Last week we learned inflation is running at the highest annualized rate since 1982. This led one Federal Reserve President (James Bullard of St. Louis) to say he will push to increase interest rates up 1% by July. Wall Street quickly upped their expectations for Fed Rate hikes to include 6 or 7 of them in 2022. The following day several Fed Presidents pushed back saying it would be unwise to raise rates that quickly.

10-year Treasury yields actually went up MORE following the second comments. It seems everybody except the academics running the Federal Reserve are concerned the Federal Reserve has completely lost control of inflation. The only reason Treasury yields ended up down on Friday was because the Biden administration warned late in the day that Russia could invade Ukraine "any day now". This led to a big drop in stock prices and a "flight to safety" to Treasury Bonds.

Weekly Talking Points

- Whether the Fed realizes it or not inflation is a concern. It is wearing on both small business optimism as well as consumer sentiment. This will hurt both earnings growth and consumer spending.

- Inflation is actually deflationary (for the reason cited above). It causes businesses to rethink growth plans as they face higher costs and strains consumers. The risk is the Fed starts hiking rates too late, causing the economy to fall into a recession.

- Stocks have held up relatively well but remain overvalued and in a trading range as institutional investors wait to see how this plays out.

- Bond yields moved up significantly, but there is a chance if the economy slows too much we could see bonds rally.

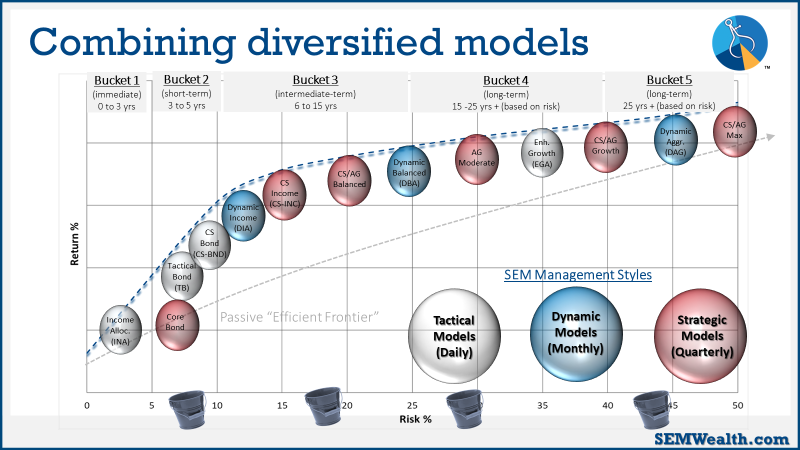

- SEM's models are reacting as we would expect. The shorter-term tactical models (Tactical Bond, Tax Advantaged Bond, Income Allocator, and Cornerstone Bond) have been invested in lower risk assets for the past two weeks. They began selling on January 10. The Dynamic Models remain in a "transition" stage as they have since October. The longer-term Strategic Models (AmeriGuard and Cornerstone Balanced & Growth) remain invested awaiting to see if this normal correction turns into something worse.

- UNLESS YOUR FINANCIAL SITUATION HAS CHANGED, THIS IS NOT THE TIME TO MAKE CHANGES TO YOUR PORTFOLIO. However, if you jumped into stocks the past year simply because you wanted to make more money, you may want to consider taking that money back off the table and aligning your portfolio back to match your financial plan, cash flow strategy, and investment personality.

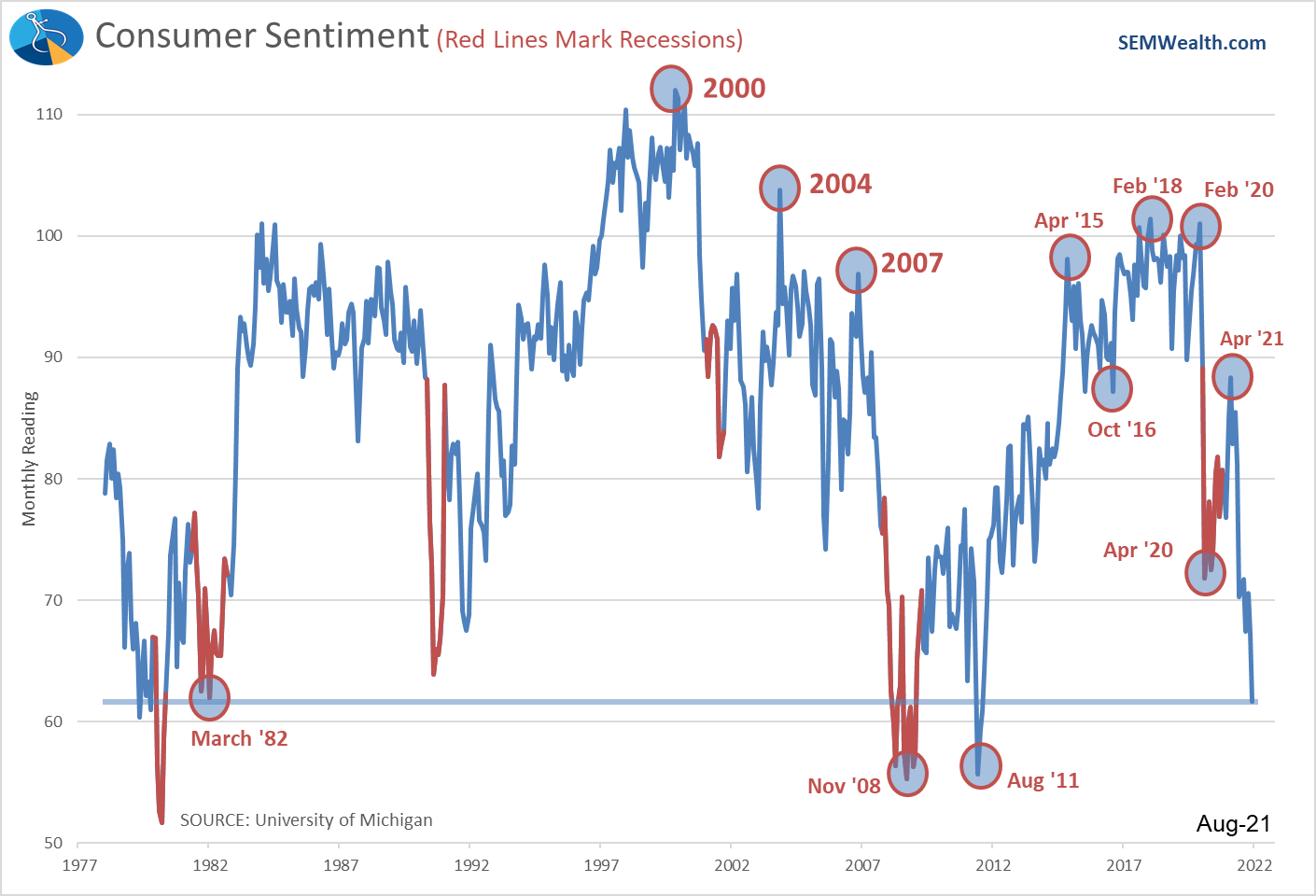

Consumers are Upset

This week we received a glimpse at how the current economic environment is impacting consumers. It isn't pretty.

The only time consumers have felt worse was back in 2011 (during the debt ceiling fiasco), late 2008 (at the peak of the financial crisis), and 1982 (the last time inflation was this high.) Pessimistic consumers do not take risks by spending their money on frivolous things. With no more government stimulus checks and inflation running high, this will play a big role in future economic growth.

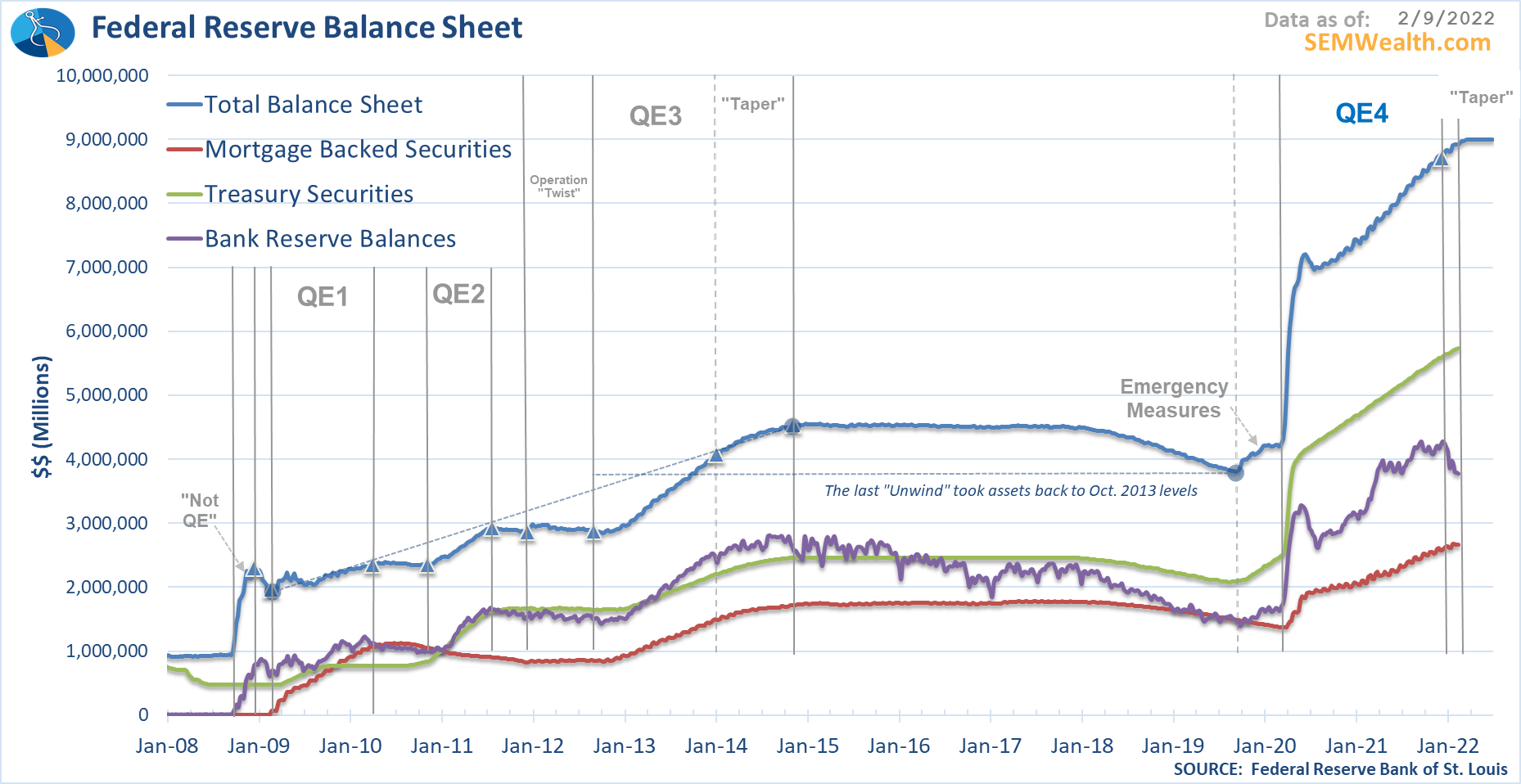

The Fed is Tone-Deaf

I honestly have no idea what the Federal Reserve is thinking. Most people believe the Fed has already started to pull back their stimulus. In reality the interest rates the Fed controls are still at zero and the Fed is STILL PRINTING MONEY. Why? What are they afraid of? Congress dropped 25% of our annual economic output into the economy at the same time the Fed added another 25% of our output via Quantitative Easing. What in the world did they expect and what in the world is stopping them from pulling it back?

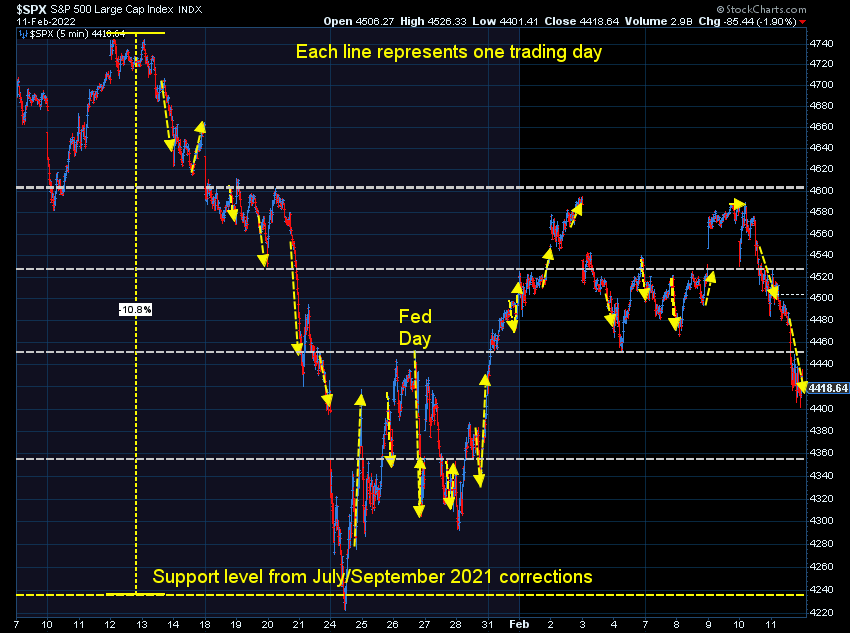

The Stock Market is Confused

Stocks have actually held up well, which should give the Fed confidence they can start attacking the excess money supply (inflation) aggressively. (Remember, Friday's sell-off came after the Biden administration warned about a potentially imminent invasion of Ukraine by Russia.)

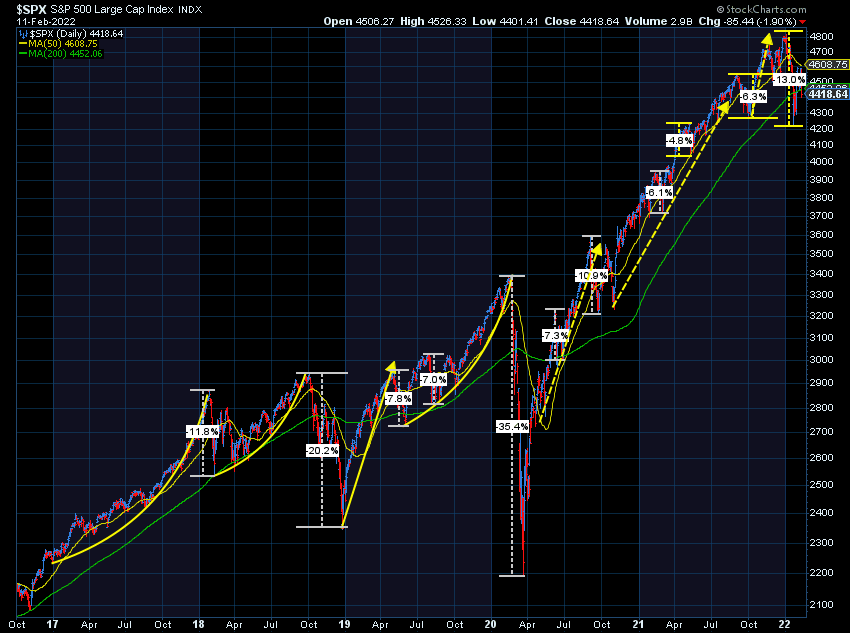

Taking a step back, how stocks handle the Fed raising rates and pulling back their money printing should be the least of their concerns. They created this bubble (along with Congress). We saw 3-year returns last experienced in the mid-1990s. At the peak, stocks doubled from their COVID lows. It's not the Fed's job to stimulate stocks, but instead promote price and financial stability. Creating stock bubbles certainly doesn't help either.

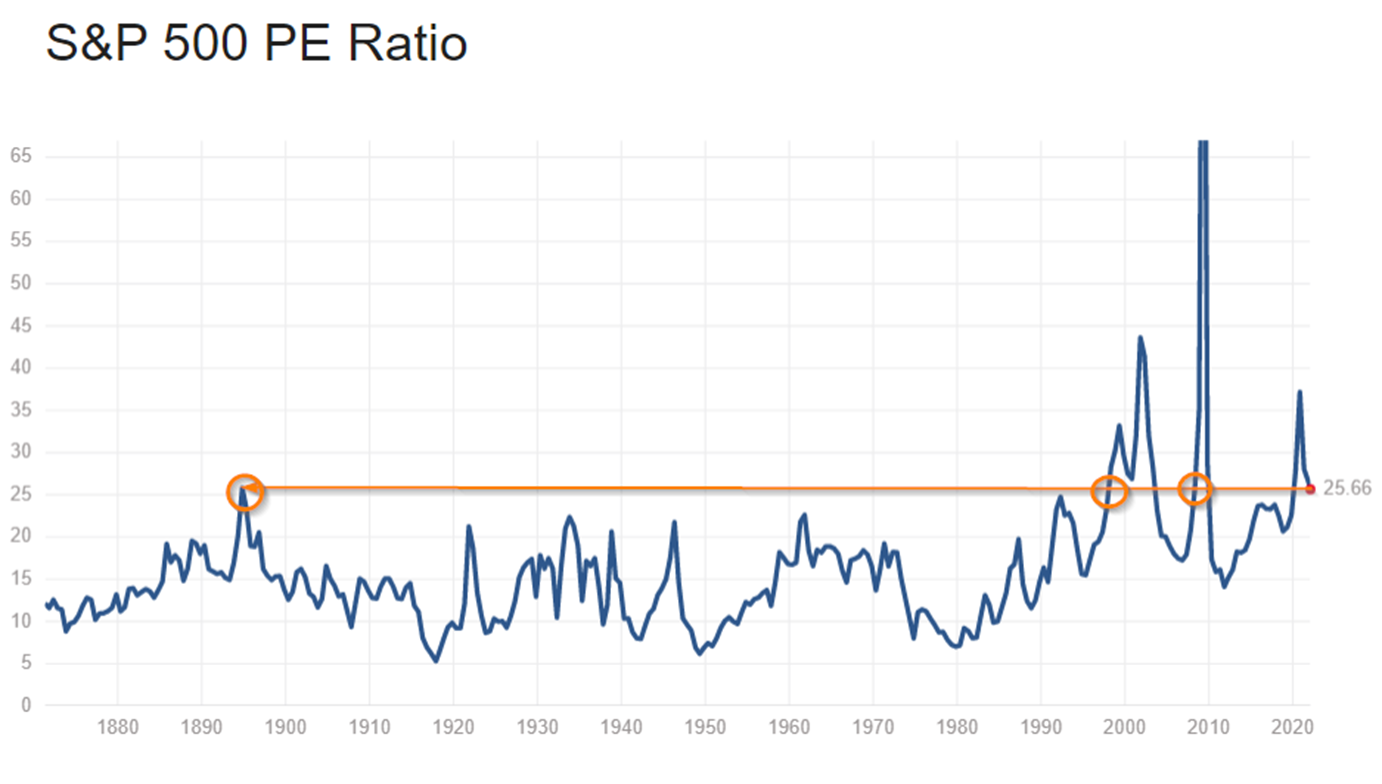

The problem is stocks are tremendously overvalued. I showed this chart last week. High P/Es can be justified if interest rates are low or growth rates are high.

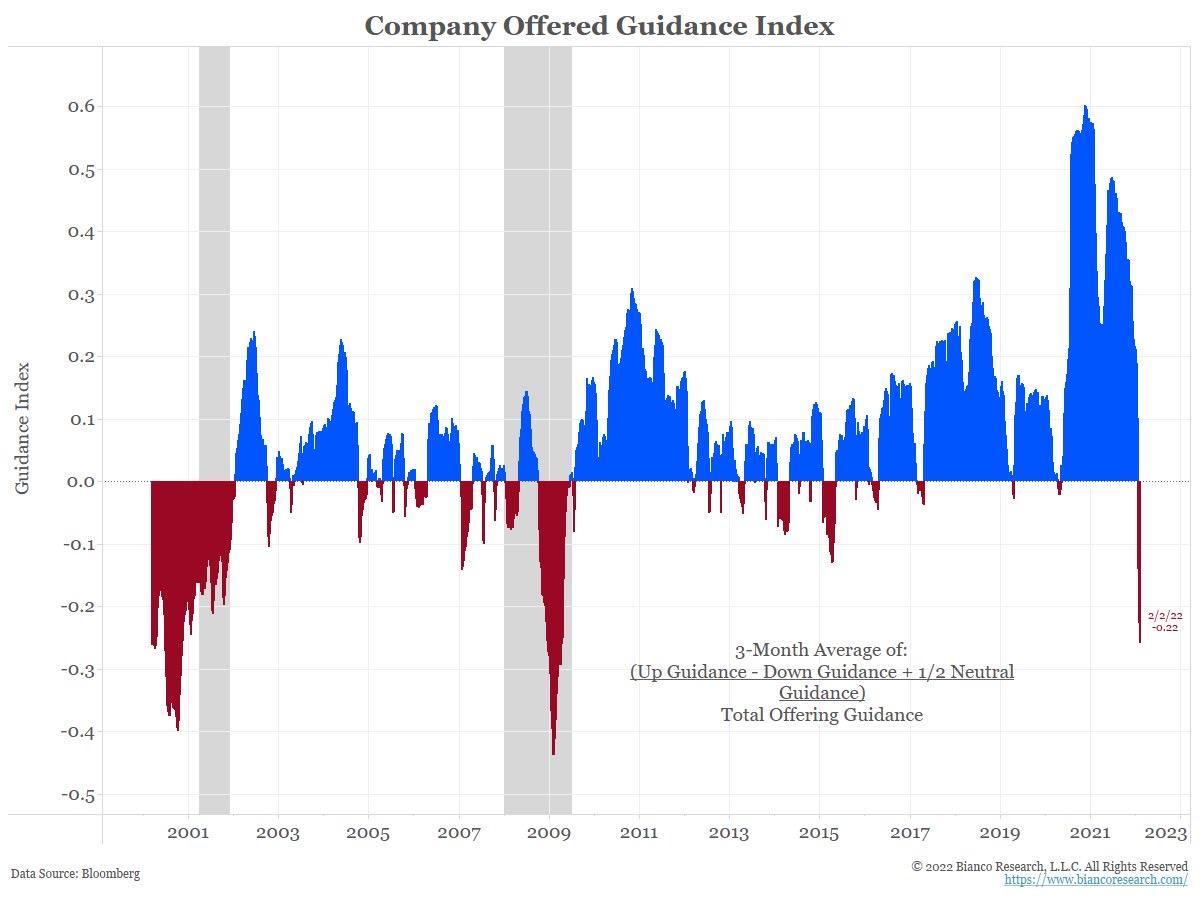

We already know interest rates need to go higher (quickly), but what about growth rates? Schwab's Liz Ann Sonders shared this chart on Twitter last week. Earnings guidance is the most negative since 2008.

Somebody tell me again why this is a "buying opportunity"? Just because stocks are down, doesn't mean they have to go right back up.

The Bond Market is Upset

The bond market has lost confidence in the Fed. Inflation erodes the value of bonds, especially longer-term ones. The bond market is signaling to the Fed they are too late and need to act aggressively. Rates on the 10-year bond have gone from 1.37% in late December to 2% today.

From a bigger picture perspective, we need to be careful about assuming long-term rates will continue going higher when the Fed begins to hike rates. This chart shows how quickly spikes up in interest rates can be reversed. Most of the reversals came when stocks got hit over fears of a looming economic slowdown (because of the rate hikes).

SEM is CALM – we have a plan

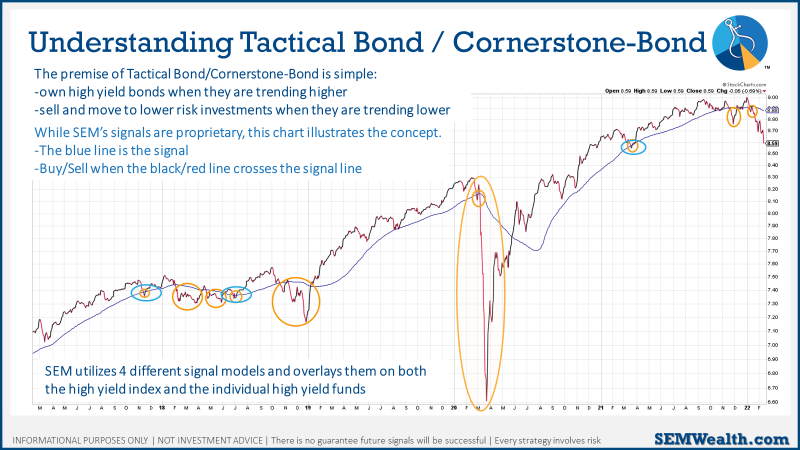

There are a whole lot of unknowns and a whole lot of emotions. I use this chart often to explain Tactical Bond and Cornerstone Bond. It doesn't exactly represent our own proprietary trading systems, but the idea is the same.

We have multiple trading systems designed to take money off the table before most people are even aware there are problems. Our first sell signal occurred on January 10. The second the third week of January. The third and fourth the last week of January. Should the market continue to fall, these systems will ride it out relatively unscathed. Should things stabilize they will start to step back in. Income Allocator and Tax Advantaged Bond are similarly positioned. They are the lowest risk models, designed to hold shorter-term money and/or to lower the risk in the overall investment account of our clients. This allows clients to stay invested with their longer-term, higher risk investments.

The Dynamic Models (which includes Cornerstone Income) have been in "neutral" or "transition" signals since the beginning of October. This is historically the most difficult environment as their is a tug-of-war among institutional investors trying to decide if the economy is going to regain its footing or slow down further. When it resolves, we will either get very defensive or go back to more aggressive positions.

Finally, our "Strategic" models are still saying this is a "normal" correction. However, we are getting VERY close to one or both of our trend indicators giving us a signal to take some money off the table if things get worse from here. This is the beauty of using SEM. We have a plan for whichever way the market goes. While others worry, we simply watch the data and follow our battle-tested signals.

Why you might "feel" concerned

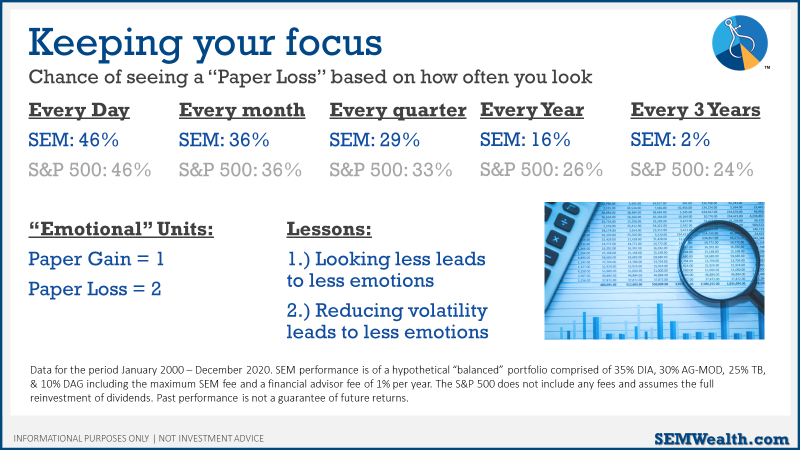

One thing that has come up over the past three to four weeks with both advisors and clients is a clear correlation between clients who are "worried" and those who are not. We've noticed it's the clients who log into their accounts frequently who are generating the most "concerned" phone calls and emails. We shared this table about a year ago in our newsletter to explain what happens to our brains if you look at your account values too frequently.

First off, we must understand how our brains work. We think in dollars not percentage points. So even though an account might only be down 3-4%, that could be thousands, tens of thousands, or even hundreds of thousands of dollars to various clients. Secondly, when we login or open a statement and see an account value, our brains automatically put that into our mental balance sheet even though often times those numbers are "unrealized" gains (meaning they can fluctuate). Finally, psychologically, our brains "feel" a loss about twice as much as we "feel" a gain. These emotional units can quickly take a toll.

The table explains how often you will "feel" a loss in the S&P 500 (stock market) and a "balanced" SEM account (based on historical performance).

You can see, if you are logging in every day you're almost as likely to feel a "gain" as you are a "loss". Even checking in once a quarter, about 1/3 of the time you will feel a "loss". As you take a longer-term perspective SEM's engineered, balanced approach begins to show its value versus a buy and hold investment in the stock market. Historically this diversified, balanced allocation has only generated a "loss" for clients 2% of the time if you check in every 3 years.

Granted, it's your money and you have the right to check in as often as you want, but there is a reason we've been so successful and been around for 30 years – our "slow and steady" management leads to a much smoother ride and less emotions.

If you're feeling a bit of angst, I'd encourage you to take our Risk Questionnaire. It will generate an automatic review and most importantly be forwarded to your SEM financial advisor to check in with you and how the current portfolio fits into your financial plan. If you're not an SEM client, but want a second opinion, just list "need a second opinion" as your "advisor" when you take the SEM Questionnaire, and we'll have somebody reach out to you to discuss. Finally, if you're an advisor and find yourself wondering how your investment portfolios will hold up in what is likely to be a very volatile path ahead let me know and we can discuss ways SEM can help.