I don't know about you, but I'm already tired of hearing about the debt ceiling. The media is sensationalizing it. Both sides of the political aisle are blaming the other side and acting like they had nothing to do with it. Worry is picking up among individual investors. Meanwhile the market is acting like this is no big deal.

Last week we dove deep into the data. I'll summarize in a moment, but to kick things off this week I think there are some important points to understand:

1.) There is no exact DEADLINE.

I saw countdown clocks on a few news channels this weekend. The Treasury Department is ESTIMATING when they MIGHT run out of money.

2.) Even if we hit the DEADLINE, we aren't likely to see 'financial calamity'

This was the term I heard one newscaster describe it. Our country won't be bankrupt. Banks will still function. The government will continue to run. We'll still be able to pay most of our most urgent bills.

3.) All the numbers coming from both sides are misleading.

The 'cost' of anything is a PROJECTED number over 10 years or longer. The numbers they are using assume that the proposed cuts for THIS year continue through every session of Congress for the next decade or longer. What nobody seems to be calling them on is the fact every Congress has to pass an annual budget, which then needs to be signed by the President. They can immediately decided to reverse any compromises next year.

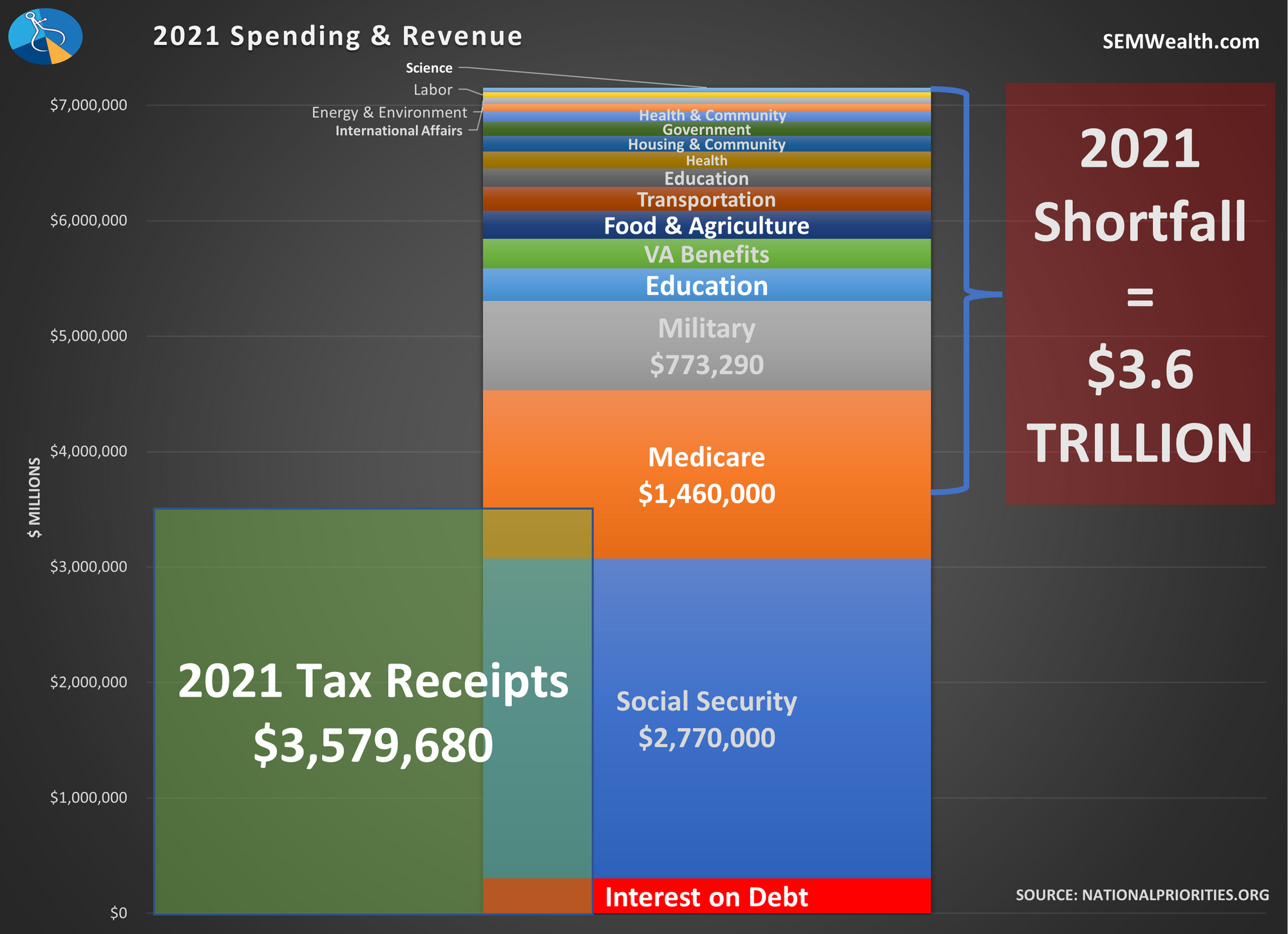

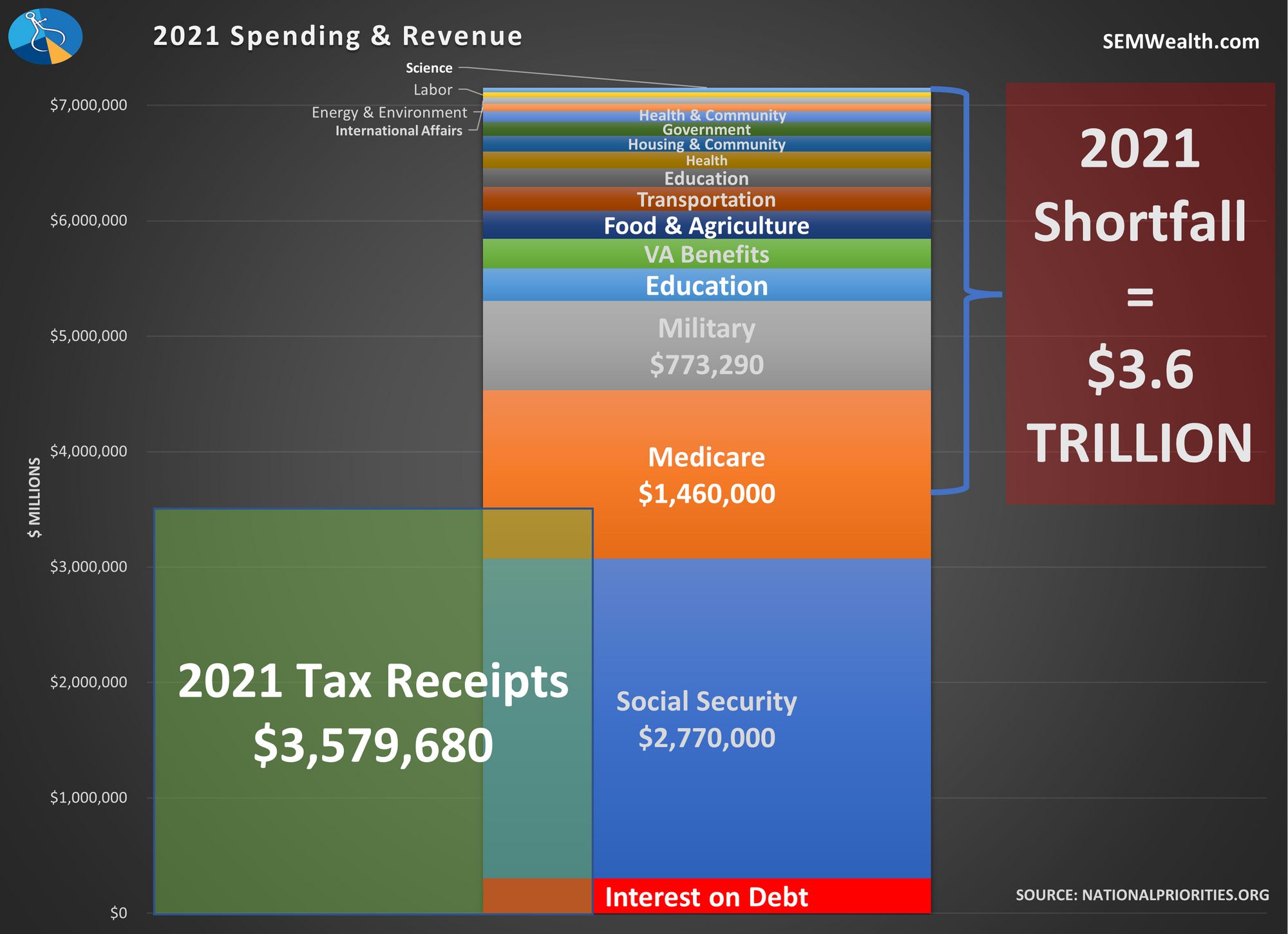

4.) Social Security and Medicare are responsible for 81% of our borrowing needs

Why does nobody understand this? Everyone refuses to touch Social Security & Medicare, which means we may as well just abolish the debt ceiling.

Here's the data. Even if we eliminated the entire government we'd still need to keep borrowing money for decades.

5.) Both sides will end up kicking the can down the road

It may take a little bit of volatility from the markets, but politicians on both sides are in bed with Wall Street, which means once the market loses a little bit of money they will decide to 'compromise' by extending and/or eliminating the debt ceiling for a while (probably through the end of Biden's first term). Both sides will claim 'victory' and the market will be back to focusing on the underlying economic fundamentals.

This latest episode of the Debt Ceiling Circus is not the actual problem. It is a symptom to our country's underlying problem. We've relied on too much debt (and too much cheap labor from other countries) to boost our economy. We've reached a decade where all of those imbalances are coming to the surface. Some grandstanding from both sides for a few weeks or months will not solve the underlying problem.

In case you missed it, I looked at the data behind this last week:

I also posted a 10-minute video discussing this on our social media channels.

@finance_nerd We’ve been getting a lot of questions about the debt ceiling. Normally we try to stay out of politics, but we need to share the data regarding the nation’s debt. Fair warning, Jeff might offend you depending on your political beliefs. #debtceiling #debtceilingcrisis #debtceilingexplained #debtceiling2023 #biden #trump #politics #republicans #democrats #offensive #datafocus #socialsecurity #medicare #socialsecurityscam #boomers #babyboomers #taxes ♬ Relaxing Flute - Unay

If you don't like TikTok, the video is also available on Instagram.

We are also going to be posting much more commentary on this as the story progresses. You can find all of our content here:

TikTok Facebook Instagram LinkedIn

Market Shrugging Its Shoulders

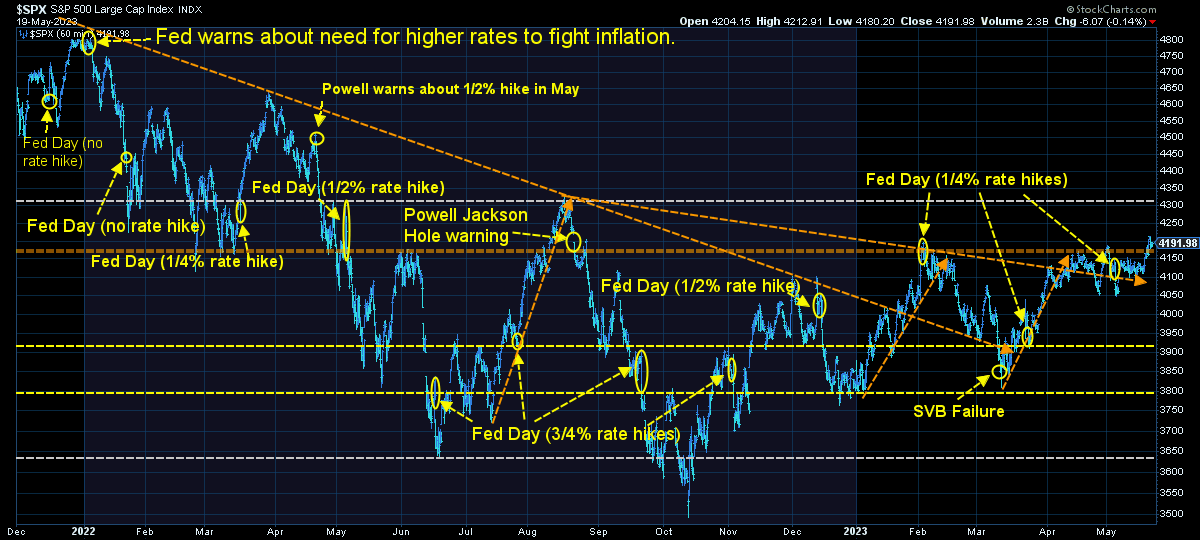

The market seems to firmly believe my point #5 above – they will eventually make a deal to kick the can down the road. The S&P 500 was able to pierce the 4200 mark where it had failed multiple times.

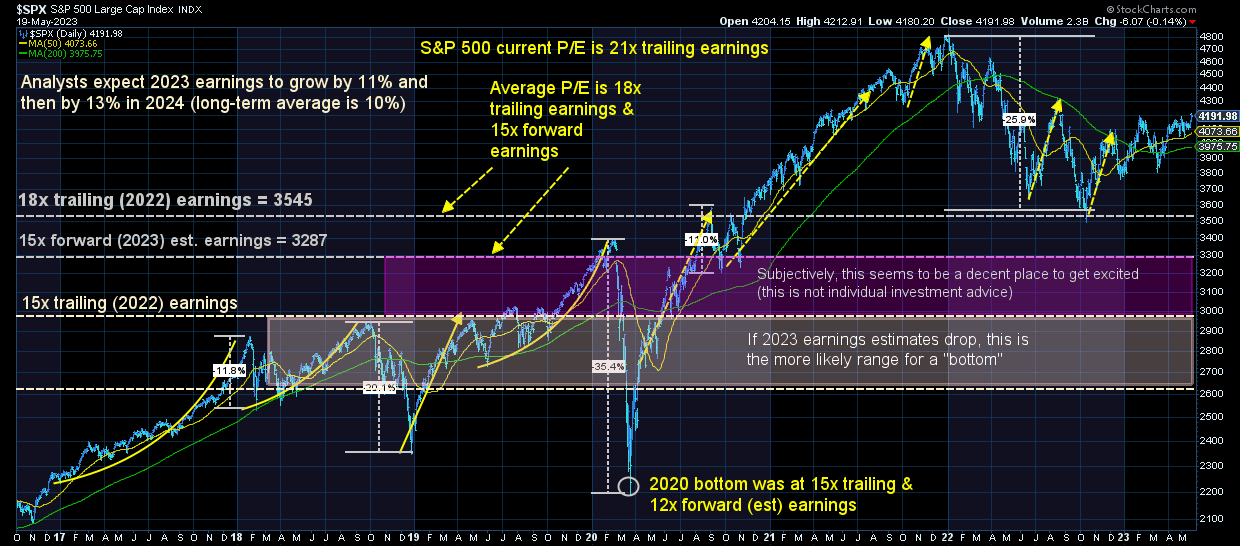

When this latest chapter of the Circus is closed, we will return to focusing on growth potential and our data still says it is not great, which means stocks are significantly overvalued.

One major concern for those who believe the economy is going to come roaring back is the action of the small cap index. While the S&P 500 is back to the levels of February and June 2022, the Russell 200 Index is hovering near its lows of the bear market. This isn't a healthy environment.

The other thing to watch, which we don't talk about much on here is the US Dollar. When the dollar falls, it provides a tailwind to US Large Cap Stocks as 40% of revenue from the S&P 500 companies comes from overseas. A weaker dollar makes their goods and services more attractive. The Dollar peaked about a week before the S&P 500 hit the lows of October last year. The sell-off appears to be over and we are seeing a rally in the Dollar. That could provide additional problems for US companies (and put a strain on valuations.)

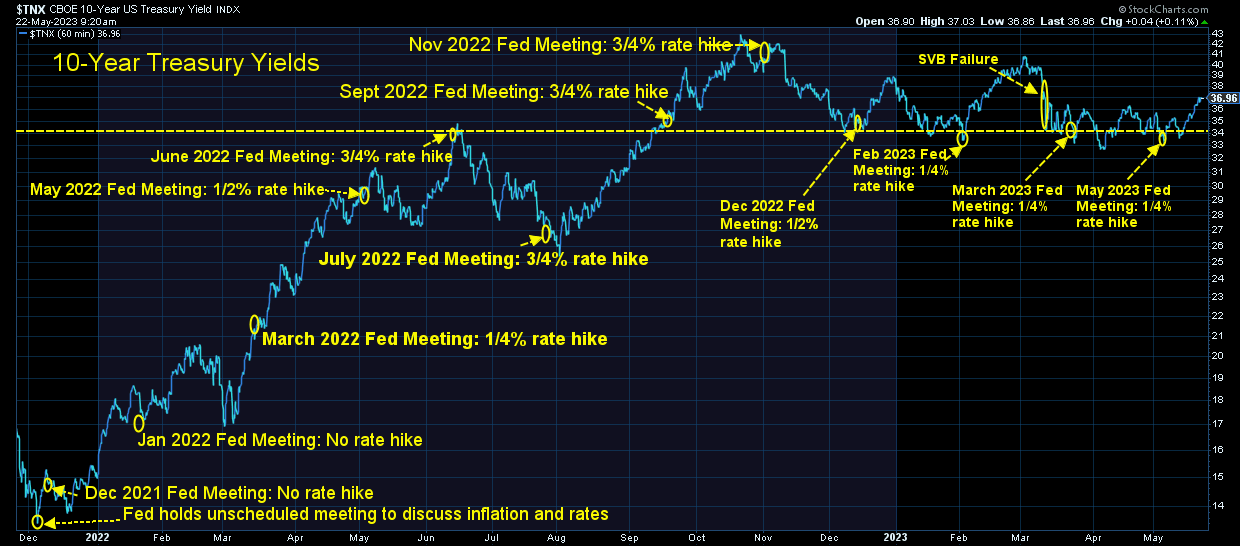

Another problem for stocks is interest rates. Treasury Bonds have seen their yields going up again across the board. For the past year and a half we've seen yields move up when the bond market believes the Fed has lost their handle on the inflation fight. I'm not sure if that's the issue this time or if the bond market is pricing in the fact we will see about $1.2 Trillion of bond issuance hit the markets over the next couple of months once the debt ceiling is extended. The question then becomes 'who will buy the debt'?

SEM Market Positioning

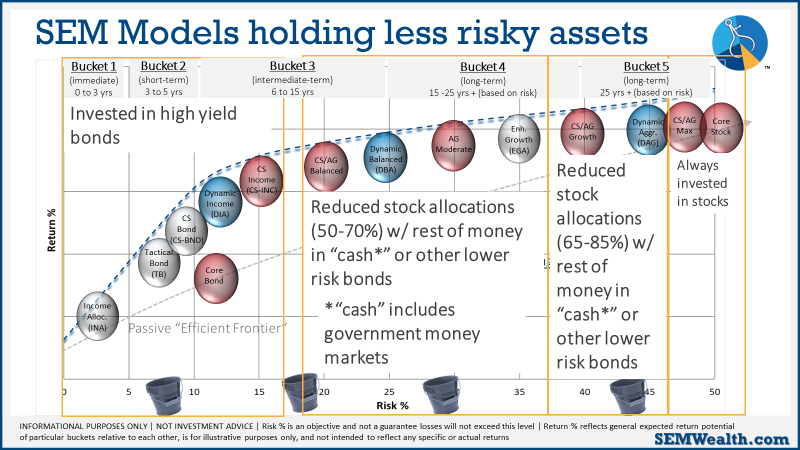

There were no changes (again) last week in any of our models. We remain mostly invested in high yield bonds in Tactical Bond, Income Allocator, and Cornerstone Bond. We remain "bearish" in the Dynamic models (reduced risk exposure based on our economic model), and right in between minimum and maximum exposure in our 'strategic' models. This chart summarizes where we are:

As always, our models will change if the environment changes. For now, calculated, short-term risks are acceptable with the knowledge things could change quickly.

While we expect Part II of the Circus to be more volatile than the first version, our models are designed to monitor the overall TRENDS. If Wall Street gets concerned, they will tell their largest clients and we will see trends change in the market. Regardless of the reason, we only care about where the money is flowing (both in and out).

That said, we will be watching more closely than usual the underlying holdings in our funds to make sure they are not taking on abnormal risks. We will keep you posted if anything changes in our positions.

I feel as if I should close with my primary piece of advice during times like this:

Do not let your political beliefs influence your investment decisions. The markets (and economy) do not always react the way you think they will based on the ideological talking points.