I've spent a lot of time the past few months discussing the way our brains work and how that is impacting our assessment of the current environment. Our role here is to use data to help us focus on what matters and what is just a bunch of noise. I continue to hear "experts" discuss the "new normal" for our economy.

Summarizing what I've said the past few months – the Fed and Congress broke the economy in both directions. Their unparalleled actions have skewed things, changed businesses, and caused abnormal impacts across our economy. It doesn't mean the fundamentals of economics (or capitalism) have changed.

Make sure you check out our newsletter posted last week for how we describe this to our clients.

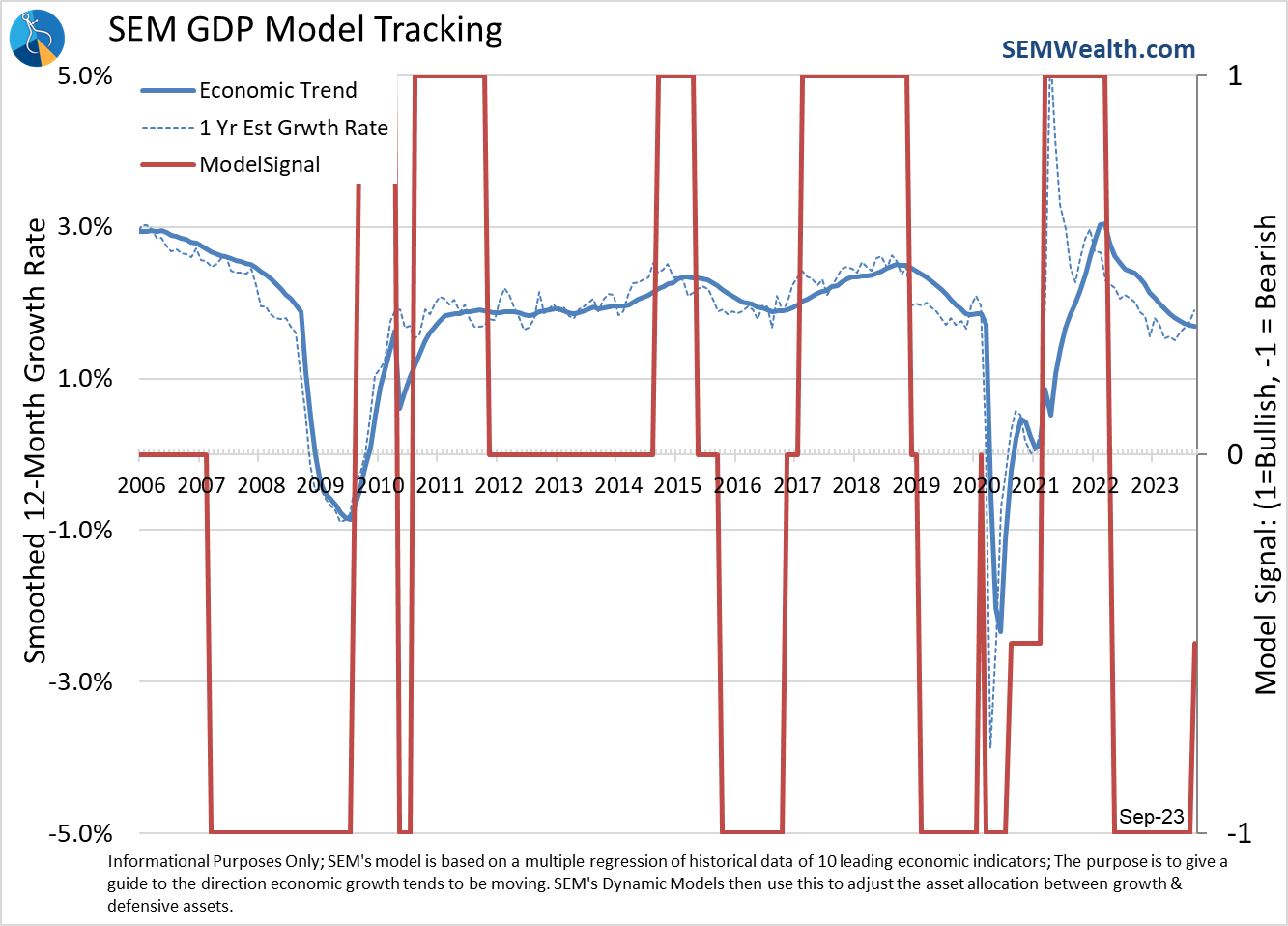

We've also heard a lot of debate about "hard", "soft", or even "no" landings in terms of the Fed's ability to control inflation and the impact it will have on the economy. SEM's economic model, which was first developed in 1995 and mechanized in 2001 when the Fed's database went fully online has obviously been impacted by the unprecedented 'stimulus'. Even with that, the model has been 'correct' on the direction of economic growth.

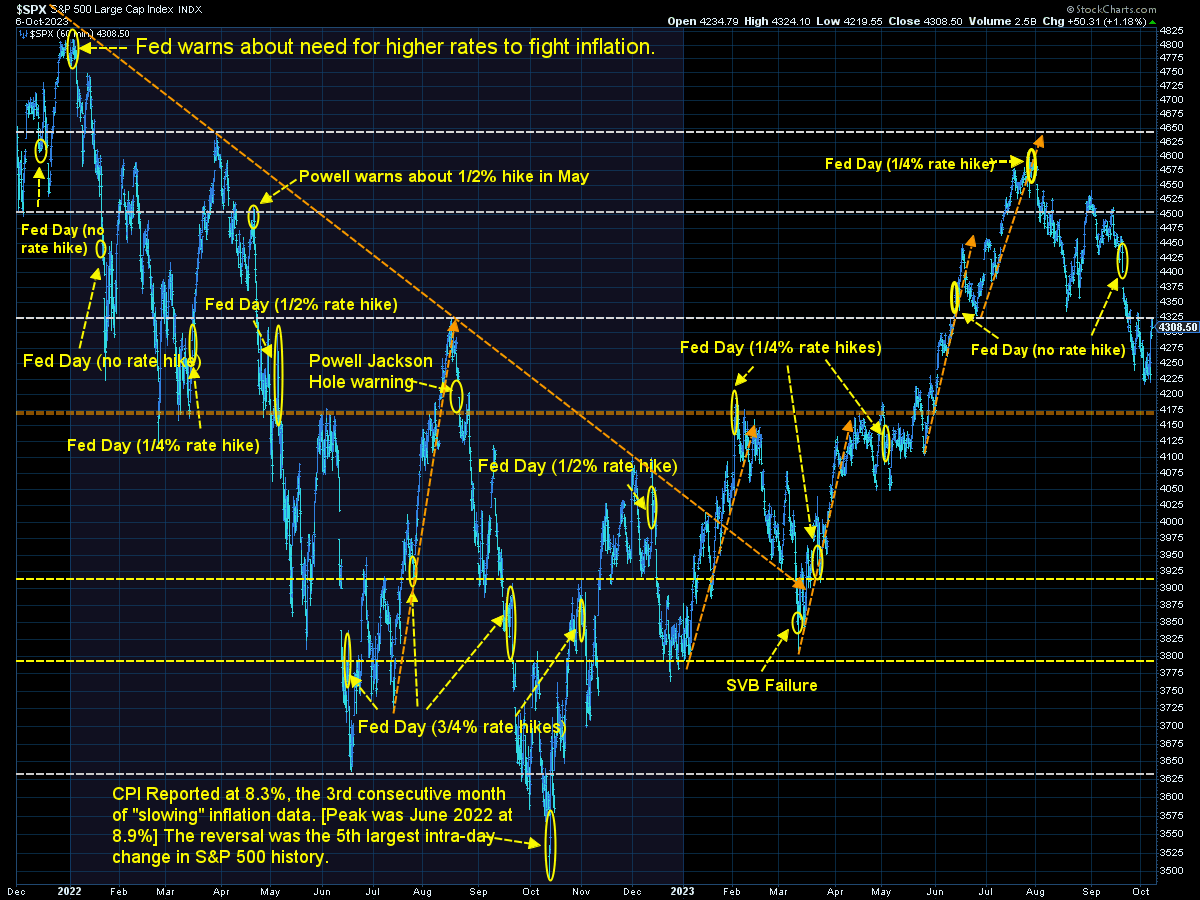

While the model was not predicting COVID, it went 'bearish' in late 2019 as the short-term boost of the Trump tax cuts wore off. It then was fully bullish in early 2021 as the economy (and corporate earnings) shot higher. Then in April 2022 it went back to bearish. Remember the model isn't designed to call recessions, but rather changes in the growth trend. After going bearish, annual economic growth dropped from 3% down to 1.75%. Corporate earnings also declined in 2022, which was the primary cause of the big sell-off in stocks.

The S&P 500 started the first 7 months on a strong note, but as we've mentioned throughout the "average" stock has not done well. Value and small cap stocks are now negative on the year, an indication that all is not well in the economy or corporate America overall. There is growing concern inflation and thus interest rates may end up "normalizing" at a higher level. This would obviously hurt smaller companies and any heavily indebted ones.

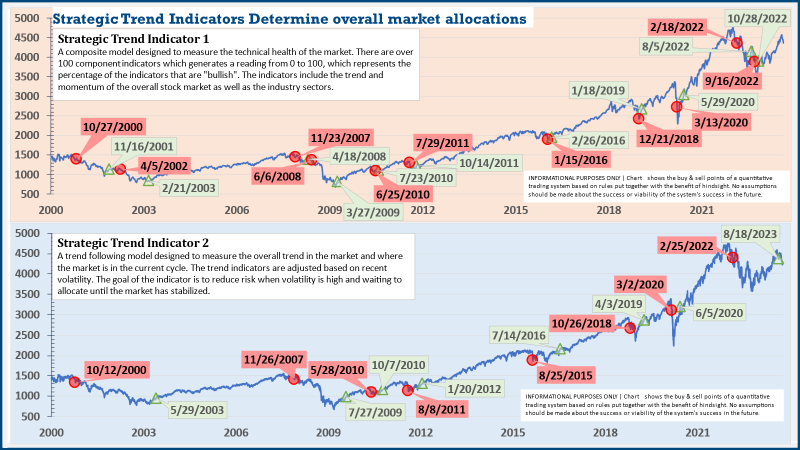

One thing I appreciate about our three-pronged, data driven approach at SEM is the ability to "zig" when everyone else "zags". The last two plus months we've seen the S&P 500 fall by 7% as those concerns spread. In mid-August the second "trend" model in our 'strategic' AmeriGuard & Cornerstone models moved to a 'buy' signal as the market strength broadened out (namely the average stock was not going down as much as the mega-cap growth stocks that drove the market higher in 2023). Note BOTH of these trend indicators are within a few percentage points of going back to a SELL.

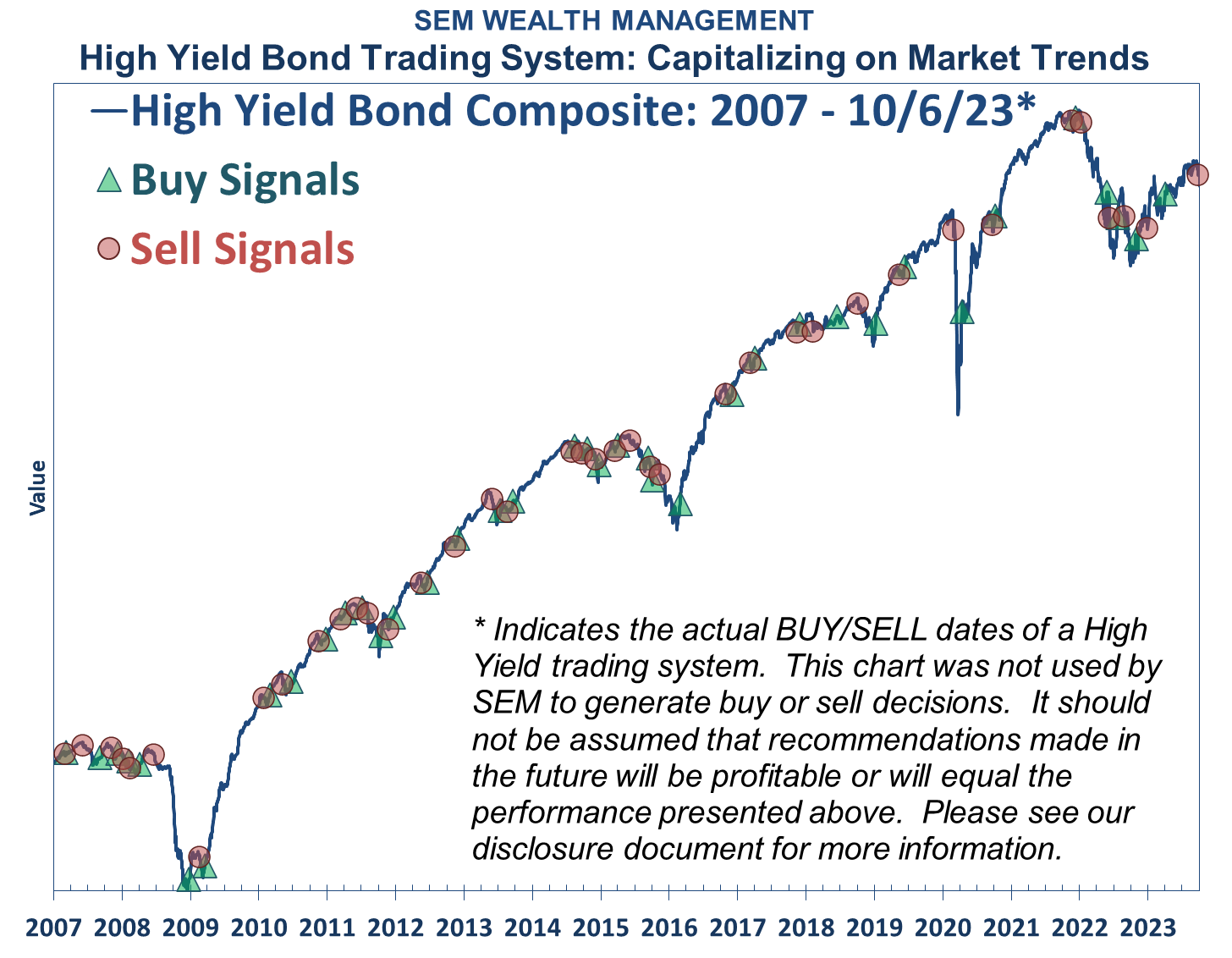

Then over the last two weeks, our 'tactical' models grew concerned about the high yield bond market and moved to the safety of money market funds (currently yielding over 5%).

Now, with the September economic model data completed, we are seeing our economic model move slightly more optimistic on the economic growth trend. This means dipping our toes in the beaten up dividend stocks on the Dynamic Income side as well as small cap stocks on the Dynamic Aggressive side. The model is still leaning bearish, but less so then it has been since April 2022.

Finally, our Dynamic Models and our Mastermind Portfolio use "tactical fixed income" allocations of outside managers who deploy quantitative approaches to fixed income investments. Over the past 8 months we've updated our due diligence files and thus our universe of possible managers. At the same time, we've added additional trend signal models to deploy assets to these managers. On Friday we deployed this model, which allocated assets to some new managers with non-corelated strategies to some of our existing managers.

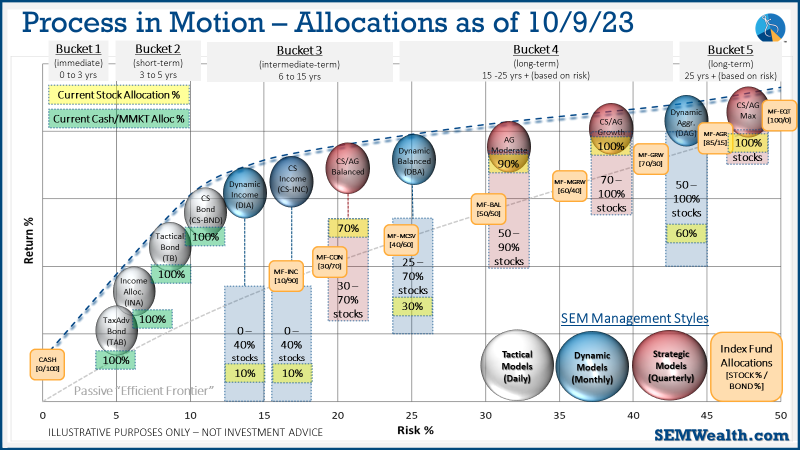

We've updated our "bubble" chart illustrating the wide range of models available at SEM. The purpose is to explain where the various models fall in terms of risk & potential returns, but also to show the 3 distinct management styles (plus a 4th 'static' stock/bond index set for those who only want consistent market exposure).

You can also see on the chart the range of stock exposure for each model below its bubble as well as where it is currently invested.

From a market perspective, the S&P 500 still is at risk of dropping to around 4000 although there is 'support' around 4175-4200, which is also where the 200-day moving average is (an indicator longer-term asset allocators use as a trend signal).

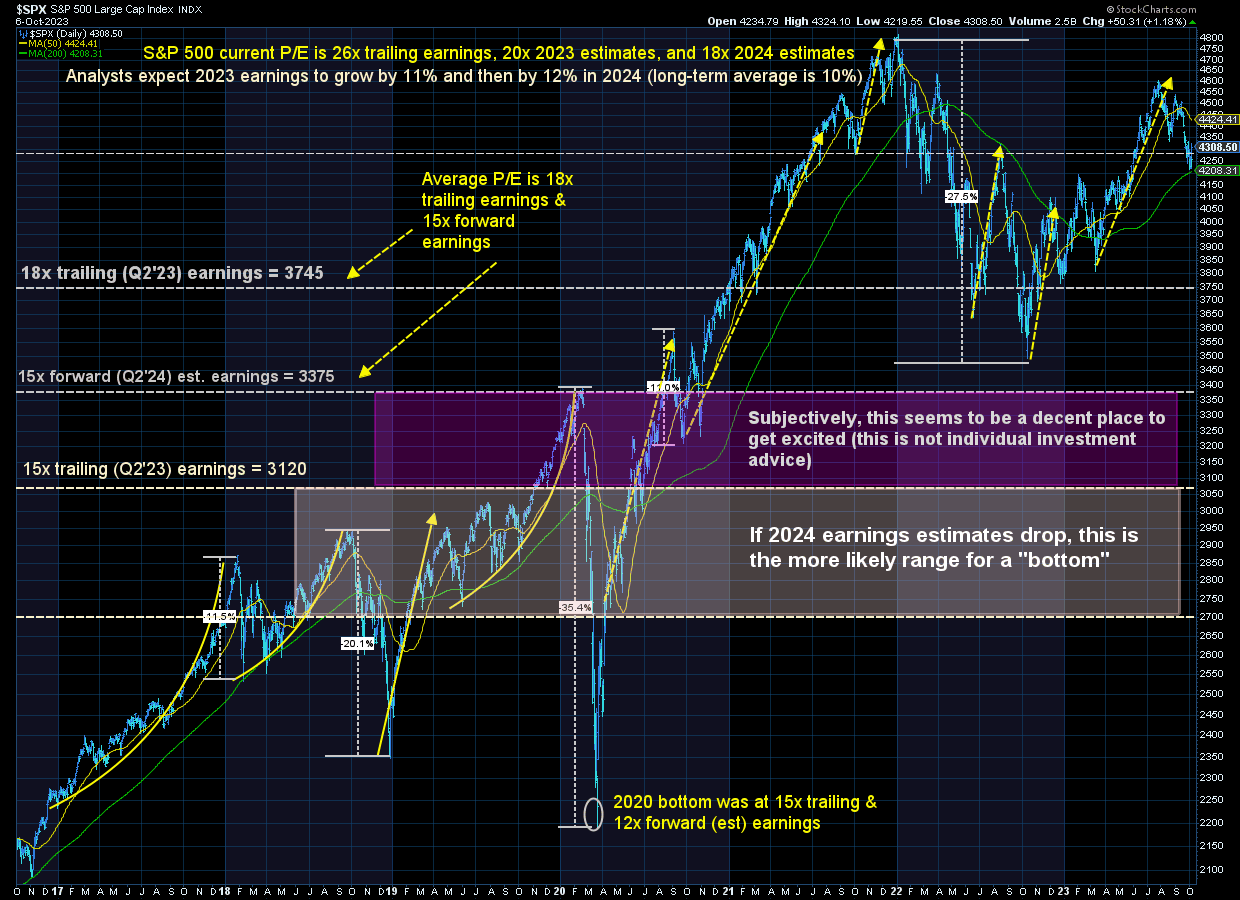

This longer-term chart puts the current market in perspective. Even with the 7% drop from the recent highs it is still "overvalued" unless we get some much stronger economic growth.

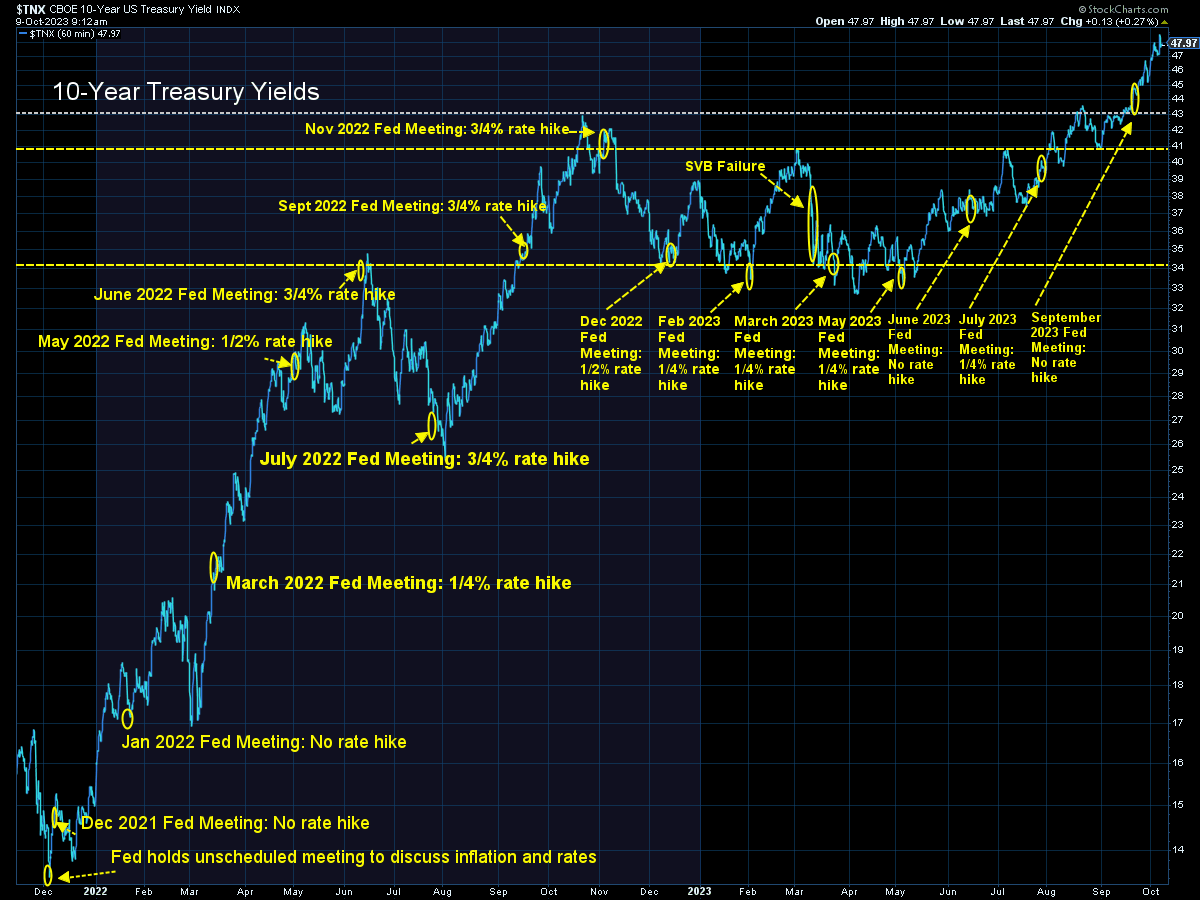

The bigger issue remains in the bond market where yields are at 16 year highs.

Unless yields come down quickly, this will obviously be a drag on earnings of any companies who need to refinance their debt. How much of an impact this will be is anybody's guess, but as illustrated above, our data driven models are ready to adjust to whatever happens next without us need to guess whether or not this is a "new normal".

Normally we provide a full economic update following the jobs report, but since we've gone long discussing the model allocations, I'll save the full update for next week (unless something else more pressing emerges).

Finally, the violence in Israel is obviously playing a role in the risk appetite of the markets once again. Like all geopolitical events how long that is the case depends on the actions of the participants and how aggressive the outside influences are from other countries. I've long spoken about my concern of how Russia, China, Iran, and North Korea all seem to come to each other's defense whenever they are involved in conflicts. We know Iran wants to eliminate Israel from the world and they are the primary backer of Hamas. Hopefully the violence will calm down, but it is something worth watching.

At SEM we do not make subjective adjustments based on news items. We follow the money and if the models see large moves in or out of the markets that drive prices we adjust accordingly. As noted above, our lowest risk models already are in money market funds. Our tactical fixed income managers are also all in "risk-off" positions. Our 'strategic' trend models are very close to sell signals. If the tensions escalate enough to cause a larger market sell-off it's safe to say they will take even more money off the table.

Stay tuned.