Thanksgiving has always been my favorite holiday because of the 3 F's – Food, Family, & Football. Thanksgiving weekend gives us what seems to be a year's worth of all 3 of them. Over the years I've learned it is important to not overindulge in any of the 3 Fs, but especially the food and football. The former is to hopefully not derail a year's worth of workouts, the latter to not upset the non-football loving members of our family.

When it comes to investing it is easy to get sucked into the euphoria of a strong year for the stock market. It's natural to believe the current trends will continue indefinitely into the future. That would mean the largest of the large cap growth stocks will always outperform everything else, which is mathematically not possible. In reality, markets fluctuate. The markets revert back to the mean. The top performers become the under-performers. Not chasing the market when it is well above average requires discipline to not upset your financial plan.

We've talked throughout the last half of this year about the "return to normal". We had a series of abnormal events and actions which created an abnormal environment for investors. The pandemic arrived, governments purposely shut down the economy, then Congress and the Federal Reserve overcompensated to offset the shutdown by dumping 50% of GDP into the financial system, which led to runaway inflation, so the Fed had to break the bond market in an attempt to reign in inflation.

What is being missed by those who are celebrating the mega cap stock rally this year is the same thing Black Friday and Cyber Monday shoppers using credit cards always forget –- you eventually have to pay it back.

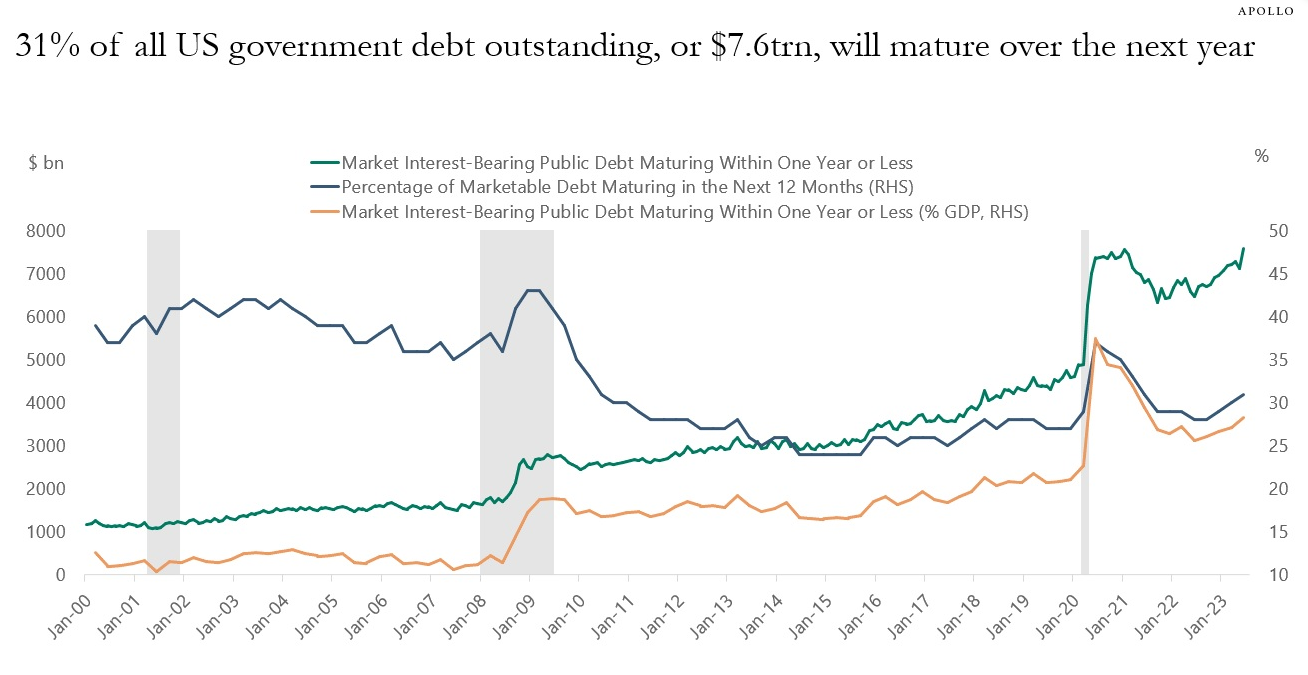

I saw this chart over the weekend and it should send alarm bells off for anybody banking on continued growth in the year ahead. A whopping $7 Trillion of US Treasury Debt needs to be refinanced in the next year. That is equal to 31% of all US Debt and 29% of GDP.

Maybe it won't be a big deal, but we're dealing with levels of debt we've never experienced before in our country. A year ago interest rates were 1% lower. Two years ago they were 2% lower (or half of what they are now).

Thankfully we don't have to guess about the impact. We will simply do what we've done the past 30+ years – follow the trends, make adjustments accordingly, and most importantly of all maintain a disciplined approach to avoid situations which could completely disrupt our clients' financial plans.

Whether over Thanksgiving or when investing, it's not always fun to be disciplined, but long-term it is worth it.

Market Charts

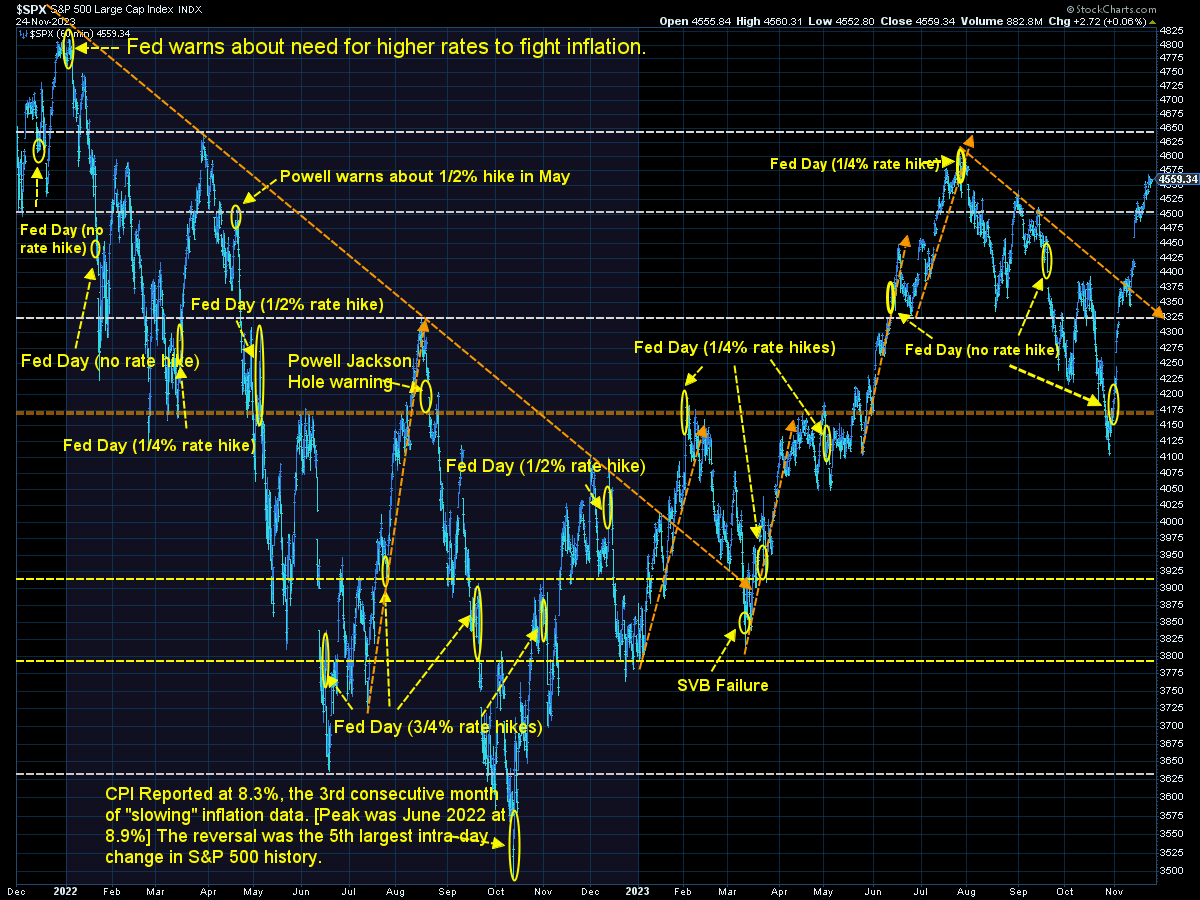

Last week was a bit of a slow week for stocks. Short-term the trend remains up, but after such a sharp move higher the risk of a pullback is high. The S&P's high from July at 4600 is a likely stopping point.

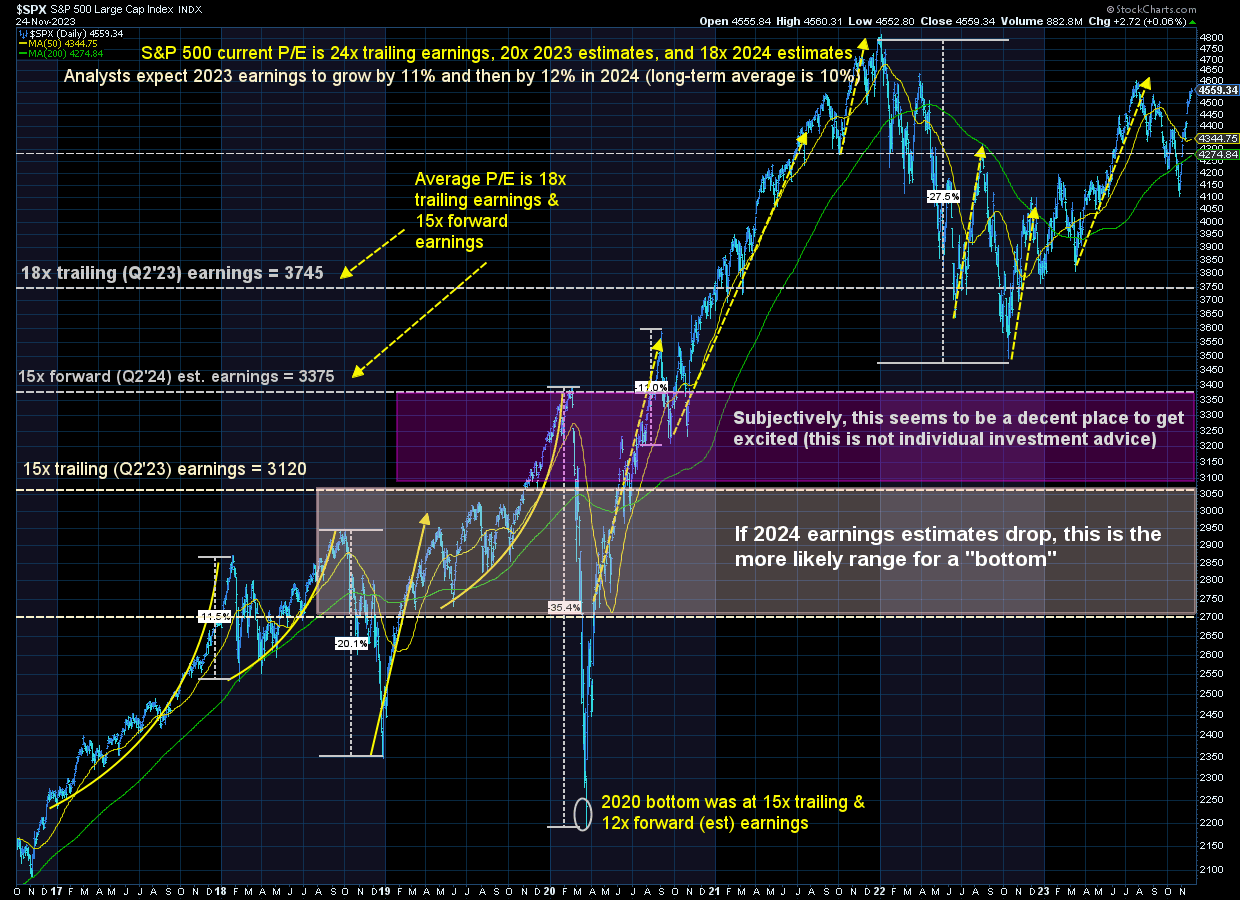

Longer-term the stock market remains overvalued. If you follow a "buy low, sell high" philosophy, now is not the time to be adding to your stock market exposure.

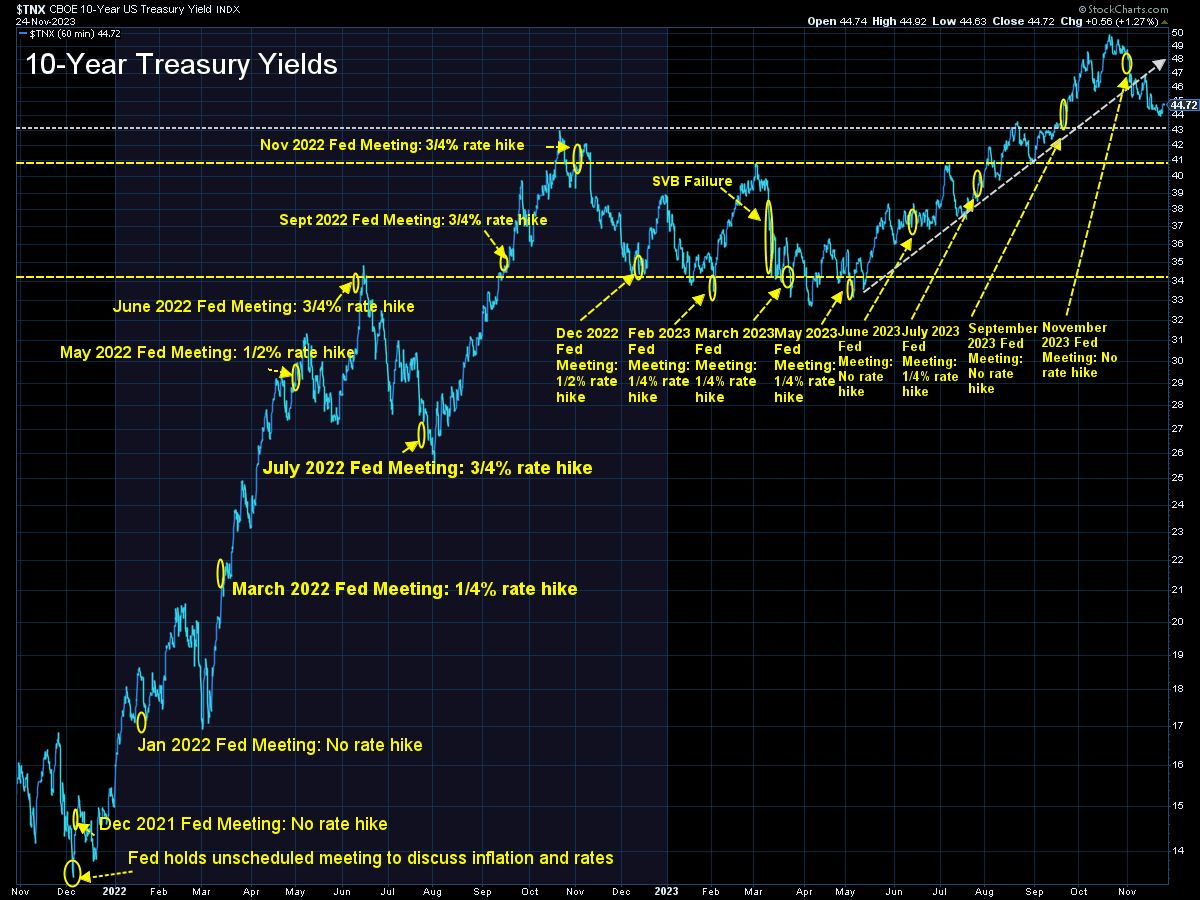

What happens with interest rates is much more important. Both stocks and bonds have been celebrating what seemed to be a hint from the Fed that they are "done" raising rates. They did not say they were LOWERING rates, but the market is still pricing in some big rate cuts in 2024. The only reason the Fed would CUT rates is if the economy was slowing and heading to (or already in) a recession. That would NOT be good news for stocks.

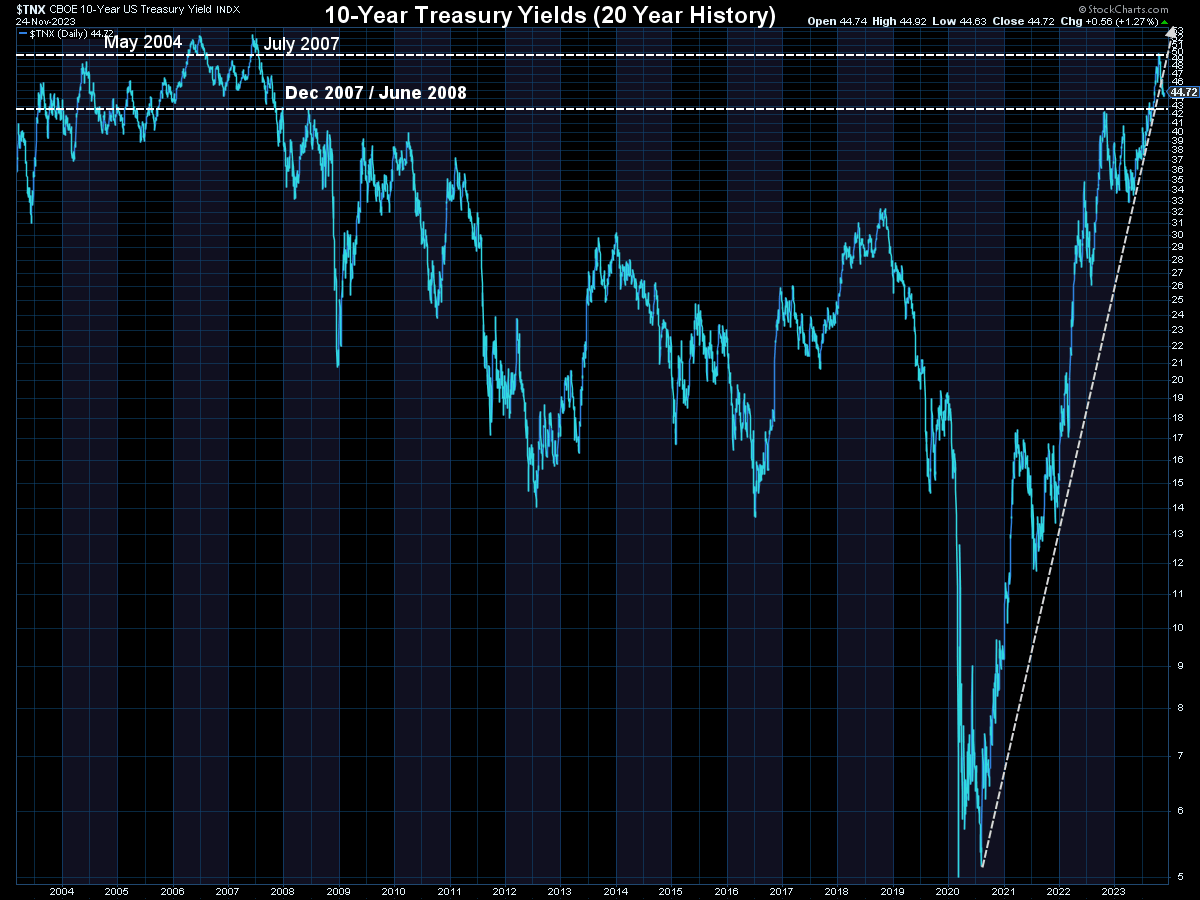

On a longer-term chart it is easy to see how abnormal of an environment we are in. We're back to 2004-2007 interest rate levels. Those were 'good' years for the economy, but not 'great'. The difference between then and now is we are not likely to see the return of the easy money policies which fueled the housing bubble (and the eventual housing crash).

Another thing to contemplate – if you began investing or began your career any time in the last 15 years you are entering an environment you've never experienced before. The things that worked then (buying and holding large cap growth stocks) may not work the next 15 years.

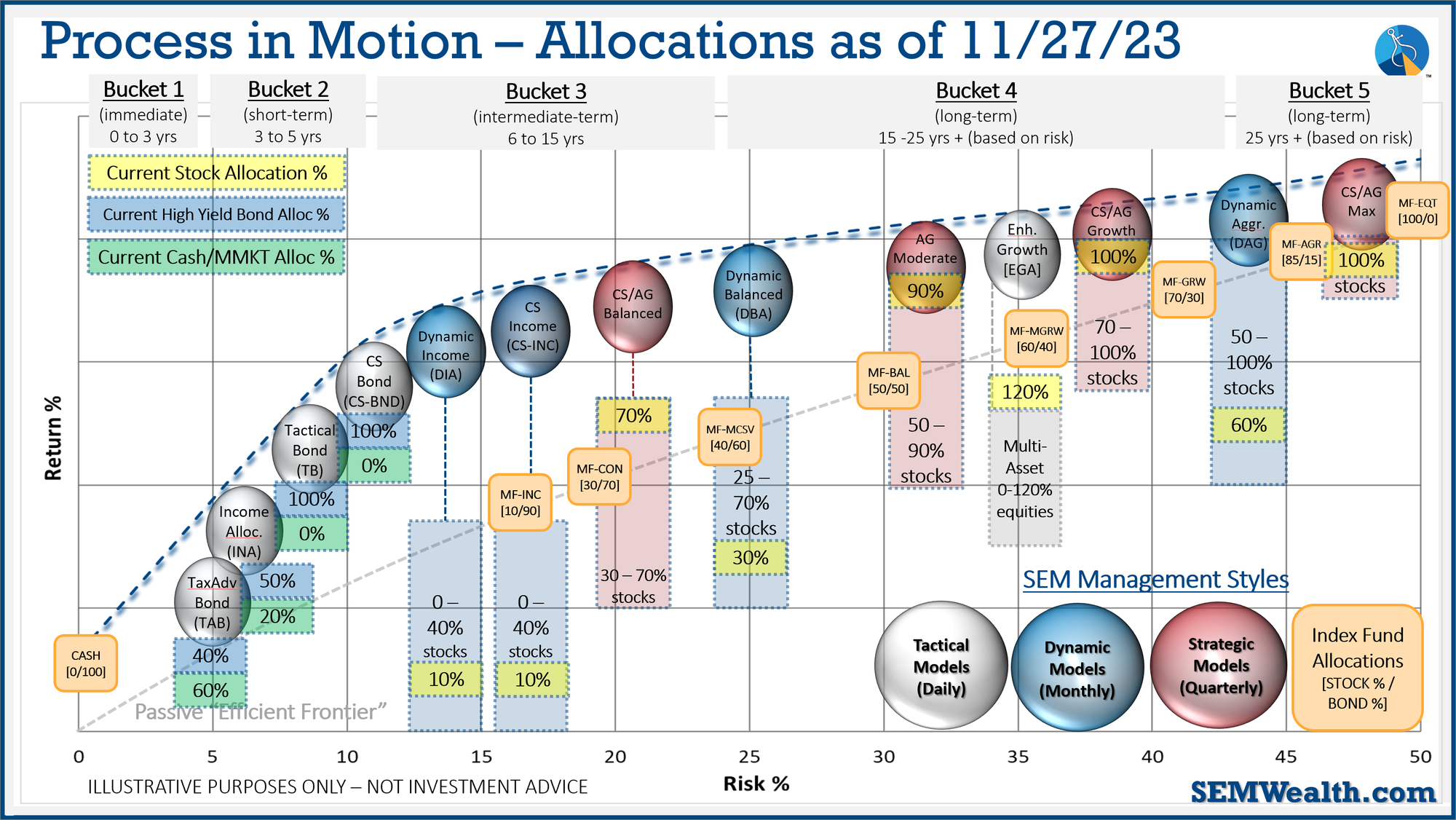

SEM Model Positioning

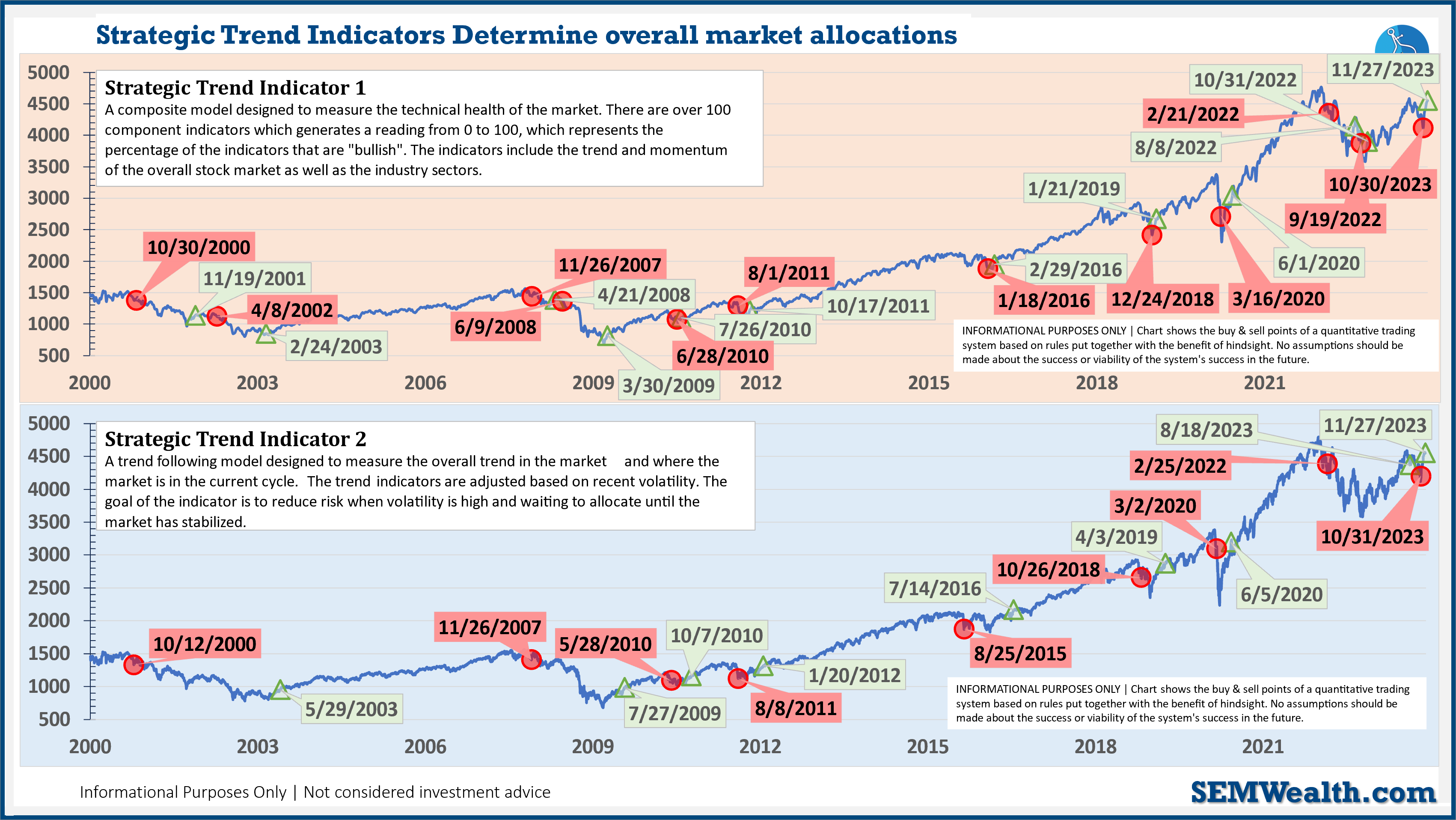

SEM's Strategic Trend Models went on a buy 11/27/2023

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

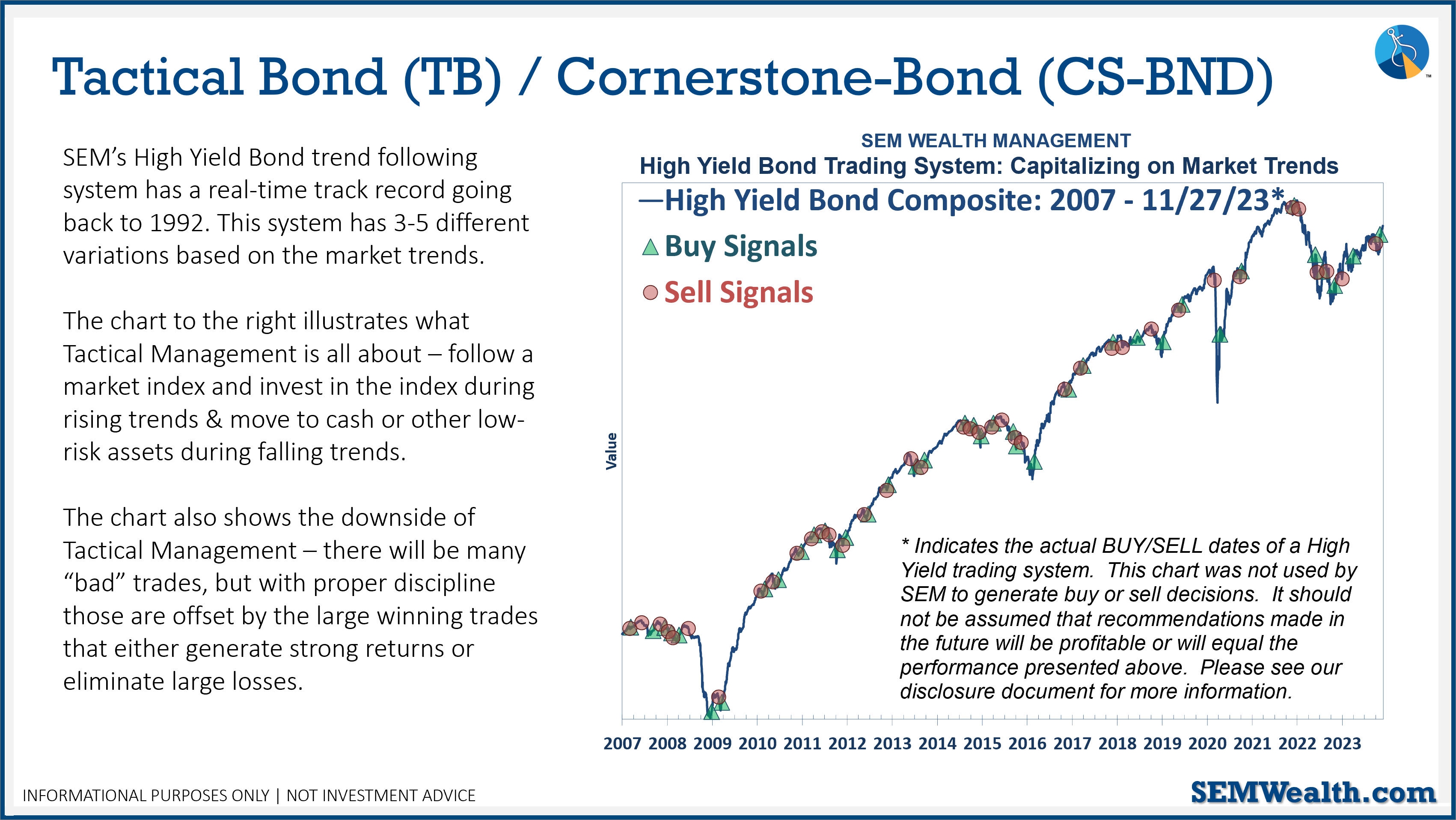

Tactical (daily): The High Yield Bond system bought the beginning of April and issued all 3 sell signals 9/28/2023. All 3 systems were back on buy signals by the close on 11/3/2023. The bond funds we are invested in are a bit more 'conservative' than the overall index, but still yielding between 7.5 -8.5% annually.

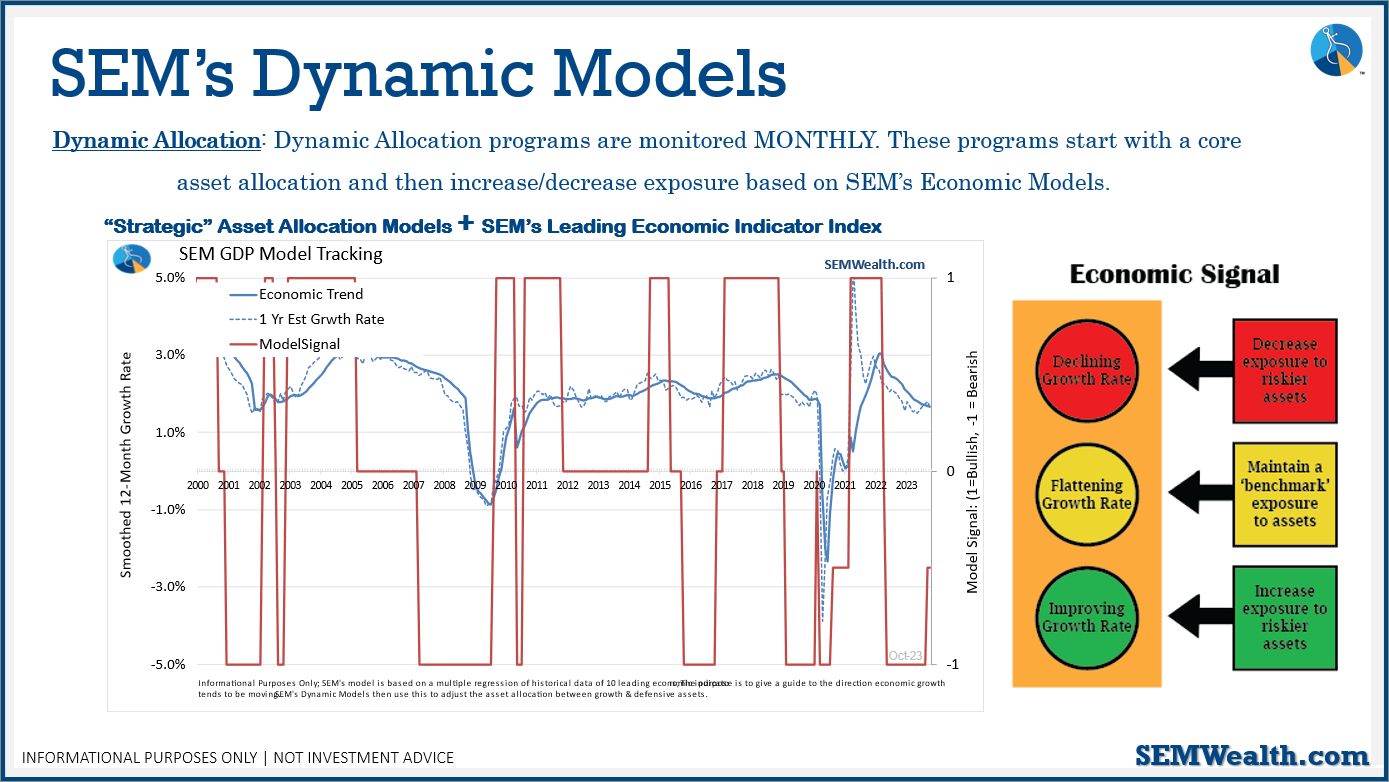

Dynamic (monthly): At the beginning of October the model moved slightly off the "bearish" signal we've had since April 2022. This means a small position in dividend stocks (Dynamic Income) and small cap stocks (Dynamic Aggressive Growth). Other than that, the models remain 'bearish' and is closer to going back to fully 'bearish' than it is to moving to 'neutral'.

Strategic (quarterly)*:

BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.)

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stock up: