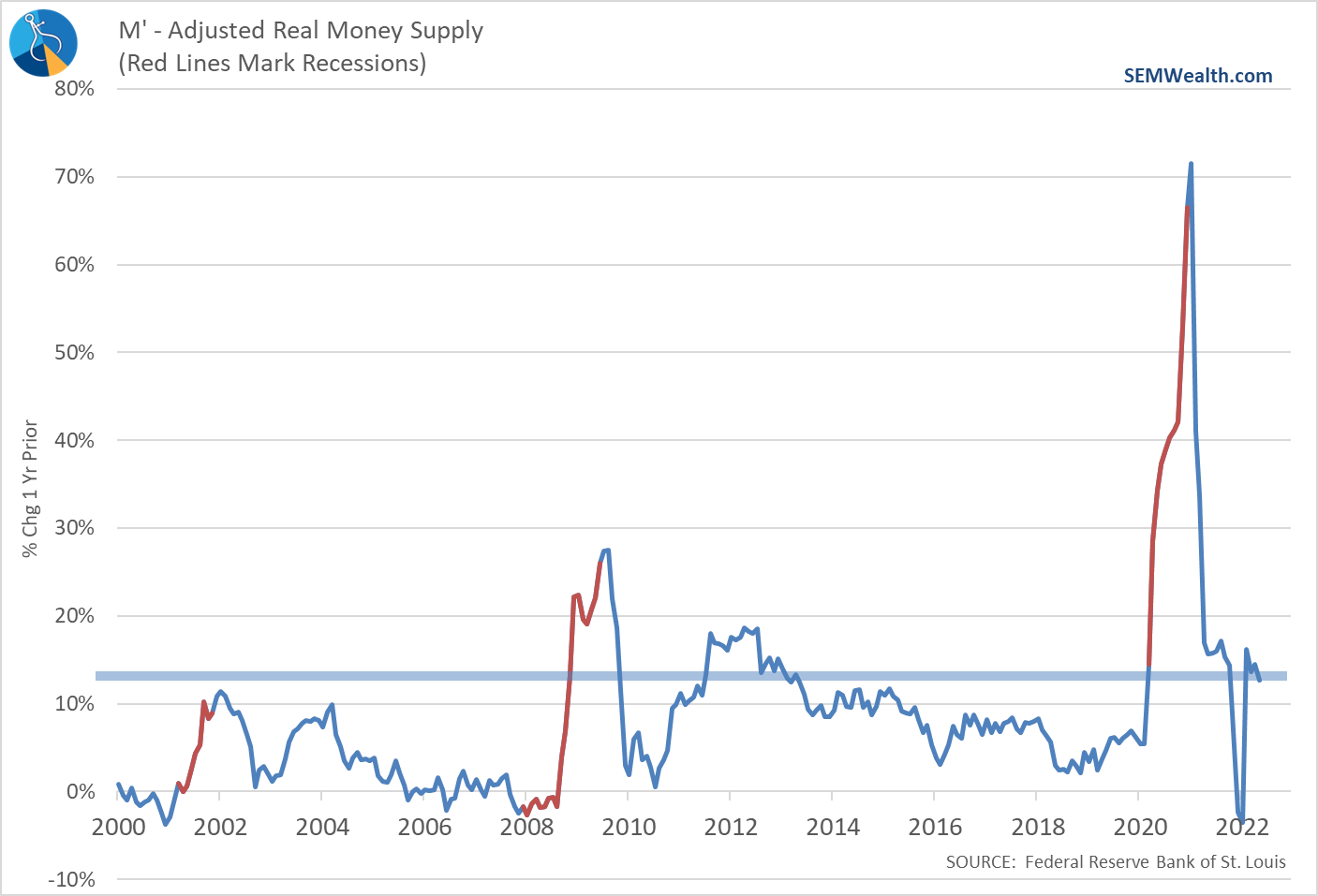

When I was reviewing our month-end economic data for our Dynamic Models, I was surprised to see how little the Fed has actually done in terms of pulling back the money supply.

On a year-over-year basis, we still have 16% more cash floating around the system than we did last year at this time. It was 18% last month, so I guess this is a bit slower. However, just in June the money supply INCREASED 2.4%. That's hardly "tight" policy.

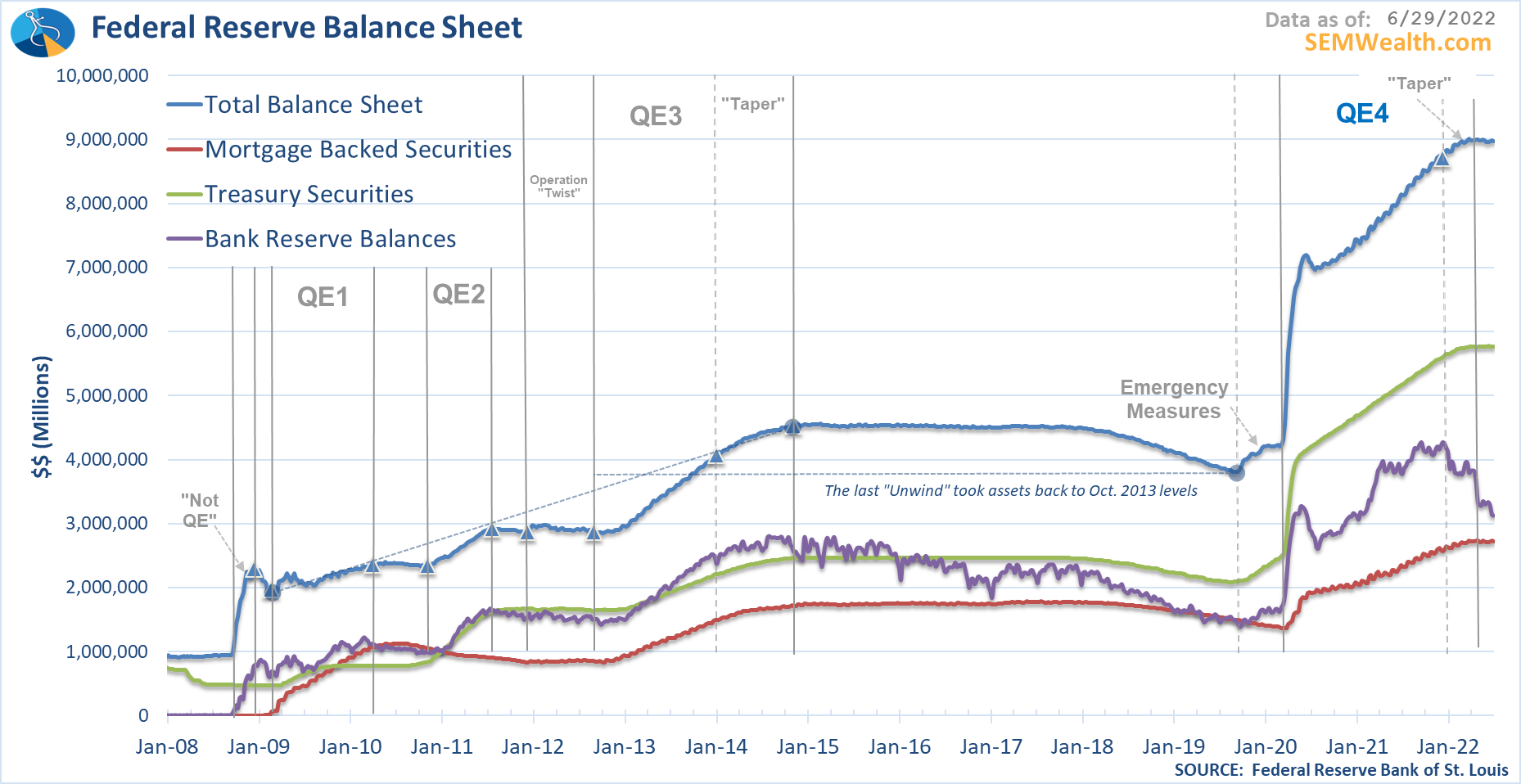

Looking at the Fed's Balance Sheet, we can see QE4 has finally ended, however you have to squint to see the "unwind" they supposedly started last month.

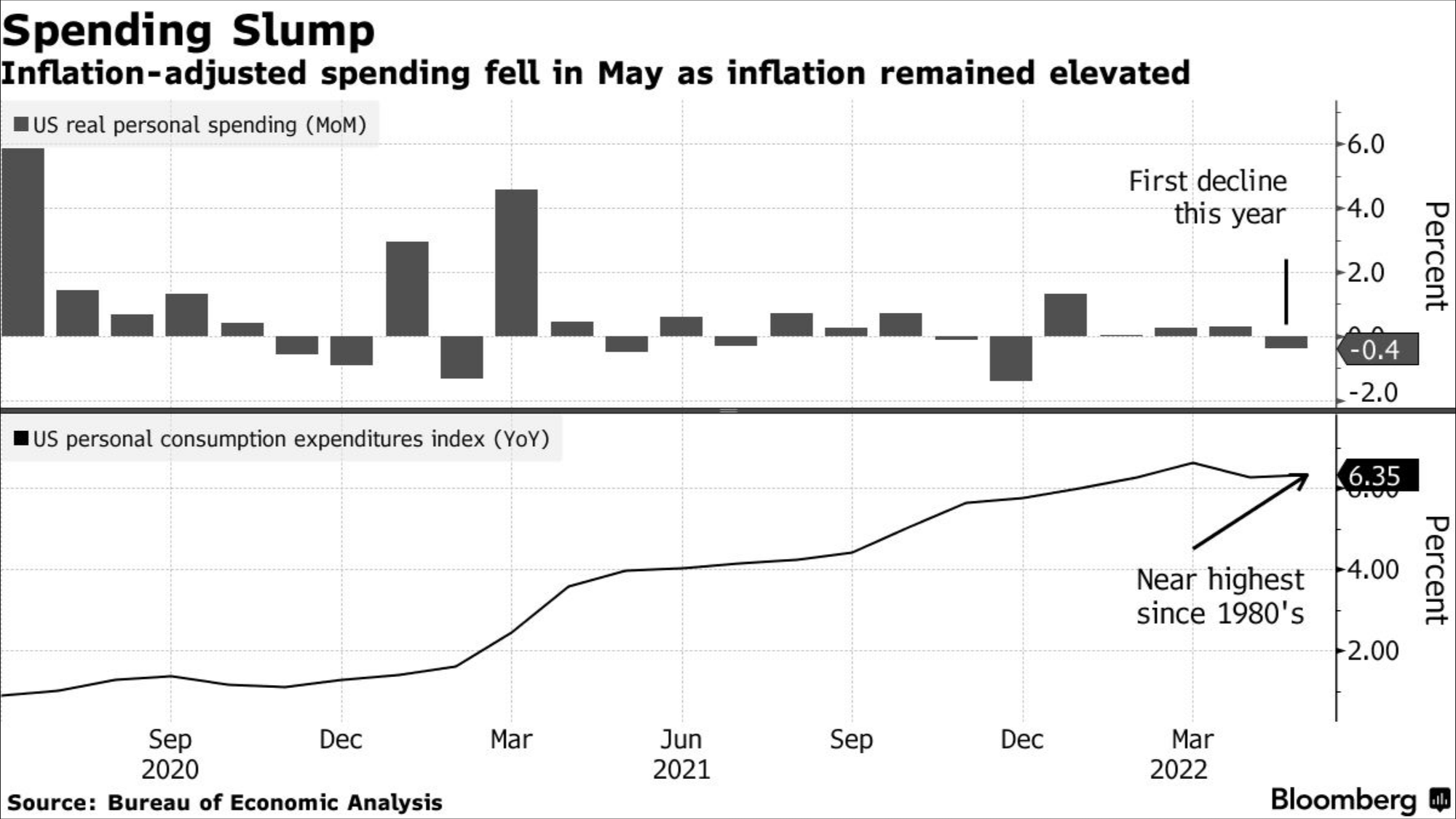

Maybe the Fed is hoping simply talking about getting serious about inflation will slow things down. That's the best case scenario. The worst case scenario is inflation remains stubbornly high and the Fed actually has to start pulling back the money supply which will have a severe impact on the economy. We're already seeing this in the spending data as shown in this chart from Bloomberg.

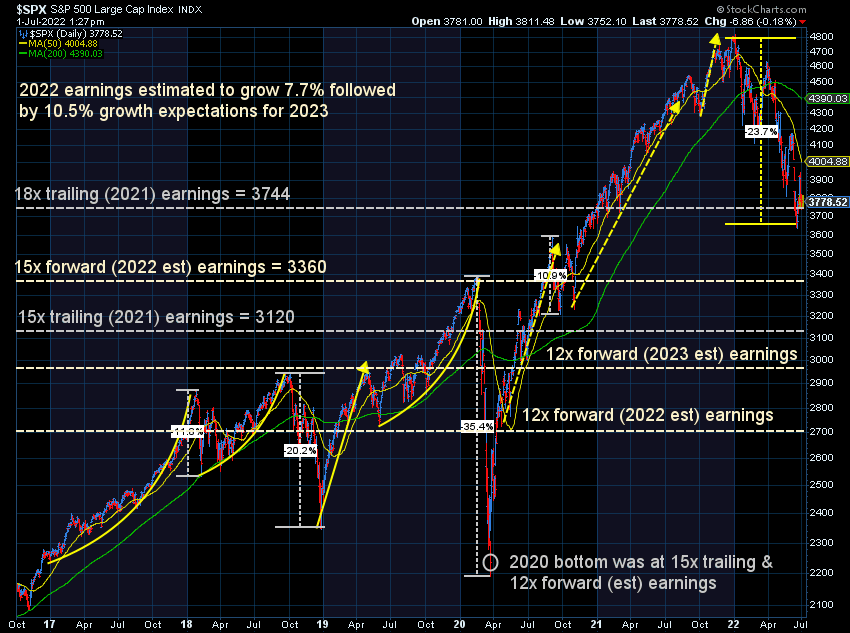

Inflation is clearly taking a toll on the economy and in my opinion, stock prices have yet to reflect this. The S&P 500 has only reverted back to the average P/E ratio of the last 20 years. A typical recessionary bear market would see stocks drop to 15x trailing earnings or 12x forward earnings. This means we could have a long way to go.

Make sure you check out our client newsletter where we talk about what we should expect for the second half of the year.