After taking Monday off in observance of Martin Luther King, Jr. Day, the stock and bond markets are making up for lost time in continuing last week's trend. Both stocks and bonds are projected to start the 4-day week on a deeply negative note.

Given the short week I'll keep the Musings short this week.

Weekly Talking Points:

- This is a small correction (so far)

- The concerning part is bonds are down more than stocks (so far)

- A bigger correction is well overdue

- Our tactical systems are just now starting to take money off the table – all others are holding steady because this is a small correction (so far)

- Markets are still EXTREMELY overvalued

A couple of weeks ago my weekend reading was filled with rosy outlooks about how great 2022 was going to be. Readers of this blog know I have not shared that outlook based on both the data I see, my 25+ years of experience, and my study of market history. In case you missed it, I discussed a lot of that in the first blog of the year.

The rosy outlooks have been dampened by the "sudden" about-face from the Federal Reserve on inflation. Unprecedented policies cause unpredictable problems and lead to unpredictable reactions. There is no playbook for how the Fed can unwind all of their COVID relief policies. I discussed this last week:

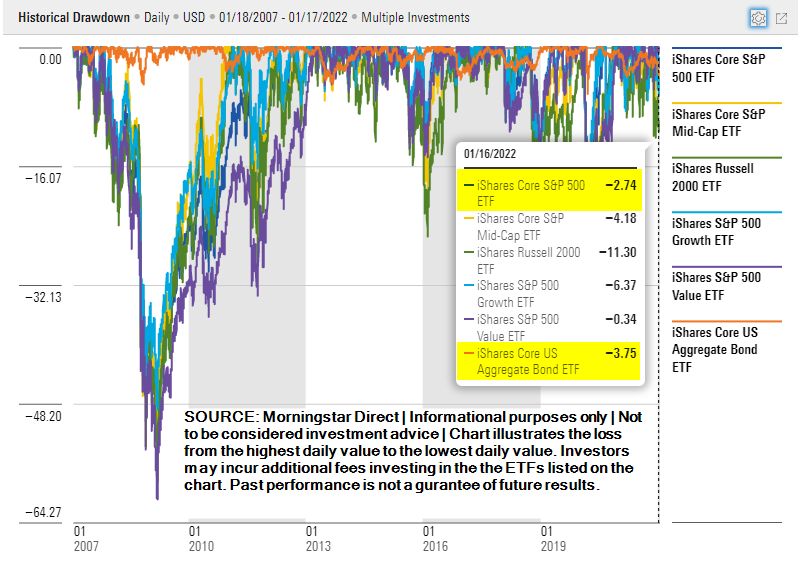

What I found interesting is how quickly the sentiment has changed in my normal line-up of sources. You'd think we were in the midst of a huge correction. Here's the updated drawdown chart to help keep things in perspective.

Probably the biggest reason for concern is the bottom number — Aggregate Bonds have lost more than the S&P 500. For pretty much the last 40 years whenever stocks declined, the bond market held steady (or rallied). This masked the losses for many portfolios. With bonds adding more losses this could be an eye opener for many investors and advisors alike.

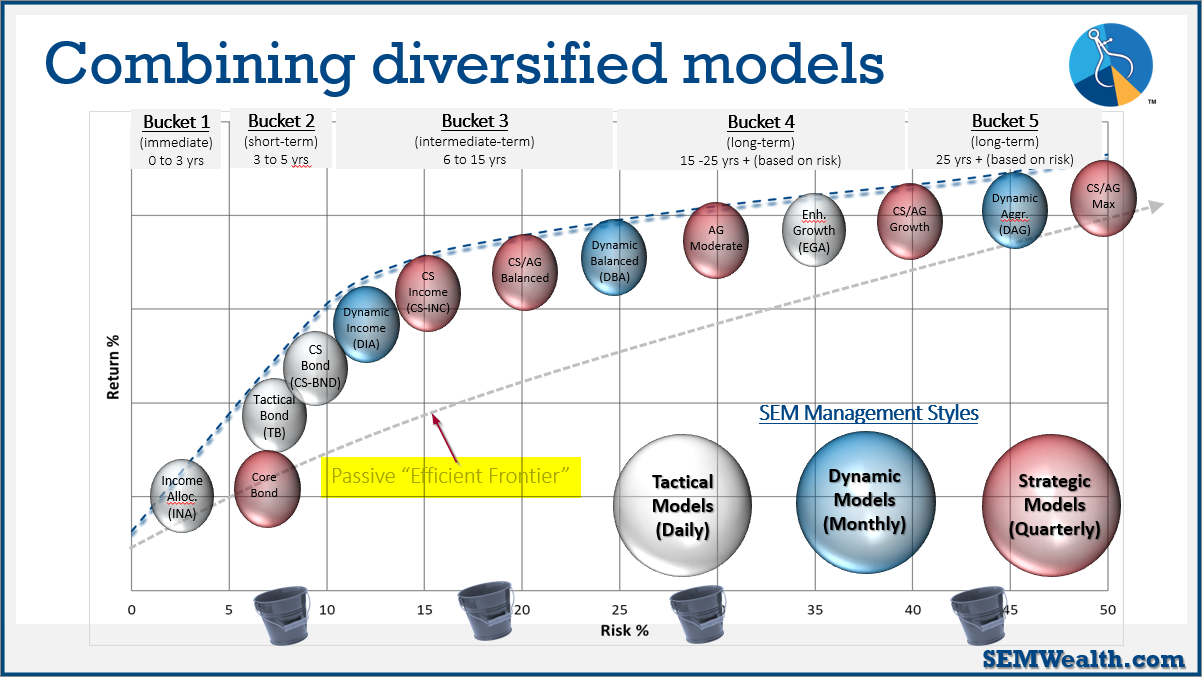

If this trend continues, we will likely see in real-time the benefit of SEM's diversified blend of investment models. This chart shows the difference in returns and risk of our models and a passive stock/bond portfolio mixture over the last 15 years (when bonds helped offset the losses).

The key difference is our tactical models do not need the bond market to rally in order to provide protection. We are once again on the verge of getting sell signals in Income Allocator, Tactical Bond, and Cornerstone Bond. This would stabilize those models and allow them to keep cash available to take advantage of lower valuations whenever this bottoms. Our Dynamic Models are already in a "neutral" position and could easily move to "bearish" if the trend we've seen in earnings is an early sign the economy is heading for a sharp slowdown. Our Strategic Models are designed to weather these short-term fluctuations (remember the stock market is down less than 5%.)

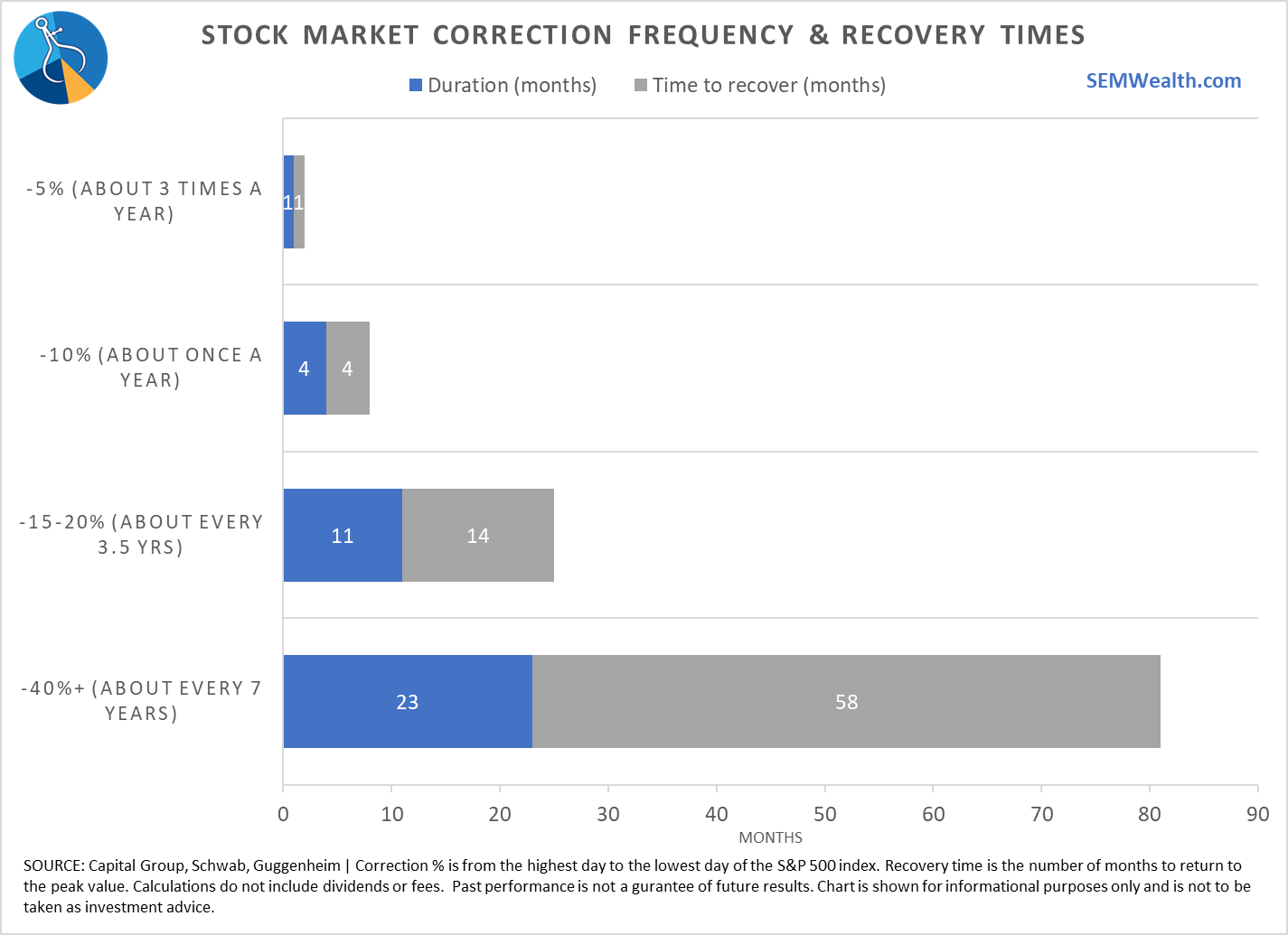

For a better perspective I think this chart is important to understand.

Even though we aren't there yet, we should expect about three 5% declines per year. These last a month and take a month to recover. We could even see a 10% correction emerge. The duration and recovery of that loss could take up a large chunk of the year (about 8 months.) What is important to understand is why we at SEM are so adamant about risk tolerance (both ability and willingness). Part of the "ability" to take risk is the time horizon. If you know you're going to need your money in the next 3 years, it probably has no business being in the stock market. About every 3-5 years we go through a 25-month period where the market is "underwater". More importantly, about every 7 years we see a 40% or larger decline that can eat up an average of 81 months (nearly 7 years).

We're due for a large correction. While the losses right now are still small you still have an opportunity to right-size the risk in your portfolio, especially for those needing money in the next 3-5 years. I'd also encourage anybody planning on retiring in the next 7-10 years to consider the allocation of your retirement accounts. The data is stacking up that we may be entering a larger correction in 2022.

Of course, the value of working with SEM is our diversified approach. Our models are designed to give us opportunities to continue to participate. We don't have to use opinions to make our decisions. We can customize any portfolio to match the financial plan, cash flow strategy, risk tolerance, and personality of pretty much any investor.