The reason we have been going through this series is because we want to honor God in all areas of our lives, including our finances. Through this series, we hope that you are learning how to align your finances with your faith. For the first several months we just focused on our attitude towards money and stuff because it is foundational. Last month we started discussing budgeting and we're going to continue to build off of that this month with talking about debt. Catch up on the past posts here if you missed them:

While debt isn't fun to discuss, we need to understand it so we don’t drown ourselves in it and leave us stressing about our finances. Oftentimes, people use credit and debt interchangeably; however, they are different. Credit is the ability to borrow money while debt is using credit to borrow other people's money. Debt typically comes with interest and there are two kinds of debt: essential and inessential. Credit card debt is considered inessential while home loans are considered essential. Before breaking down the types of debt and how to eradicate it, let's look at what the Bible says about debt.

God does not forbid debt, but He does point out how dangerous it can be. The problem arises when we are living on debt. When we are living on debt, it means we aren't trusting God to provide for us. We're trying to live beyond our means.

"It is better that you should not vow than that you should vow and not pay." -Ecclesiastes 5:5

"The wicked borrows but does not pay back, but the righteous is generous and gives." -Psalm 37:21

It can be really easy to see what other people are buying and what the same things – vacations, new car, bigger house, etc. We need to stop focusing on what others have and worry about or own work and finances. This ties back into contentment which we covered in January.

Here are some verses that tie into comparison:

"Wrath is cruel, anger is overwhelming, but who can stand before jealousy?" -Proverbs 27:4

"You shall not covet your neighbor's house; you shall not covet your neighbor's wife, or his male servant, or his female servant, or his ox, or his donkey, or anything that is your neighbor's" -Exodus 20:17

"But let each one test his own work, and then his reason to boast will be in himself alone and not in his neighbor." -Galatians 6:4

Wanting what other people have and not being content with what you have can get you in trouble. Not only does God tell us to not covet our neighbor, but if we don't have the money, it leaves us in financial trouble (debt). You don't know people's financial situations; therefore, you shouldn't compare what you have versus other people.

Now that we've covered what the Bible says about debt, let's get into more about the types of debt.

Credit Card Debt

Credit card debt can get a lot of people in trouble. While credit cards have some positives to it such as building your credit and cash back rewards, you need to be careful that you don't go overboard and purchase things you can't afford. This type of debt is usually a spending problem, not an income problem. The key to not getting into massive debt with credit cards is to budget and learning to WAIT to purchase things until you can afford it.

Personally, I've been using credit cards for most of my purchases (grocery store, fuel, etc.); however, I use FaithFi, one of the budgeting apps mentioned in last month's blog [link], to make sure I'm not overspending. This allows me to stay out of debt because I can fully pay off the credit card each month while also building my credit and taking advantage of the cash back rewards.

Here are two rules for navigating credit cards:

- Do not charge something unless you already have the money to pay for it.

- The first time you cannot pay in full, cut up the credit card!

It's likely to snowball into something worse, so better to cut it off right when it starts to get bad. You don't want to continue to rack up more debt and then have to pay the interest too.

Car Debt

People tend to take out car loans because they think it is "essential" for traveling to/from work. While the car is essential, the debt is not essential. Car salesmen are shrewd and can convince you to pay more than you can actually afford. Ideally, you'll be able to pay for the car in full; however, if you can't do that, it's important to understand how much of a loan you can actually afford. When you're purchasing a car, it's important to know how much per MONTH you can afford, including WITH interest.

Oftentimes, people will roll car loans into the next one, and the next… You might not know this, but the loan is kept for your entire life because it continues into the next (if you didn't pay it off before getting a different car). Remember, new cars lose significant value once it's driven off the lot. Make sure you're not getting something you can't afford because it's just going to lose it's value when you leave.

Here are two rules for purchasing cars:

- Buy what you can afford

- Pay cash – then you won't have to worry about interest!

If you follow these two rules, it will help you avoid that never-ending car loan. Before you purchase another car, shift your mindset of the car being essential, but the debt is not essential. Another little tip is to start saving now for your next car! Put whatever you can afford aside each month so you be ready when you need to purchase a new car.

Home Debt

Here are seven things to keep in mind with home debt:

- A home is not an investment.

- Home debt is still debt, so be careful!

- Ignore the hype when prices are rising rapidly.

- Try to put 20% down – this forces you to save, which requires more consideration into how much you can truly afford.

- Be extremely careful with Adjustable Rate Mortgages (ARMs). With fixed rate mortgages, the interest rate remains the same for the life of the loan. However, with an ARM, the interest rate will change periodically.

- Consider a 15-year loan instead of a 30-year loan, if possible.

- Try to make one extra payment and/or double monthly payments to help you pay it off sooner.

When it comes to refinancing a home, here are some tips to help:

- Only refinance if the rate is 2% below your current rate.

- Only refinance if you are going to stay there for more than 5 years.

- If you refinance, consider reducing the number of years on the loan.

Eradicating Debt

I know this blog is already longer than I've been trying to keep them for the Biblical Finance series; however, I think it's important to end with discussing how to get out of debt. Getting out of debt will take a big weight off your shoulders, but it will take a lot of discipline and commitment. If you're serious about wanting to get out of debt, you'll need to change habits in your life and learn to say "no" to yourself and others. You have to make the choice for yourself to refuse to live on debt anymore.

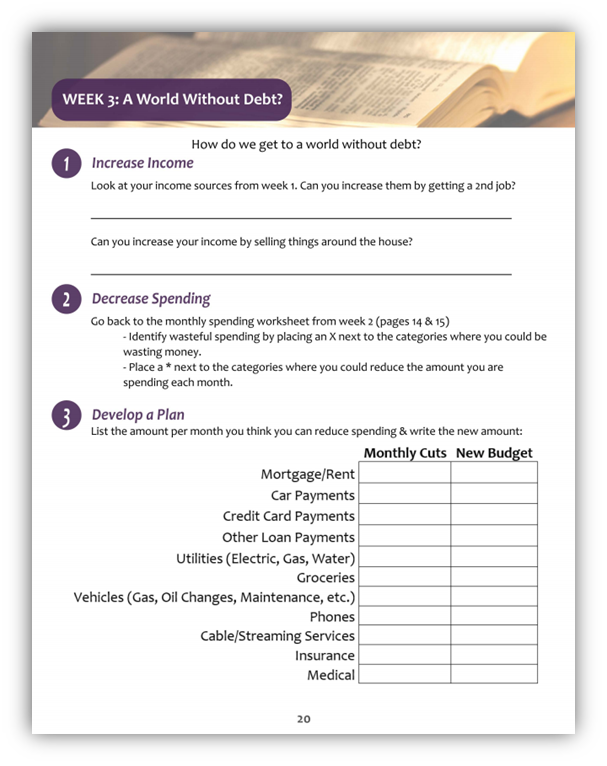

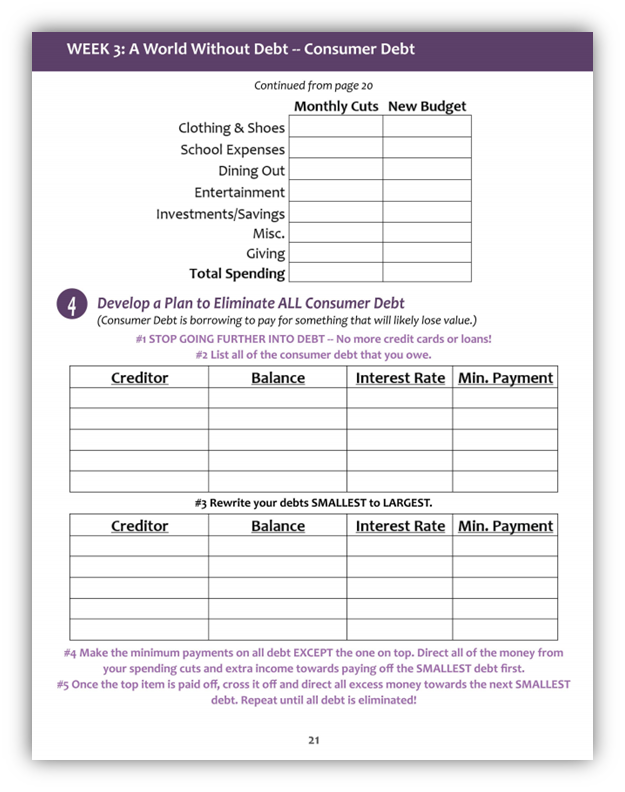

This might sound obvious, but the key to getting out of debt is to either increase your income or decrease your spending. Usually, it's easier to find ways to decrease your spending. To do this, look at your spending on things you don't need like things in the entertainment category (going out to eat, activities with friends, etc.) If you can't decrease your spending enough, you can consider increasing your income by getting another job, starting a side-gig, selling stuff you don't need, etc.

Application

Now it's time to apply everything to your own finances! Below is the "homework" for this section. I encourage you to complete this over the next month and start working towards eradicating your debt (if you have any).