Last week was certainly an eventful one. It seemed every day had a "crisis" at a (relatively) small bank, which caused a big drop in share prices across the financial sector. This pulled the markets lower, but then a rumor, news release, government announcement, or something else emerged to calm the markets. This of course has brought memories of the Great Financial Crisis of 2007-2009. I continue to remind anybody who will listen, this is nothing like that time.

Now, this doesn't mean there aren't tremendous risks to the financial system and thus the stock market. It just means we cannot use the "playbook" from the last crisis to predict what will happen this time. We will see 'aftershocks' to the events of the past few weeks. I often say, 'a bear market is a process, not an event.' The same can be said about a financial crisis as well as the eventual market bottom. We shouldn't take a move up in prices as a sign the crisis is over. There will be more companies who run into problems over the months ahead.

My market 'musings' were born during the financial crisis. They reappeared during the pandemic in 2020. Other than that, this blog spends most of its time discussing a common theme.

With so much happening, we are back to the random "musings" format again. So here we go, in no particular order, everything that is on my mind as we start the third week of the 'banking crisis':

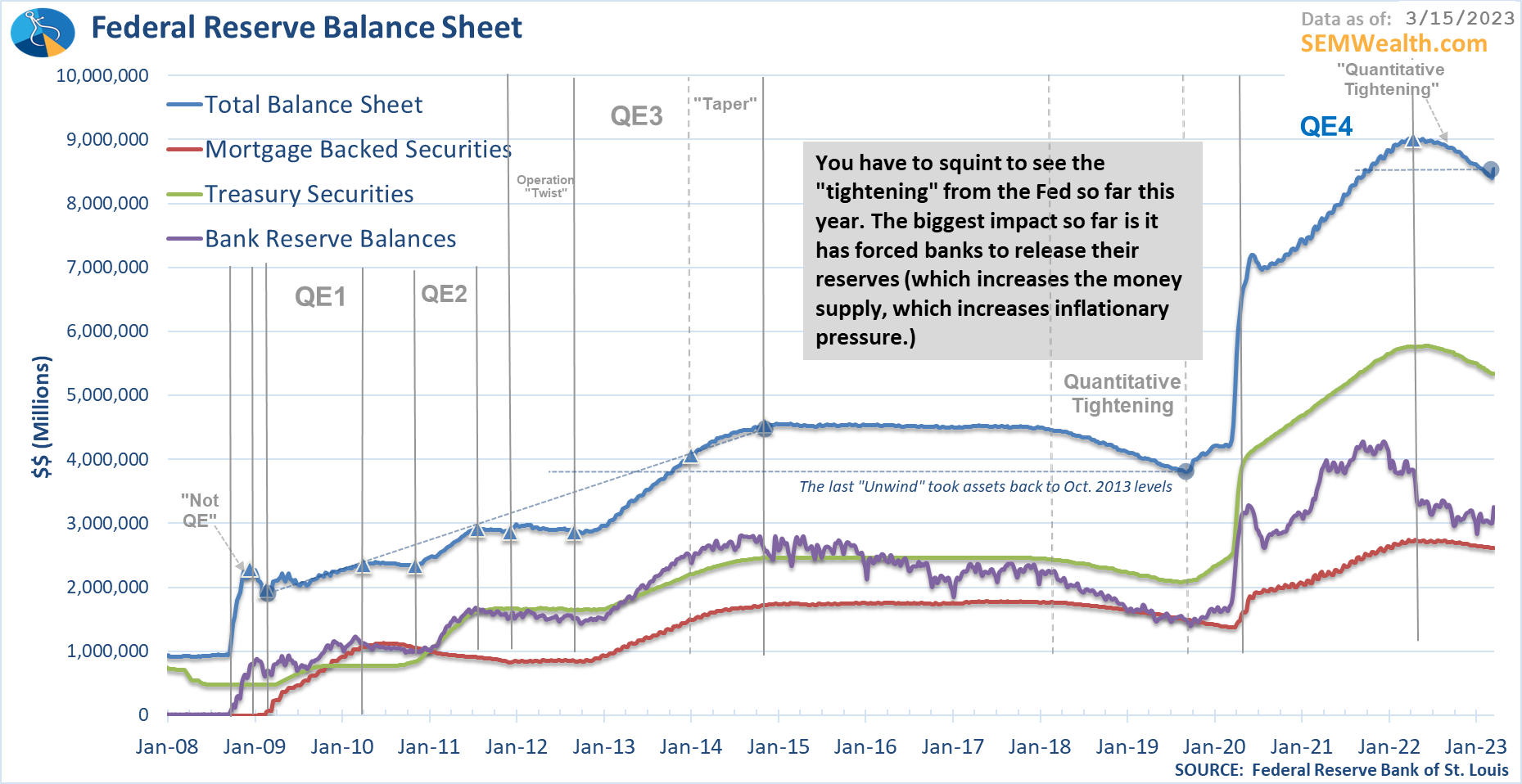

That didn't take long: The Fed started "quantitative tightening" a year ago. This is the structured reduction of their balance sheet. In the past year, they essentially took the balance sheet back to September 2021 levels. Here is an updated Fed Balance Sheet chart through Wednesday.

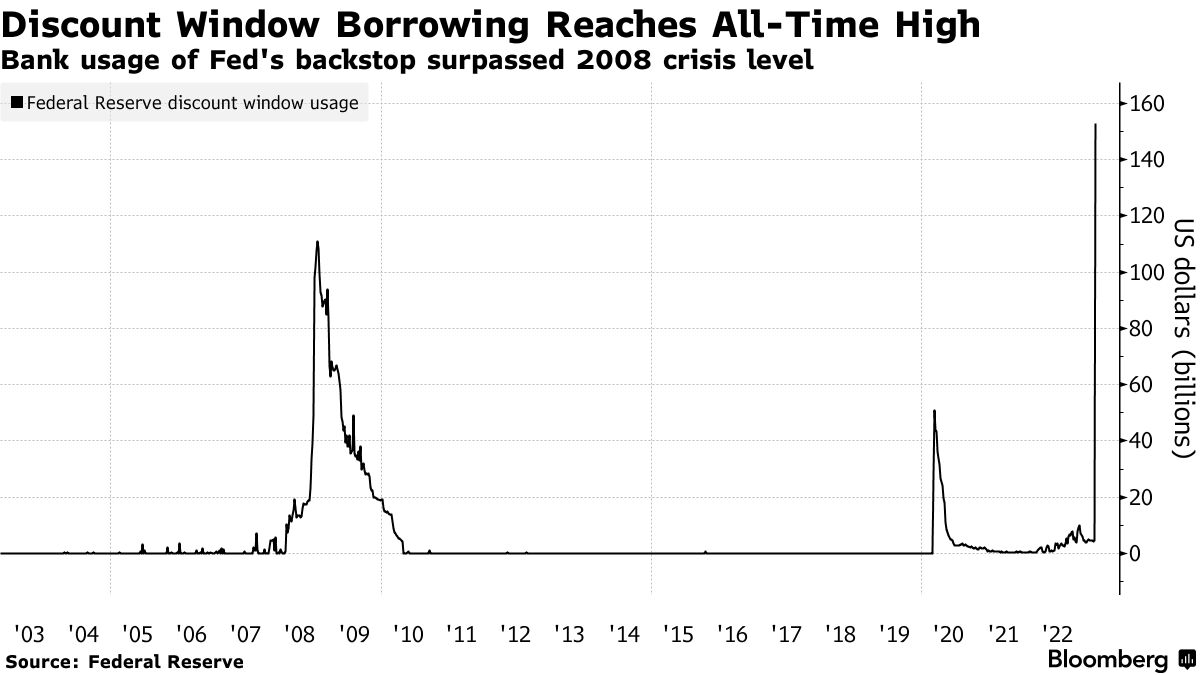

Emergency measures: It's fascinating how just a handful of unknown banks could cause so much angst. Silicon Valley Bank, Signature Bank, and most recently First Republic Bank led to across-the-board stress in the banking system. This chart from Bloomberg shows the amount of money borrowed from the Fed to meet short-term demands.

Rushed policy creates more problems: Last Sunday the FDIC, Fed, and Treasury jointly ensured SVB and Signature Bank customers they would cover any "uninsured" deposits (those over $250K per account). While most people assume if the government would "backstop" the 16th largest bank's uninsured deposits that means they will do the same for all banks, it is not a guarantee. Similar to the early days of the financial crisis in 2008 the lack of coherent and consistent policies and rules is leading to a rolling series of panics.

How fragile is the system? The bigger question is why would the FDIC, Fed, and Treasury seemingly panic over such relatively small losses? The uninsured deposits at the failed banks were a fraction of the overall financial systems deposits. These were not "systematically important" banks, yet they are acting like they were. It leads to the question of how much more risk do the regulators see in the system and should we all be concerned.

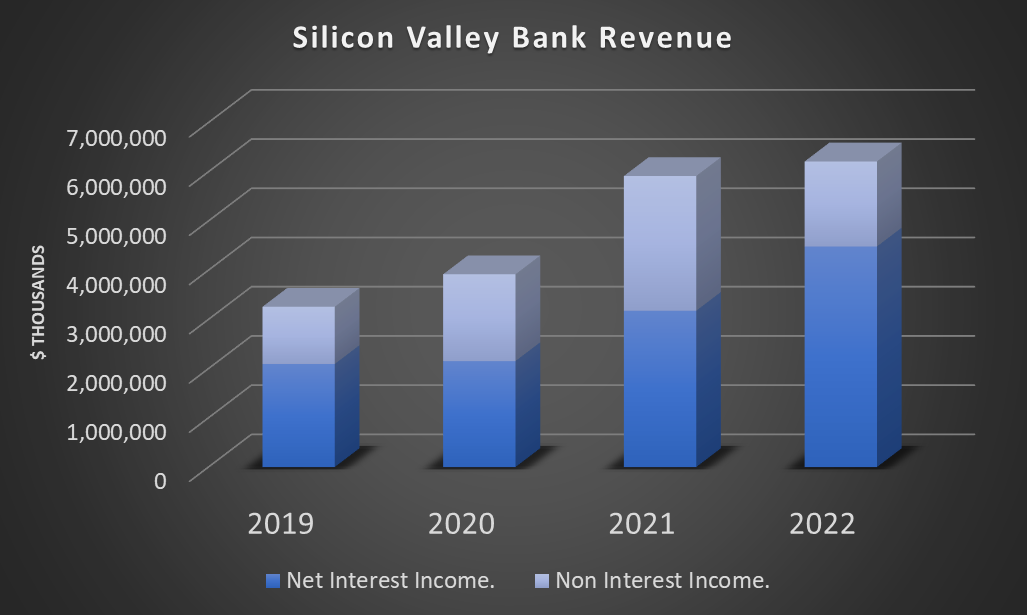

What happens when you double in size? I took a quick look at Silicon Valley Bank's financials. I was surprised at how much they grew in the past few years. They essentially doubled in size. Low regulations and easy money meant they could lend money to companies who probably shouldn't have received those loans. Those companies blew through that money when the easy money stopped, and this created problems with SVB that now all of us are dealing with.

How did regulators miss this? We are supposed to believe the Fed is auditing the banks. They are supposed to know the quality of the balance sheets, the credit and interest rate risks they are taking, and the duration and structure of the depositor accounts at the bank. Did nobody ask the question about what the assets are really worth given the more than 300-basis point increase in long-term interest rates in less than a year?

This is different than 2008: Despite all of the above, the key difference between now and 2008 is this – the assets on the balance sheets of the banks back in 2008 had an unknown value with many of them likely worthless. (Most) of the assets on the bank balance sheets now are worth less (by some accounts 20-30% less) but are considered to be safe bets that they will eventually be paid back (for the most part). Another way to look at it – the assets are on the books at $100, are currently worth $70-80, but are likely to pay the banks back $92-100 (depending on the quality of the assets). The problem is they aren't due to be paid for another 5-10 years (or longer). This is a LIQUIDITY crisis, not a SOLVENCY crisis like we saw in 2008.

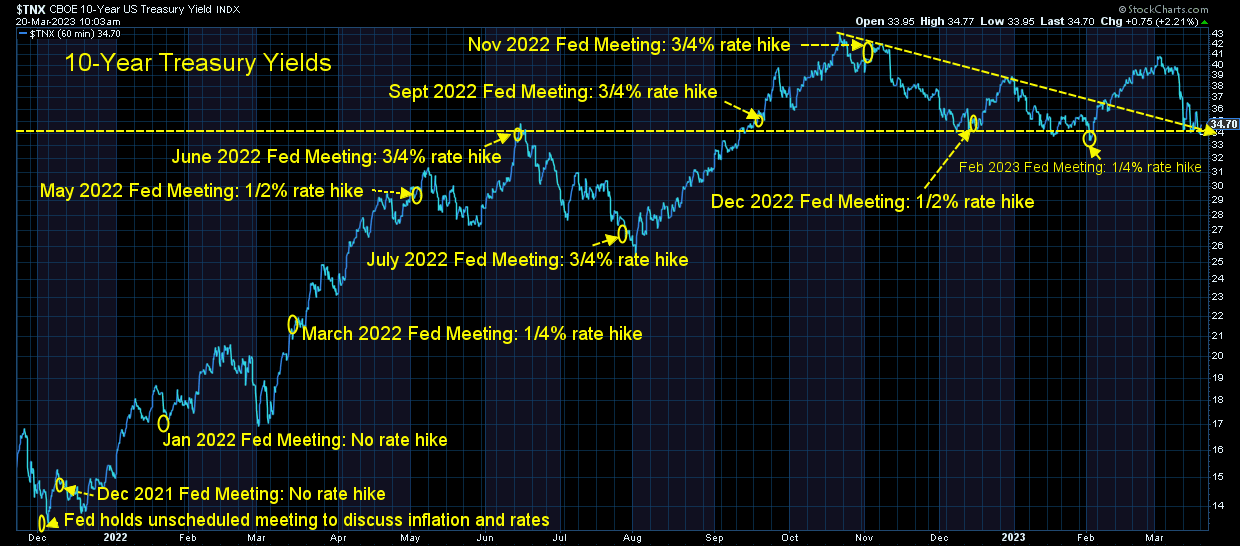

Everyone is blaming the Fed: I spent most of the week agitated because it seems every single person is blaming the Fed for this crisis. I also (partially) blame the Fed, but not for the same reason everyone else is. Everyone is pointing to the "rapid" rate hikes as the culprit for this crisis. What they fail to acknowledge is the fact the FREE MARKET sets LONG-TERM interest rates and this is where the losses occurred. Had the banks not been greedy and invested their deposits in short-term instruments, we wouldn't have this problem. The issue is the Fed took the $5 Trillion Congress dumped into the economy across 3 stimulus bills and essentially doubled it with their QE programs. They kept their foot on the gas until last March. That's the problem. There was too much money in the system and whenever there is too much money stupid things start happening. Businesses that had no business getting funding got funded. People who had no business getting a loan got loans. Investment managers who had no business managing money saw significant growth. Bankers who had no business being bankers received huge bonuses. When the Fed pulled away the stimulus, all those stupid things were exposed.

Yes we use TikTok: We've posted A LOT of content to our social media channels over the past week and plan on posting A LOT more. The short-form videos have been effective in telling the story in a way people can relate to. While we understand the concerns over privacy being raised, we've looked thoroughly at the risks to SEM and believe they are no more than any other technology platform at this time (because we have other systems in place to protect our devices/data). Whether you use TikTok or not, you can view our content online without an account here:

@finance_nerd

If you'd rather view our videos elsewhere, you can check them out here (we post the same videos on all the sites):

What does the Fed want to happen? We saw a big drop in the "Fed Fund Futures" contract, which essentially illustrates where the market believes interest rates will go. In 3 days we saw the "terminal" (final rate of the tightening cycle) move from 5.5% down to 4.25% (which would indicate rate CUTS in the next 9 months). Here's the problem — if the banking crisis spreads too much further and longer, it will both be deflationary (less money freely flowing) and likely cause a quick recession. In other words the Fed's "job" of knocking inflation back down to 2% would be taken care of. However, if they successfully calm the markets, we could see rampant risk-taking return which would probably keep inflation uncomfortably high and cause the Fed to have to RAISE rates even further.

When your only tool is a hammer......: I've often described the Fed as having only one tool (interest rates/money creation) – their hammer and said, when you're only tool is a hammer, everything looks like a nail. My friend John Ellison of Richmond Quantitative Advisors, a fellow CFA and tactical manager described it better – he said the Fed's 'tool' turned into a sledgehammer in their post pandemic response. At the same time the "nail" was turned into a screw by Congress. Sure, we can ask the Fed to use their sledgehammer to smash down the screw of inflation, but it's going to do a lot of damage to the table. We shouldn't be surprised that stuff is breaking right now.

Smells like 1998: Many of you may not remember the Long Term Capital panic in 1998. At the time there was a panic because it turned out a few Wall Street banks had too much exposure to a hedge fund (Long Term Capital) who had bet too much on the direction of the Russian currency. The panic was short-lived when it was announced a consortium of Wall Street banks all banded together to shore up the holes in the other banks' balance sheets. It was revealed a few years after the fact the Federal Reserve led the meeting and guaranteed the money the Wall Street banks were "lending" to the other banks.

Last week, in an attempt to save First Republic Bank, the big name Wall Street banks and a handful of mid-tier players announced they were depositing $30 Billion with First Republic. Reports were this "deal" followed a meeting between Jamie Dimon, Fed Chair Jerome Powell, and Treasury Secretary Janet Yellen. Coincidence?

Uncle Warren to the Rescue: Over the weekend, somebody posted flight tracking data from Omaha showing over 20 private jets landing in Omaha all around the same time. The flights originated from some of the cities where regional banks are headquartered, several ski resorts, and Washington DC. Before other big Berskhire Hathaway deals were announced, the private jet flight tracking has been a reliable indicator of secret meetings happening in Omaha, so this certainly looks like an announcement could be pending about some big investments in some regional banks by Warren Buffett's firm. It has also been reported, Buffett, a long-time Democrat has had several phone calls with the Biden administration about the crisis.

(I'd also note that Buffett is a big investor in insurance companies who are also likely holding a bunch of unrealized losses in their bond portfolios.)

Credit Suisse Finally Going Away: I don't follow a lot of individual banking stocks, especially foreign ones, but I've been surprised how Credit Suisse has been able to stay in business. From LIBOR scandals, to several bailouts by the European Central Bank, to other litigation about questionable business practices, I couldn't understand how they were able to stay in business. I guess it was because they were the second biggest bank in Switzerland. Now the largest bank in Switzerland (UBS) is buying them with regulators there not even allowing it to go to a shareholder vote. An estimated 60% of all Swiss deposits will be through the combined bank. Back in 2008, much ire was focused on these two banks because they received bailouts from both the Federal Reserve and TARP. We won't find out until 2 years from now whether or not they received more funds from the US Central Bank (because the Fed has sealed those records to prevent 'negative' impressions of those banks needing funds.)

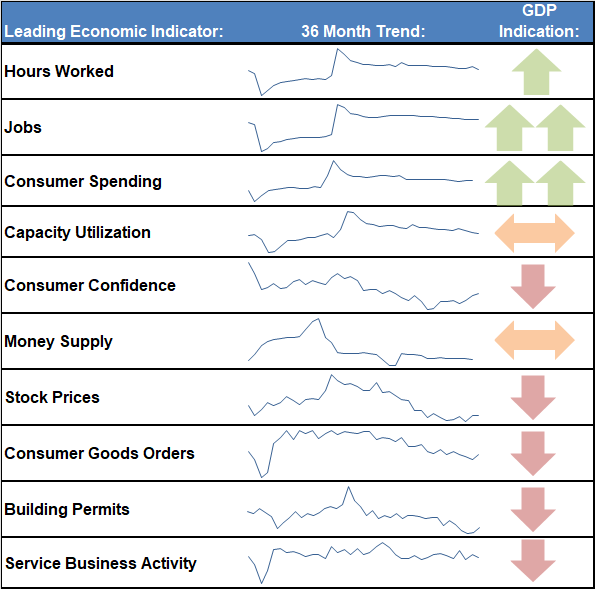

Recession coming? I promised an economic update this week, but once again current events are making the blog already too long. What's interesting is the backwards looking data (pre-banking crisis) showed some signs of improvement. Our model is still 'bearish' but we saw several indicators become "less bad" in February. Here's a quick look at our dashboard. It's very likely if we have a few more weeks of this we'll see some more damage done to the indicators when the March data is released.

Don't forget Geopolitics: I've often shared my biggest concern over the past 15 years is a major global military (or cold) war. Every crisis the past 15 years we've seen China side with Russia who always sides with Iran who always sides with North Korea. It may be politically incorrect to call them an "axis of evil", but the evidence is there – all 4 countries hate the US and what we stand for (freedom). We've seen increasing moves by these 4 countries to irritate the US. All military conflicts start with economic strains and by all accounts, those 4 countries are struggling economically.

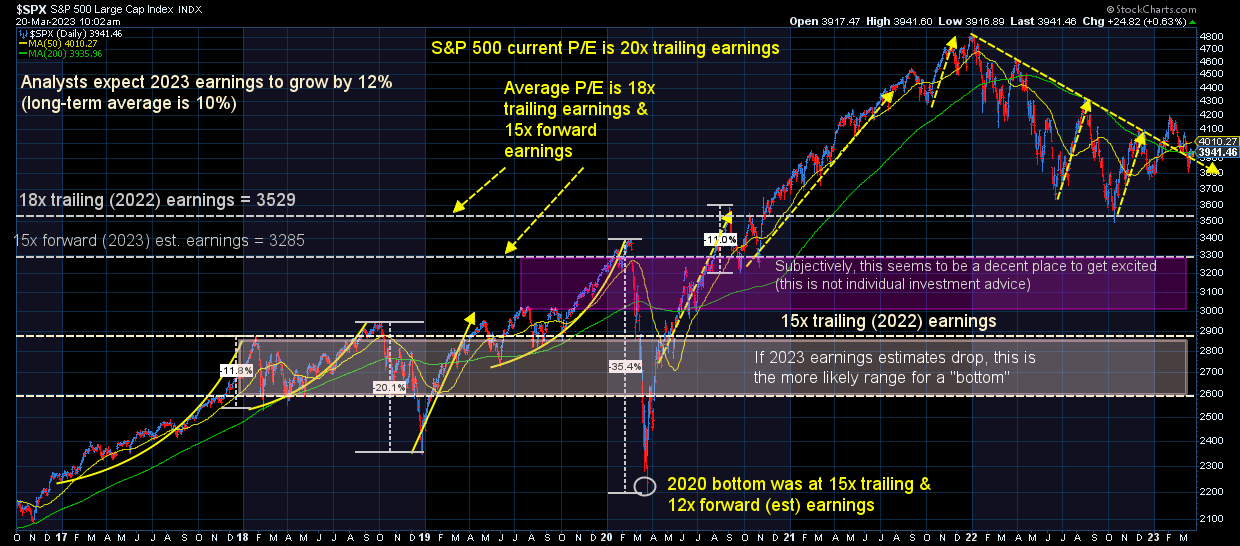

Should you reduce risk? I received this question multiple times over the past week. My answer was simple – NO! Nothing has changed in our expectations. We are in a recessionary bear market that remains overvalued. Based on past recessionary bear markets, we could see the S&P 500 drop to 3300-3000-2700, which is obviously a big drop from here. Our models already had reduced risk and we are close to 'minimum' exposure levels. If you belonged in a growth portfolio a year ago, what has changed other than the market going down that says you don't belong in a growth portfolio today. The issue of course, is somebody who wanted a growth portfolio simply because it was going up faster than the 'boring' conservative portfolios.

Technicals holding up: Despite the 'panic' last week, both stocks and bonds held up relatively well. The "lows" from December were not broken for the stock market.

This means stocks are still overvalued:

On the bond side, 3.4% remains the "support" area for 10-year bonds:

I'm sure there will be a lot more events this week. Stay tuned for additional updates as needed.