Inflation is dead.......at least that is what you would think by watching the stock market the past two weeks. In reality, the pundits are saying we have seen "peak inflation". They are absolutely right (hopefully). However, that doesn't mean we are done having to worry about inflation.

The source of the euphoria this week is after the "headline" CPI number showed a 0% month-to-month change. What this means is the basket of goods and services used to calculate CPI did not change overall in July. The "core" basket, which excludes food and energy rose by 0.3% for the month. For what it's worth if the "core" basket rose by 0.3% per month every month we'd have 3.7% inflation for the year. After experiencing 9% inflation, 3.7% sounds pretty good, except when you consider the damage that would do to our economy.

The Fed's target rate for inflation is 2%. We've been accustomed to inflation below 2% for the past 15 years. Inflation above 3% will be a problem and something the economy needs to adjust for.

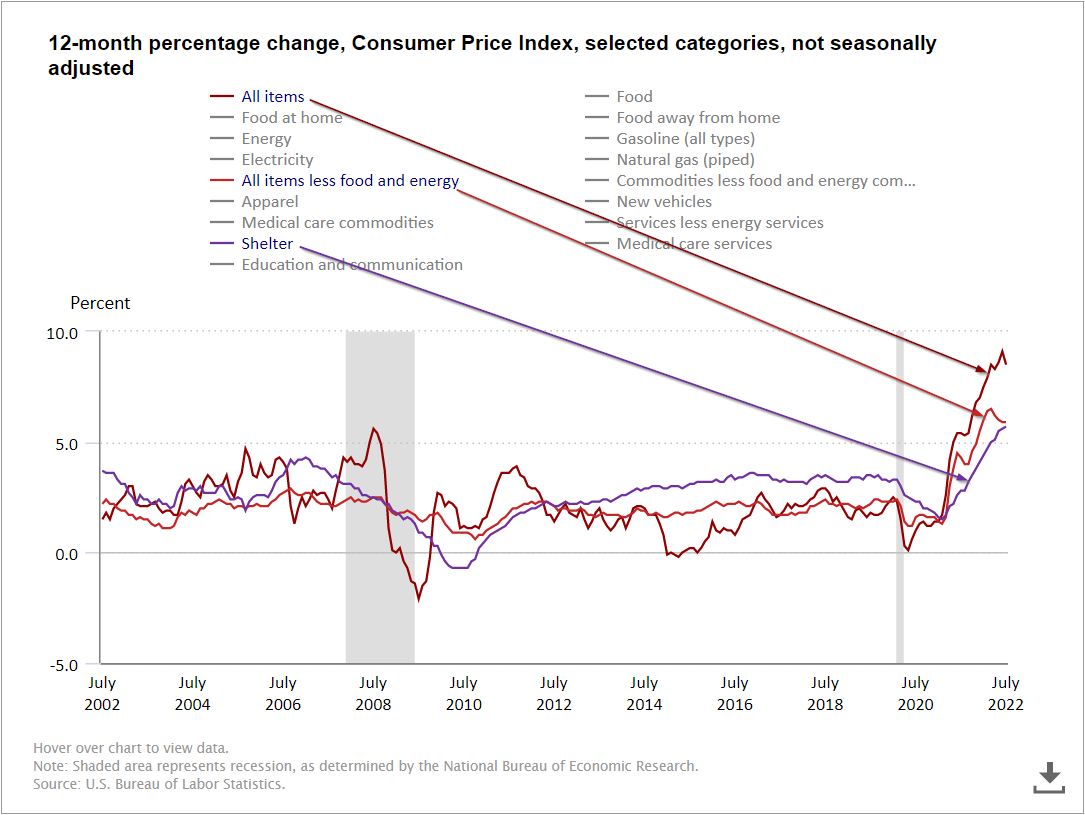

So the market is focusing on the point inflation appears to be SLOWING, but it is ignoring the fact inflation is still likely to be above "normal" levels for the foreseeable future. Here are some of the charts from the CPI report to help put things in perspective.

You can see the small change that generated so much excitement.

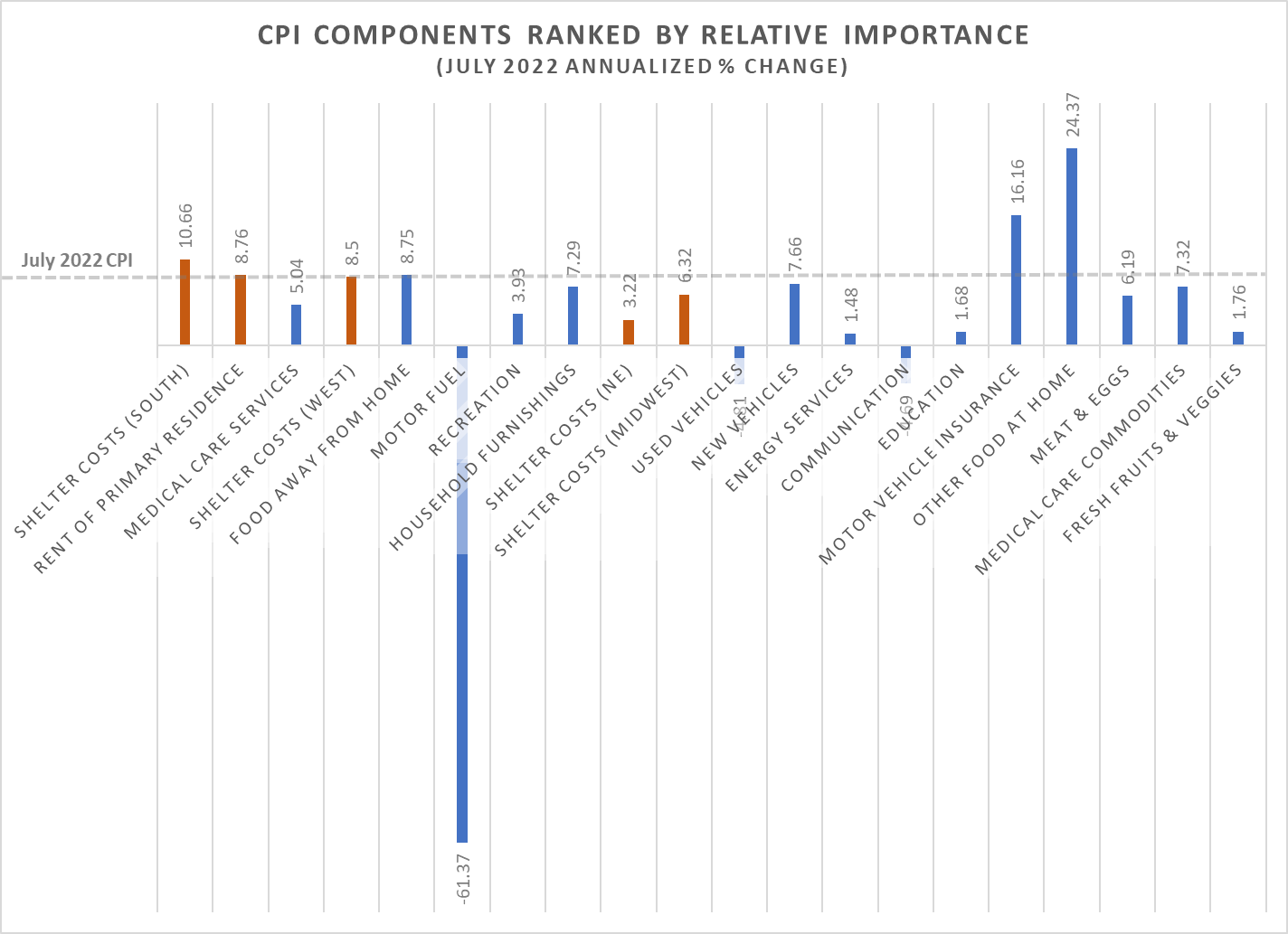

I found this data interesting:

Each category is listed from left to right in terms of its weighting in the basket. I have no idea why shelter costs in the south would represent more of the index than the northeast, but that's how the government does it. What is important to understand is two things:

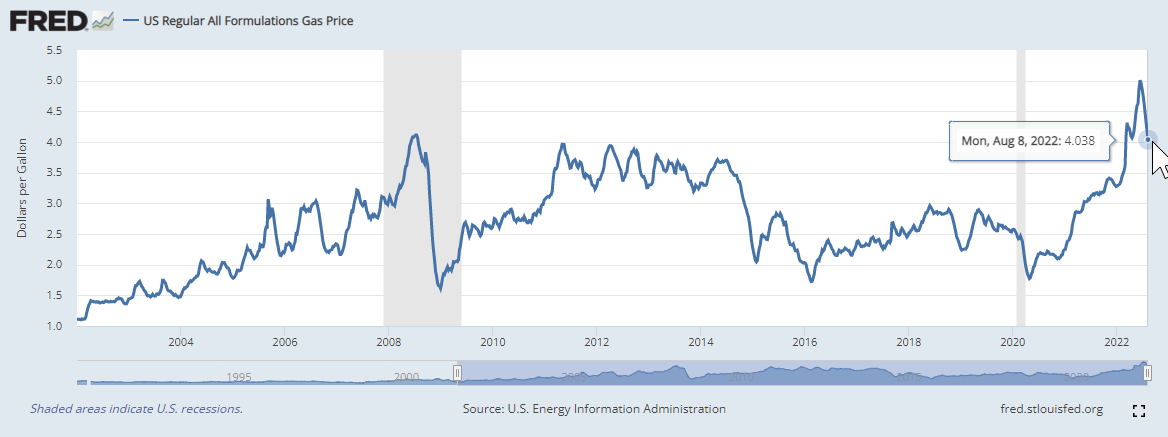

1.) The primary driver of CPI being "flat" was the huge drop in motor fuel. I think we've all enjoyed the nice drop in prices, but we have to realize fuel prices are significantly higher than they were a year ago and other than a sharp economic slowdown there aren't a lot of reasons fuel prices may not return to the $3 range from last Labor Day.

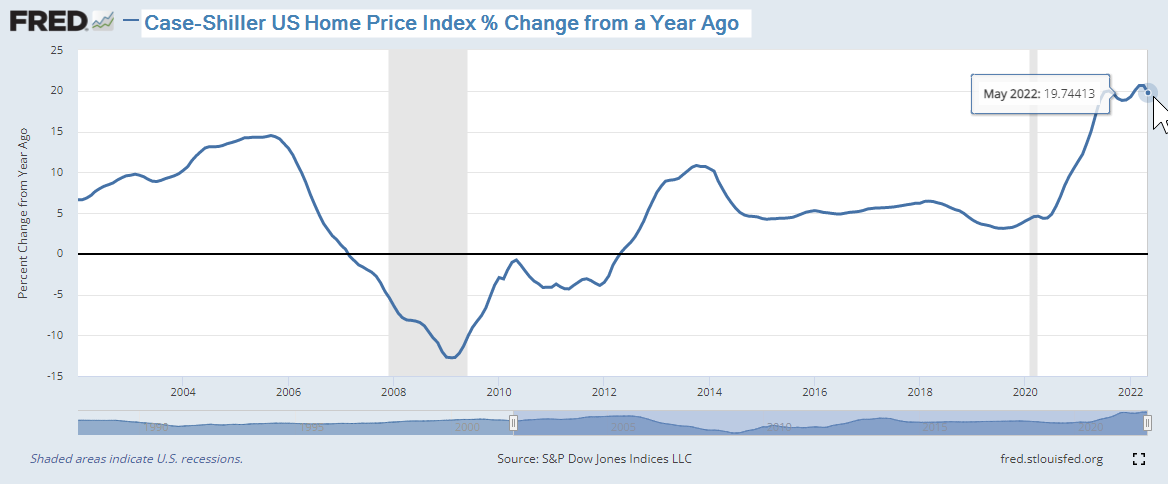

2.) "Shelter" costs are horribly understated in the CPI. The contribution to CPI the past year has been much too low, but going forward the way the index works is we are going to see the shelter component pushing CPI higher.

Home prices are still rising at a nearly 20% annual rate.

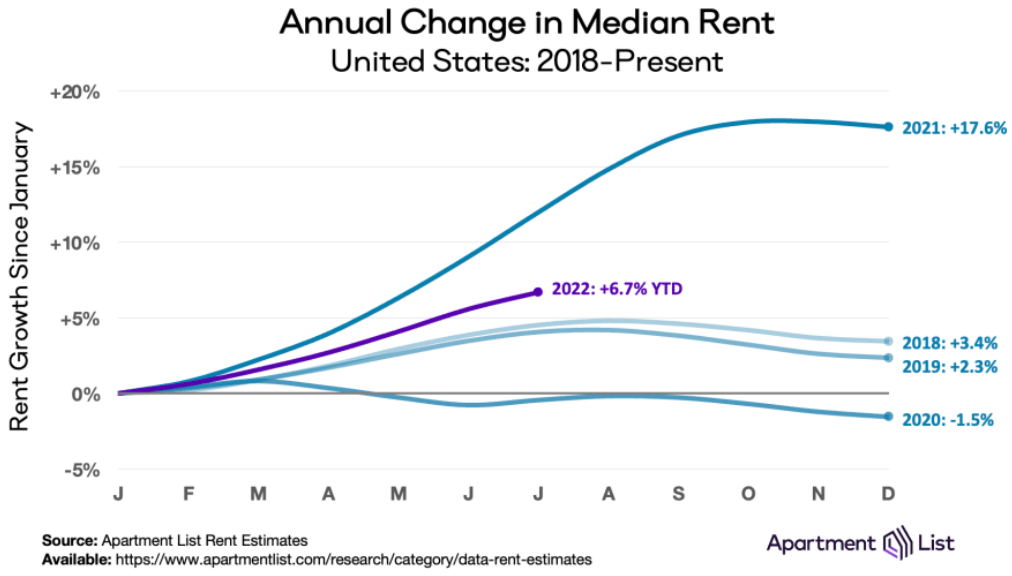

Rent prices are not going up as much as they did in 2021 (which wasn't reflected in CPI), but they are still running much faster than "normal". Note on this chart, they are up 6.7% through July, which means we are on pace for a +10% year.

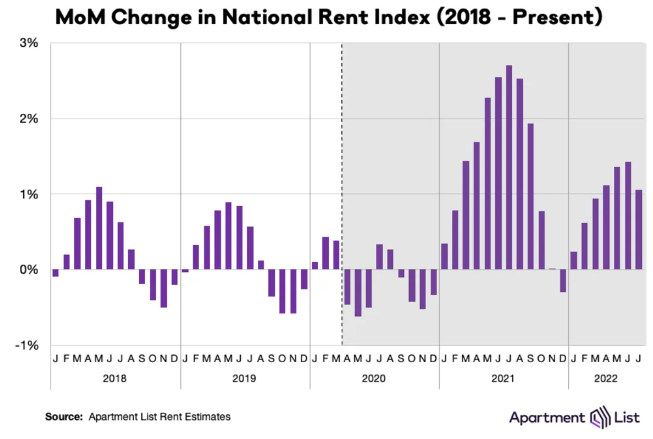

The monthly data shows a bit of a slowdown, but prices are still running too high for those renting apartments.

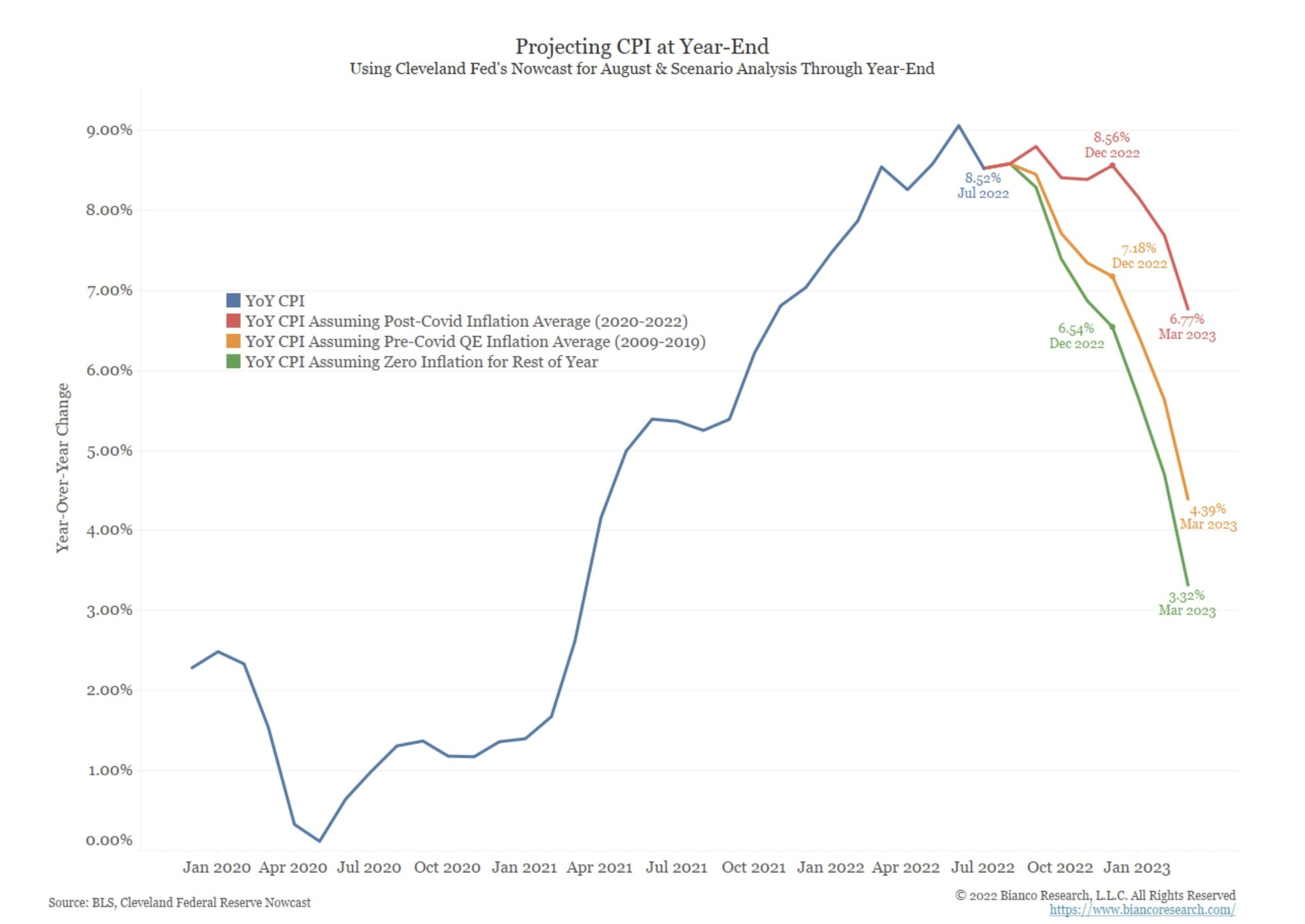

I think this chart shared on Twitter by Schwab's Liz Ann Sonders is fascinating. Look at the green line – if we had ZERO inflation through the end of the year, inflation next March would still be at 3%. If we return to the pre-COVID levels we'd be looking at 4% inflation. Post COVID average inflation would have us close to 7%.

All of this means it will be close to impossible for CPI to get back down to the Fed's "target" of 2%, which means they are still going to be in "tightening" mode for quite some time. It's really hard to justify paying this much for future earnings on stocks when the Fed will be focusing on slowing growth down.

Speaking of inflation .... in an attempt to get around the new algorithms on Facebook, which is deemphasizing friends, family, and groups/pages to focus on "creators" on Instagram, we created an Instagram page to start sharing short videos on that platform. Since we were doing those videos anyway we also decided to join TikTok. Our mission is to provide unemotional, data-driven, common sense analysis of the economy and markets as well as helping to promote financial literacy.

You can follow us here: Instagram | TikTok

Last week we posted some videos talking about the "Inflation Reduction Act". Check them out:

The only part of the act that might reduce inflation (for a small subset of people):

@finance_nerd Does the inflation reduction act reduce inflation? #inflationreductionact #inflation #reduceinflation #part1 #biden #healthcare #breakingnews #medicare #insurance #greenscreen ♬ original sound - finance_nerd

Let's talk about the energy "savings"

@finance_nerd Does the inflation reduction act reduce inflation? Part 2 #inflationreductionact #inflation #reduceinflation #part2 #biden #taxcredit #energysavings #houseprices #greenscreen ♬ original sound - finance_nerd

Raising taxes to cut inflation?

@finance_nerd Does the inflation reduction act reduce inflation? Part 3 #inflationreductionact #inflation #reduceinflation #part2 #biden #corporatetaxes #taxes #amazon #priceincrease #greenscreen ♬ original sound - finance_nerd

Rumor has it we'll be posting some "Monday Morning Musings" videos each Monday, so if you like short-form video recaps, you can follow our channels here: Instagram | TikTok

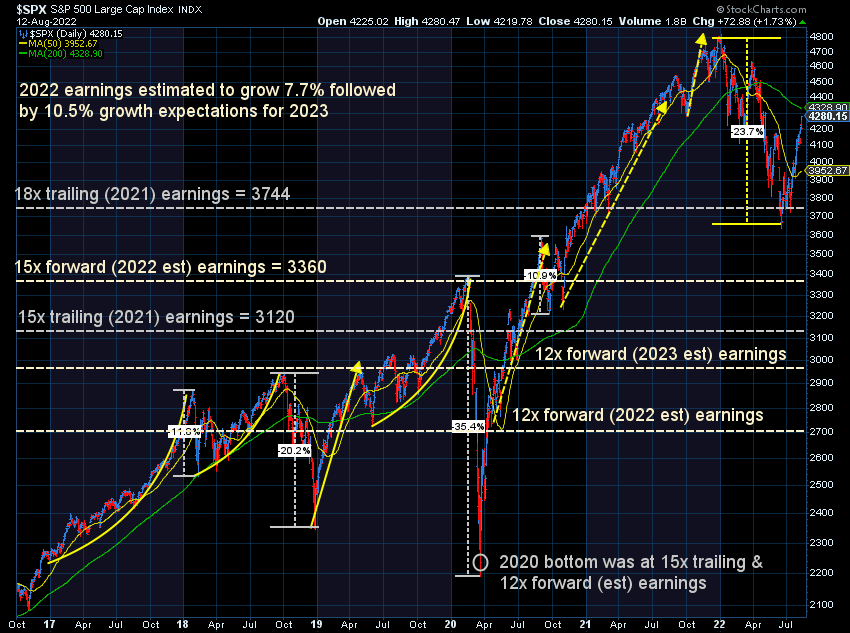

Turning to the markets, stocks blew by the resistance level around 4170 we outlined on the S&P 500 last week. The problem since mid-July has been there has been very little volume behind these rallies. This allowed the market to close the week all the way back at the next level of resistance just shy of 4300.

The Fed may be pleased with the easing of inflation pressure, but they cannot be pleased with the euphoria in the markets. Speculation in risky assets and bets on a robust economy can create continued pricing pressure, which makes the Fed's job much more difficult. Stocks are now up 13% since the Fed's first 3/4% rate hike. The current bottom in the market only took stocks down to "overvalued" territory. Stocks once again are extremely overvalued, betting on a strong economy.

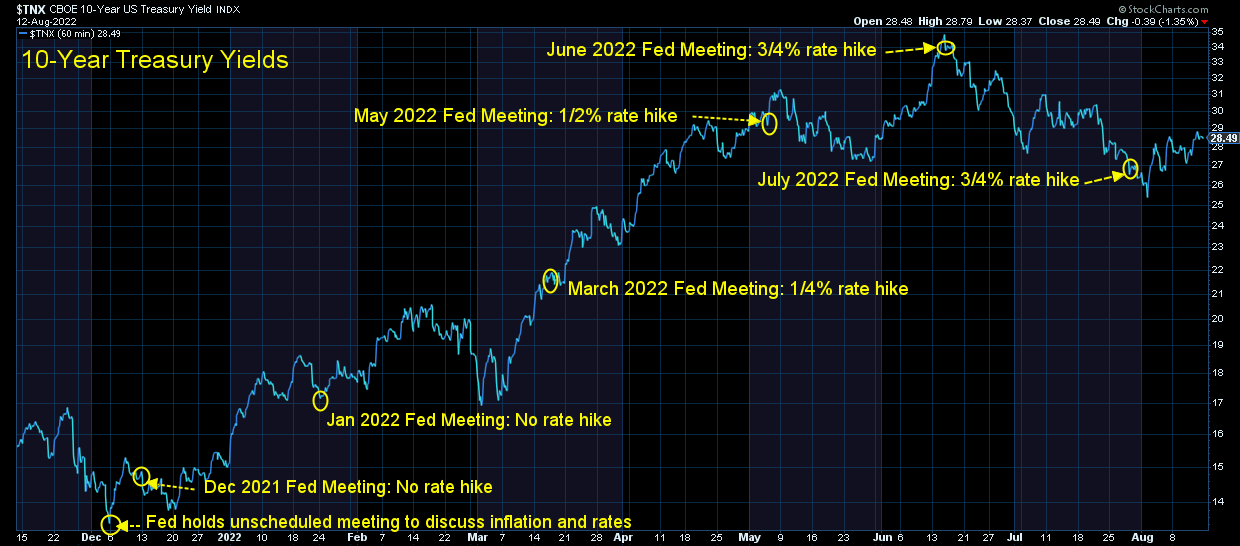

What I'm watching more closely is the reaction to the bond market. I said earlier in the year we could see a peak in yields if the Fed shows they are actually serious about fighting inflation. We certainly saw that after the first 3/4% rate hike, but over the past couple of weeks yields have drifted higher.

We focus on the data when making investment decisions, but my opinion is those investing in stocks with a shorter time horizon (less than 3-5 years) are playing a dangerous game. You are fighting the Fed. You are buying/owning stocks at valuations near all-time highs. You are facing higher interest rates. You are facing slower growth.

So far our stock models are not being sucked into this rally, mostly due to the anemic volume behind the rally. On the bond side, we've been enjoying a very nice rally in Tactical Bond, Cornerstone Bond, Cornerstone Income, Dynamic Income, and Income Allocator. I would venture to guess this won't last through the end of the year and we'll see another sell signal ahead of a reality induced sell-off in high yield bonds (and stocks).

The nice part about investing with SEM is my opinion and guesses do not enter the equation. If I'm wrong, we'll continue to participate and move back to being positive for the year in our income models. If I'm not, our losses remain at levels which can easily be made back up when the market's valuations actually reflect the economic realities. Markets move in cycles.

As I warned back in May when I listed our Bear Market tips – we will see very strong rallies inside a bear market which make most people believe the bear market is over. This is a dangerous time to be speculating in stocks. Stick to your plan. If you happened to jump too far into stocks in the past 18 months, use this rally to reset your asset allocations. If you need money in the next 3-5 years, be careful having very much exposed to the stock market. If you're a long-term investor, ignore the noise all while looking to find additional cash to put to work WHEN the market valuations move from extremely overvalued to extremely undervalued.