Update: On Tuesday, February 22 the first trend indicator in AmeriGuard & Cornerstone triggered a sell. This moved AmeriGuard Balanced, Moderate, Growth, and Aggressive as well as Cornerstone Balanced & Growth to the mid-range of our equity exposure. For instance, AmeriGuard & Cornerstone Balanced are now 50% exposed to equities (down from 70%). AmeriGuard & Cornerstone Growth models are now at 85% exposure (down from 100%). Depending on how the market handles the latest break of the January lows we could either receive a buy signal in the coming days or see the other trend indicator issue a sell.

For weeks the markets have been on edge as Russia has amassed troops on the Ukraine border. We have purposely avoided speculating about what may or may not happen. It really serves no purpose. We've instead focused on what the market was worried about. While headlines surrounding Ukraine temporarily moved the markets, the key driver the past six weeks has been surrounding the Federal Reserve and how they may or may not attack inflation.

It looks like as we start this holiday shortened week, we are going to be forced to turn our focus, at least briefly, towards Ukraine. We will continue to do our best to avoid speculation and focus on what the markets care about.

Weekly Talking Points

- From an economic perspective, even if they disrupt the flow of natural gas into Europe, Russia is not a major player in the world economy. Like in 2014 when the invaded and eventually annexed Crimea, the global economic impact of any invasion or prolonged conflict should be minimal.

- Any time there is a military conflict there is a risk it could turn into something much worse. Russia's closest allies are China, Iran, and North Korea – all countries with unstable leadership who would love to inflict harm on the Western countries. While the chances of the conflict drawing in these other powers is small, it is something that does cause portfolio managers away from making risky bets for the time being.

- President Biden's approval rating is below where President Trump's was at this point in his presidency. With this being a mid-term election year, how the president responds could be partially dictated by polls. That's not a slam on the president or his party. The same would be said if the opposite party was in the same position. That's just how things work in election years.

- The S&P 500 needed a "retest" of the lows from late January. A solid retest typically comes 2-4 weeks after the initial drop, so depending on how things play out, the stock market could put in a more stable and tradable "bottom" this week. Of course, if the lows from January are pierced it could bring out more selling and the market could be in a freefall. (The "retest" has failed – see update above for trades made on 2/22/22)

- Regardless of how things play out, the Fed is still behind the curve in terms of fighting inflation and raising interest rates. Stocks are still overvalued. The economy is still facing a year with no stimulus and consumers who are quite pessimistic. In other words, any drop is not a long-term "buying opportunity", but rather a chance for investors to "right size" the risk in their portfolio.

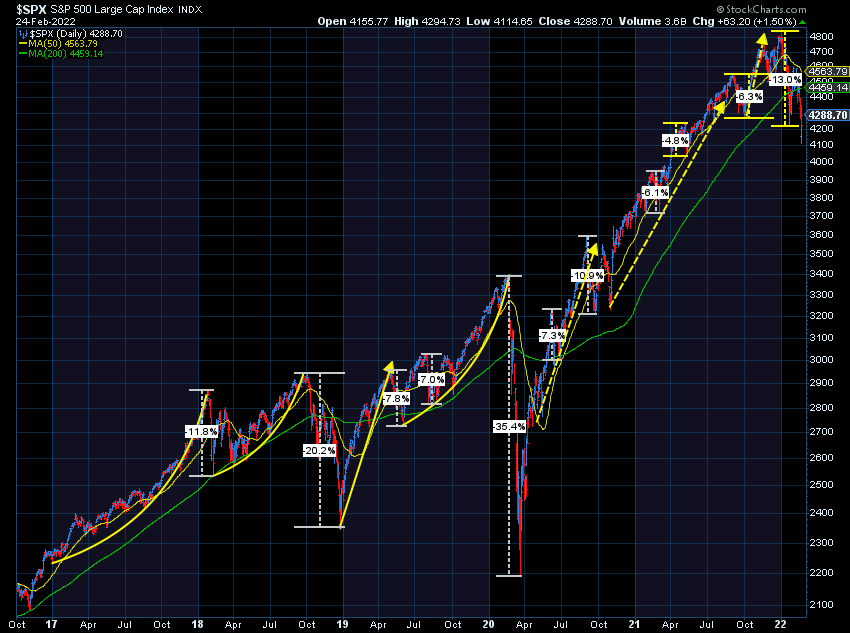

With this being a shortened week, I'm not going to go into too many details. I'll be updating this chart quite frequently throughout the week. Not because it will impact any of our trading systems, but more because it is always interesting to see how investors/traders/speculators react when the market approaches prior lows.

For those who haven't been following along, the yellow arrows mark the movement of the market during the last two hours. This is when we see larger institutional movements and is a good indicator of what the "smart" money is doing with their portfolios. A positive sign this week will be a rally during the last couple of hours.

This chart is more important for anybody believing stocks are "on sale". Even a 5 or 10% drop still leaves them significantly above any reasonable trendline.

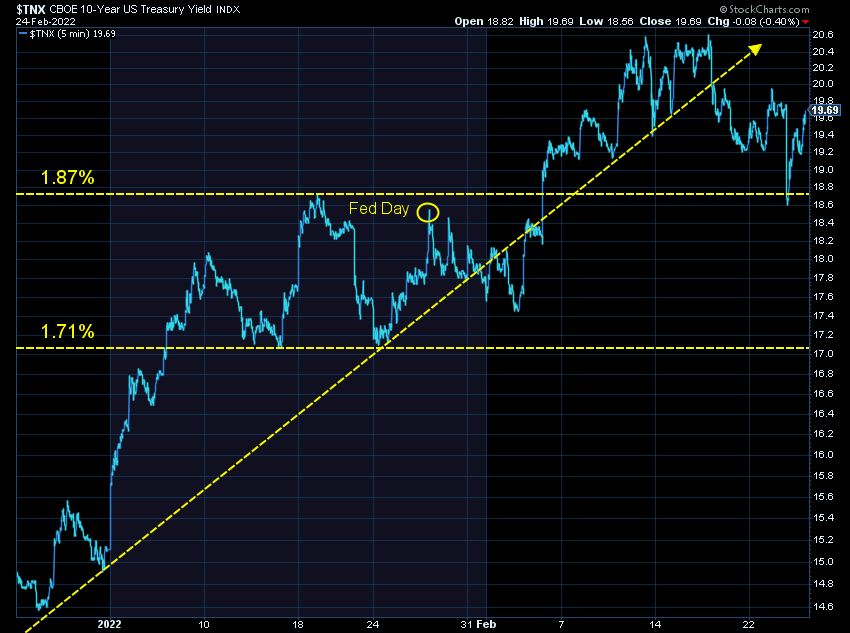

Interest rates had been spiking out of fears the Federal Reserve is well behind the curve in terms of fighting inflation. They have since backed off as institutional investors around the world consider long-term Treasury Bonds as a "safe haven".

1.87% will be a key level to watch. If rates drop back into the bracket below that point, it could be a sign institutions see the conflict turning into a global economic headwind.

As I said from the outset, it is not worth speculating how this turns out. Regardless of the outcome, stocks are still overvalued, the Fed still needs to raise rates to fight inflation, and the economy is still going to have to stand on its own. Last week I lined out the current economic situation including how SEM is positioned to handle it.

Rather than reading up on what may or may not be happening in Ukraine, it'd be more worth your time to read last week's post.

One update from last week – both of our trend indicators in our "strategic" models are within a whisker of triggering a sell. That would mean reduced stock exposure in AmeriGuard as well as Cornerstone Balanced & Growth. These indicators are based on both intermediate and long-term price trends as well as the volume and breadth behind those moves. We will be watching these indicators closely as we move throughout the week.

[See update at top of page for new trades in AmeriGuard & Cornerstone]

Stay tuned.