For the second week in a row we are greeted with some very positive COVID-19 vaccine results. Don't mistake the rest of the article as me not being extremely excited about this development. As I've said from the outset, I have full confidence in the American people, our scientists, and even our government leaders (from all parties in all states) that as we've done for over 240 years we will conquer any enemy that threatens our country.

That said, the stock market reaction to the news is not based on any sort of reality. The market had ALREADY priced in a full economic and earnings recovery, yet we are set to see the second straight insane rally in "value" stocks, cyclical stocks, and any other stock that was beaten up due to the COVID panic. I don't know how in the world any reasonable person could have confidence in their earnings forecast for any company, yet people are blindly buying stocks simply because we are close to having a few vaccines ready sometime next year.

As a whole, the stock market has only been more highly valued once – in 1999. By several measures (including my favorite, the Buffet Indicator (market capitalization/GDP) it has NEVER been this highly valued. When you are investing your starting point matters. If you buy at extreme prices your chances of achieving even average returns is significantly reduced. Conversely, if you buy when valuations are near the low end of the range, your chances of achieving ABOVE AVERAGE returns are significantly increased. It doesn't mean you won't have times when you buy high and still get high returns or buy low and still lose money, but we should set our expectations according to where we are today.

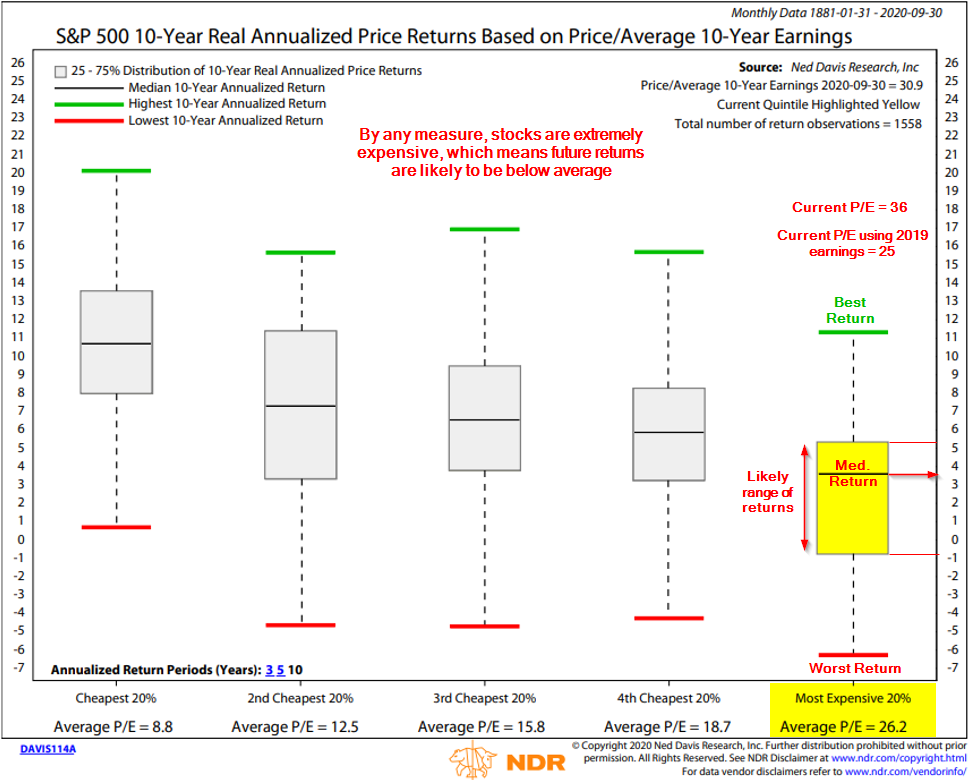

A good way to look at it is this chart from Ned Davis Research. It breaks valuations into quintiles to help us frame expectations. We then can look at all the rolling returns to properly set our expectations. We are in the most expensive quintile, even if we ignore the current shock to earnings and use the 2019 results.

If you own stocks today, you should expect your 10-year annualized returns to be somewhere between -1 to 5%, with the median right around 3.5%. If you were planning for higher returns then you could run into serious problems, especially if you are using a buy and hold strategy.

Even with a vaccine the economy will continue to struggle. Businesses will not survive. Entire industries will never return to the 'old world' normal. The more the disfunction continues in Washington, the worse it will be. I detailed where our economy sits in last week's musings:

We still have the 2nd (or 3rd) wave.....

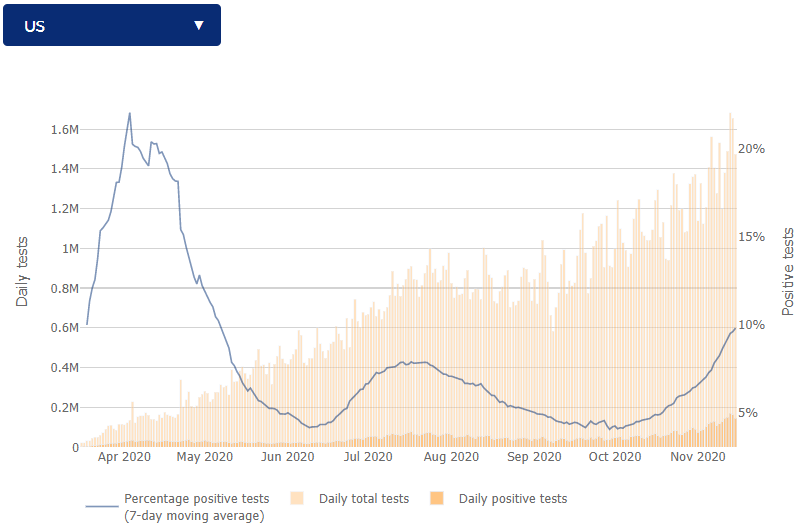

While we await the vaccine, our country still has to survive another wave of COVID. We've learned a lot over the last 36 weeks, but it seems we've gotten so fatigued as a country overall that we are seeing outbreaks across the country.

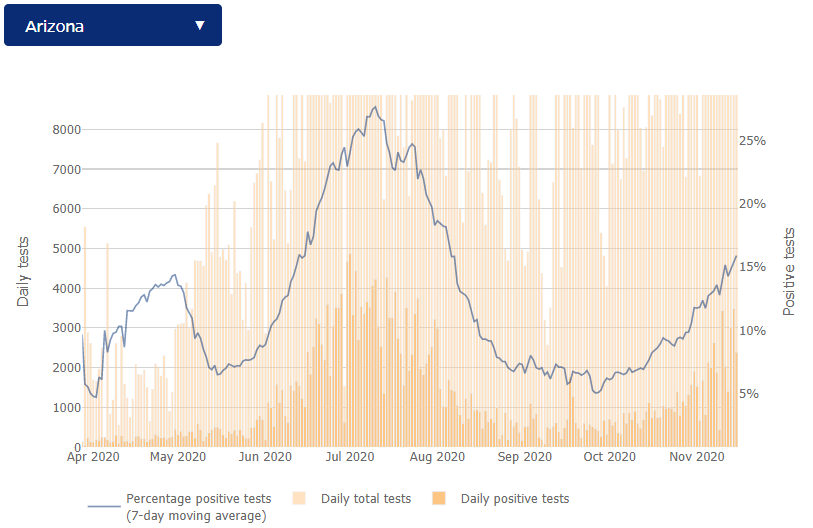

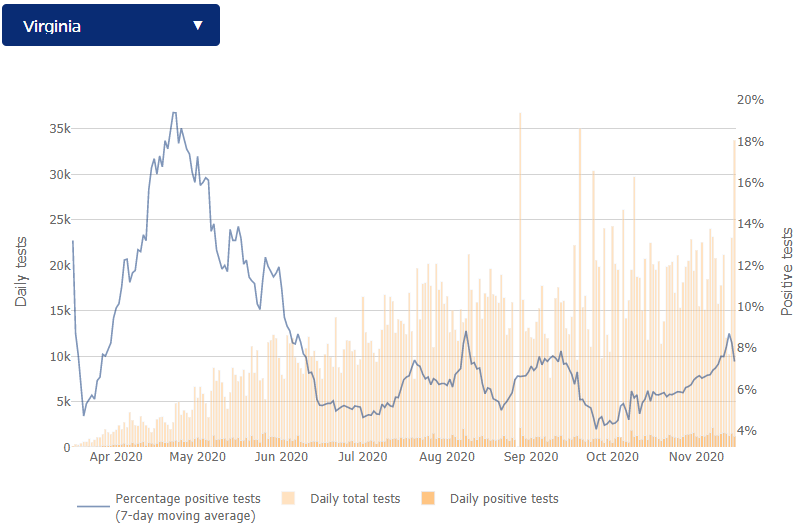

For those of you who have been following along, the stark differences between Arizona and Virginia are again showing up. Cases have spiked significantly since the beginning of October.

Virginia has had a spike, but not as severe as Arizona. Virginia has once again re-imposed restrictions on larger gatherings, restaurants, and bars. Virginia has also had a mask mandate since May. Arizona is still leaving it up to the mayors of the individual cities.

Masks will not prevent COVID, but it will reduce the viral load, making it easier to fight the virus without complications. A lower viral load also lowers the spread. Scientists are still learning, but there seems to be a consensus about masks and good hand hygiene being the best way to reduce the spread.

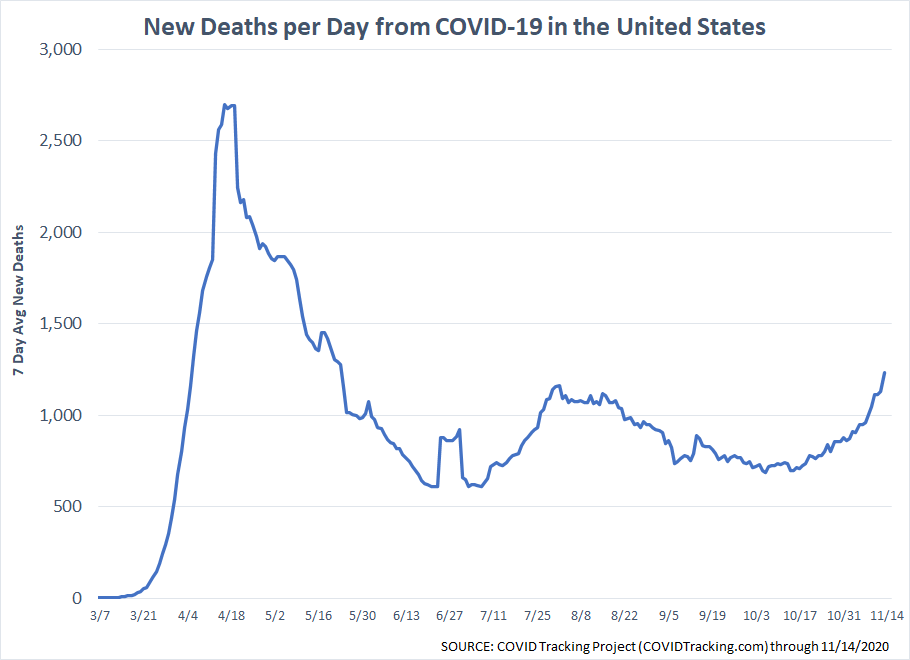

What is most surprising to me is despite all the new knowledge and treatments, deaths are spiking. Whether these are truly COVID related or not, the fact of the matter is our hospitals are again seeing increased patients and more people than would be considered normal are dying.

Again, I'm excited that we now have two strong vaccine candidates, but we still have to deal with higher caseloads, more hospitalizations, more deaths, and more economic pain before we can take care of this. I personally would not be using this news to blindly be buying stocks.

Thankfully if you work with SEM you aren't blindly buying stocks. We are fully invested across most of our investment models and will continue to ride the market higher as long as it wants to keep climbing. We don't care about the reason stocks are going up or if it is justified. We follow the trends and adjust as necessary. Whether it is this week, next month, next year or sometime in 2022 or beyond, the valuations of the market will be adjusted significantly and it will be critical to make sure your financial plan (and your emotions) can handle that correction.

Did you miss the last SEM University: Post-Election Game Plan? Make sure to watch the replay as I discuss the election results and what it means going forward.