Sometimes I have a lot of topics to discuss on this page, other times I cannot think of much to say at all. Today is the latter. I'm not sure how many different ways I can say the same thing:

- Stocks are extremely overvalued

- The economy is likely heading towards a recession

- Wall Street is either not expecting a recession or not expecting the recession to impact earnings

- Unless we avoid a recession, stocks need to come down

- Even if the Fed were to CUT interest rates, based on history they cannot save the economy from a recession

I've said pretty much all of the above the past month. Stocks move in cycles and there are times hope prevails. Those are the most dangerous times. Walking through each item above:

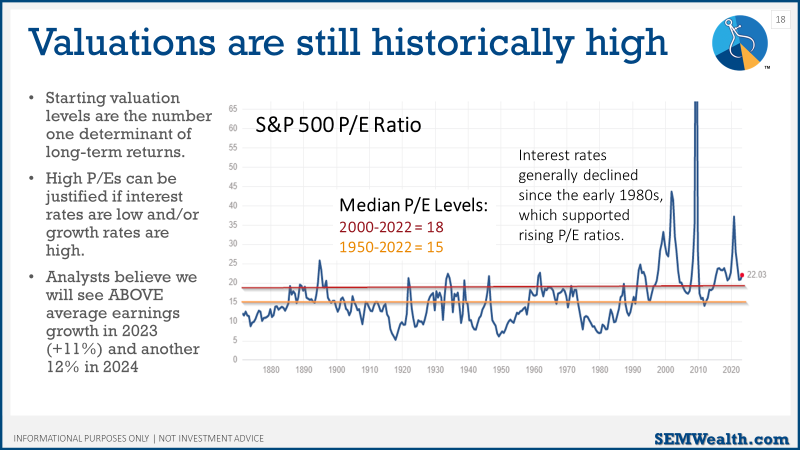

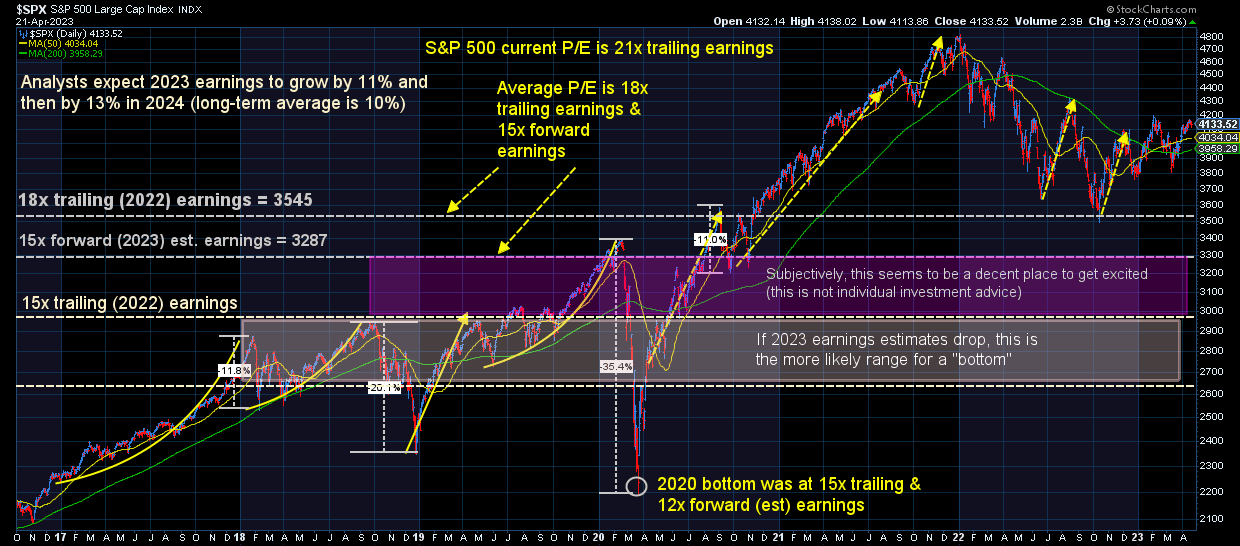

Stocks are extremely overvalued

No matter which way you look at it, stocks are expensive even if we hit the rosy Wall Street earnings targets.

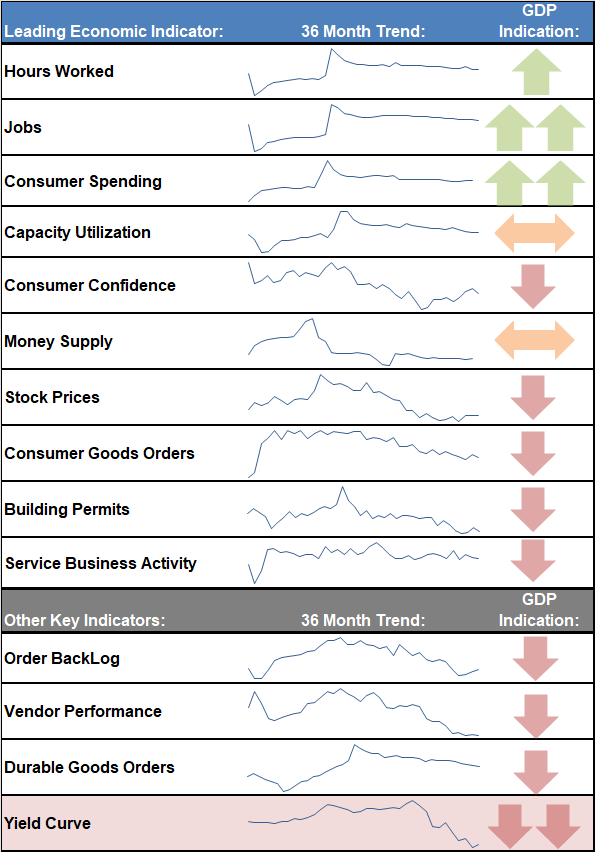

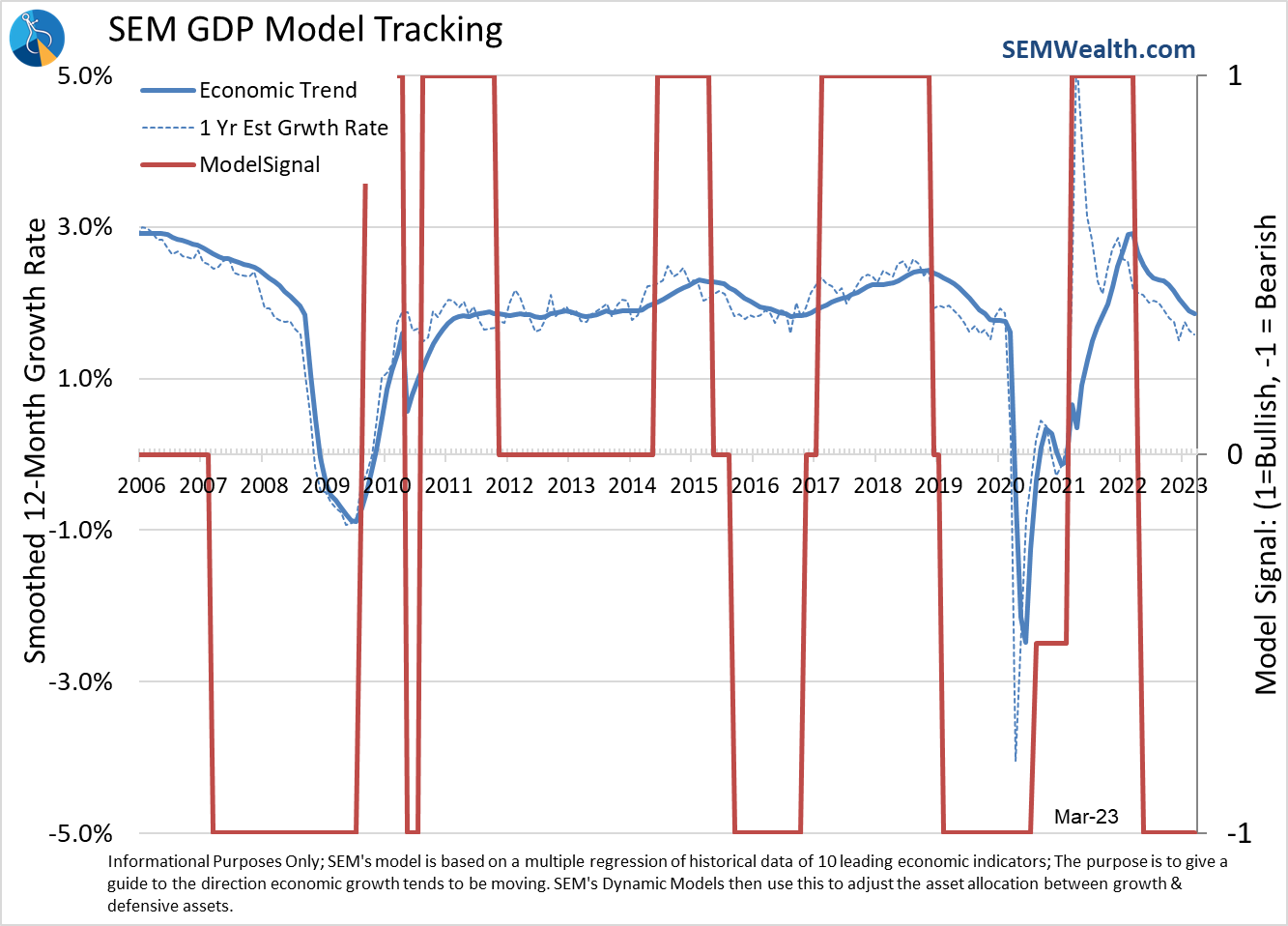

The economy is likely heading towards a recession

We covered our economic model a few weeks back (click here), but here is an updated look at our dashboard.

Jobs & Consumer Spending are literally holding everything up. Those both appear to be showing signs of weakness. Our model remains "bearish".

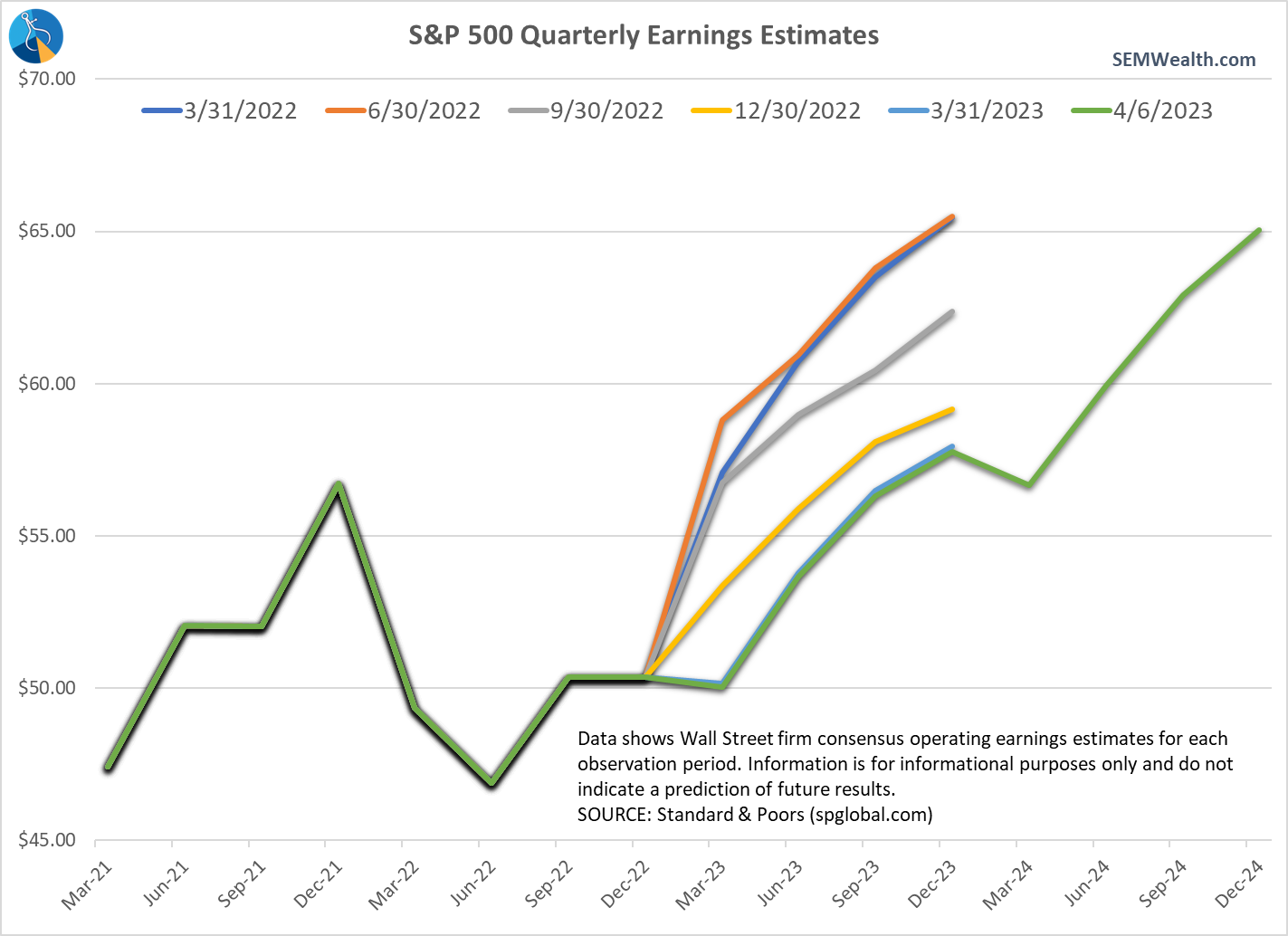

Wall Street is either not expecting a recession or not expecting the recession to impact earnings

I showed this chart last week. Notice how Wall Street currently expects a minimal impact to earnings this year.

Unless we avoid a recession, stocks need to come down

All I can say is Wall Street is usually wrong, which means earnings estimates will probably come down (look at where they thought they would be 9 months ago). The problem is at the same time P/E ratios likely come down (if earnings are going to be lower, you're likely going to want to also pay LESS for slower growth). What was strange with 2022 is we saw earnings estimates come down 20% throughout the year, but the P/E ratio barely changed. Essentially Wall Street assumed earnings would simply be DELAYED. We can see they continue to hold this hope.

In other words, Wall Street believes any economic problems will be minor and will not impact corporate America. I hope they are right, but if they are wrong, things could get ugly.

I continue to use this chart as my guide as to when I would (subjectively) get excited by stocks. A little quick math:

- If we assume earnings grow by 11% in 2023 and using the median P/E of 18, "fair value" for the S&P 500 is 6% below where we are today.

- To get back to "average" valuations (P/E of 18 based on the last 12 months' of earnings), the S&P 500 would need to drop 15%

- If we have a recession, the S&P 500 likely falls a minimum of 20-28% from here (based on the "average" recessionary bear markets)

- If earnings drop in 2023 due to a recession, the S&P 500 could drop 35% (or more)

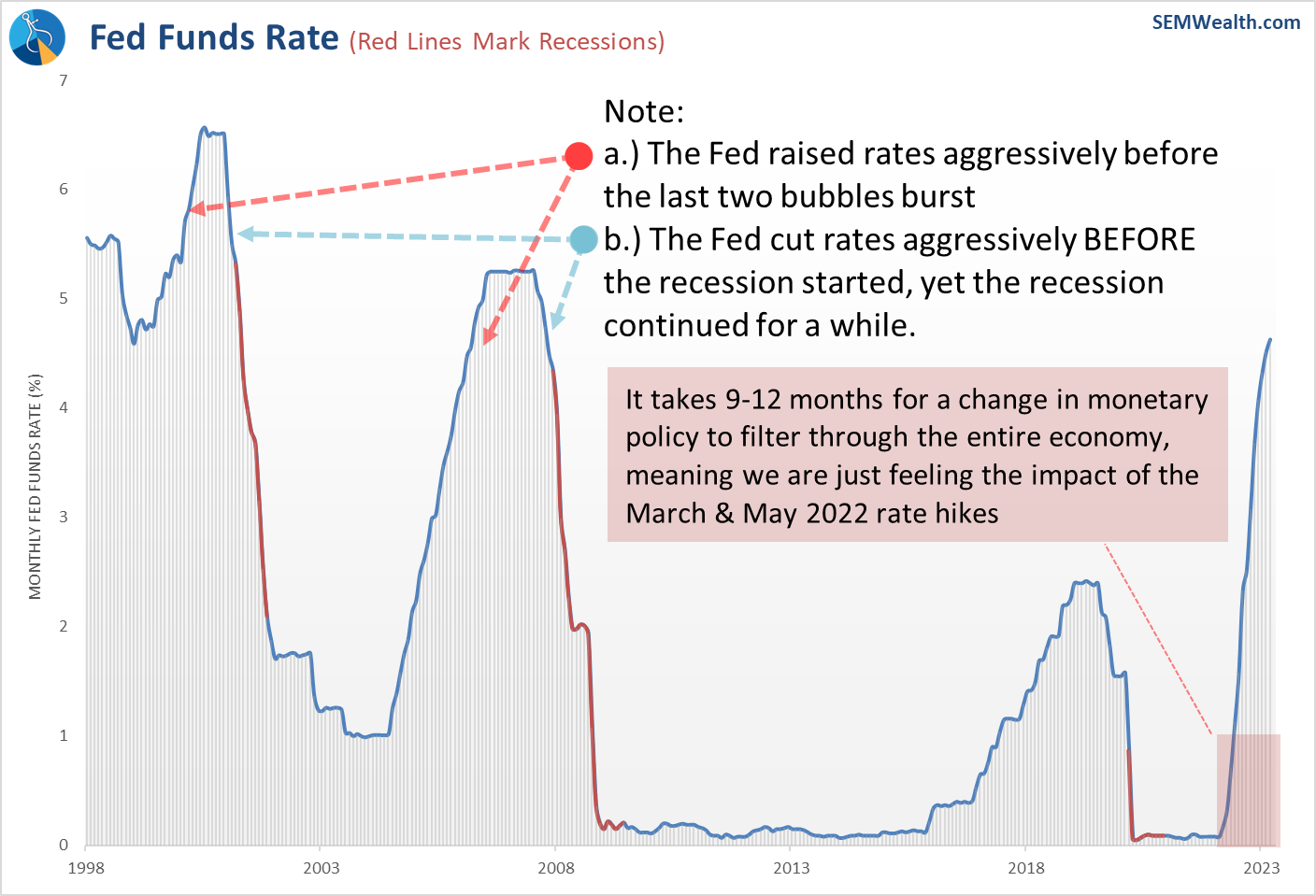

Even if the Fed were to CUT interest rates, based on history they cannot save the economy from a recession

What I cannot get over is how much credit investors continue to give the Fed. They truly believe despite their abysmal track record in forecasting the economy (and inflation) that they will be able to forecast the economy (and inflation).

I've shown this chart a few times the past several weeks:

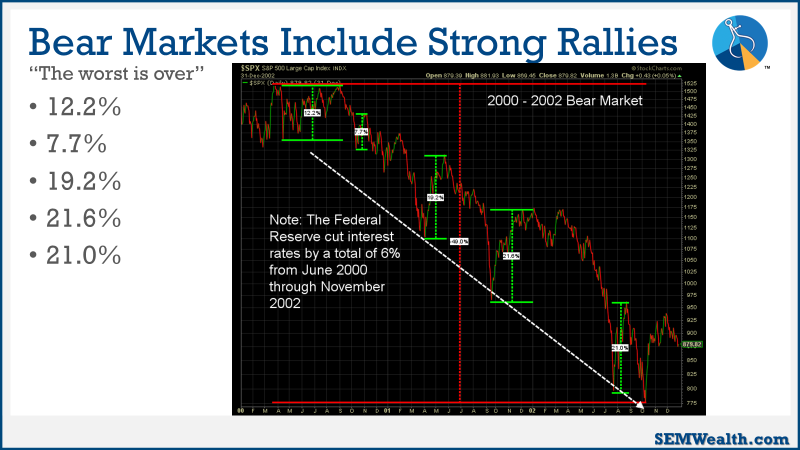

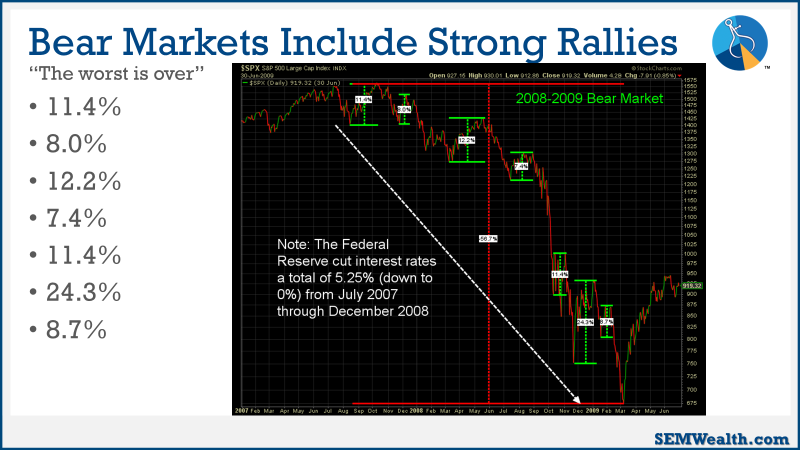

I've also shown these slides many times to remind people how AGGRESSIVE the Fed was in cutting rates during the last two recessionary bear markets. We saw some rallies, but ultimately the Fed could not save the markets.

What's most important is this – we don't base any decisions on our opinions or what we think MIGHT (or SHOULD) happen. We follow the data and the quantitative systems which have been the key to our success the past 30+ years. From a markets standpoint, here are the charts I look at every day:

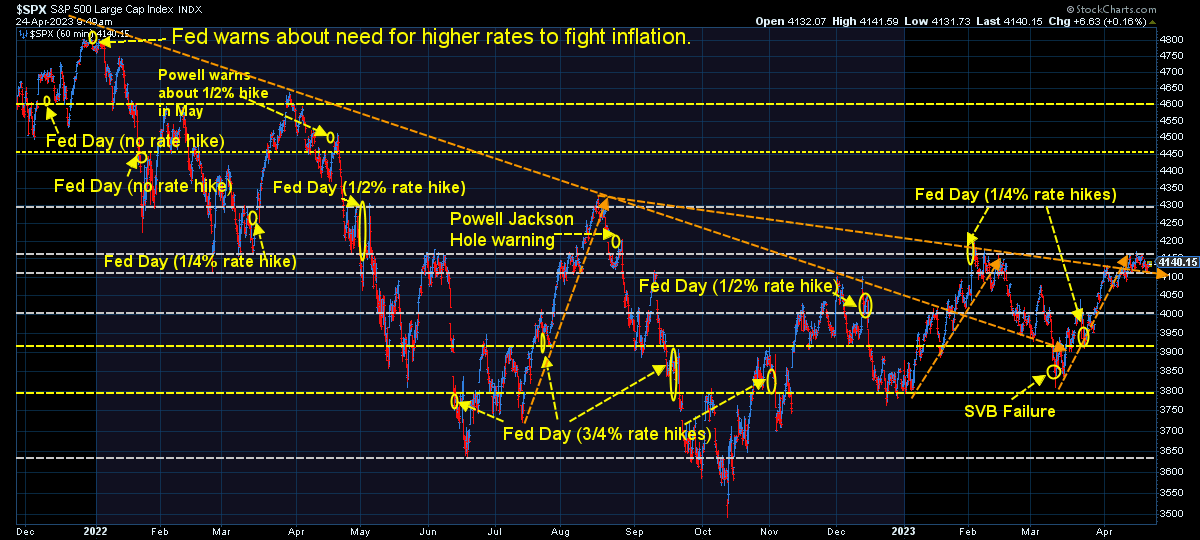

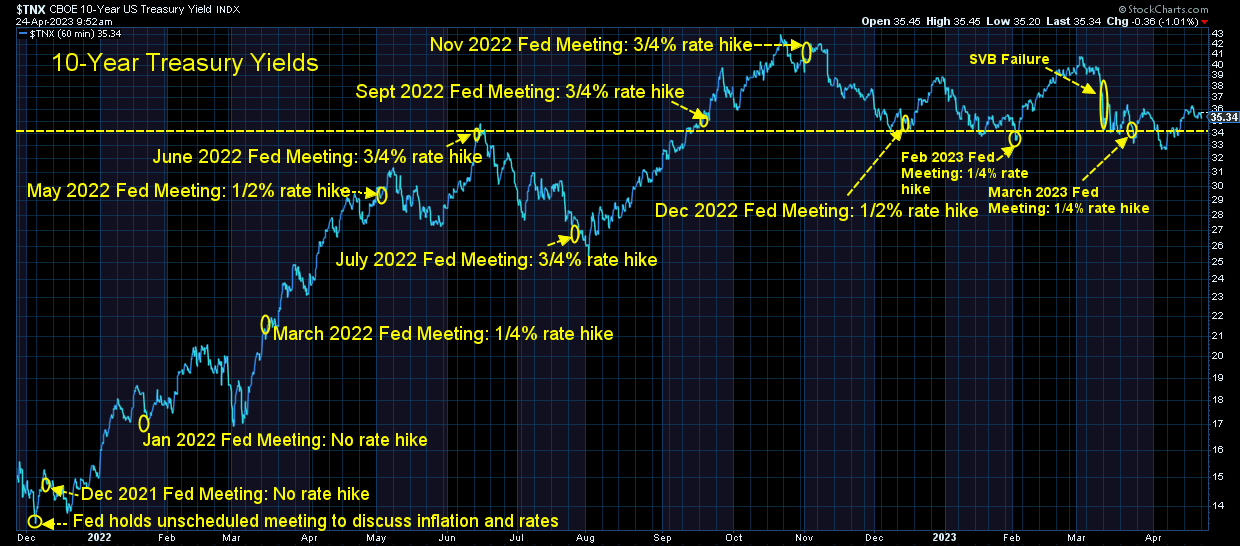

Stocks are consolidating the move off the bottom, which ironically came after SVB Failed and the government (perceivably) acted so quickly as to give confidence to the markets that we will not have any sort of contagion. The fact stocks have not reversed lower is (for now) a good thing.

Treasury yields remain above the mysterious 3.4% barrier. For whatever reason this remains a pivot point for bond traders

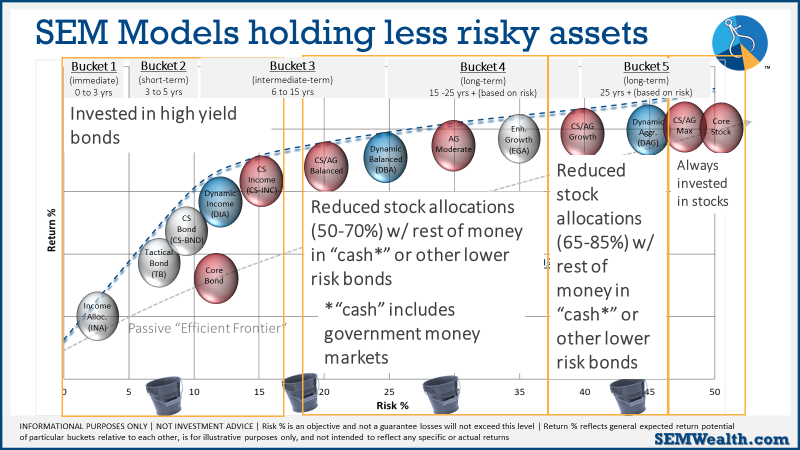

From an investment standpoint, here are our current positions. Note two weeks ago we moved into high yield bonds in our lower risk systems. Subjectively this could be a short-term trade as the set-up between low risk and high risk bonds is not attractive, but high yield trends have been picking up steam the past few weeks, which generated the buy signals.

We also are quite close to seeing the 2nd "trend" model inside AmeriGuard and Cornerstone portfolios going back to a "buy". This would put those models at 'maximum' investment for the first time since February 2022.

Hopefully you can see the key differentiator with SEM and most other investment managers – we may have our opinions, but we know as humans those tend to be wrong at times and then our brains try to overcompensate for our mistakes. This could be particularly risky when it comes to handling investments, so we rely on the DATA to make the decisions.