I have a mixed reaction to doing something new. I am a mixed personality in general, in that I do like to do some exploring (both physical and metaphorical) but I’m also reserved and comfortable with where I’m at. This week will both be new for me and feel like new, as I will be hopping on an airplane, maskless for the first time in 3 years (feels like a new experience) and will be going on a family vacation to Myrtle Beach, my first time to the city and the first time in South Carolina. I expect this to be a fun “new”. While not all things that are new are things we are keen on accepting, sometimes "them's the brakes."

I guess I’ll quickly add that SEM’s stance on who our president is has very little impact on the market, and people who try to buy or sell depending on who is president are likely hurting their own returns. So what impact will a new British prime minister have? Despite the angst in their stock markets, probably not a lot. Carrying on.

In what has been a funny little distraction throughout all the “new” we’ve had to experience these last few years, I got a little break from all of this and got to learn about GameStop stock all over again. First with a stock split, which created a 15% up day, and then with their CFO being fired, knocking 8% off their stock price --- all in 2 days. Keep being you GameStop, we all need our distractions sometimes.

We also saw a return of the post-pandemic 2020 playbook. You know the one where large cap growth is the only asset class in town? This week we saw value stocks go down along with small and mid-caps while large cap growth had one of their best weeks in over a year. Coincidence or not, a large Wall Street bank has gotten VERY bullish.

I had the pleasure of sitting in on a call with JPMorgan this past week as they went over some of their data charts in their Q3 update. On the hour-long webinar they only had the chance to highlight a handful of the 100-plus charts and data points, but some of their charts and analyses were about indicating an upcoming recession. They pointed to a number of things that are causing people to fear the markets and the general state of the economy, including inflation and rising gas prices, and were able to find a way to explain the temporary nature of both of those things.

According to JPMorgan, gas prices were caused by issues in Ukraine and slow production from OPEC. Both of those things can be corrected. Inflation has been caused by the aftermath from the pandemic and issues in Ukraine. Both of those things can be corrected. Normally, they point to certain cyclical industries and wait for them to go from heavy growth to declining growth as a recession indicator, and those sectors they looked at already have slowed growth; therefore, there doesn’t need to be a further market correction. Ultimately, they determined that a recession, if there is one at all, will be mild and short. Part of this analysis is embedded in a prediction of what the future will be based on current data. That data can be analyzed a number of different ways, especially when there are hundreds of pieces of data to analyze.

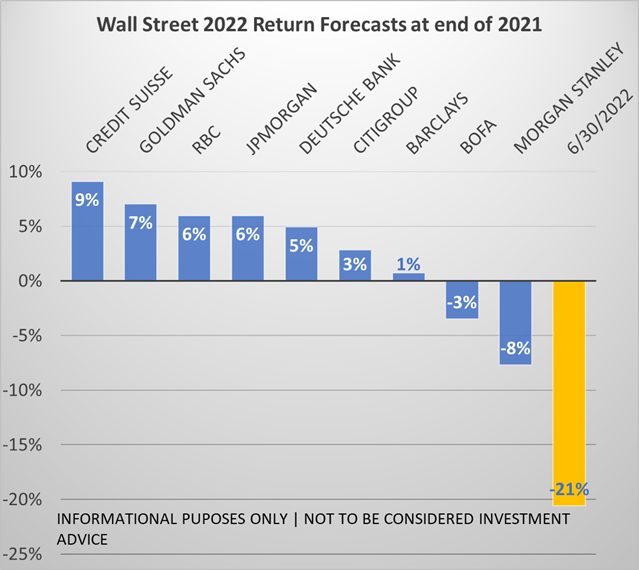

Ironically, the same day Morgan Stanley came out and sung a far different tone than JPMorgan – when they said that the slowdown will be worse than expected and that the S&P has yet to price in a full-blown recession. We don’t know if their predictions will come true, but we do have information about what was predicted at the start of this year which we mentioned in our quarterly newsletter. Below is the forecasts for 2022 by some of the leaders on Wall Street. What we do know is that if we’re following whoever was closer to their forecasts from 7 months ago, then we should listen to Morgan Stanley in this instance.

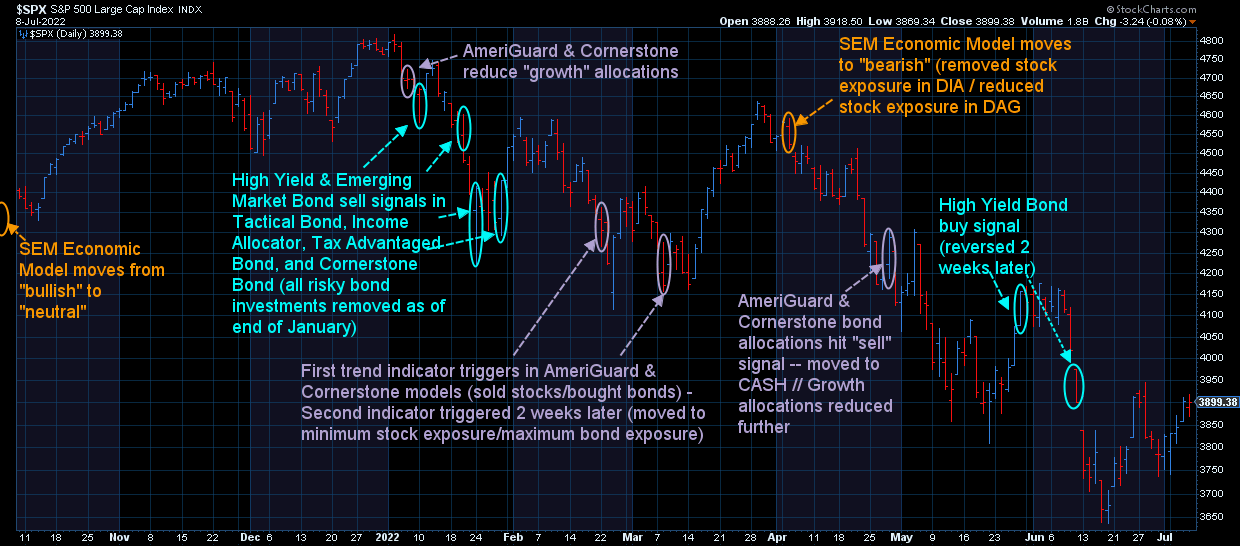

This isn’t to say that JPMorgan will be wrong, but that making forecasts about what the market will do based on what it is currently doing and using economic events from the past is a very difficult thing to do. Nobody really knows what is going to happen. SEM isn’t trying to forecast what percentage the market will rise or fall for the rest of the year, we’re simply trying to put clients in the best position possible based on what the market is looking like. And while we did get new data to use we did not make any major changes to our Dynamic, AmeriGuard and Cornerstone. We were bearish and we stayed bearish going into the new month and quarter. We did reduce our small cap value positions a bit, eliminated the Real Estate and Basic Materials positions we held for the past 3 quarters, and added some small and mid-cap value holdings.

There’s a lot of noise out there and a lot of distractions for us to get lost in (again, thank you Gamestop) and it’s difficult to see through all of that. And there’s A LOT to see through. For example, this past week’s jobs report. It beat expectations, but when the expectations are set by forecasts that as we’ve just gone over can be very, very wrong, what does that really mean? Well in terms of the actual number, the thing we pay attention to, it wasn’t enough to change what our models are saying, that we are still not in a good market for returns. You can probably continue to expect the leaders of the financial world to continue to contradict each other and box each other out in their announcements of what we will go through. It can get confusing. We are here for any questions or concerns you would like to discuss.

Jeff's Walk through the Charts

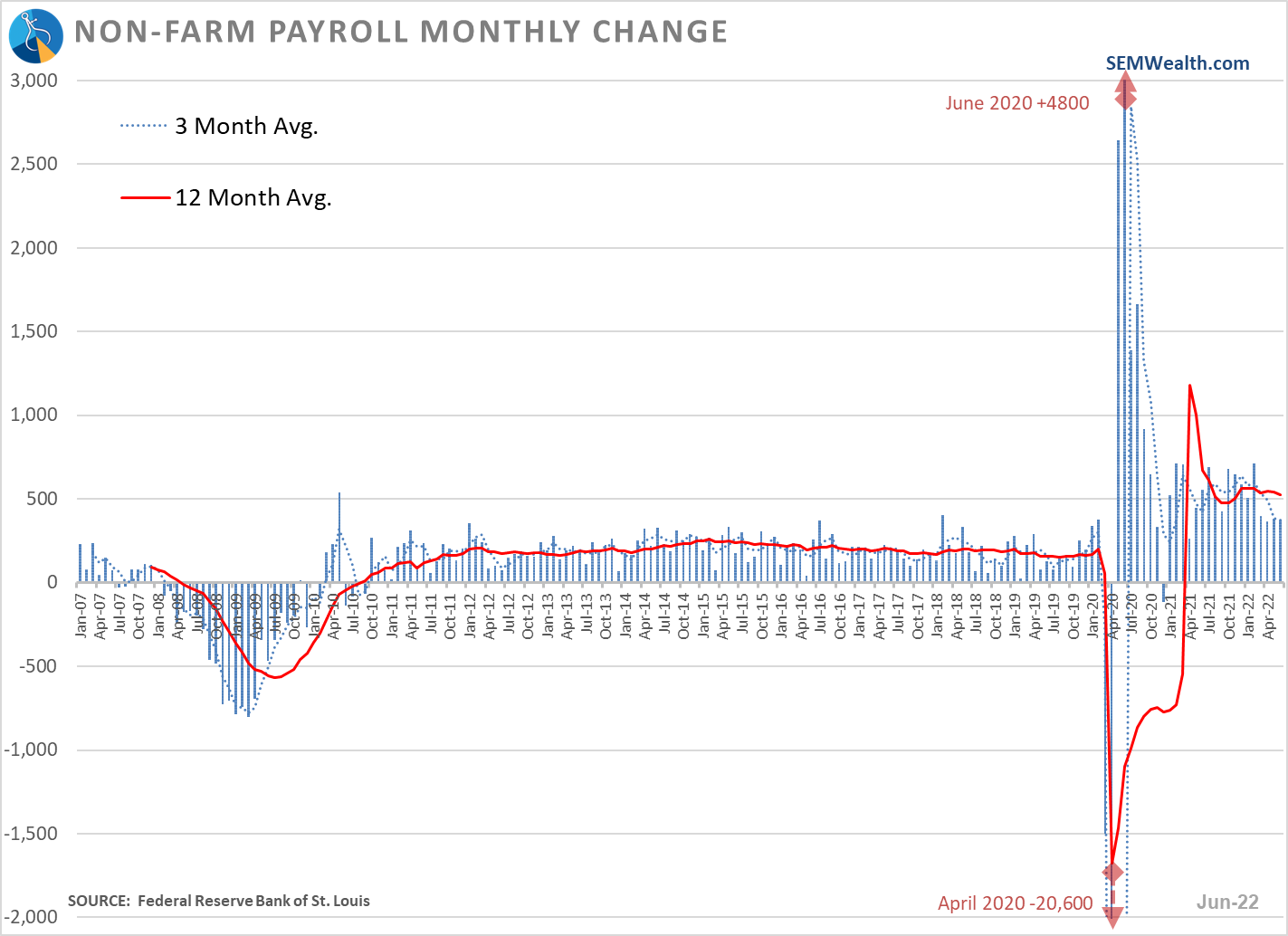

The primary piece of economic data this week was the jobs report. While "better than expected" and still "strong", it leaves more questions than answers:

- Does this mean the Federal Reserve has more room to continue raising rates (because the economy is strong)?

- Are the fears of a recession overblown?

- Will the tight labor market lead to longer, more stubborn inflation?

- What will it take to increase the labor force participation rate?

- Will the big gains in leisure and hospitality be reversed in the fall?

My take on this chart is a mixed bag. Jobs continue to grow around 4% versus a year ago. That's above average, but nothing to get overly excited about.

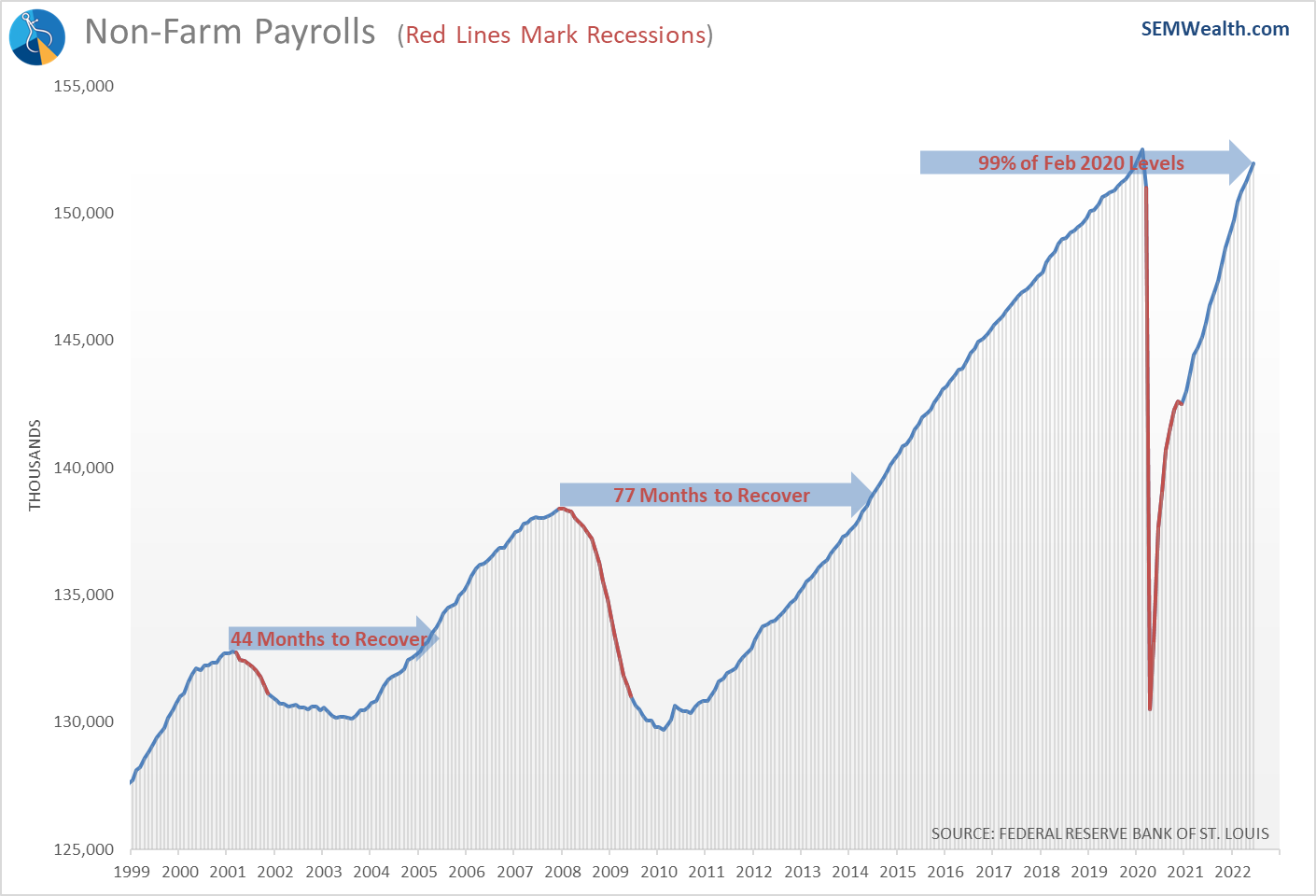

We are within 1,000 (estimated) jobs of a "full" recovery, which is obviously faster than the past two recessions.

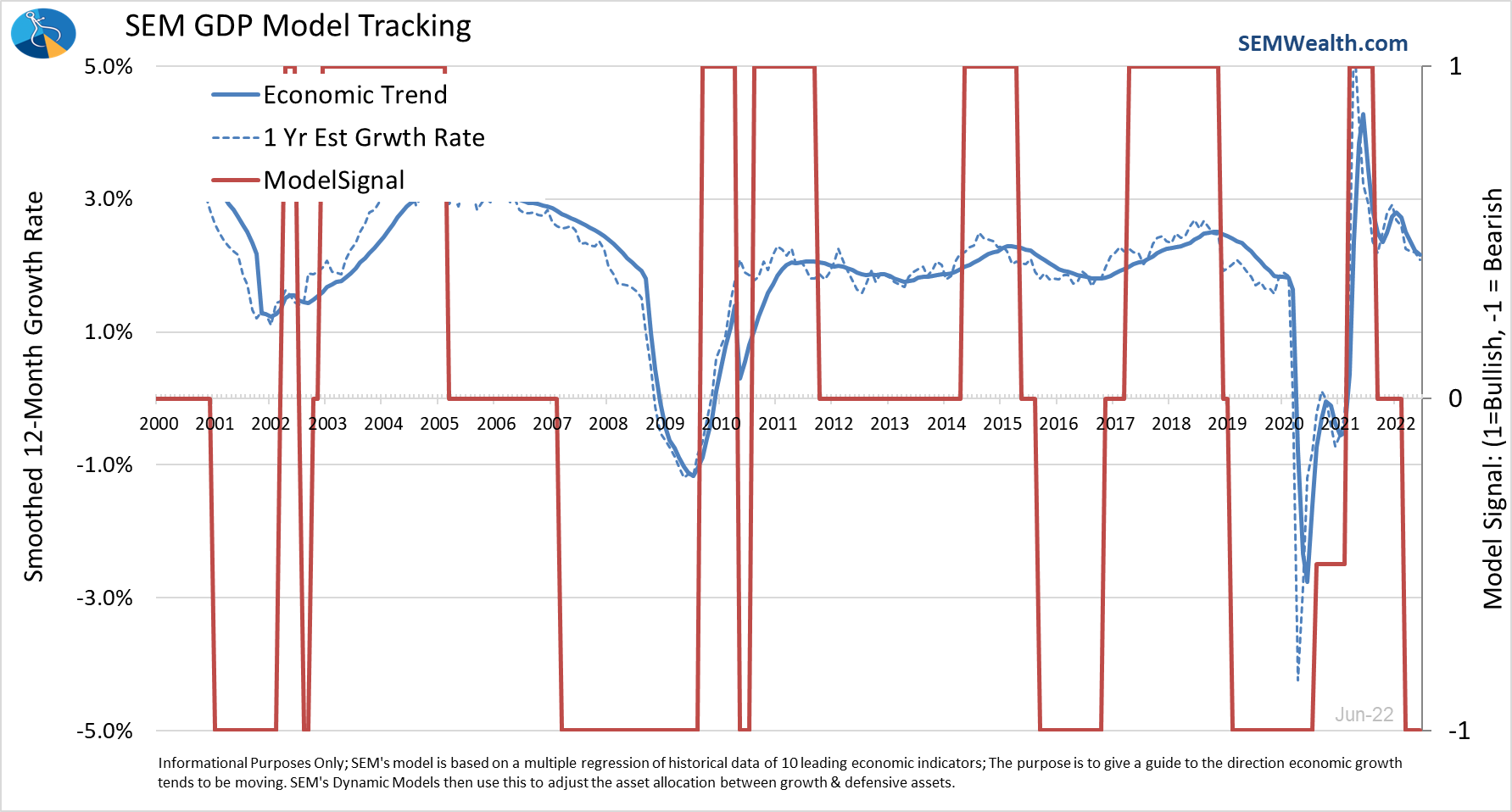

Based on our economic model, we could easily see jobs being eliminated again. Our model is still "bearish" meaning "slower" economic growth. It doesn't necessarily mean recession, but it certainly doesn't justify stock prices trading above their long-term median P/E ratio.

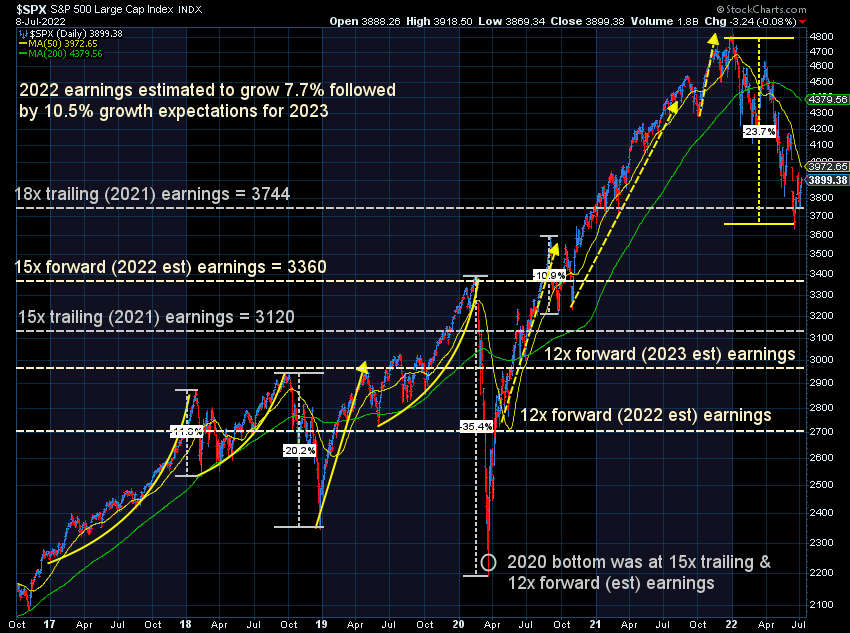

The S&P 500 is attempting to bottom. As Cody mentioned, large cap growth was really the only strong asset class all week. For whatever reason, the assumption is interest rates have peaked, economic growth will resume to pre-2022 levels, and inflation will be under control. This is the only reason you'd want to own large cap growth stocks right now. I'm glad we don't base our decisions on our opinions (or others) and instead let the data dictate where, when, and how we invest.

Stocks are trading at 19 times 2021 earnings and 17 times estimated 2022 earnings. Even using estimated 2023 earnings the P/E is 16. 2022 and 2023 earnings estimates have not come down at all (based on data from Ned Davis Research). This means the only reason to believe the bottom is in is if you buy into the "there will be no recession/inflation has peaked/the Fed is almost done raising rates" argument.

As it is, stocks are OVERVALUED based on historical data. Tread carefully.

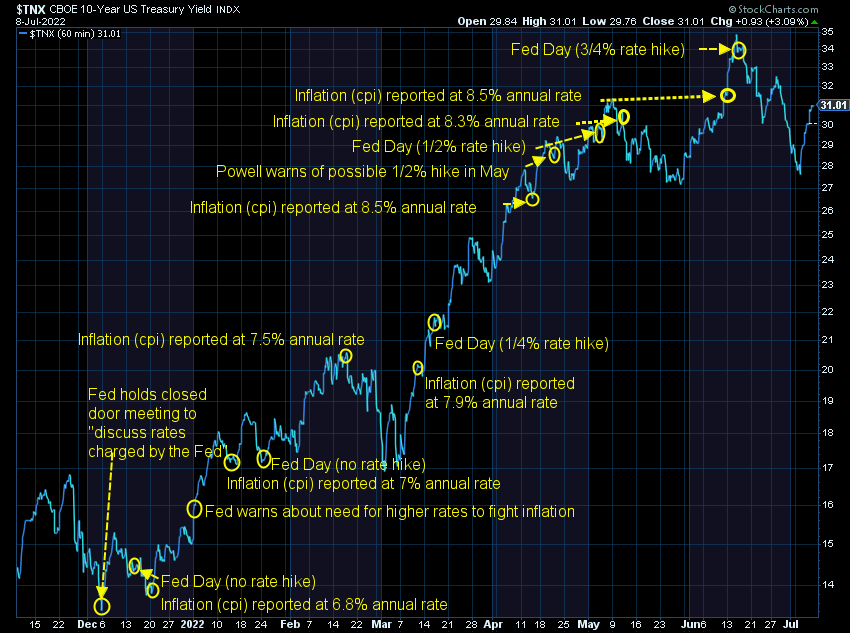

Turning to bonds, earlier in the week they were also falling for the "there will be no recession/inflation has peaked/the Fed is almost done raising rates" argument. On Thursday and Friday they changed their tune and we saw rates move back above 3% on the 10-year.

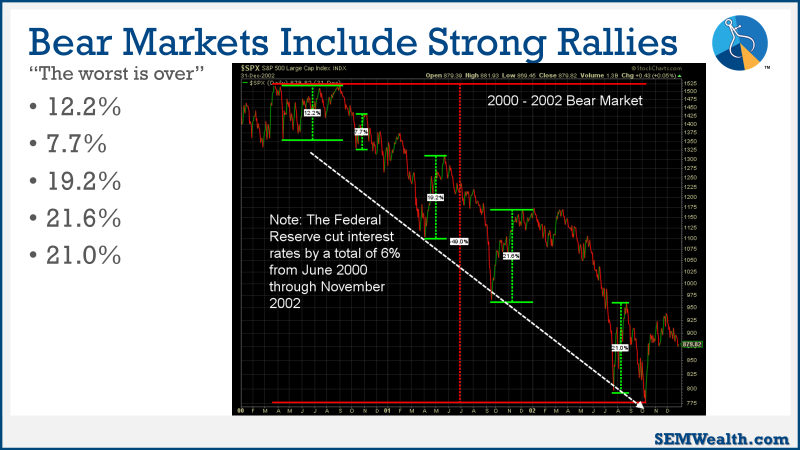

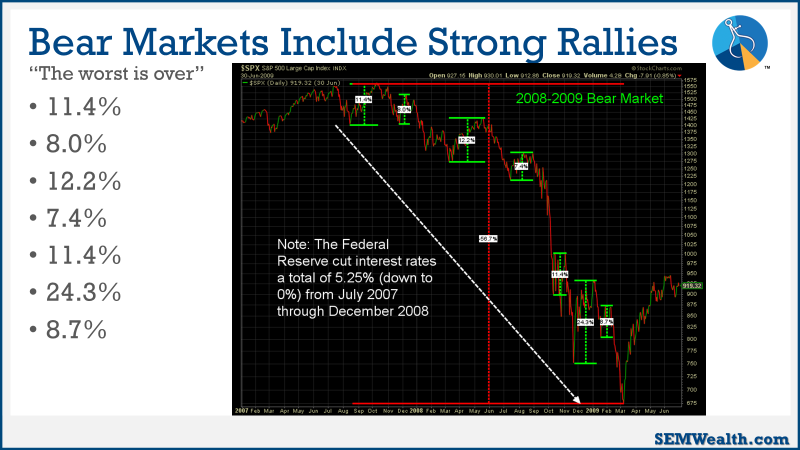

Following big rally weeks it is important to keep in mind our "bear market tips".

We will see HUGE rallies that make you believe the worst is over (and there will be plenty of people in the media declaring the worst is over).

Remember:

1.) Don't panic (including thinking you missed the bottom)

2.) Ignore the media

3.) Be patient

This has been the key to our success the past 30+ years and I trust it will continue to provide tremendous benefits in the years (and decades) ahead.