This year I've marveled about the optimism shown by market participants and Wall Street experts alike who truly believe the Fed has reigned in inflation and would not cause a recession (or even a slowdown in earnings). They also believed the Fed would be stopping their rate hikes soon, which would allow the stock market to march to new highs.

Warning! Those who know me know I've been a constant critic of the Fed and have warned for 20 years about the risks the Fed has created in our financial system. I've attempted to not let this turn into a rant, but it's been difficult to not let the Musings do that. I'm beyond angry that this is happening again and the "masters of the universe" (bankers) along with the politicians and regulators have once again created a crisis that was preventable.

Last week was an eventful one. "Everything, Everywhere, All at Once" swept the Oscars on Sunday night. It also described the banking crisis which emerged late last week. A seemingly unknown bank outside of the venture capital world failed on Friday. This sent shockwaves through the financial system. Over the weekend Federal regulators stepped in to "backstop" Silicone Valley Bank and Signature Bank by guaranteeing all deposits above the FDIC limits of $250K per account holder. They fell all over themselves saying this is not a bailout and that taxpayer funds would not be used. They are technically correct. The banks will "fail" and be merged into another bank, but this was a blatant bailout of the millionaires and billionaires in the venture capital industry. Their investments were going to fail and thus they were going to lose tens of billions of dollars, which would hurt their millionaire and billionaire investors as well as decimate their fees (they are paid very high fees based on performance).

This may not be a "bailout" of the bank, but it's interesting how when times are great venture capital investors are all about the "free market", but when it fails, they want the government to step in and save them.

Everyone is blaming the Fed, but for the wrong reason (more on that below). They point to the Fed's aggressive rate hikes as the cause of the collapse. While that is technically the reason they collapsed last week, what is being missed is the runaway risk taking that occurred in 2020 and 2021 (which was fueled by the Fed's policies). The other issue is the regulators completely missed the risks at the banks as did their board of directors and management teams. Sometimes you can't make this stuff up. Remember Barney Frank of the "Dodd-Frank" Financial Regulations?

Barney Frank, DIRECTOR, SIGNATURE BANK: Barney Frank has been a member of the Board since June 2015. Mr. Frank served as a U.S. Congressman representing the 4th District of Massachusetts from 1981-2013 and also was the Chairman of the House Financial Services Committee from 2007-2011. As Chair of the House Financial Services Committee, Mr. Frank was instrumental in crafting the short-term $550 billion rescue plan in response to the nation’s 2008-2009 financial crisis. Later, he cosponsored the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was signed into law in July 2010. Prior to serving in Congress, Mr. Frank spent eight years as a state Representative in Massachusetts and, earlier, served as Chief of Staff to Congressman Michael Harrington and Chief Assistant to Mayor Kevin White of Boston. Mr. Frank’s extensive experience as a Congressman, and particularly as Chair of the House Financial Services Committee, led the Board to conclude that he should be a member of the Board.

Yep, the co-sponsor of the "reforms" which were supposed to prevent another financial crisis literally was a part of a bank which failed.

I've been trying to think of a way to explain this in simple terms. In its simplest form this was a combination of way too much money flowing into the system, which filtered down to private equity firms. With the cheap, easy money we saw rampant risk taking at a level never before witnessed in the system. The regional banks (such as SVB and Signature) which catered to a specialized group of customers not only lent money to the investors in the firms, they provided cheap loans and banking services to the founders and upper management of the start-up companies, AND on a smaller scale invested in some of the start-ups. Worse, they also had most of the checking accounts for these start-up firms.

Essentially, they made the loans to fund the firms and then received the money back in the checking account.

When money was flowing freely into the system, the "burn rate" (how quickly the start-ups were spending their cash) did not matter. New loans could be made with the cheap money and new deposits would come in. Here's the problem.......

All banks have a "reserve" requirement (how much they need to keep in LIQUID assets). Typically this is 10-20% of the total deposits. The rest of the money is supposed to be matched with the types of accounts. A 1-year CD should be matched with a 1-year interest bearing investment. A 5-year to a 5-year, etc, etc. These would be in a "Assets held to maturity" accounting bucket. On the income statement the value of these assets are not "marked to market" like the "assets held for sale" bucket. What that means is if the value of the "held to maturity" assets dropped, it didn't matter because when it matured it would help pay off the "liability" (the CDs or other products they received money for).

What SVB (and many other banks) did was they took their BUSINESS CHECKING account deposits and invested in long-term Treasuries and Mortgage Backed Securities. If they put those in their "assets held for sale" bucket or the "investment" bucket (typically 10-20% of the bank's total assets) that would be ok – those assets would be marked up or down based on the changes in market price. The problem is they took these LONG-TERM Treasuries (which were funded by SHORT-TERM DEMAND DEPOSITS) and put them in the "held to maturity" bucket.

This meant as interest rates went up the value of those assets plummeted. These losses were not booked on the balance sheets so the banks appeared far more healthy than they actually were. At SVB (and then Signature and probably other regional banks), when the easy money dried up and stopped flowing, the "burn rate" of all of the start-up companies started to eat into the 'cash' and 'held for sale' bucket. It got so bad at SVB on Wednesday they announced a stock sale and a sale of some of the "held to maturity" assets in order to meet their capital requirements. When they did that, they were forced to write down the losses in the 'held to maturity' assets they wanted to sell (an estimated 20-25% loss on those assets). This spooked their clients and we had a good old fashion run on the bank as more deposits were pulled, more "held to maturity" assets had to be sold.

You can blame the Fed's interest rate hikes all you want, but the fact of the matter is the regulations put in place after the financial crisis are still woefully lacking. Banks take on significant levels of risk and the regulators have no idea because they aren't marking their assets to market every day (or at least monthly or quarterly). How can a DEMAND DEPOSIT be matched with a LONG-TERM BOND? It works great when interest rates are falling – banks make more money, they lend more money out, they take in more deposits, and everybody is happy. The model fails when interest rates go up. Yes, the Fed should be blamed, but not because they raised rates too fast, but because they provided the drugs for the party in 2020 & 2021.

[Side Note 1: How in the world does CNBC still have Jim Cramer on the air? He recommended SVB back on February 8, now he's on the air telling us what went wrong and what to do next.]

[Side Note 2: Everyone is saying how the taxpayers will not pay for the "backstop" (repeat after me, "this is not a bailout, this is not a bailout, this is not a bailout....."). Technically they are correct. The FDIC is an insurance fund, so they will simply raise the fees they charge to their member banks. Does anybody believe the banks will just eat these fees, or will they instead pay less on the deposits and/or charge higher fees to their customers (i.e. the taxpayers)?]

Why do we trust the Fed?

Before all of this happened, we saw a major shift in the expectations for the next Fed meeting. Following the rally to end the week before after one Fed governor stated he could make a case for a "pause" in rate hikes (despite nearly every other speaker that week saying their job is far from over), Fed Chair Jerome Powell threw cold water on the rally when he indicated the Fed may need to revert back to a 1/2% increase in rates in their next meeting. Chair Powell also said it appears the "terminal" rate for Fed funds (the level where they end their 'tightening' cycle) would likely be higher than the previously expected 5% to 5 1/4% level.

[Side note 3: He also said he did not see any 'systematic' risks due to their rate hikes. Either Chair Powell and his buddies at the Fed didn't realize how much the banks have in long-term 'held to maturity' assets and thus have not booked the losses, or he was lying.]

[Side note 4: Interest rates have fallen sharply across the board. The 10-year is down to 3.4% this morning after hitting 4.1% on March 2. The expectations for the 'terminal' rate has dropped to 4.75%, meaning the market now believes the Fed is done raising rates.]

I still cannot believe anybody takes what the Fed says seriously. They have continued to miss even their one-month forecasts for inflation. Somehow, despite their pathetic track record investors still believe the Fed will be able to save the economy. This is despite the fact the Fed slashed rates aggressively during the 2000-2002 bear market and the 2007-2009 financial crisis. Even with those highly stimulative policies, stocks still lost half their value. What people seemed to have forgotten is the fact the Fed stimulated far too much and far too long prior to those bear markets. Excesses created during the 'expansion' had to be removed. With so much speculation, it was impossible to stop.

I've said all along the biggest problem for the Fed is they waited far too long to realize inflation was a problem. Think about this: a year ago the Fed had yet to raise interest rates once since the COVID panic. This is despite the fact inflation had been raging since the spring of 2021.

In March 2021, inflation exceeded the Fed's "target" level of 2021. They chose to do nothing.

When the government issued their third and largest round of stimulus checks in April 2021, the Fed chose to do nothing.

When the stock market shot-up 20% from January to August 2021, the Fed chose to do nothing.

When the unemployment rate fell below 4% for the first time since February 2020, the Fed chose to do nothing.

When consumer spending growth hit 7% in December 2021, the Fed chose to do nothing.

Actually, they did something in 2021 — they kept PRINTING MONEY! They didn't end their Quantitative Easing program until the end of 2021!

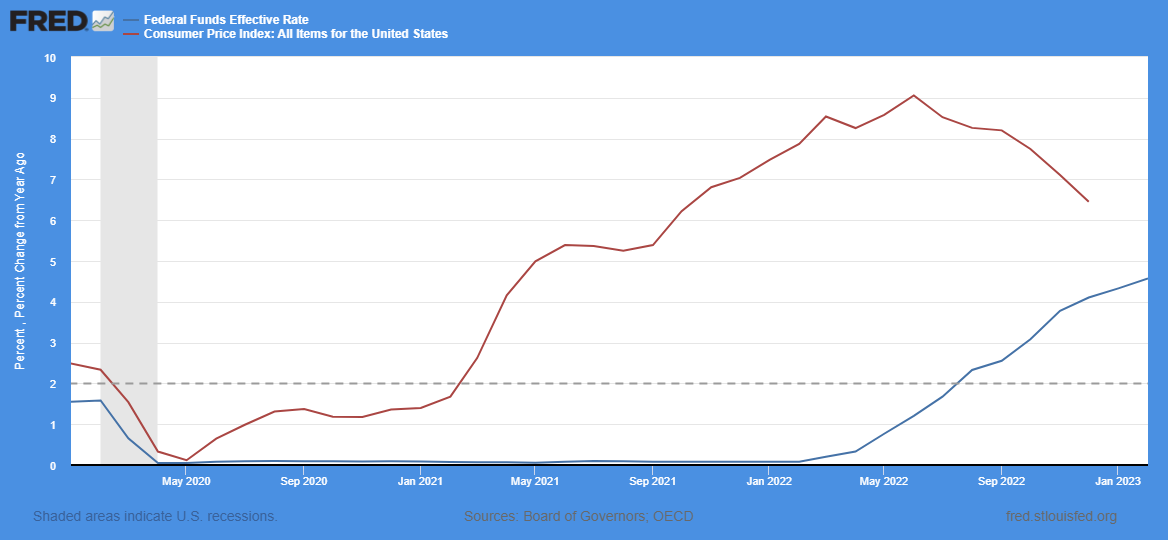

When the Fed finally got around to raising rates on March 16, 2022, their first move was a mere 0.25%. By that time, inflation was at 8.5%. This chart illustrates how far behind the curve the Fed has been. The red line is inflation, the blue line is the Fed Funds interest rate. I added a dashed line to illustrate their 2% inflation target.

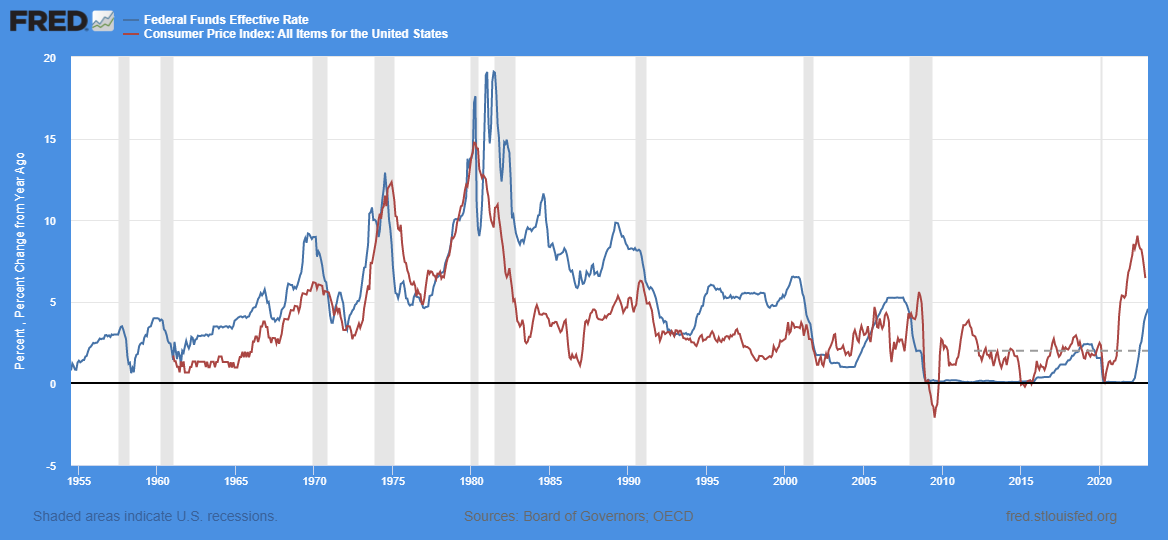

This long-term chart illustrates the normal relationship between the Fed Funds rate and inflation. As you can see, most of the time the Fed has kept interest rates above the current inflation rate. The only exception was from 2010-2012 when the country was climbing out of the financial crisis.

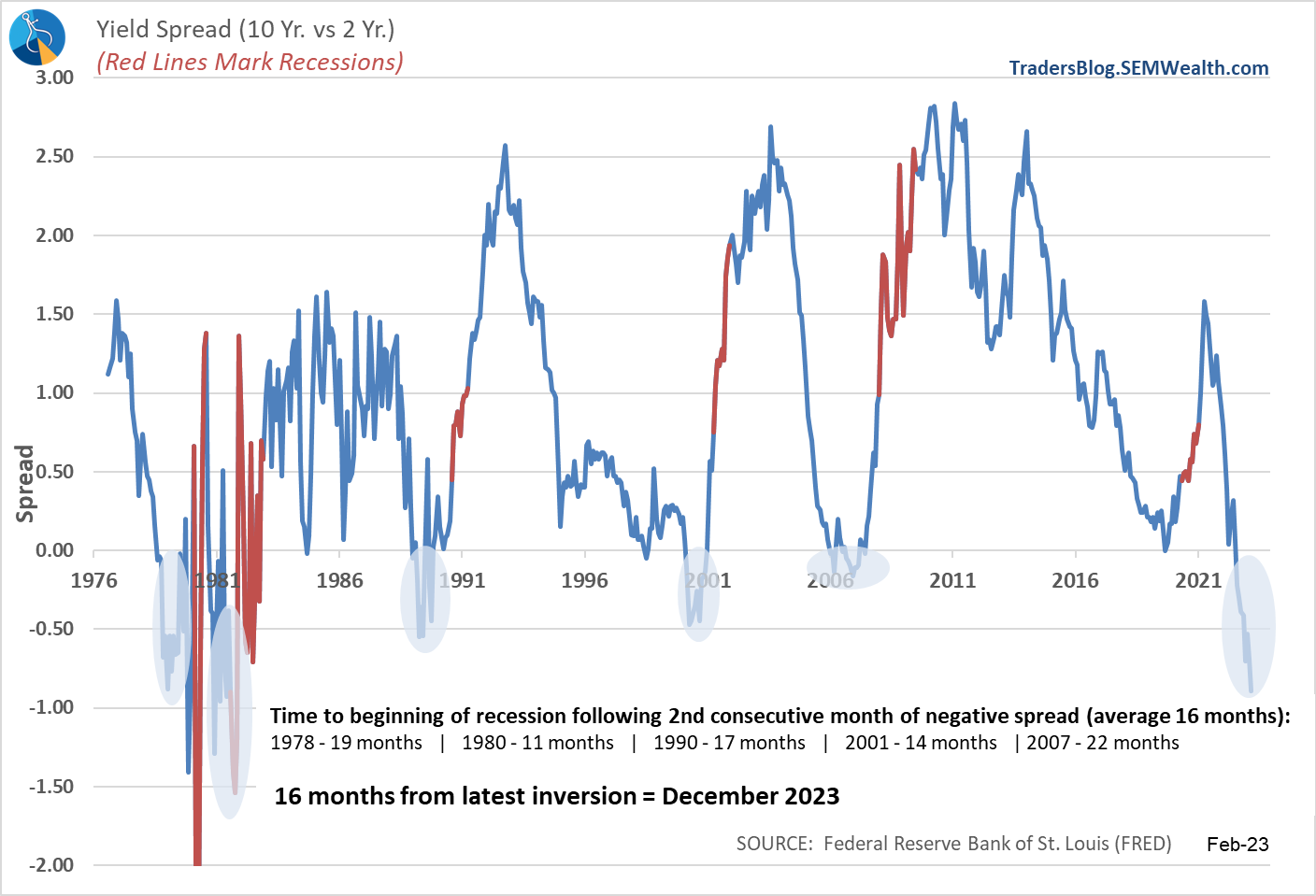

The Fed has been woefully behind the curve. They created the bubble of 2021 and by waiting too long they have broken the normal functioning of the financial markets. The bond market has been screaming from the rooftops that the Fed needed to do something. The yield curve (the difference between long-term rates and short-term rates) is one of the most reliable recession indicators. It is now at the worst inversion since the early 1980s.

With the inversion, which was created because the bond market knows how far behind the Fed is in their inflation fight is starting to create cracks in the financial system. SVB Financial (Silicon Valley Bank, which helped fund a lot of the venture capital fueled start-ups over the past few years) has apparently run into a liquidity problem. Banks "borrow short" and "lend long". This means they raise capital with short-term bonds and then turn around and lend money to generate revenue with long-term bonds. In a normal functioning market, you receive higher rates for long-term bonds.

Because the Fed waited too long to do anything about the speculative bubble, we saw riskier and riskier long-term loans being made. As those borrows have run into problems at the same time the short-term funding loans are maturing, the banks who made them are being hit on both ends. They are not receiving revenue, their "assets" have been marked down, and they have to raise money at significantly higher rates.

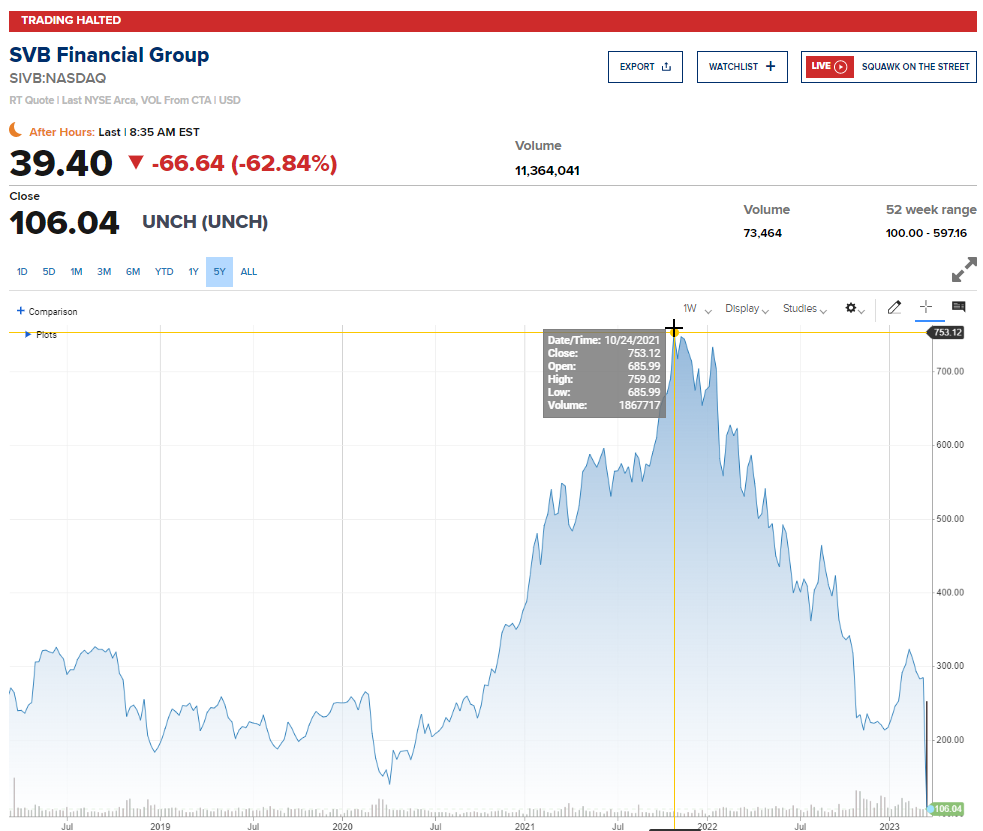

At its high in October 2021, SVB Financial was above $700. Before being halted on Thursday it was down to $106. The last afterhours quote available showed it down to $39 (94% from its high).

The overall banking index was hammered last week as fears of "contagion" spread. The optimism we've seen throughout the year apparently was not enough to overcome the memories of the financial crisis. While I do not believe we will see the type of losses in the banking sector generated by the overexposure to subprime mortgages, I do know the private equity market was running out of control in 2021 and the first half of 2022. Money was cheap and easy to find, and bankers were more than willing to take on the high fees of putting it to use. I've been shocked by the types of prices small business owners (including financial advisors) were receiving from private equity buyouts. I've warned those owners counting on continued high valuations that once the easy money dried up, we could see some failures.

SVB Financial is the first. The question is how many other financial institutions were overly exposed to private equity loans. I also hate to say it, but you have to wonder when/if the Fed will bailout Wall Street due to their exposures. As an aside, given the "k-shaped' economy and our current social divide, I'd hate to see the uproar if Wall Street receives another bailout. For a refresher of how our economy is broken and why this could be a problem, check out this short video.

Stay tuned. Based on what we saw in the past two bear markets, this story is far from over.

Economic Update Postponed

Normally I post our monthly economic update the Monday after the Payrolls report. Given that my synopsis (rant) about the Fed and all of their recent failures has run over 2500 words, I will postpone our economic update until next week.

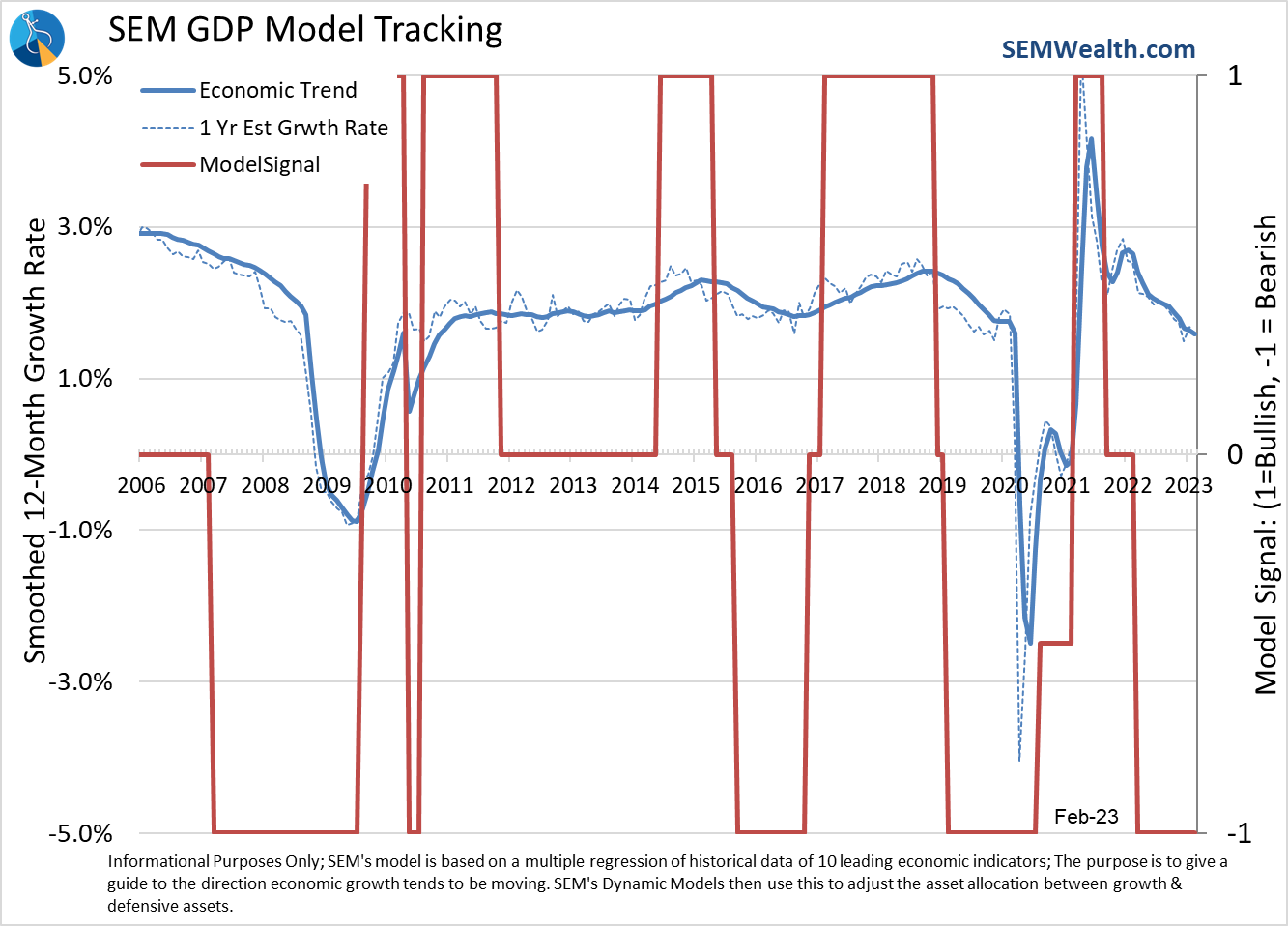

I'll give you a short preview — the data for the most part worsened. Our economic model remains where it has been since April 2022 (one month after the Fed first raised rates). While SVB's failure has driven the markets the past few days, we got a glimpse into the idiotic "bad is good" thought process on Thursday and Friday morning. Both mornings, the futures markets were indicating a lower open for stocks. On Thursday the weekly jobless claims data came in showing a big jump in unemployment claims. Stocks rallied big off the lows and were looking to open positive (before SVB news hit the markets).

On Friday, the February payrolls report showed the lowest year-over-year increase since March 2021 (and the unemployment rate move higher). You'd think that would be bad news for those who believe we won't have a recession and thus see 13% earnings growth this year. Instead, we saw stocks rally. The thought process both mornings was "woohoo, a weaker economy should mean the imminent end of Fed rate hikes."

That thinking is wrong and dangerous. It takes 9-12 months for one change in Fed policies to filter through to the economy. Even if they do not hike rates again this year, we'll still see the strains from past rate hikes move through the economy. Our data continues to say "be careful" and our models continue to reflect this cautious stance.

Turning Point for Markets?

As mentioned earlier, bond yields have dropped precipitously the last few days. We're back down to the "support" level of 3.4% on the 10-year.

The S&P 500 is back below the bear market downtrend line. A move below the December lows of 3780 would probably not be a good thing.

I've lived through 2 bubble bursts and know the news will come fast and we cannot base our analysis on the short-term reactions of the market. Cracks have emerged in the system and it will create problems throughout. Please be careful.