Not a normal market

The way our brains are programmed we tend to believe what has happened in the recent past is likely to continue for the foreseeable future. This is called “recency” bias.

This can be especially dangerous for investors as they may forget what history tells us about investing — markets move in cycles, which include periods of time where investors are overly optimistic or pessimistic.

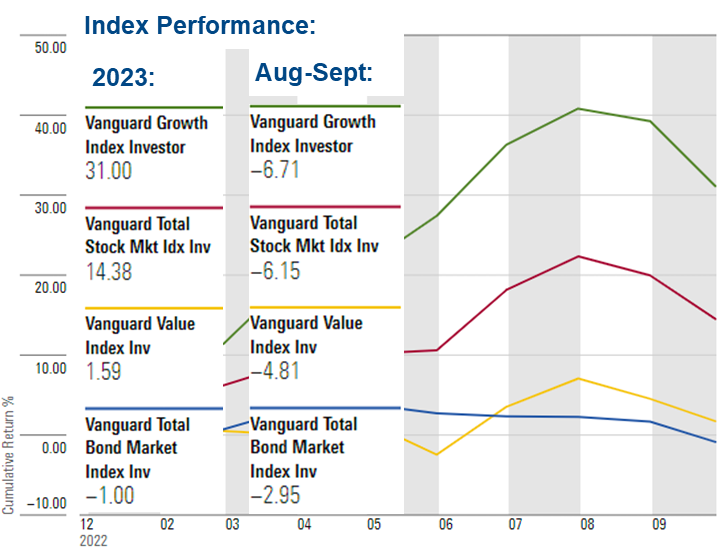

In 2023 we’ve witnessed this as investors have been chasing “growth” stocks and abandoning “value” stocks. At the same time the bond market is down for the third straight year.

From studying history we know this is not “normal” which means being especially cautious in making adjustments based on what’s happened this year.

The Fed (and Congress) broke the economy

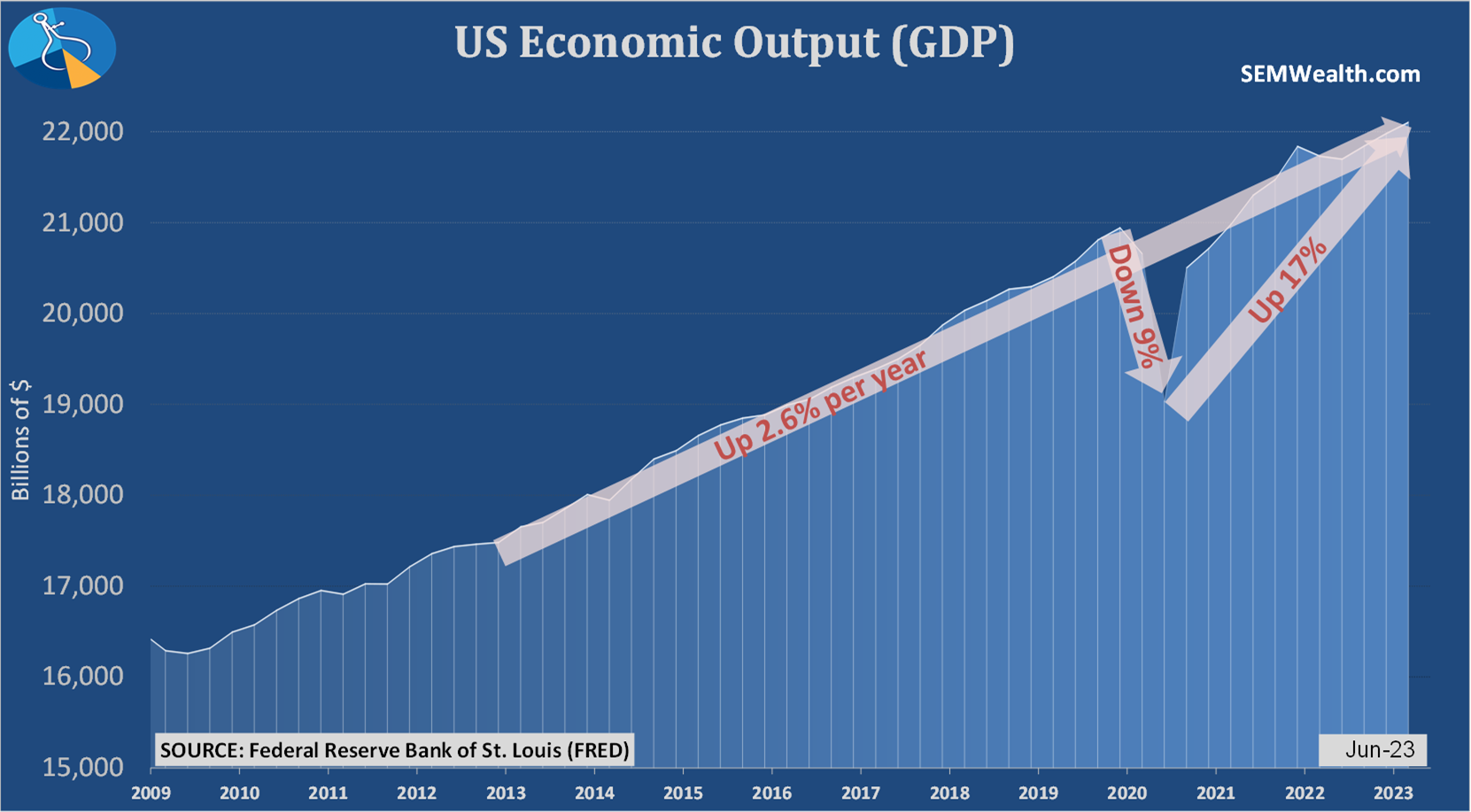

One reason the current market environment is not “normal” is due to the policies of the Federal Reserve and Congress. They’ve essentially “broken” the economy (and thus the market) 3 times in the last 3 years:

- Economy was shut down to “beat” COVID

- Congress & the Fed added 50% of GDP output to the economy in less than 12 months to “beat” the recession

- The Fed hiked rates at the fastest rate in 40 years to “beat” inflation

This has caused many areas of the economy to break and generate abnormal behavior. The economy appears to be heading back to the “normal” trend, which means investment asset classes are likely to revert back to “normal”. How long it takes is anyone’s guess, but it usually takes longer than most of us are comfortable. Patience & discipline will be the key to successfully navigating this normalization.

Dichotomy of Expectations

Over the long-term, the stock market will move based on the overall direction of the economy. Over the short-term it will move based on the expectations of the market participants. Those expectations can change frequently and certainly can cause abnormal behavior as discussed earlier. This year there have been 3 primary expectations for the market which has driven stocks higher:

- The economy will continue to grow throughout 2023 & 2024 (along with corporate earnings)

- Inflation will come back down to "normal"

- The Fed will cut rates in 2024

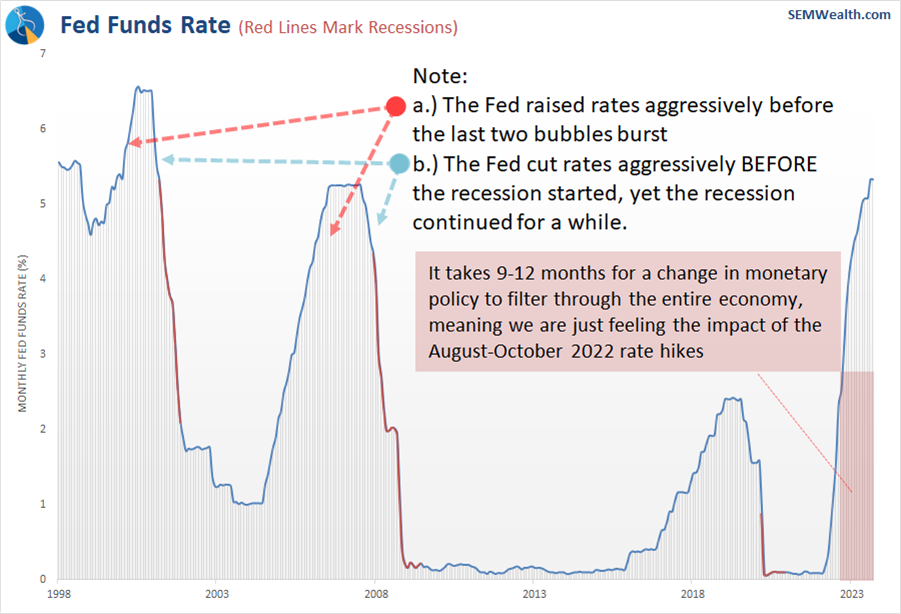

The problem with these expectations is they do not make sense. #1 & #2 are certainly possible and would be good for stocks, but why in the world would the Fed cut rates if the economy was still growing? Maybe this time is different, but we’ve never seen a time the Fed has cut rates while the economy was strong. This means rates are not likely to come down until they see the economy slowing down (which would hurt corporate earnings and thus stock prices.)

The Fed Funds rate chart above illustrates the Fed’s interest rate policies the last 20+ years. They hike rates too far, cause a recession and then slash rates. Note how simply slashing rates doesn’t mean the recession magically ends. Based on our economic data the first 2 expectations may come into question the rest of the year and into early next year. That would not be good for stocks even if the Fed were to cut interest rates.

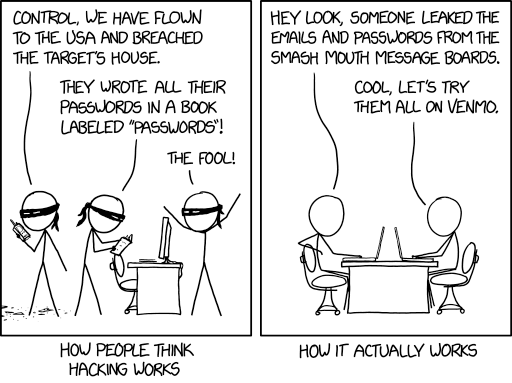

Bonus Content: Managing Passwords

Managing all of our passwords is hard. Best practice says we should create strong passwords that are also totally unique. How is it possible to create strong and unique passwords that you can actually remember? We have a blog post that deals with this question in-depth, but here are two quick tips to help you get started:

- Use a password manager. You can create completely random, long, and complex passwords then let a password manager take care of the rest – you only need to remember your master password. We recommend 1Password.

- Use passphrases instead of passwords – especially for passwords you do need to memorize or type in on a TV remote (e.g. your streaming services). Typically passphrases are more secure than a human-generated password anyway. Don’t believe it? Check out https://useapassphrase.com.

Here is the full article which goes into more detail on managing passwords effectively:

A Behavioral Approach to Economic Analysis Webinar Replay

Did you miss our SEM University in September? This presentation is near and dear to my heart because when I was in school, I struggled with economics classes. Our hope with this presentation is that we can help our advisors and clients understand how the economy works.

Long story short, humans don't act the way economists think we're going to act. In this webinar, I first explained how our brains work which will influence how we make decisions and interpret data. Then I discussed what truly moves the economy and what we're currently seeing with the economy as we head into the Fall of 2023. Check out the replay below.

The Importance of "Suitability"

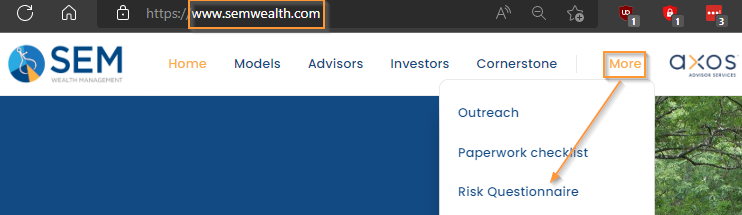

Each year the Securities & Exchange Commission (SEC) Rule 3a-4 requires SEM to request certain financial information from any client accounts we manage. In previous years SEM has mailed a 1 page form for clients to complete, sign, and return. This information is important for the management of your account, and we request clients to contact their financial advisor within 90 days if there are any changes to their financial situation.

This year we are asking clients to complete the information online through our website. Your responses will be shared with your financial advisor and reviewed to ensure the investments match the financial profile. To do this clients can go to risk.semwealth.com or click on the “Take Our Risk Questionnaire” at SEMWealth.com.

If we do not receive a completed questionnaire by 12/10/2023 we will assume your information on file is current.

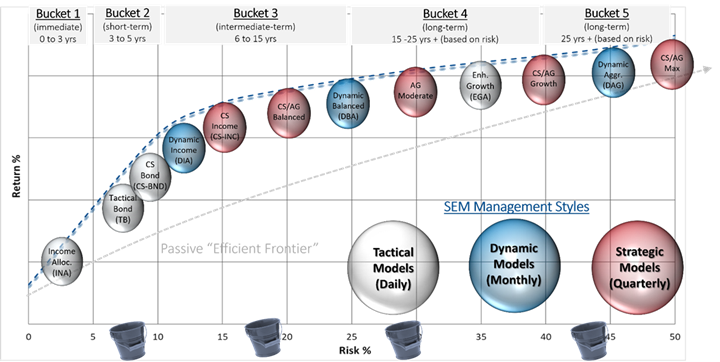

Creating a Customized Solution

Every investor has a unique set of circumstances that makes it difficult to find a pre-packed solution. SEM offers a wide range of investment models that are designed to be risk efficient for a broad range of investors. The key to long-term investment success is allocating your assets to the portfolio that best suits YOUR individual needs.

Step 1: Determine Your Time Horizon

Investing involves risk. Risk is essentially the volatility of returns during the time it is invested. While over the long-run an investment may have superior returns, over short periods of time the returns may be negative. The shorter the time horizon, the less risk a portfolio should have. Keep in mind different portfolios may have different time horizons based on the purpose of the funds. For investors taking income from their portfolio, separating the income portion into its own portfolio is a popular strategy.

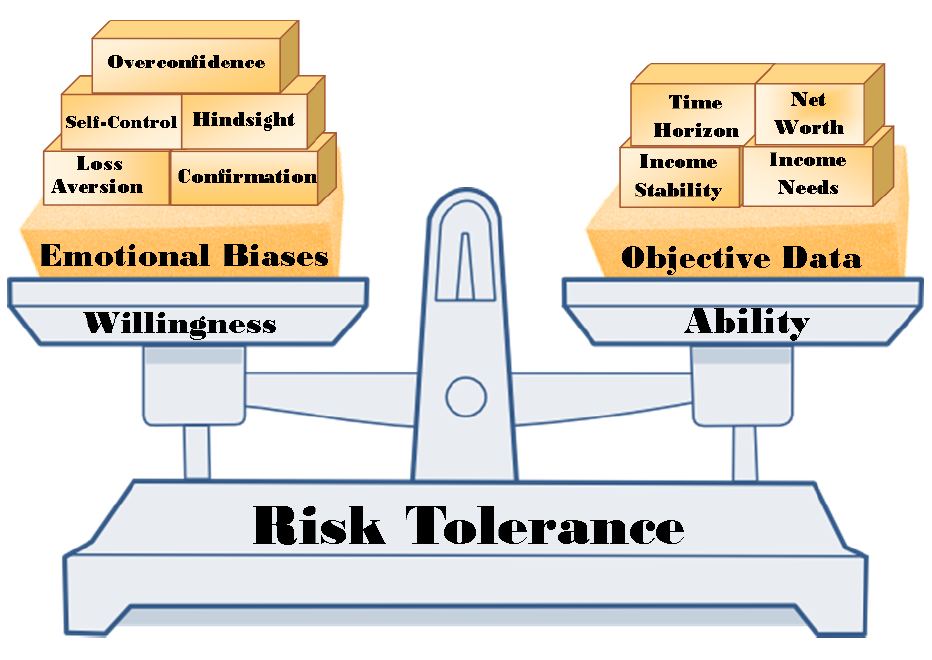

Step 2: Determine Your Risk Tolerance

Risk tolerance is generally thought of how much risk an investor is WILLING to take. This is certainly an important determinant, but it is typically driven by EMOTIONS. Often investor feelings toward risk fluctuate with the direction of the market. The more important determinant is the ABILITY to take risk. The ability to take risk is determined by data, not emotions. While time horizon is one portion of a portfolio’s ability to take on risk, other determinants are based on the individual situation.

There are numerous questionnaires, including SEM’s, available to determine the WILLINGNESS to take risk. Your advisor can look at your overall situation to help you determine your ABILITY. Like Time Horizon, portfolios can be separated into different portions based on the purpose and objectives for that money.

Step 3: Understand Your Personality

Too often our industry places clients in portfolios using a pre-determined model based on age. Our behavioral approach understands that even if you have time on your side and the ABILITY to take on risk, if you are invested in a portfolio that does not fit your overall investment personality there will be times where you are not comfortable. Typically when we are not comfortable we are more likely to make an emotional decision.

Step 4: Determine Your Customized Portfolio Blend

SEM’s Risk Questionnaire generates a blend that matches your time horizon, risk tolerance, and personality. It is designed to be a starting point with additional adjustments to be made to make the portfolio fit into the overall financial plan. You may already be in an optimized, custom blend of SEM models, but when you submit your questionnaire results SEM will send them to your advisor to review your portfolio and how it compares to your results. Upon review your advisor may work with SEM and possibly recommend a change to your investment allocations.

Understanding Your Portfolio Allocation

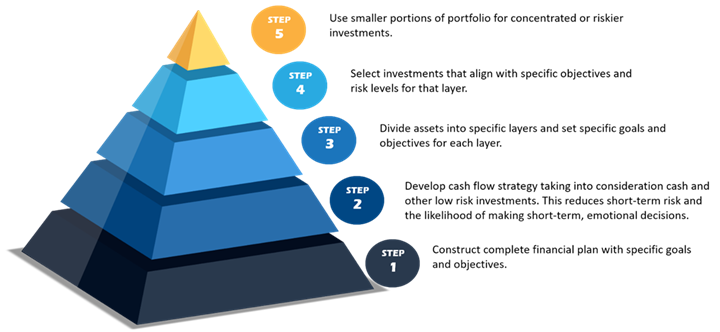

Creating a Customized Behavioral Portfolio

SEM works closely with our financial advisors to create a customized portfolio. We believe the strength of the portfolio starts with a solid financial plan as the foundation & then follows these steps.

SEM's Portfolio Building Blocks

Beginning in step 3 above, SEM works with the financial advisor to select investment models that fit the financial plan, cash flow needs, and the client’s personality. We have over a dozen building blocks to choose from across three distinct investment management styles (tactical, dynamic, & strategic). Each model has its own risk/return profile which can be blended with other models to create the customized portfolio. Each plays a different role. Note in general, the higher returns you seek, the longer time horizon you need to have, and the more risk you must be willing to accept.

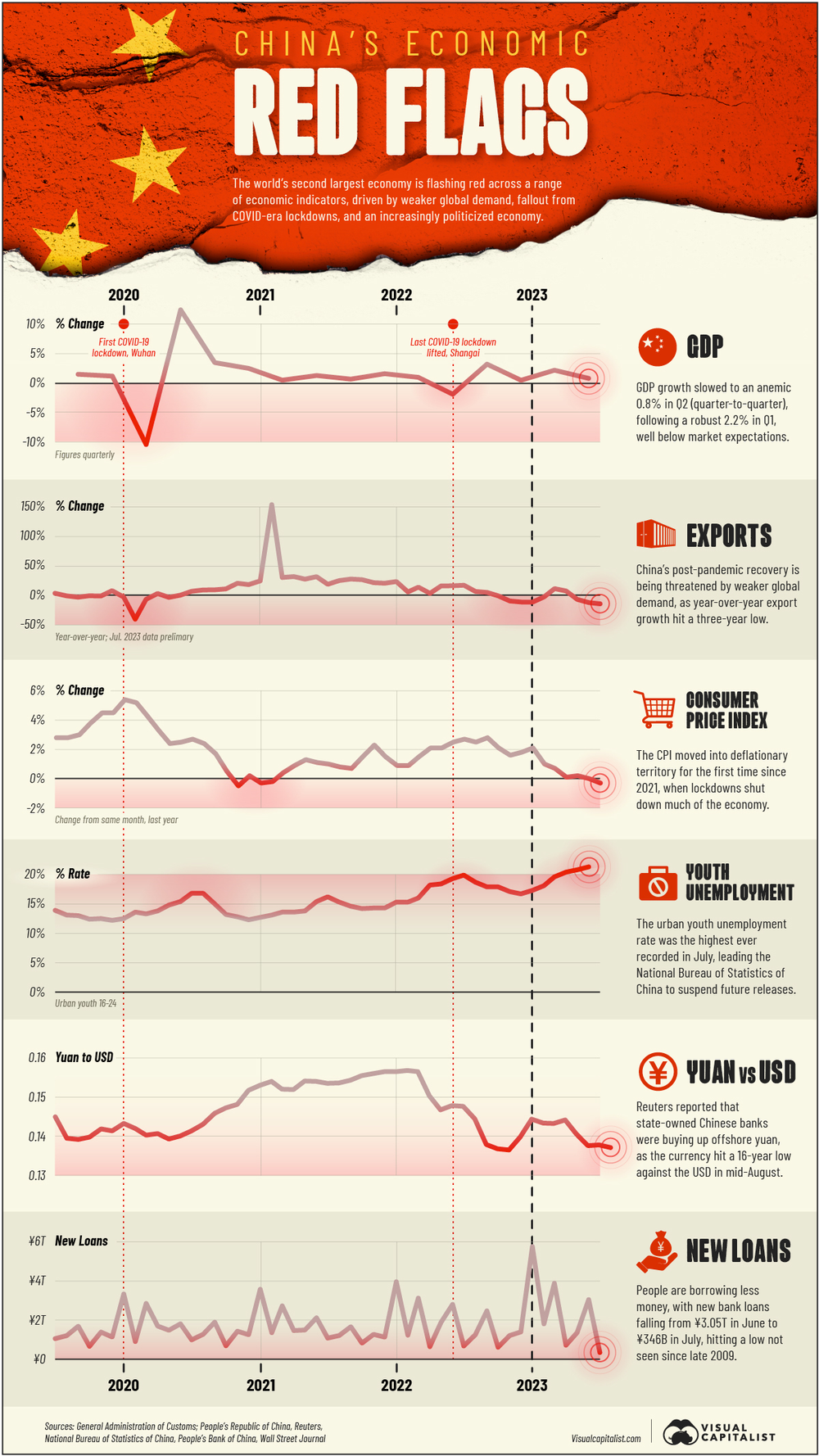

Concerned about China?

Nearly every speaking engagement for the past 15 years we have fielded at least one question on China. Most of the time the concern is they were going to overtake the US as the world's dominate economy. This chart illustrates the economic struggles facing China.

Here is a recent post discussing the chart:

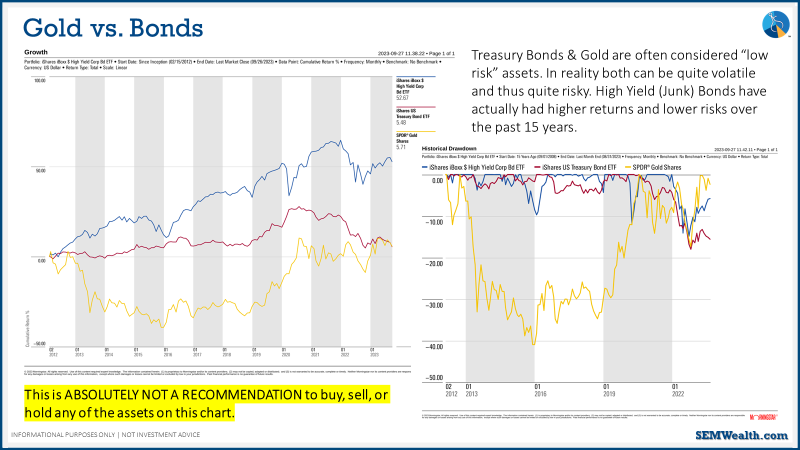

Gold vs. Bonds

During our SEM University a question came up:

Would like you to discuss my options of buying gold versus government bonds which are tanking

I shared some charts from Morningstar comparing Treasury Bonds to Gold and also High Yield (Junk) bonds. As I said in my answer, this is an apples-oranges-grapes comparison (they are all fruits, but cannot really be called better/worse than the others)

The DATA shows both gold and Treasury Bonds can be VERY risky and interestingly enough more risky than Junk bonds. Here is the full answer from our webinar:

As with all things, please consult a financial advisor to discuss whether or not any of these investments belong in your overall investment portfolio.

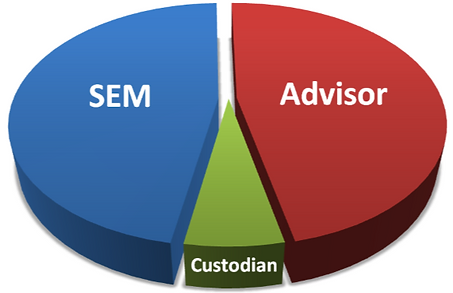

What am I Paying For?

When returns are leaner we often hear clients ask this question. While we would like to make money every month and every quarter we know that is not possible. It's important to understand the fees inside the account cover many different roles. You will see 3 categories of fees:

- Financial Advisor Fee

- SEM Investment Management Fee

- Custodial Fees

Financial Advisor Fee

While services vary from advisor to advisor, this is the largest fee inside your account for a reason – it is the most comprehensive. From development and monitoring of financial plans, tax strategies, goal setting, and simply being there to guide you through your investing life cycle, the financial advisor is there to assist you in this journey. Remember, you only get 1 shot. Your financial advisor has helped hundreds of people along this journey.

In addition to this, studies have shown the value of having an advisor. For more, click the box below.

SEM Investment Management Fee

We already discussed many of the things our models are designed to do throughout the market cycle. In addition to that, part of working with SEM is gaining access to institutional (lower cost) investments, offering scientific diversification, daily monitoring of your investments, tax management, and all kinds of operational duties (contributions, withdrawals, distributions, and other service items.)

Custodial Fee (Axos)

The custodian provides many different roles. The primary one is safeguarding your investments. Remember, all investments in your account are owned by you (not SEM or your financial advisor). This is important in an era where we continue to see fraud and other schemes. Axos also provides unlimited trading with no additional transaction costs, access to over 8000 mutual funds and ETFs, tax reporting, the client portal, performance calculations, and quarterly statements. They also handle ACH and check withdrawals at no additional costs.

For more see:

Download/Print version of the Newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.