As US-based investors, we spend the vast majority of our time focusing on things happening in our country. While we have a little less influence in the world than we did 20 or 30 years ago, the US still dominates the global economy so this makes sense. However, US-based companies, and thus our stock market have profited greatly from outsourcing. They also have benefited from being able to sell their goods and services to China (although this meant compromising their values, intellectual property, and independence because after all, they are still a Communist country.)

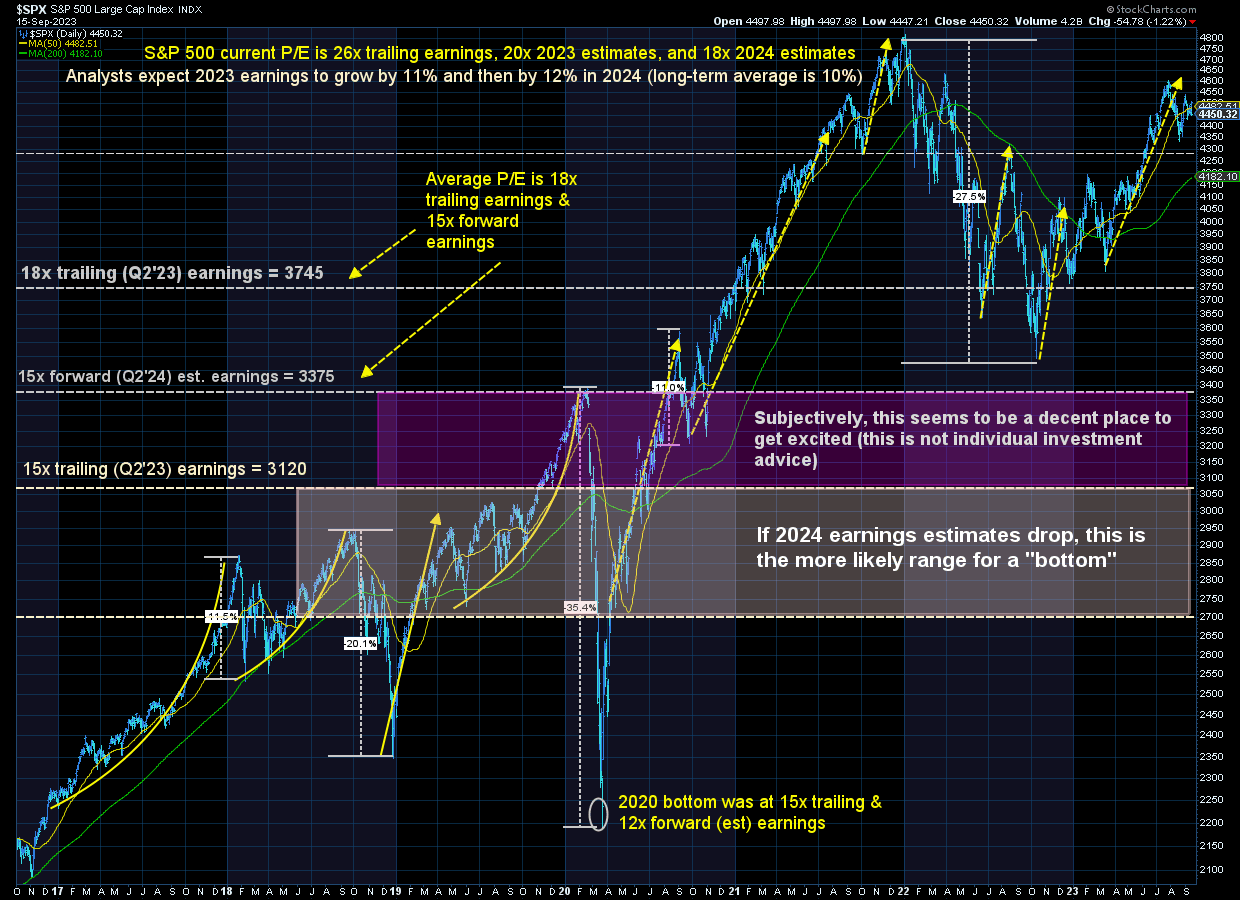

The US stock market has had a strong year so far as the economy has remained resilient in the face of high inflation and higher interest rates. Earnings growth has rebounded strongly and investors are banking on above average earnings growth next year. This has led to near-record high valuations for US stocks.

Something to keep on our radars, however is China. For nearly my entire career at every speaking engagement at least one person has asked me if I was concerned about China becoming a dominant power. Every single time for 20 years I said, "no". The reason is the combination of their demographic imbalance and their heavy use of debt to boost their economy. In short China went from an average of 6 kids per family (who are now elderly) to a 1 child policy. Like Japan in the 1990s, they are now facing the problem of way too many elderly people being supported by way too few younger workers. Following the Global Financial Crisis, China was literally borrowing money to build ghost cities just to put people to work and grow their economy. We also cannot forget despite their best efforts to hide it and fool American companies, voters, and politicians – they are still communists.

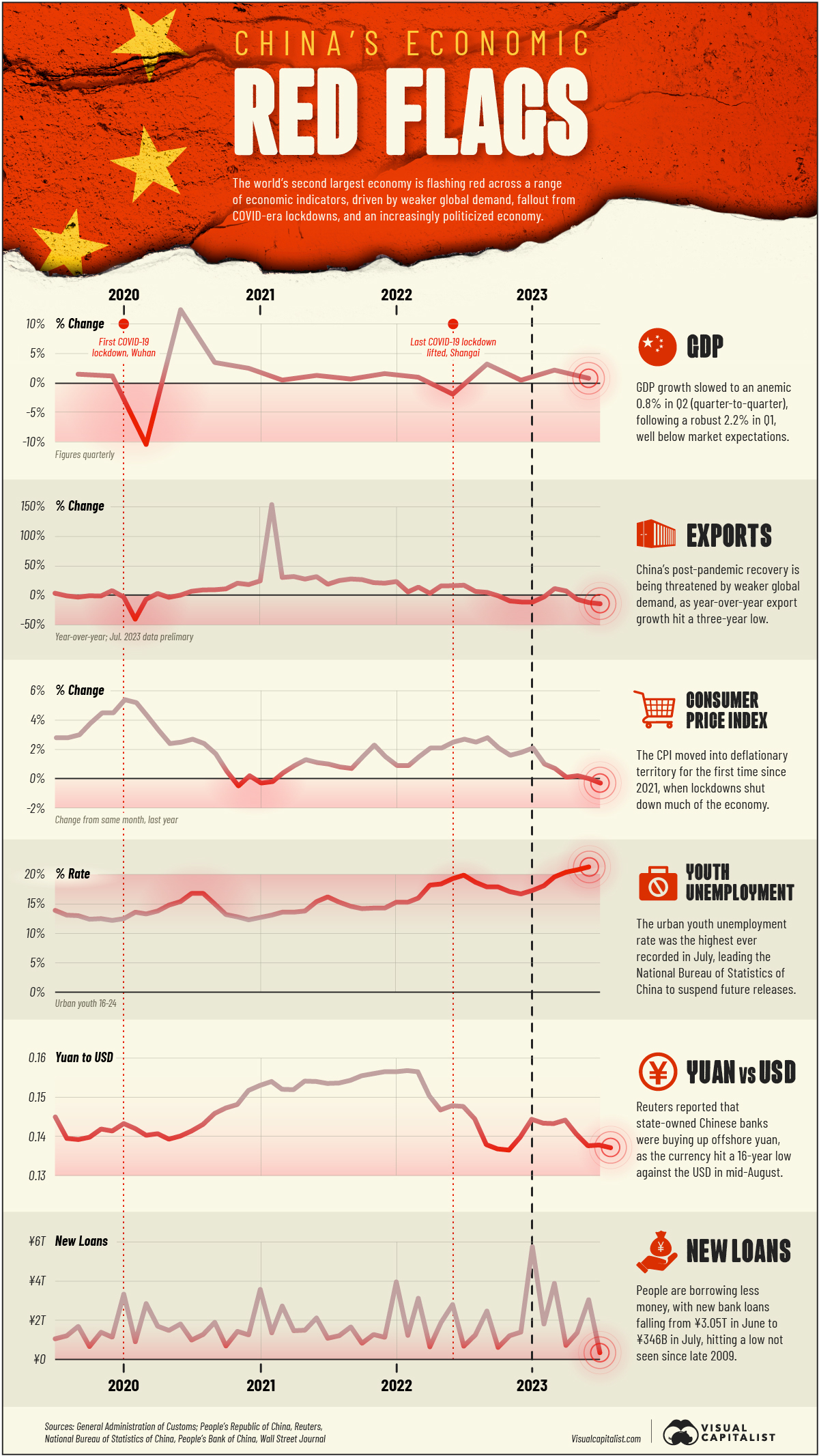

I've said, one of the "benefits" of COVID is we learned the hard way what happens when you source your entire supply chain to one region. When China's economy shutdown several times due to COVID the rest of the developed world realized they needed to diversify. Their economy is struggling as shown by this graphic from the Visual Capitalist.

This could be the end of the fears about China's dominance of the world economy. Of course shorter-term a slowdown in China could be a problem for the rest of the world, especially those companies relying on China for growth. We recently had a client who was worried about SEM's exposure to China who also was bragging about his investments in Tesla and Nvidia. SEM essentially doesn't have any direct exposure to China in our portfolios (we have no international holdings currently).

While SEM does not offer stock we took a quick look at the financials from Tesla and Nvidia. We were a bit surprised to learn that over 20% of the revenue growth in both companies came from China in the last quarter. Obviously these two stars are not the same as the S&P 500, but it does raise a red flag for those who believe technology stocks are going to continue to outperform everything else. If China continues to struggle, growth will be difficult to come by for many highly valued firms.

The other concern I've always had with China is all wars start with economic imbalances and desperation. They usually start with words, but are followed by restrictions on trade, and often high tariffs. The last few weeks Apple has been the latest example of China's desperation to maintain dominance as they continue to increase bans on the use of Apple devices in China. Hopefully this brewing 'cold war' does not turn into a more physical war, but it is something I've listed as my top concern for the 2020s for as long as I can remember.

I don't want to end on that negative note, but I do want our readers focusing beyond the recent history. SEM has been around for over 30 years because we use data, not our feelings or opinions to make decisions. We don't have to take preemptive action based on fears of China slowing down (or worse) or jump into tech stocks at or above all-time high valuation levels because we will let the DATA tell us when to make changes to our allocations.

I'm long-term optimistic for both our economy and the markets. We've been a bit busy lately and haven't posted a lot of videos on our social media channels. With school being back in session and our twins starting their junior year I was reminded of the shift our economy is going through. There is still a push from counselors to go to college despite the economic shift that is happening in our country. I posted this video 2 weeks ago, which is likely to turn into a series.

@finance_nerd High Schoolers are often pushed to go to college, but is that the smartest financial decision for them? You might be surprised what Jeff has to say about college. #unpopularopinions #college #studentloans #debtfreedom #tradeschool #highschool #posthighschool #financialfreedom #financialliteracy #financialliteracyfriday ♬ original sound - Finance Nerd

The follow-up video contained some ideas of general rules parents could use on paying for their kids' college. I'm not sure of the definition of 'viral', but this has by far been the most viewed, liked, and commented video we've posted in the year we've been doing this.

@finance_nerd Replying to @Becky even if you have the money you should set rules on paying for college. #college #student #parenting #financialfreedom ♬ original sound - Finance Nerd

What I'm seeing is a large amount of students choosing to pursue a trade, which is something our country desperately needs, but parents/teachers/counselors still under the belief that paying for college at all costs and with no rules is the only way for 'success'. More on that later.

While long-term "reshoring" jobs and production will be a net positive for our economy, it will be much more expensive. It costs money to have a stable, independent, thriving economy. We should expect higher inflation levels, higher interest rates, and lower profit margins while we adjust. None of that is good for stock prices.

We discussed this often during the "trade war" of 2018 – the stock market would sell-off every time President Trump rattled his saber too loudly. Even though I firmly believe he had the right idea, the problem was the sell-off in the stock market spooked him and made him back off. BOTH sides need to be willing to endure some short-term pain in order to make our country more stable and independent long-term. We shouldn't fear China getting "angry". They are in a very weak position and will only get weaker.

Market Charts

I've mentioned many times how many research notes/reports hit my inbox on a daily basis (70-100 depending on the day/time of year). I scan the topics to see if it is something relevant to SEM. Most of the time they aren't. I also have several which are 'must reads' because of their methodology, track record, or expertise. One of those is the "Sevens Report". They do an excellent job of giving us the trading 'color' (what the market is focusing on each day).

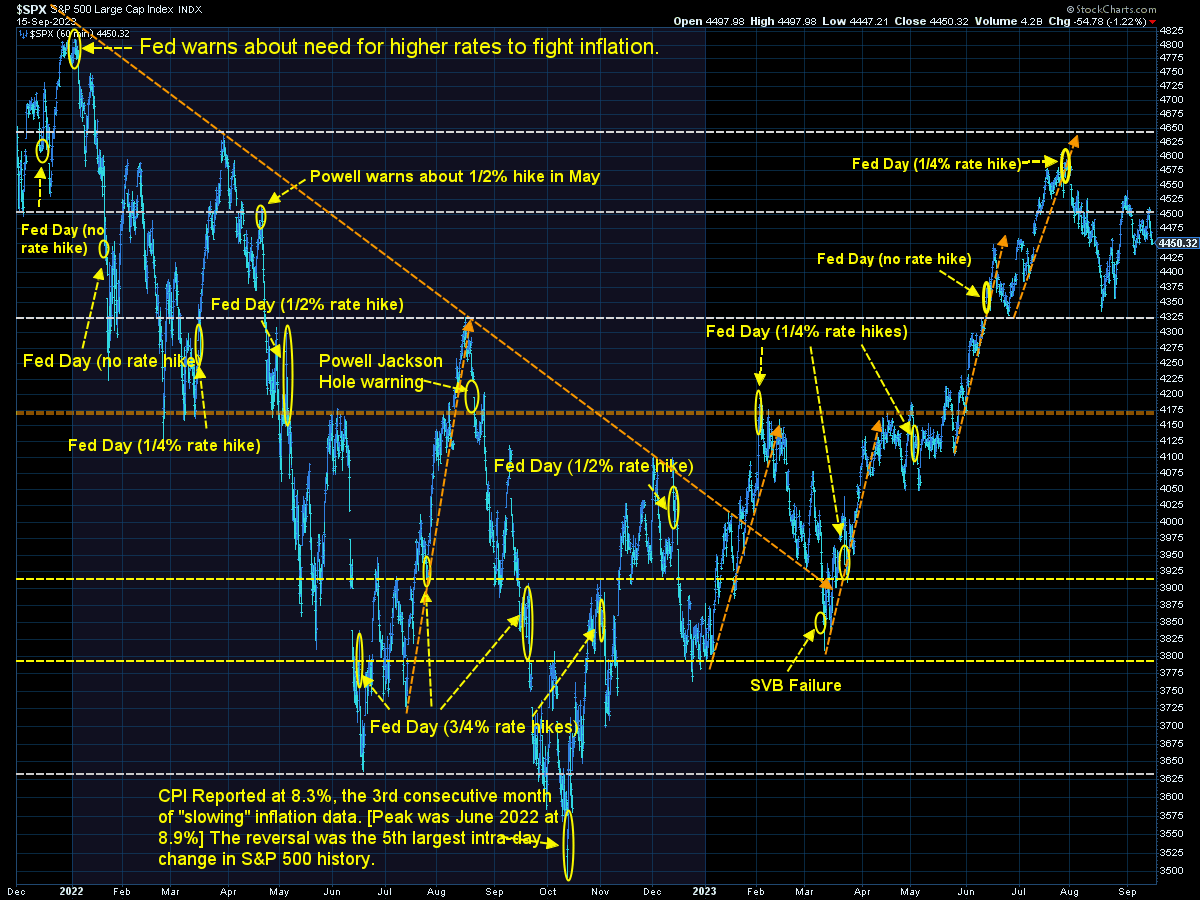

The question of the day was 'why did stocks drop so much on Friday?' The answer is pretty simple – at 4500 the S&P 500 is priced for perfection — no economic slowdown, inflation returning to 2%, AND the Fed cutting rates in 2024. The problem is it is difficult to foresee an environment when the economy is strong and the Fed decides, 'you know what, we should cut interest rates.' When you look at the short-term chart of the S&P we can see a new range appears to be forming between 4325 on the low end and 4500 on the high end.

Longer-term, the S&P is most certainly overvalued UNLESS we see the perfect world of strong growth plus Fed rate hikes.

While stocks believe both inflation is heading back to 'normal' AND the Fed is going to cut rates in 2024 (while the economy remains strong), the bond market begs to differ. 10-year Treasury rates are again threatening the highs of the year.

This puts rates back to the same levels we saw in the 07/08 market/economic peak.

As I like to say when dealing with humans — this doesn't matter until it does. Our data, research and experience tells us spikes in interest rates by this much are a big deal and WILL have consequences. I also like to say, 'the bond market is far smarter than the stock market'. Stock investors simply want to sell their stocks at a higher price (regardless of the quality of the company). Bond investors have to consider whether or not they will even be repaid (which means focusing on the underlying financial statements). They also have to look at the 'reinvestment' risk (what rates will be prevalent when the bond matures).

The bond market is saying the opposite of the stock market. Short-term the stock market may be right, but I'd be careful believing the narrative that all is right in the world.

SEM Model Positioning

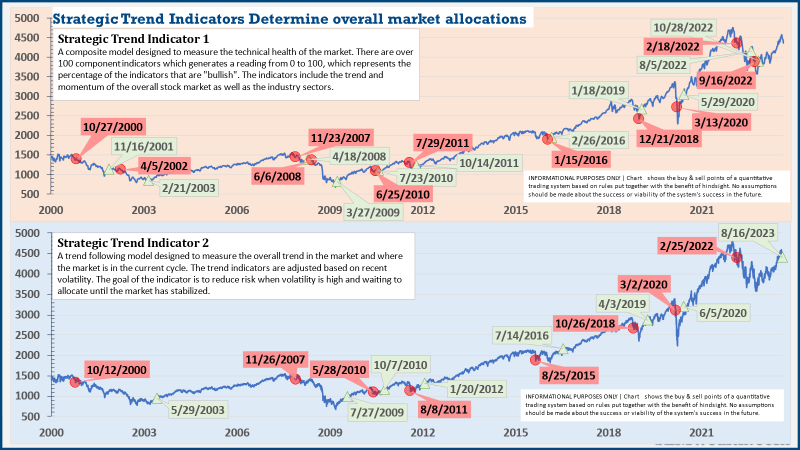

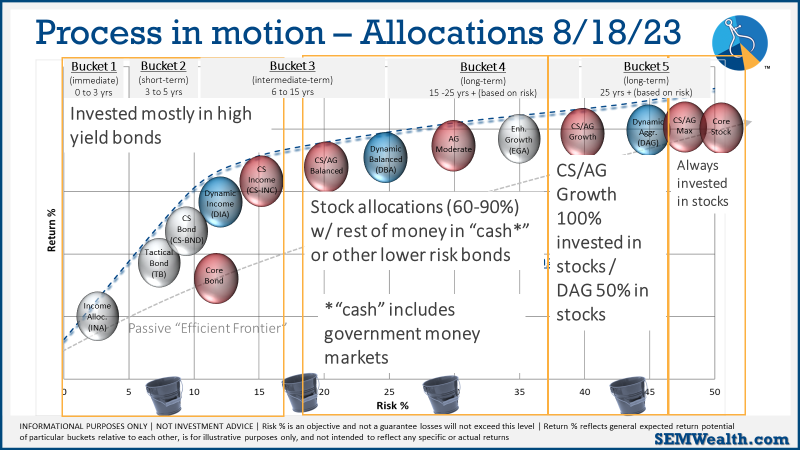

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The High Yield Bond system which bought the beginning of April remains very close to a sell. Once again after being within one more down day of triggering, a late week rally kept us invested (for now).

Dynamic (monthly): As we've been since April 2022, our economic model remains "bearish". This doesn't mean we are predicting a recession, but rather a slowdown which means a difficult environment for corporate earnings. Other than the technology and discretionary sector this has been the case.

Strategic (quarterly)*: The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.)

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The second indicator triggered on August 16, brining the strategic models to a fully invested position. We are NOT locked into these for the next quarter. The 'sell-point' for this system is down around 3-4% from here.

This is the beauty of SEM's truly diversified approach. You get 3 distinct investment management styles inside one portfolio. We can customize models to match nearly any objective, risk level, and investment personality.

Our "bucket" approach allows for different parts of the portfolio to be positioned differently based on where we are in the market cycle. Whenever we are at a crossroads moment it is especially risky. This requires a disciplined approach which is what SEM brings. There will be much easier times to invest. Our goal is to get there with as much capital in tact to take advantage of that opportunity.