With each economic report released, it is getting more and more difficult to find anybody on Wall Street who can find anything bad to say. Everyone (including our economic model) was predicting a slowdown or outright recession in 2023 due to the dual pressures of inflation and the fastest Fed interest rate hikes in over 40 years. When that didn't happen the message from Wall Street started to move towards, 'maybe it is different this time'.

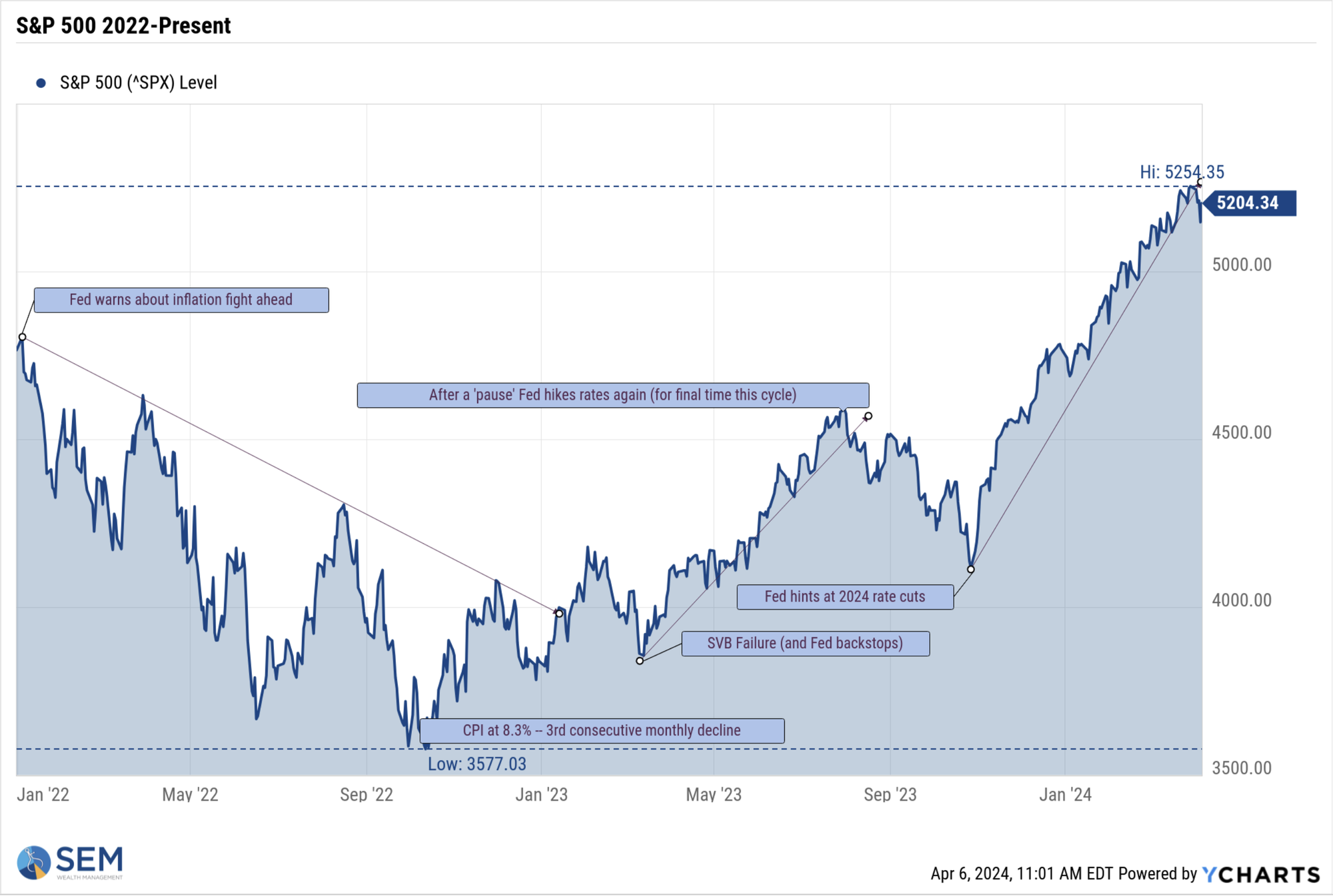

The Fed sparked even more enthusiasm for the economy when they hinted last October they were not only done raising rates, but would likely start to cut in 2024. That led to the stock market pricing in 6 rate cuts totaling 1.5% this year. That expectation has since come down to 'only' 3 cuts for a total of 0.75%, but the enthusiasm remains. The lead story on Yahoo Finance on Friday had this headline:

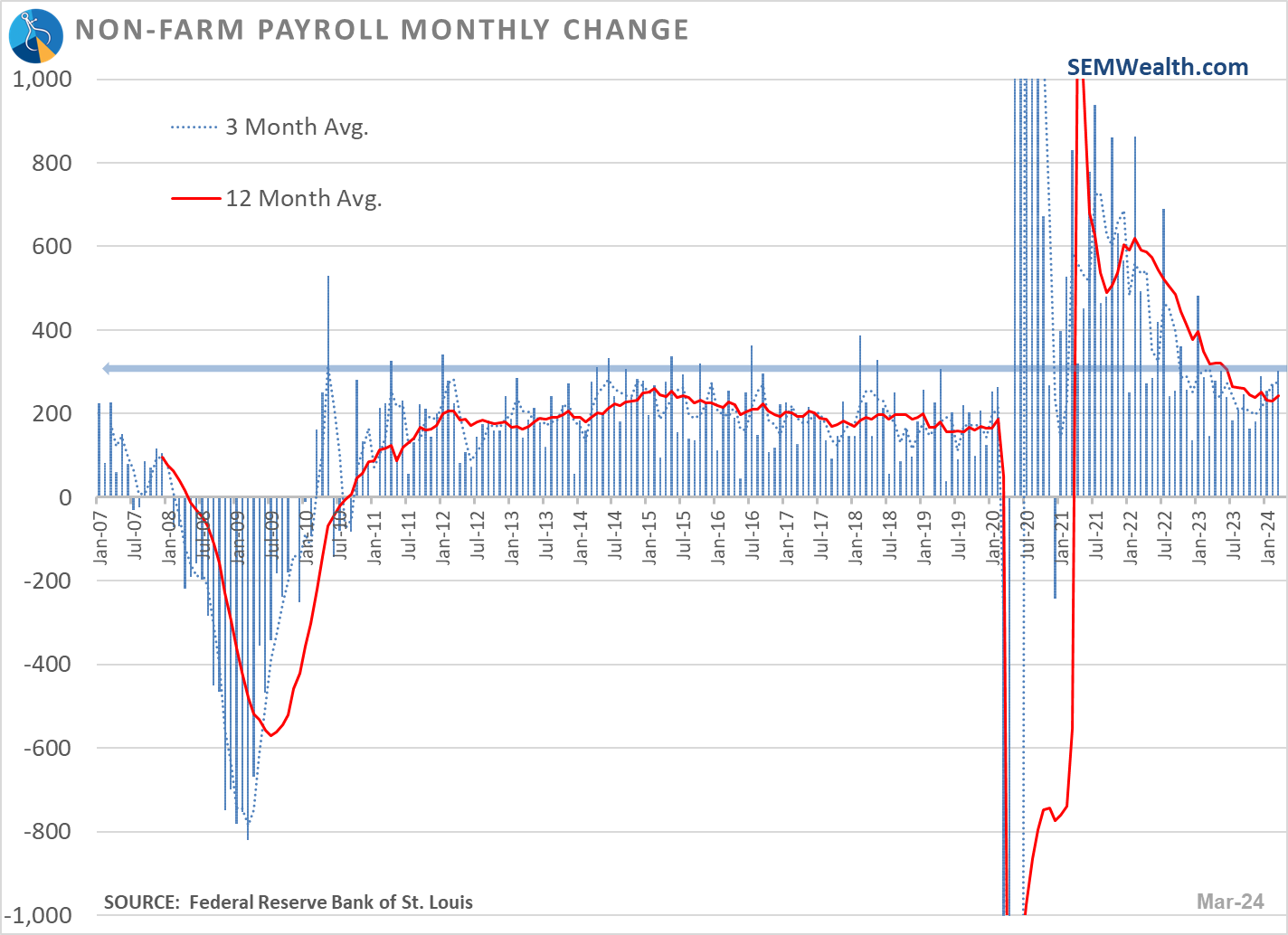

The report was indeed impressive.

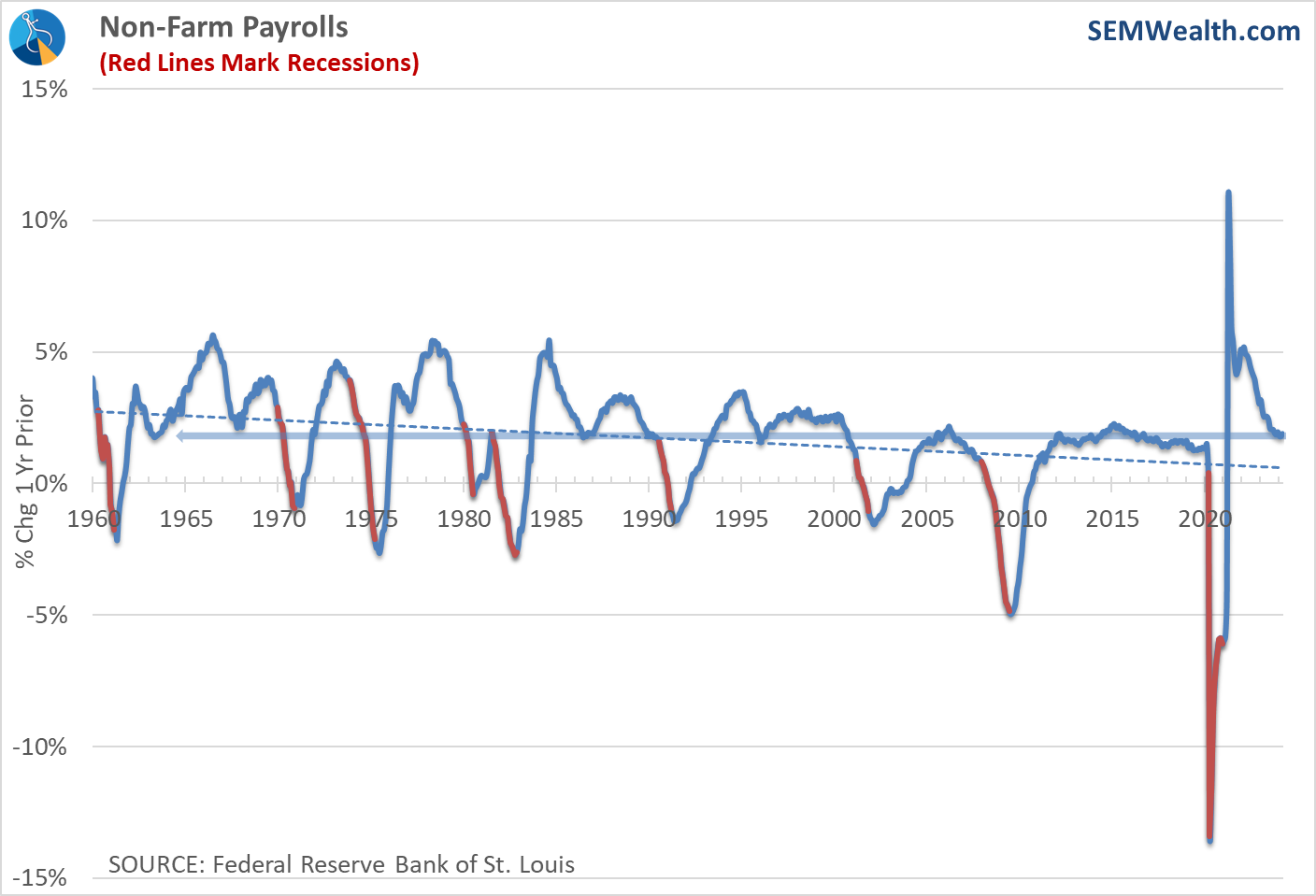

3 1/2 years since the end of the recession, the rate of job growth is running at a rate that was only exceeded this century at the end of 2000, 2006 & 2015.

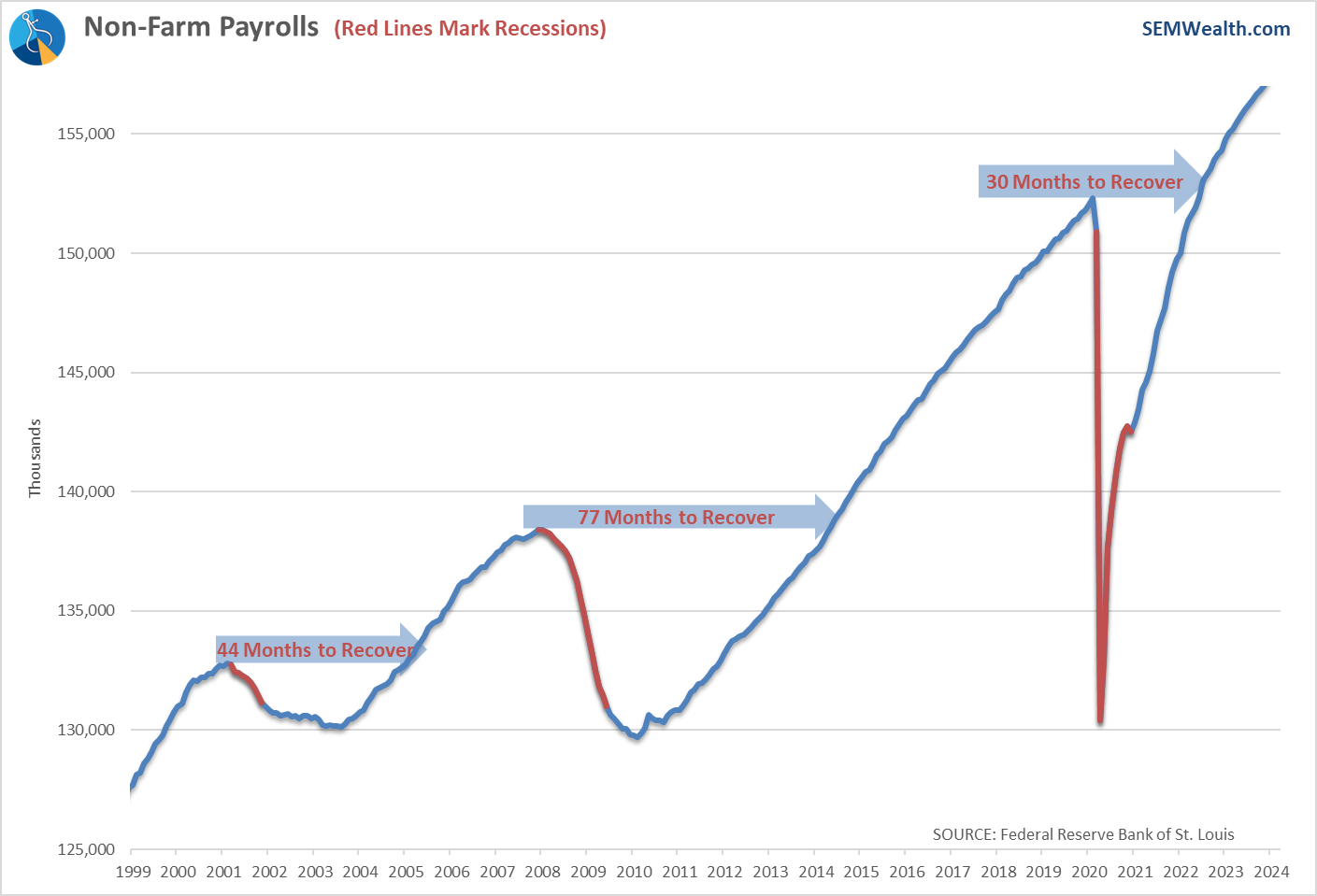

This chart helps put the recovery in perspective.

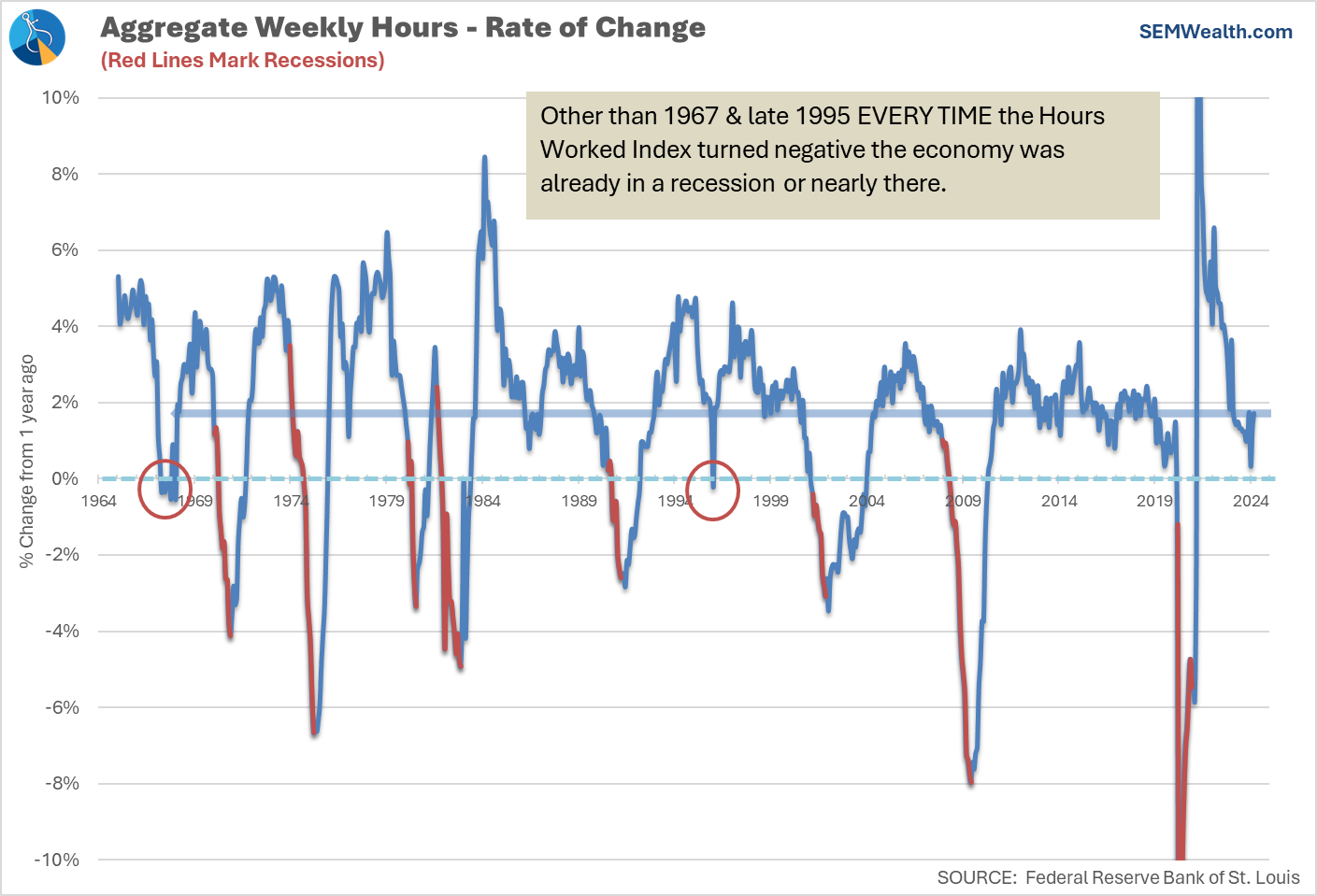

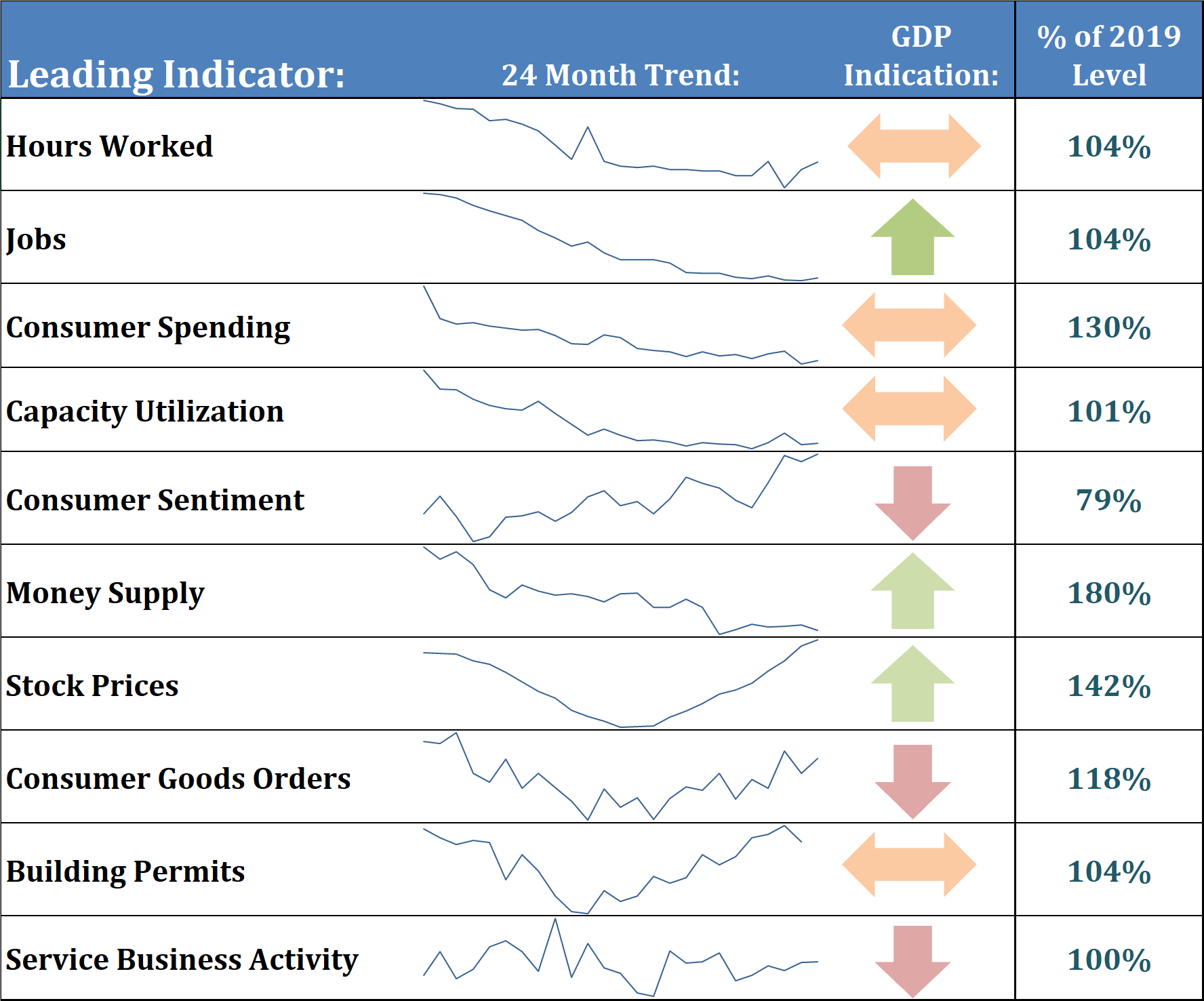

More importantly, the average work week, which had been declining to start the year has again started to increase. If you had to pick only one leading indicator, this is the best in terms of forecasting changes in the economic growth rate.

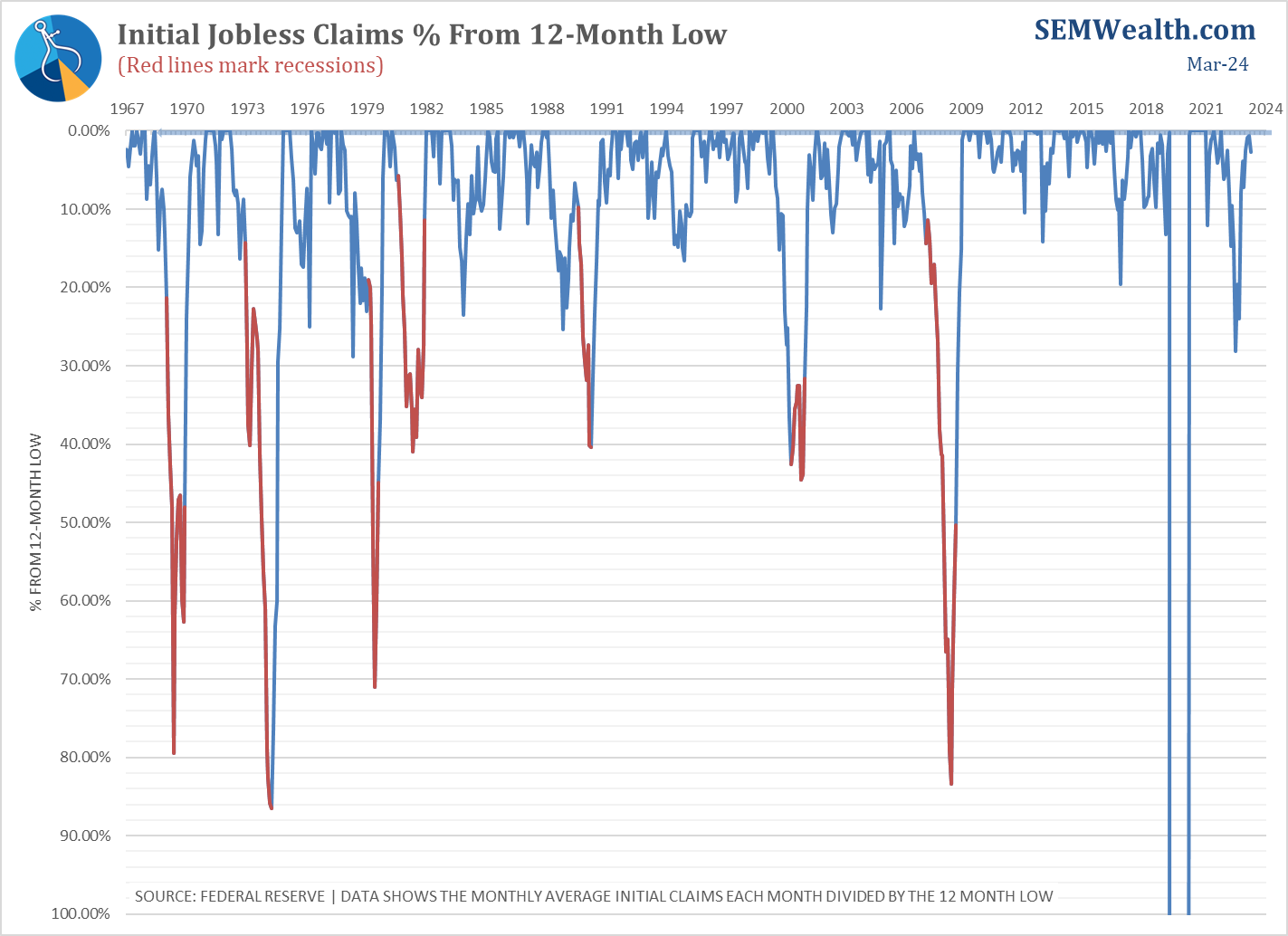

On a monthly chart, the 2nd best leading indicator, Initial Jobless Claims isn't showing a reason to believe the economy is slowing down.

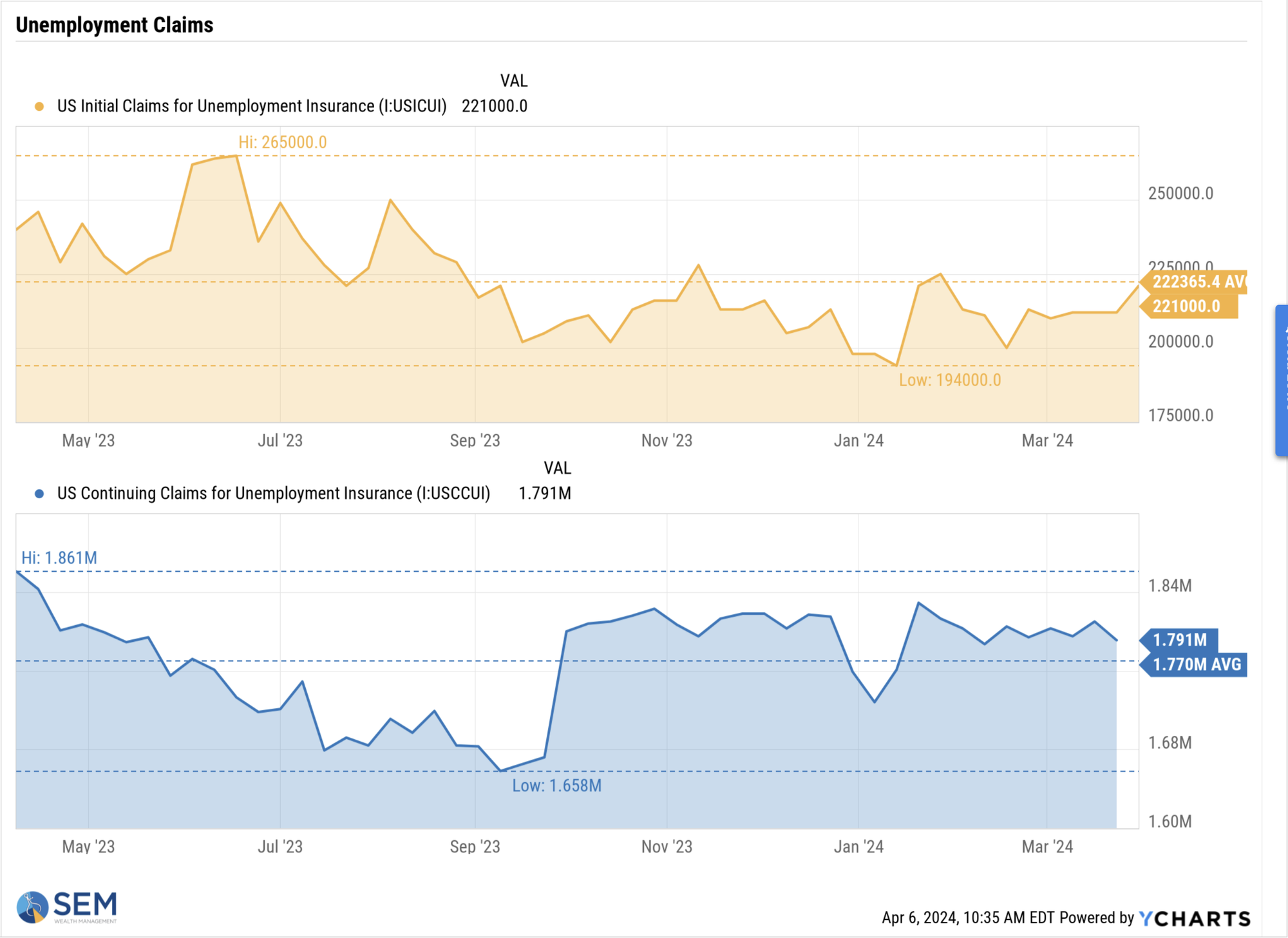

On a weekly chart, initial claims have picked up a bit, but more importantly continuing claims have leveled off.

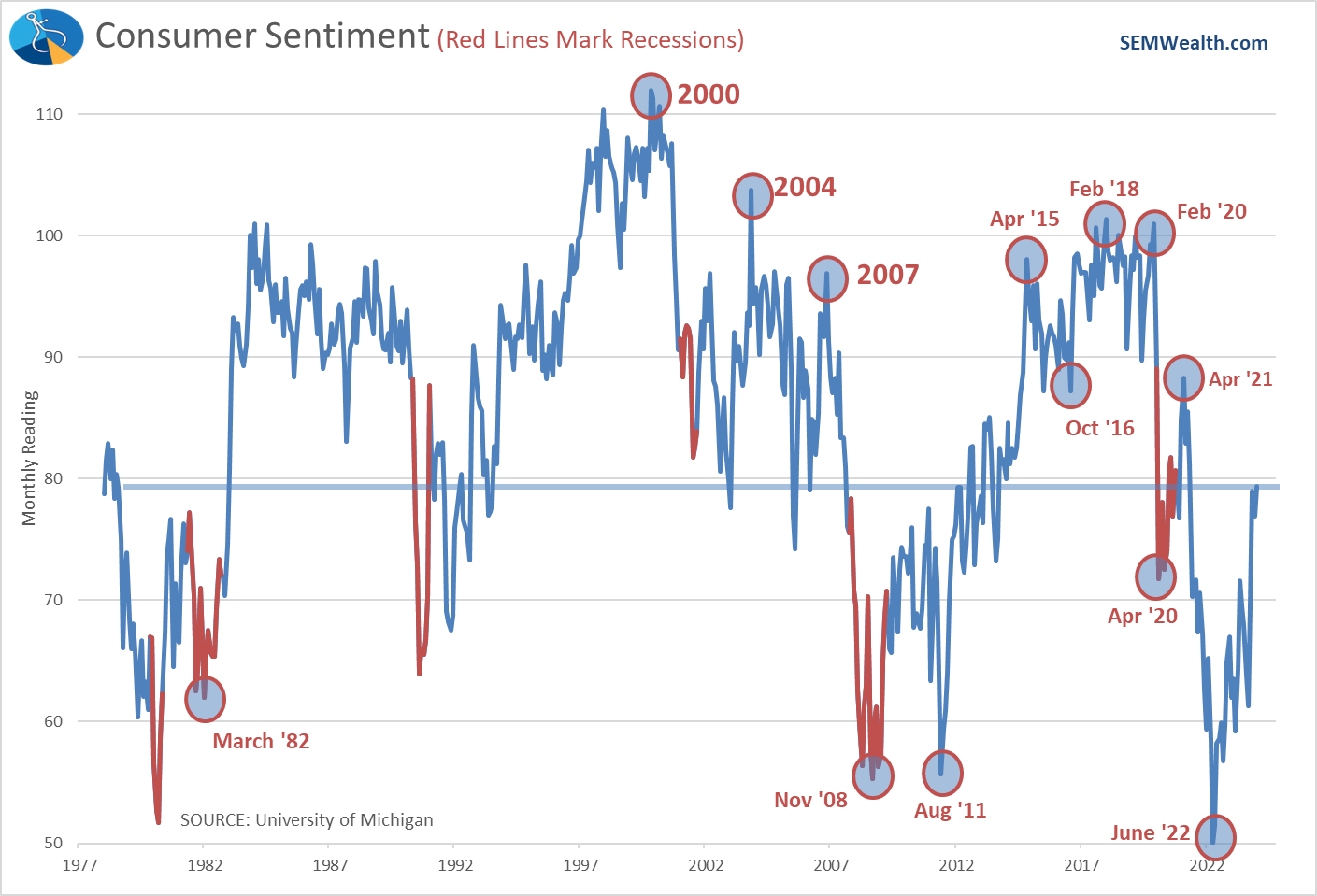

Americans, who had been pessimistic while inflation roared has been improving since inflation began to ebb in the summer of 2022. Over the past few months, that sentiment has reversed which could lead to continued strength in consumer spending.

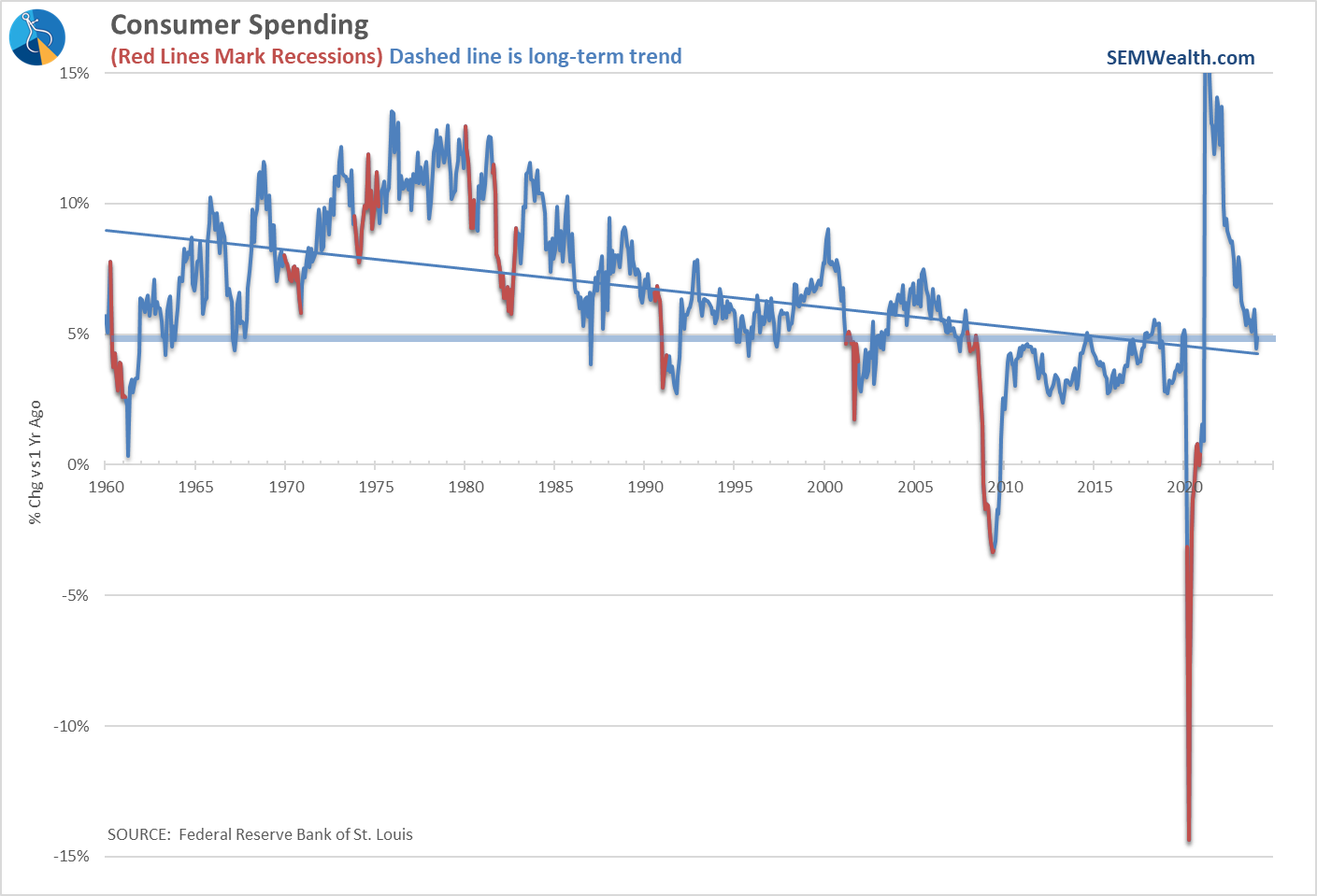

We touched on this last week, but spending growth, like job growth continues to run at a pace seen rarely since the financial crisis.

The only thing that could throw the impressive economic data off would be a resumption of inflation. Last week we discussed how Fed Chair Jerome Powell still seems ready to cut rates no matter what as soon as June.

Given the Fed's track record of constantly misunderstanding the economy and how anyone other than Wall Street is functioning, I wouldn't be surprised to see the Fed cut rates despite a "borderline speechless" economic environment. Cutting rates could spark more inflation (which is already picking up on the energy side). While a drop in rates could make mortgages more affordable, it could also lead already too expensive for most home prices to move appreciably higher.

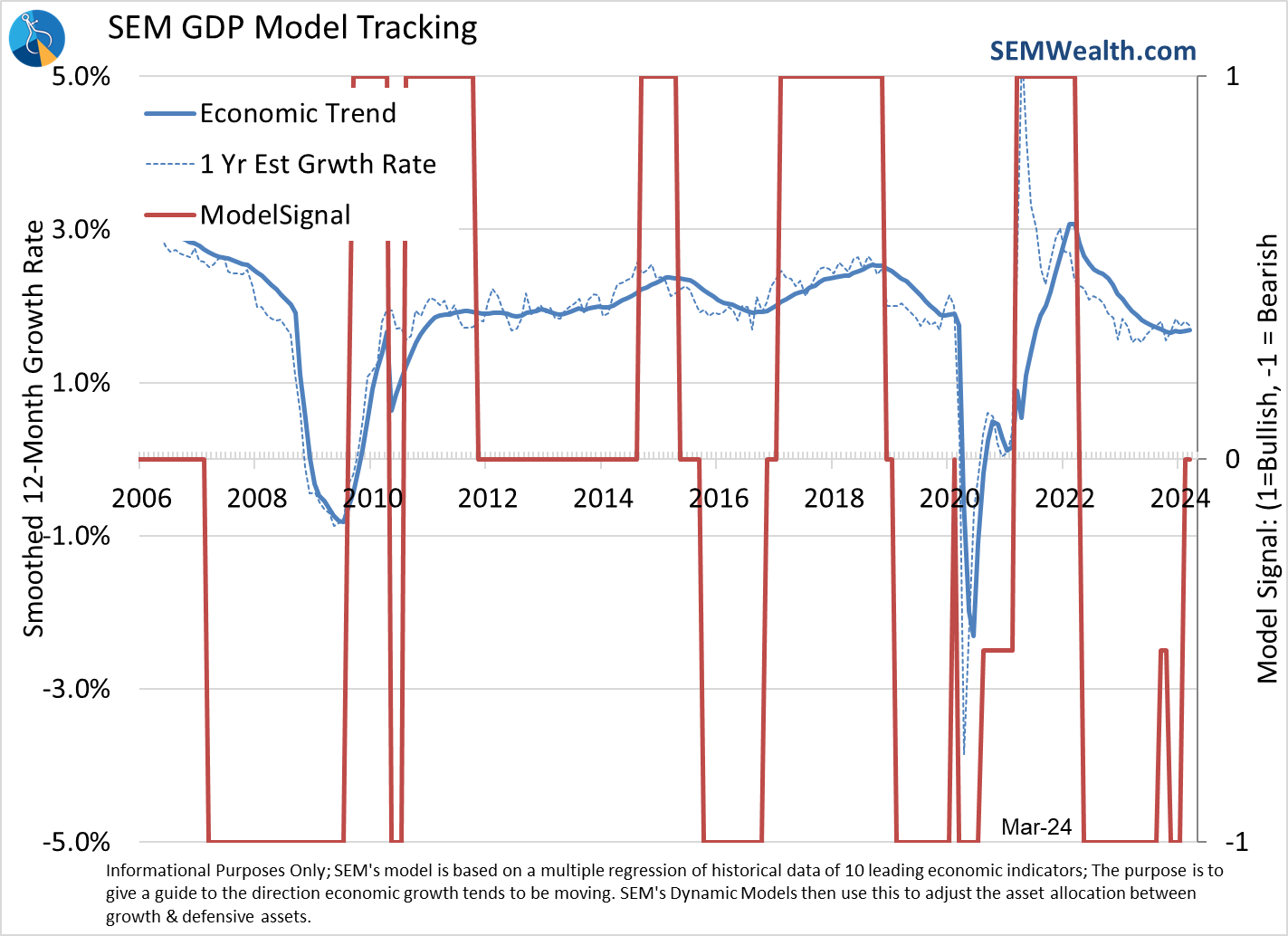

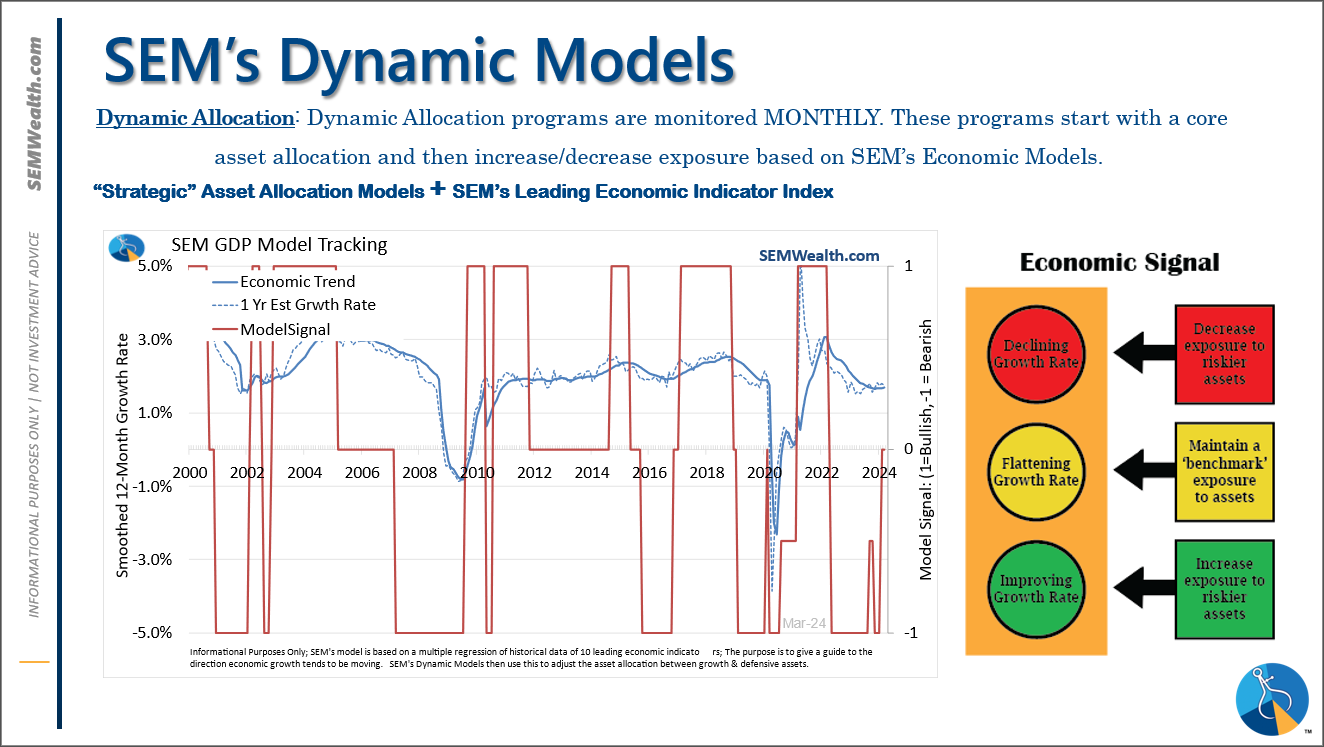

What they decide to do is out of our control. All we can do is follow our time-tested models. On the economic side our overall model remains mixed.

Right now it is leaning to the 'bullish' side, so a few more positive economic data points this month could cause it to swing all the way positive.

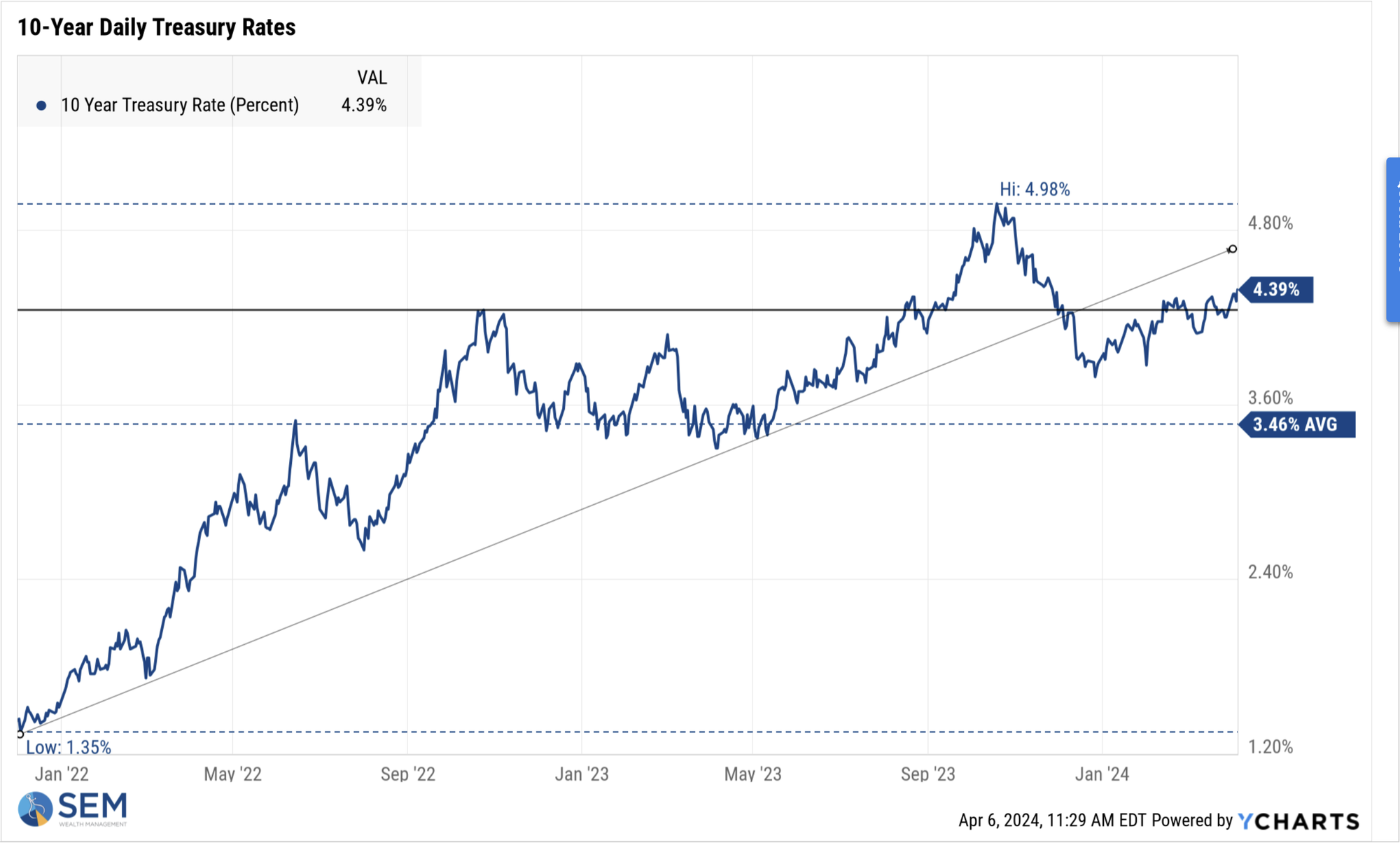

While our allocation to risk assets in our Dynamic models did not change with this update, our Treasury/Interest rate model (10% of Dynamic Income) did move from 'bullish' on Treasury bonds to 'bearish'. With the improving economic data and the rate of decline in the inflation rate slowing, the model believes rates should move higher.

Market Charts

The S&P 500 finally had a down week, triggered by sell-offs on Monday (following the inflation data from last Friday) and some pre-jobs report jitters (more on that below). The very steep uptrend off the October lows has been violated with little in the way of clear support.

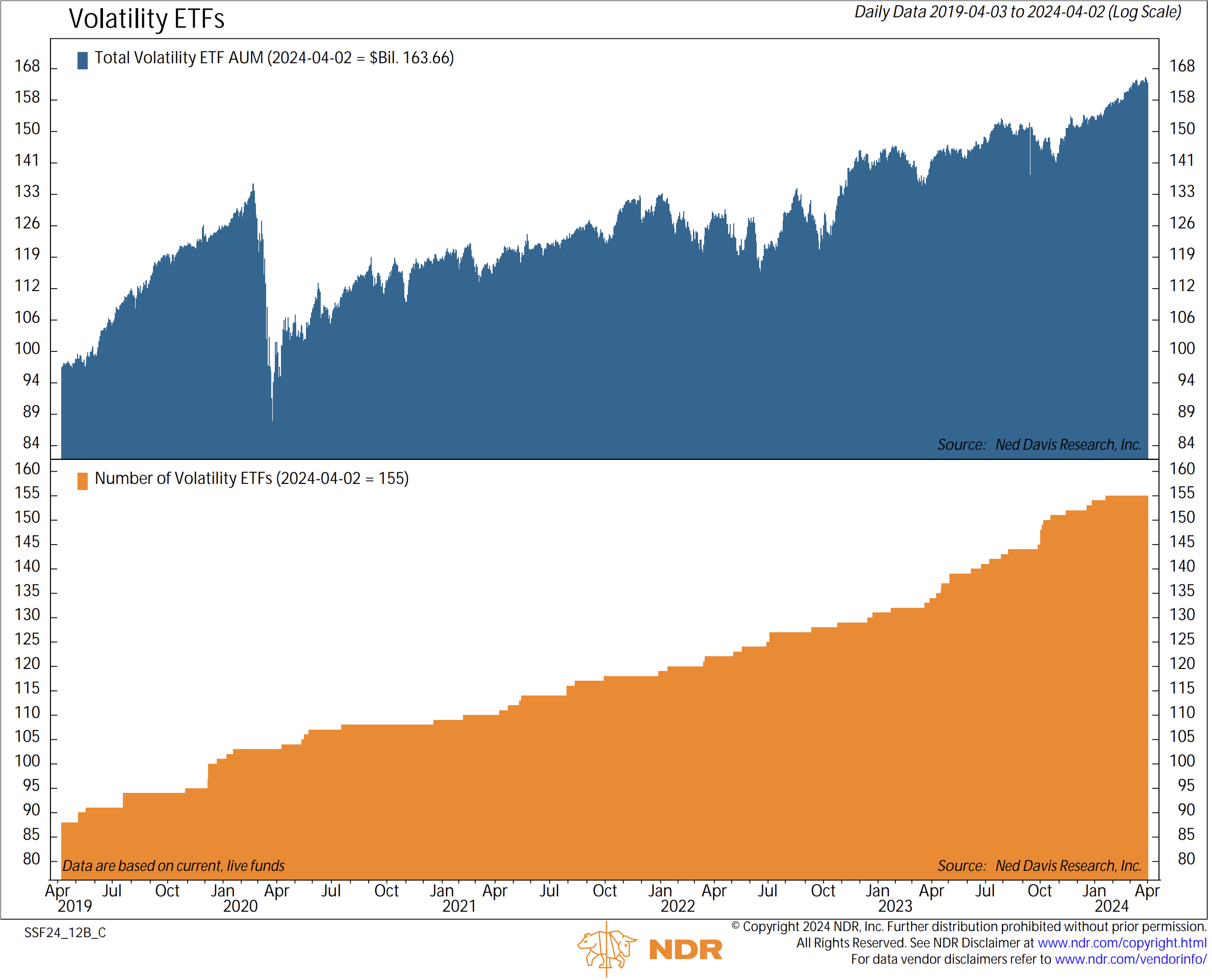

On Thursday, Ned Davis posted a report asking, "Is the market set-up for Volmegeddon 2.0?" The premise of their concern is the huge surge in volatility based ETFs. Back in 2018 the market endured two large corrections to start and end the year. Both were fed by an unwind of the 'short VIX' trade. I won't bore you with the details. Essentially the 'easy' money being made by betting volatility stayed low led to very outsized positions that were reversed once a little bit of volatility picked-up in the market.

The cause of the volatility back then was fears of a recession as the temporary economic boost from the Trump tax cuts ran their course (along with the on again-off again 'trade war' from the President). NDR posted this chart highlighting the risks of another volatility driven correction.

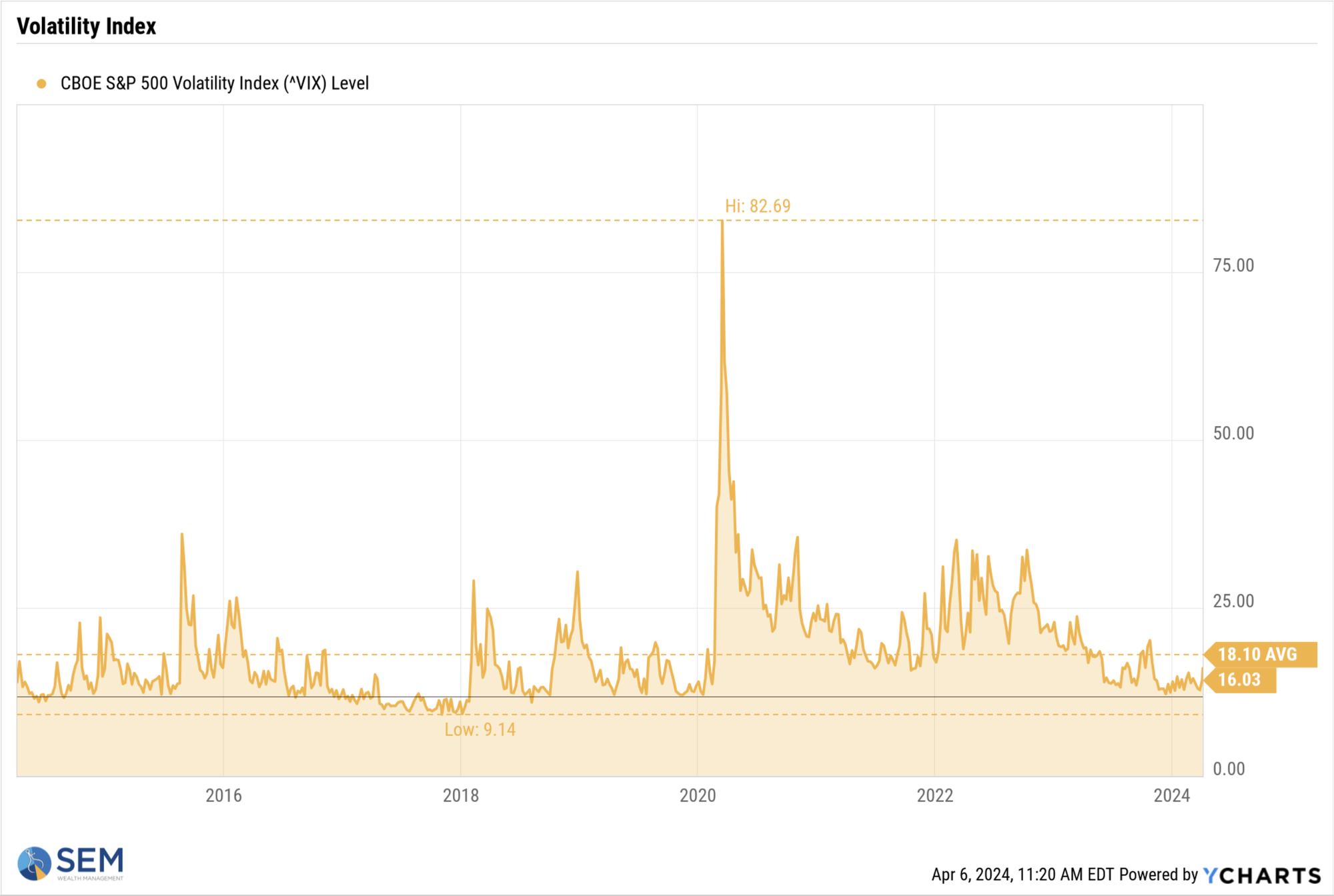

The Volatility Index has been running at the lowest rate since before the pandemic and around the low points of the 2018-2019 period.

As we've been saying all year, higher highs tend to bring higher highs until something causes sellers to emerge. What causes that is anyone's guess. In 2018 it was fears of an economic slowdown along with the 'trade war' rhetoric from the White House. On Monday and Thursday last week it was fears inflation would resume and the economy would be 'too hot' to justify rate cuts. The concern is with volatility so low and so much money allocated to 'volatility' ETFs it won't take much to spark a big sell-off.

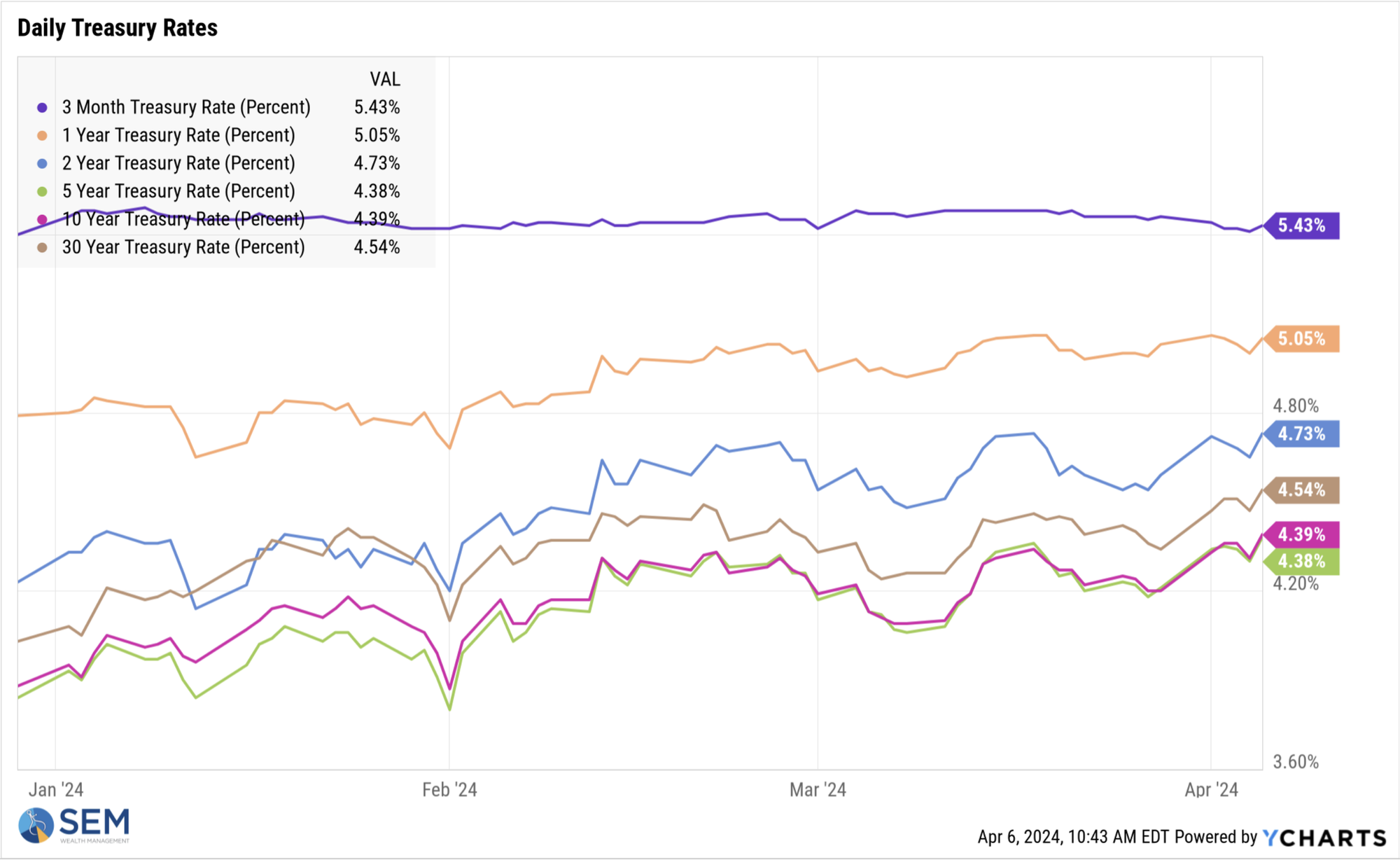

On the bond side, rates have been moving higher throughout the year.

The 10-year Treasury yield is also moving to uncomfortable territory again.

It's going to be an interesting struggle between the fears of inflation and the fears the Fed won't cut interest rates.

SEM Model Positioning

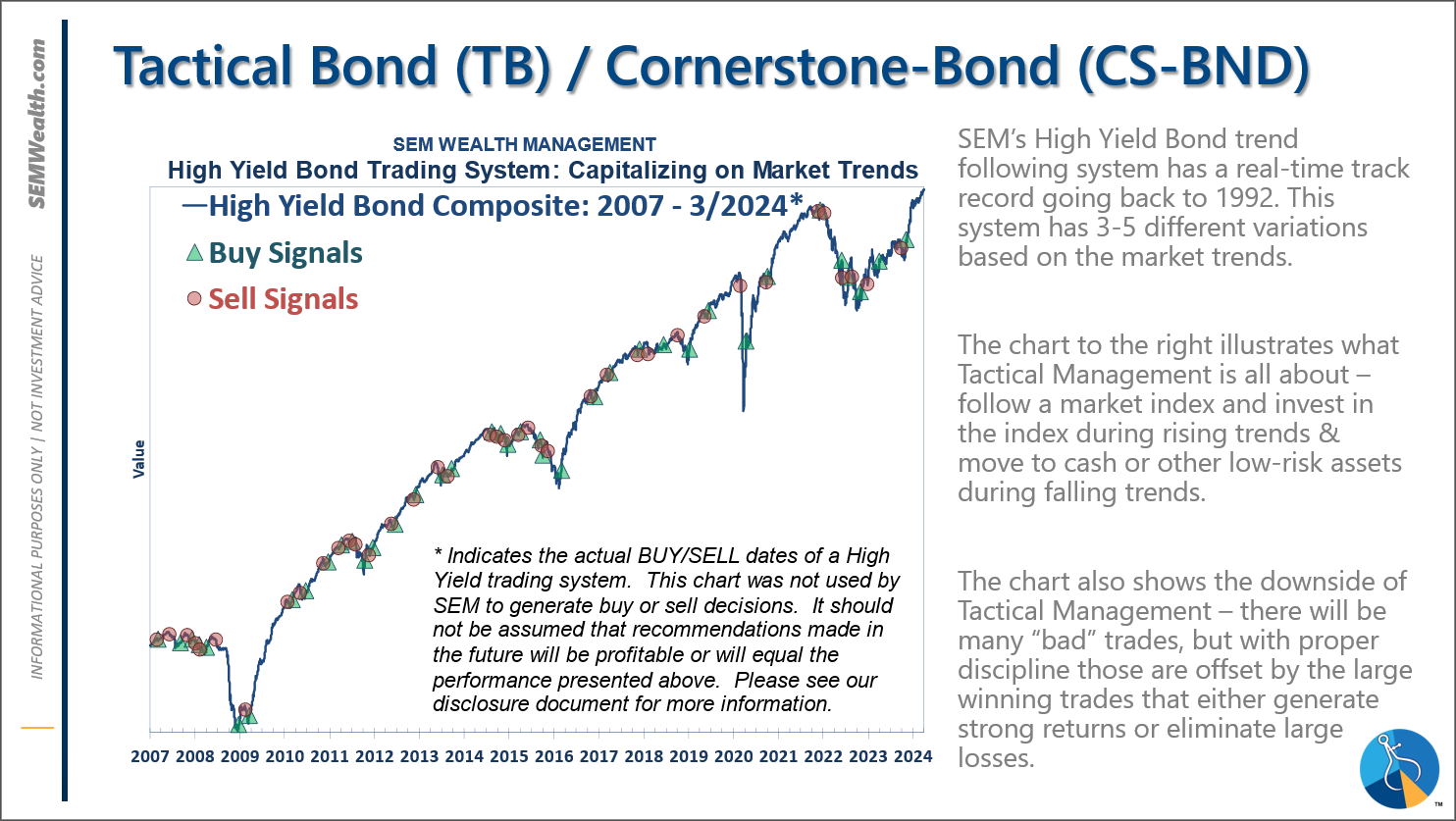

-Tactical High Yield went on a buy 11/3/2023

-Dynamic Models went to 'neutral' 2/5/2024

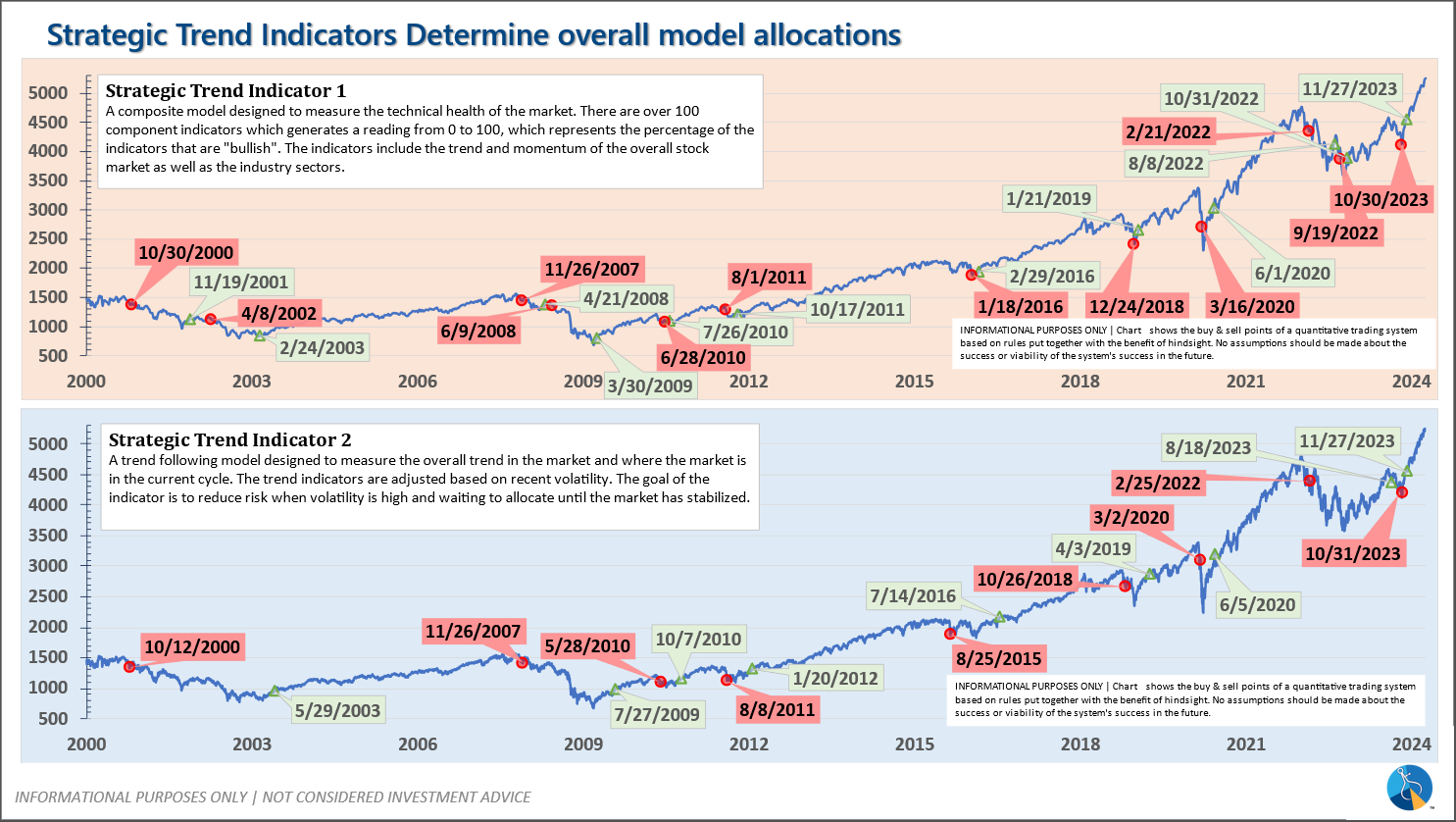

-Strategic Trend Models went on a buy 11/27/2023

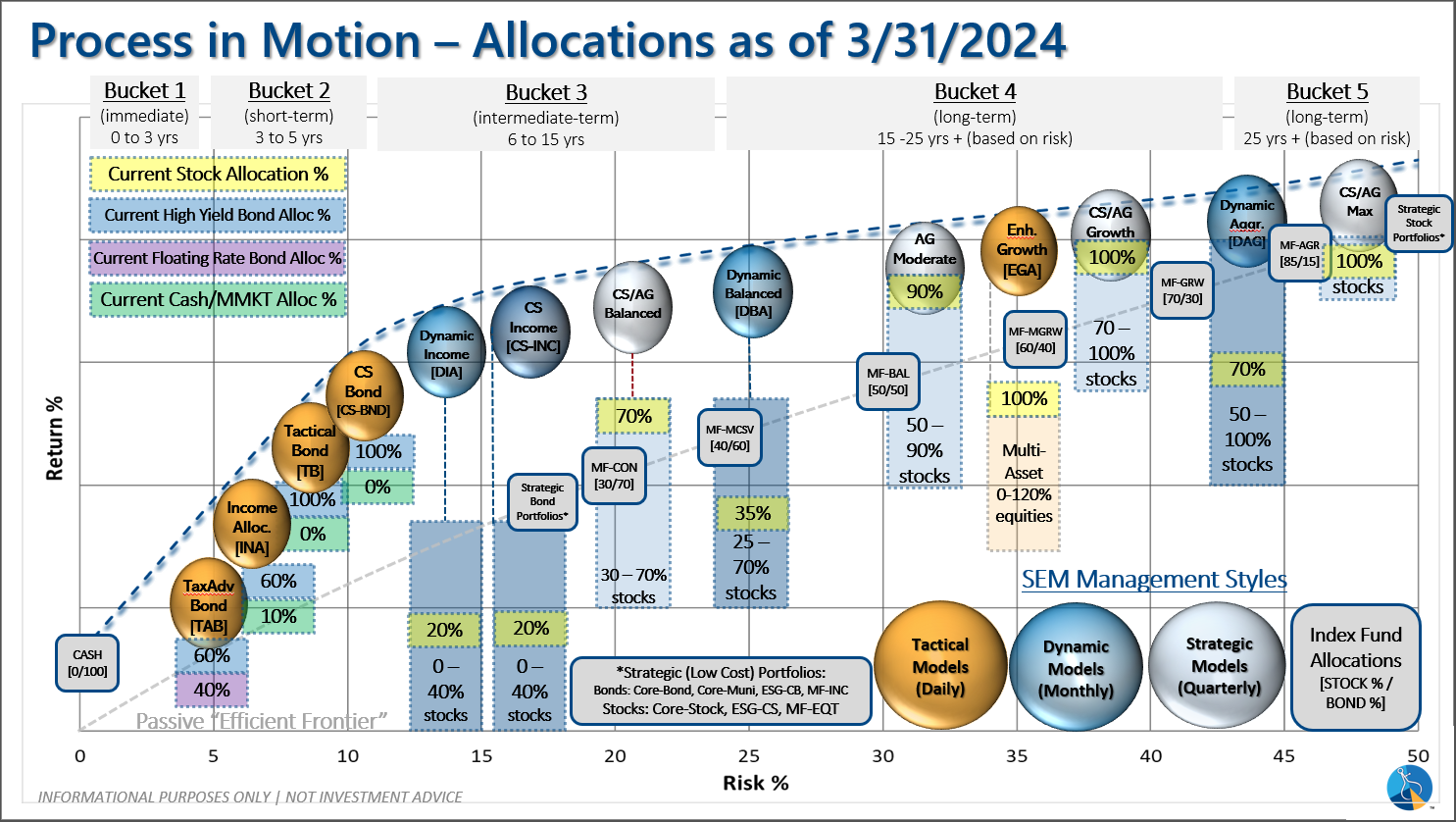

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The High Yield Bond system bought the beginning of April and issued all 3 sell signals 9/28/2023. All 3 systems were back on buy signals by the close on 11/3/2023. The bond funds we are invested in are a bit more 'conservative' than the overall index, but still yielding between 7.5 -8.5% annually.

Dynamic (monthly): At the beginning of December the economic model reverted back to "bearish". This was reversed at the beginning of February. This means benchmark positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth.

Strategic (quarterly)*:

BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change: