This morning we woke up to some encouraging news on a Coronavirus vaccine. 35 weeks after the US began to panic, it seems investors/speculators are banking on a huge economic comeback. We'll leave the speculation to them and stick to the data.

As Rick pointed out last week, we were well positioned for the market rally following the presumptive election of Joe Biden although the Senate does now hang in the balance after neither Senatorial candidate in Georgia reached their state-mandated 50% voter share. Based on the early action, we're also well positioned for this positive virus news.

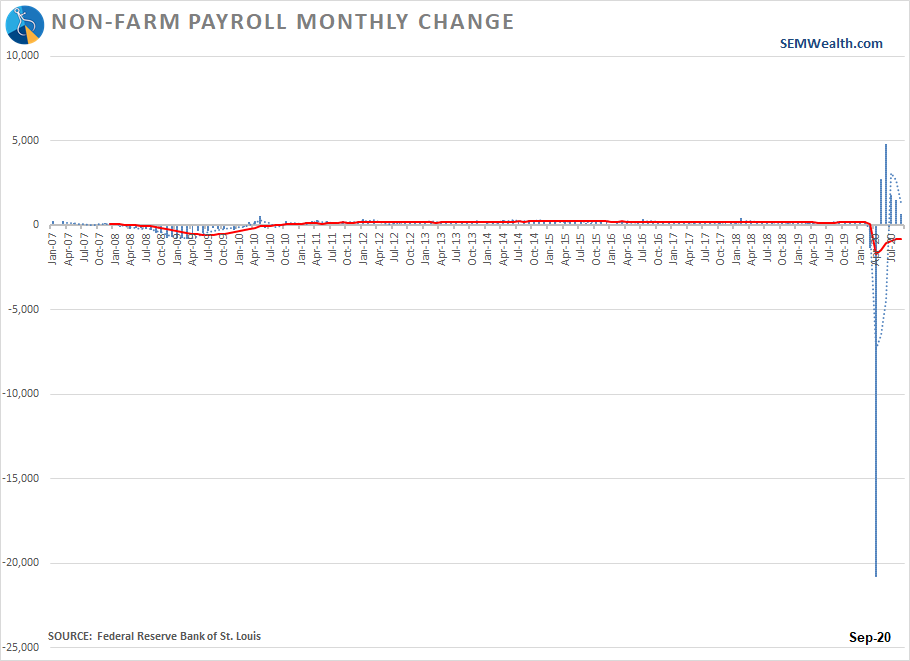

For the US economy, this is welcome news. Last week's Employment Situation report showed continued slowdown in the pace of job recovery.

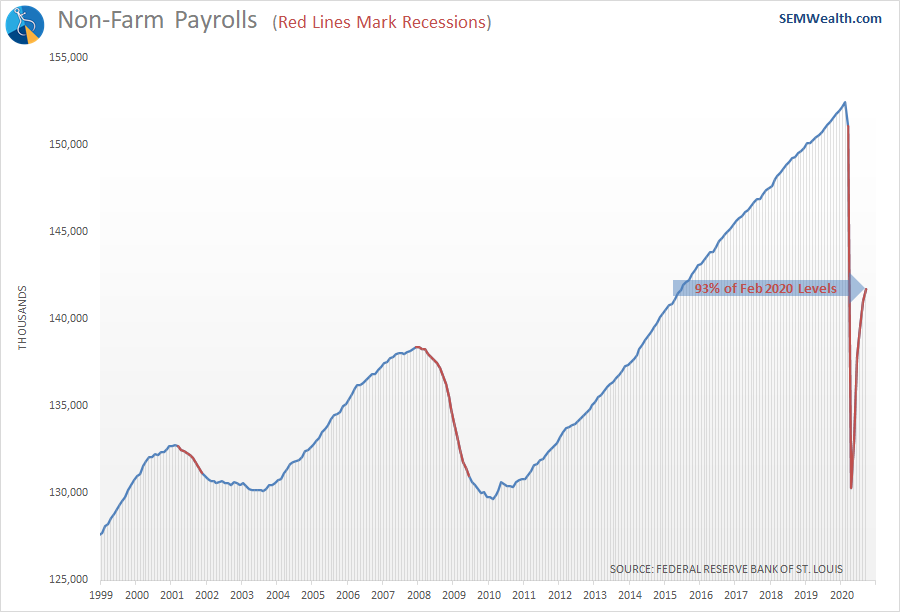

The number of jobs are still well below the peak levels in January and are back to 2015 levels.

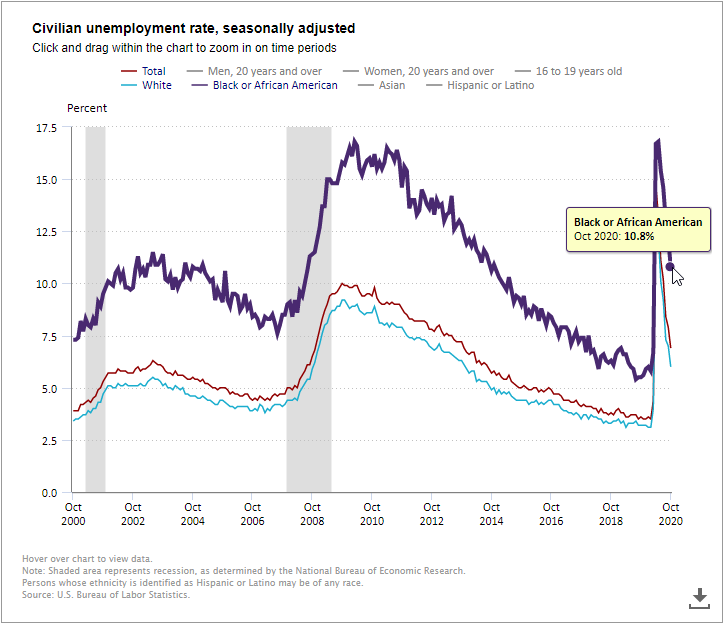

The unemployment rate has come down significantly, but it is still elevated and still shows a large racial gap.

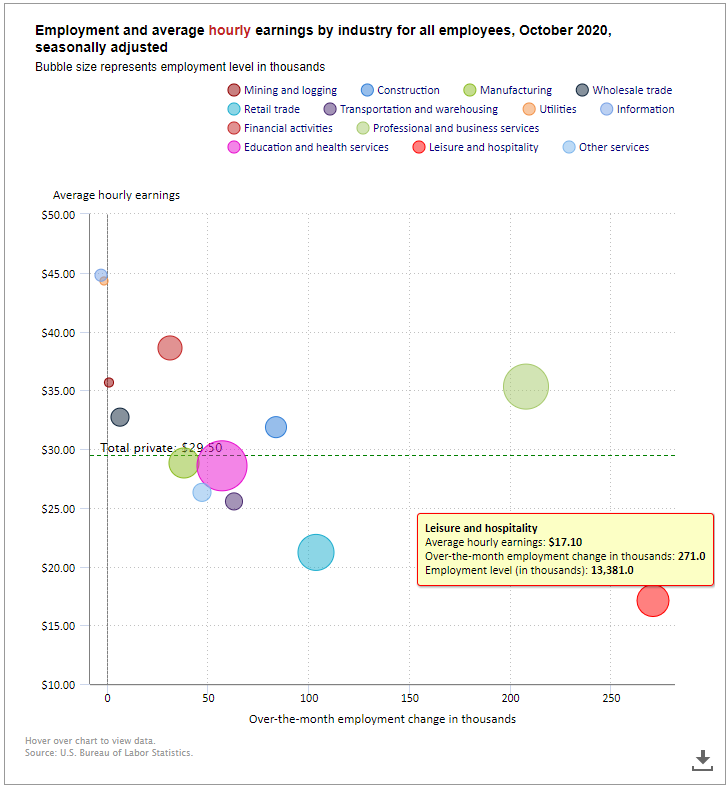

We continued to see the lowest paying jobs be the ones that were gained, although it was nice to see an increase in higher paying manufacturing jobs last month.

This is another illustration of our structural economic problems. A vaccine will not fix this. Where you sit in the economy tends to adjust your perspective on how strong it is. I'd encourage each of you reading this to consider the economic experience others are going through before making blanket statements about the strength of this recovery.

I truly appreciate the outpouring of love, prayers, and support and especially those of you who have supported our son's memorial fund. As our heads clear a bit we will begin working with schools, businesses, and local leaders to start implementing real change in our communities. To learn more about Tyler's fund, go to racerty34.org.

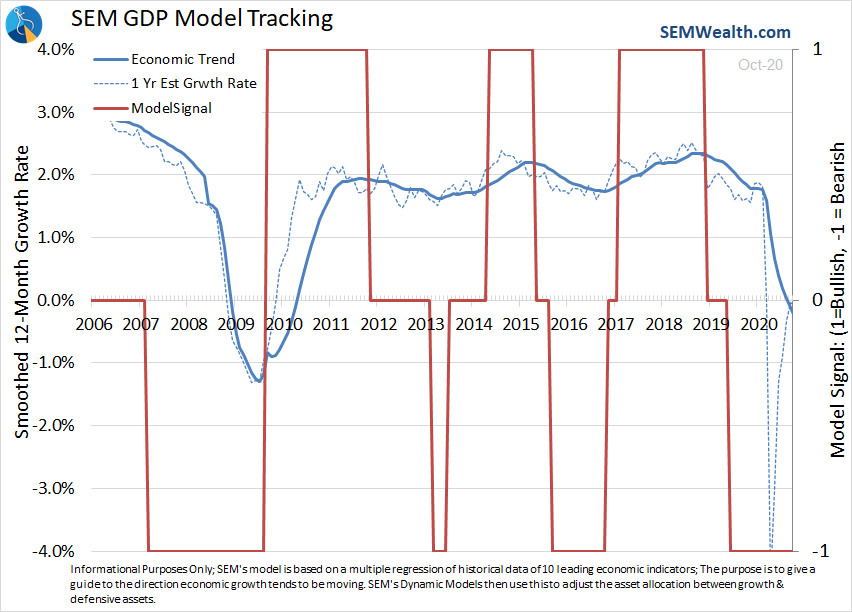

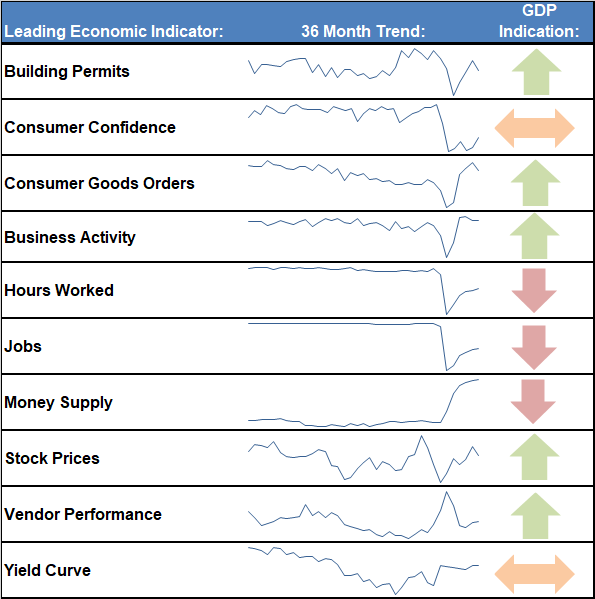

Economic Model Update

Life goes on and stocks will move based on the overall direction of the economy, not whether or not we have structural issues beneath the numbers. Our model still shows a slowing recovery. The more stocks go up without a broad based strengthening in our indicators the more likely investors/speculators will see some large losses when the economic growth doesn't live up to expectations.

Stocks are at all-time highs, yet the economy has little chance in the next six months of being back to where it was at the beginning of the year. Stocks were overvalued then, making them more overvalued today. We will deal with that when it matters to those investors/speculators. For now, as I mentioned at the top we will stick to the data and are well positioned for whatever euphoric rally we see develop this week and/or the rest of the year.