The subtitle for this week's blog could be "dumbfounded". I try my hardest to stay out of politics and especially about giving opinions, but after Thursday night's debate I'm trying to find the positive in the debacle we witnessed. Unfortunately, the outcome of the election will play a role in our investments, our economy, and our future so we do need to talk about it at times.

I've said since 2010 that our two-party system was broken and we needed to see either a powerful third party rise up or a massive change in leadership on both sides. Thus far, the only thing Republicans and Democrats have agreed on is they will not change and will do everything possible to prevent a third (or fourth) party from standing a chance. Unless something changes on the ballot, and based on Thursday night's performance from President Biden, it should, this will go down as the two least liked candidates for president in modern history. Is this really the best either party has to offer? How can two candidates who are disliked by the majority of Americans be the choice of either party to lead the country?

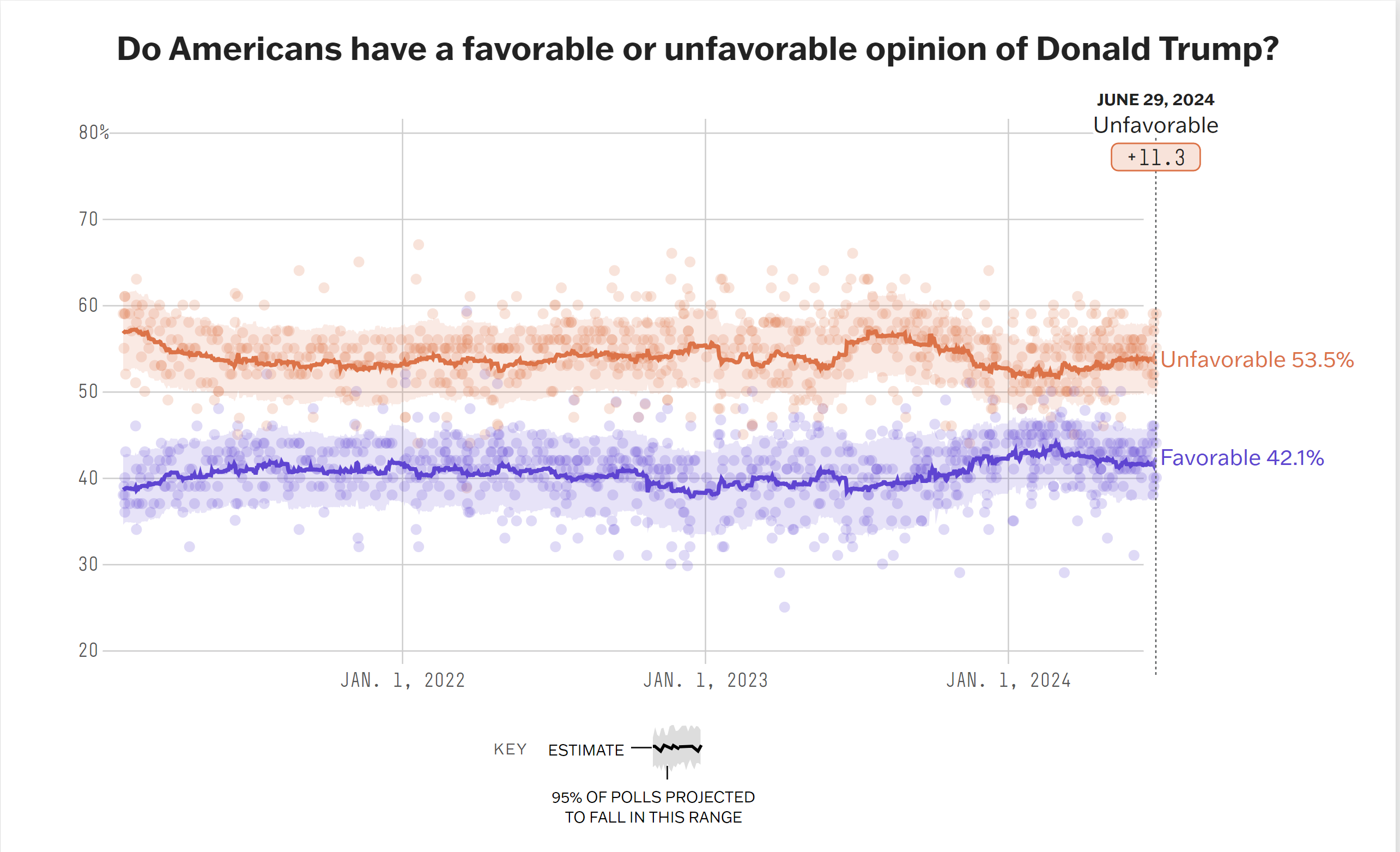

We all know what we are getting with Donald Trump. We know what happened to his approval rating in the weeks following the election. Yet, this is the person Republicans overwhelmingly backed for their side of the ballot. Over half of the country finds President Trump 'unfavorable'. Nothing seemed to change better or worse following the debate.

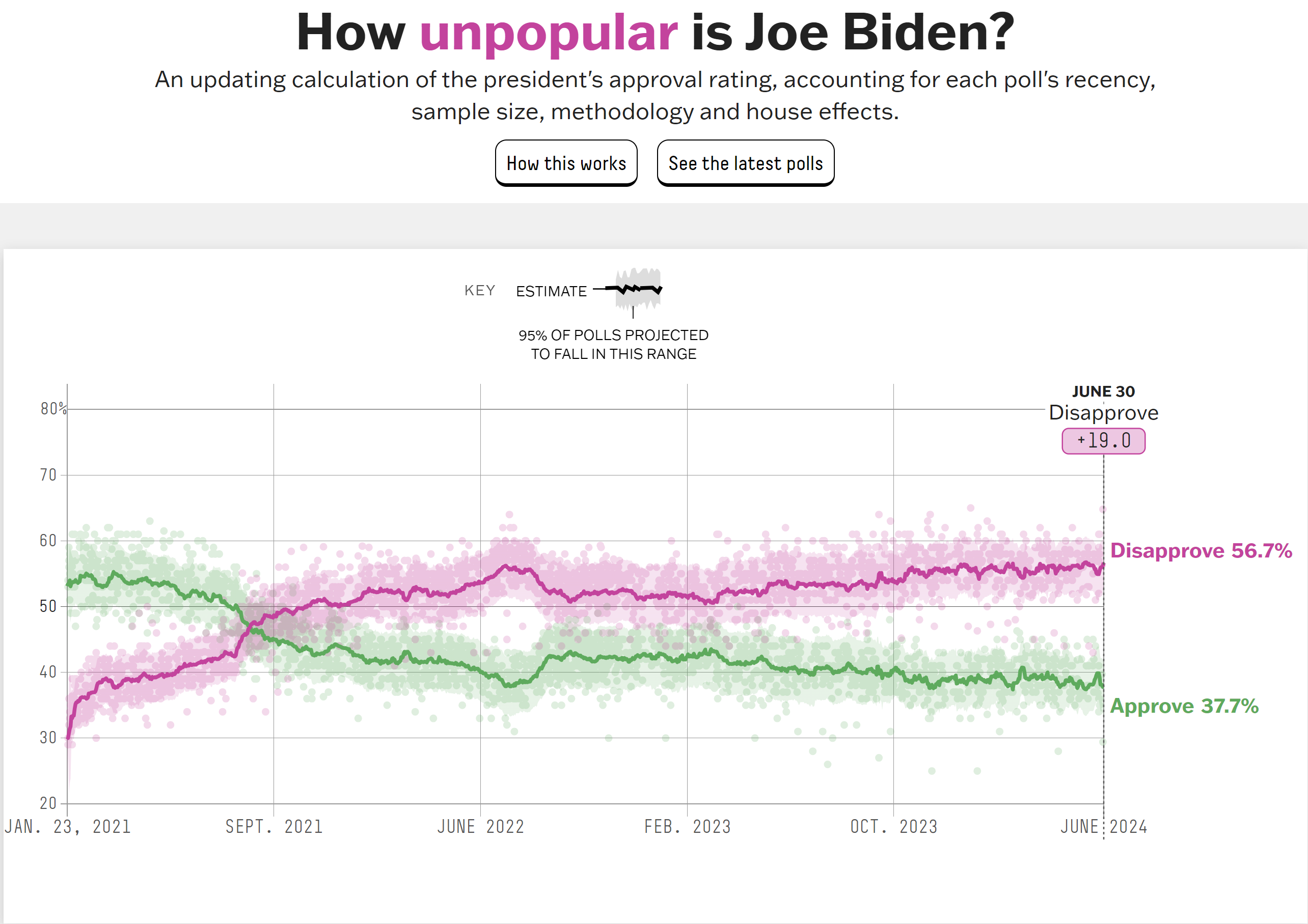

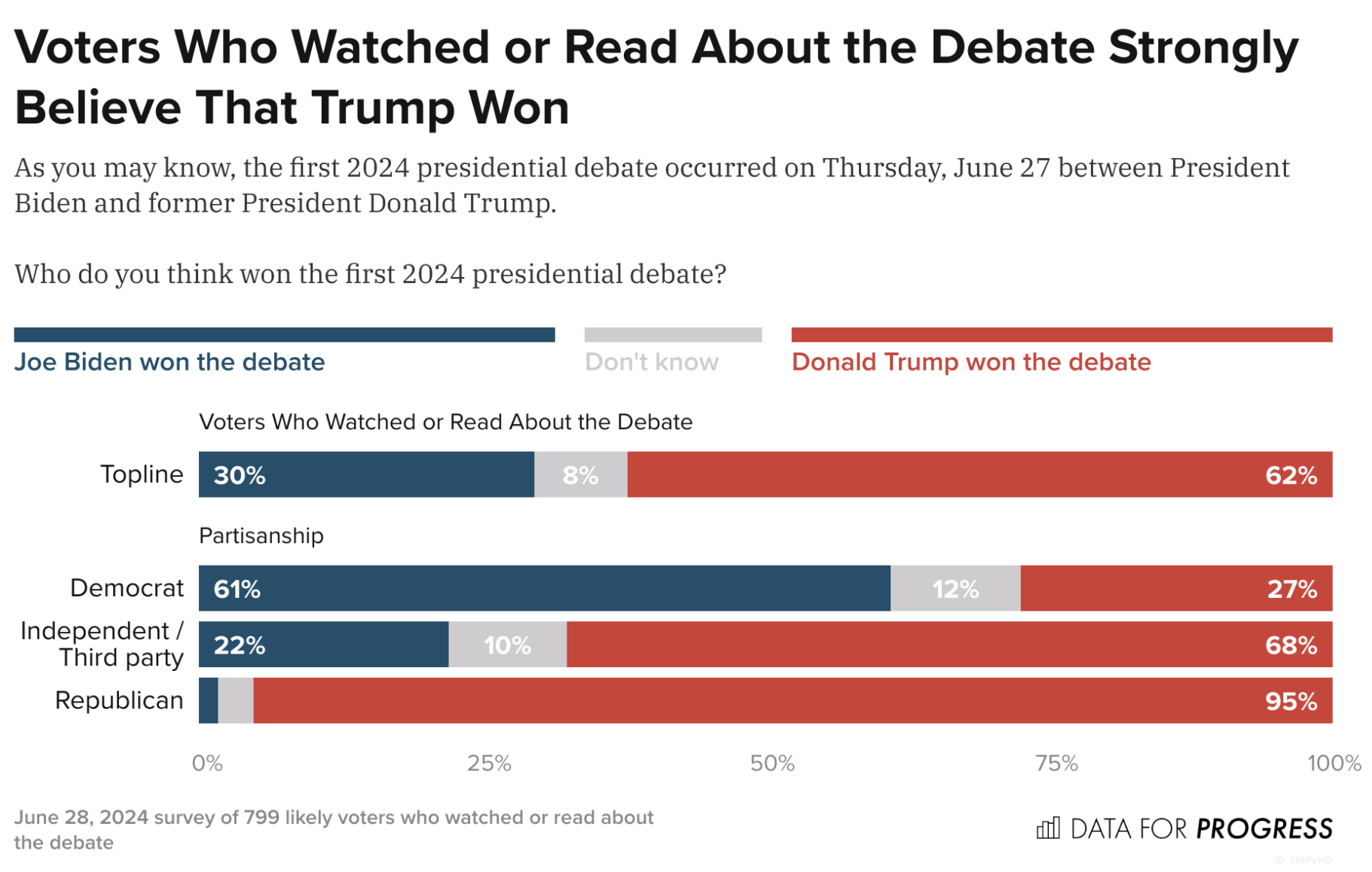

Not to be outdone, the Democrats continue to insist President Biden is the best choice, yet he is actually performing worse, with 56% of American disapproving of his performance. Thursday night's debate actually barely moved the needle on the disapproval of Joe Biden as president (see chart below). Being President has got to be the most challenging job in the world. If you are not capable of discussing key topics in front of no crowd, not being interrupted, and spending a week preparing for it, how are we supposed to trust you to handle the job?

This is my opinion, but if the Democrats do not replace President Biden on the ballot their entire party leadership should be replaced. If you disagree, please let me know what I'm missing.

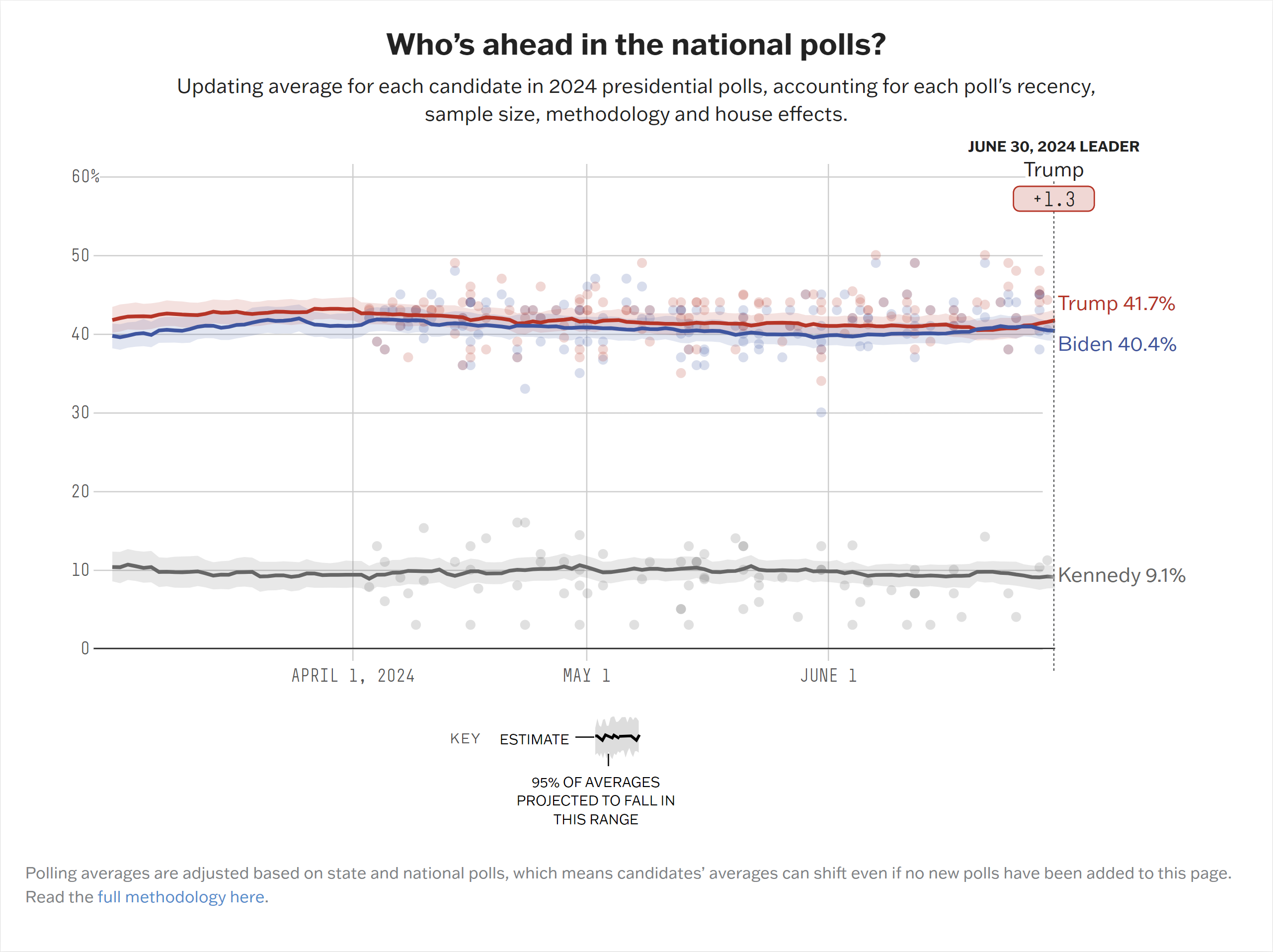

Since these are our only two choices (so far) it doesn't seem to matter whether Americans disapprove of both candidates. We have to choose somebody. Going into the debate, Trump had a 0.1% lead according to 538 Politics consensus of all national polls. That lead jumped to 1.1% in just a couple of days. That's probably not enough for Democratic leaders to seek to replace President Biden, although the rumors of behind the scenes discussions about ways to replace him picked up on Friday. I felt bad for President Biden, until I saw him out on Friday and over the weekend refusing to step down and declaring that he is still fit for office.

What's even more shocking is 61% of Democrats who watched the debate believe Biden won. What did I miss? To be fair, I watched with my 17-year old twins who will be old enough to vote in November and I lost track of how many times they asked, "Is that true" when President Trump said something and I had to respond, "not even close to the truth." President Biden said plenty of things as well that were not factually correct. How sad is it for new voters who are excited about getting to have a voice when they ask, "why do they allow them to lie?" and my response is the people running the Democratic and Republican party either do not care or they honestly believe what is being said. They believe the opposite party is so evil and so dangerous that they will do whatever it takes for them to win.

They watched clips of the 2012 debate between Romney and Obama and couldn't believe how different our presidential candidates behaved a mere 12 years ago. I also watched clips of the 2012 Vice President debate between Biden and Paul Ryan and couldn't believe how much the President has deteriorated in a mere 12 years. He doesn't look, sound, think, or talk anywhere close to the many who 12 years ago was on stage.

Opinions aside, the election is going to again come down to how the Independent voters land. What baffles me is in both 2016 and 2020 the winners who won with barely half (or not even half) of the votes on their side declared a 'mandate' for their policies. I'm not sure what kind of thought process happens there, but based on the display Thursday night it is easy to see that our candidates look at things differently than most Americans.

The last two elections came down to pretty simple math – enough independents who voted for Obama in 2012 swung to Trump's side in 2016. Then in 2020, the same percentage of independent voters swung back to Biden. Unless something changes on the ticket it is pretty easy to see which way the Independent voter will go in November. As I mentioned in the webinar, the control of Congress, not the president will dictate which direction we head.

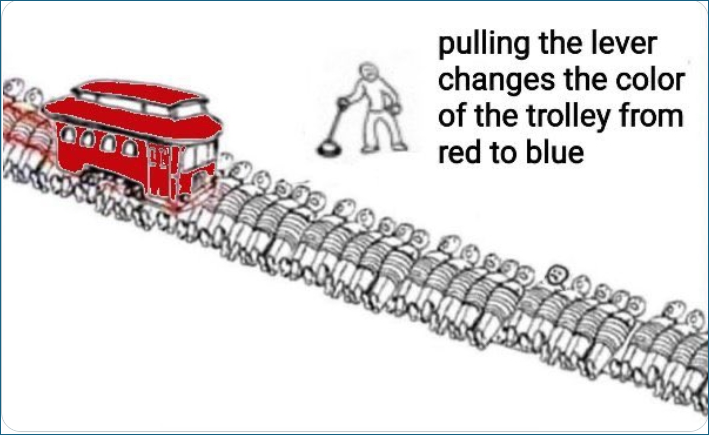

Somebody shared this meme with me and I think it is fitting (again see our webinar for the DATA that backs this opinion). The current version of the two party leadership does not seem to care about the FUTURE, only trying to ram their beliefs on the rest of the country before they no longer have control.

I apologize to anybody who takes offense to anything I said. Everyone is entitled to their opinion and if you disagree with mine, I'd love to have a conversation about what I might be missing (click here to send me a message). I try to give whomever is president the benefit of the doubt, but it's getting hard to do if this is what we are left with. I love our country and I believe we will eventually get it right. Our history is littered with dark times and times much darker than where we are right now. We have always found a way to make things right and come out stronger than ever. I believe we will do so again even if it has to get ugly before that happens.

This is part 4 in our occasional series this year. Here are the first three posts:

Speaking of politics, last Wednesday we hosted our latest SEM University where we gave a quick overview of the current economic environment and more importantly what we should expect following the election. Some of the data may surprise you. I encourage you to watch with an open mind and feel free to share it with clients, friends, family. The more educated we are as voters the more likely we will start moving in the right direction.

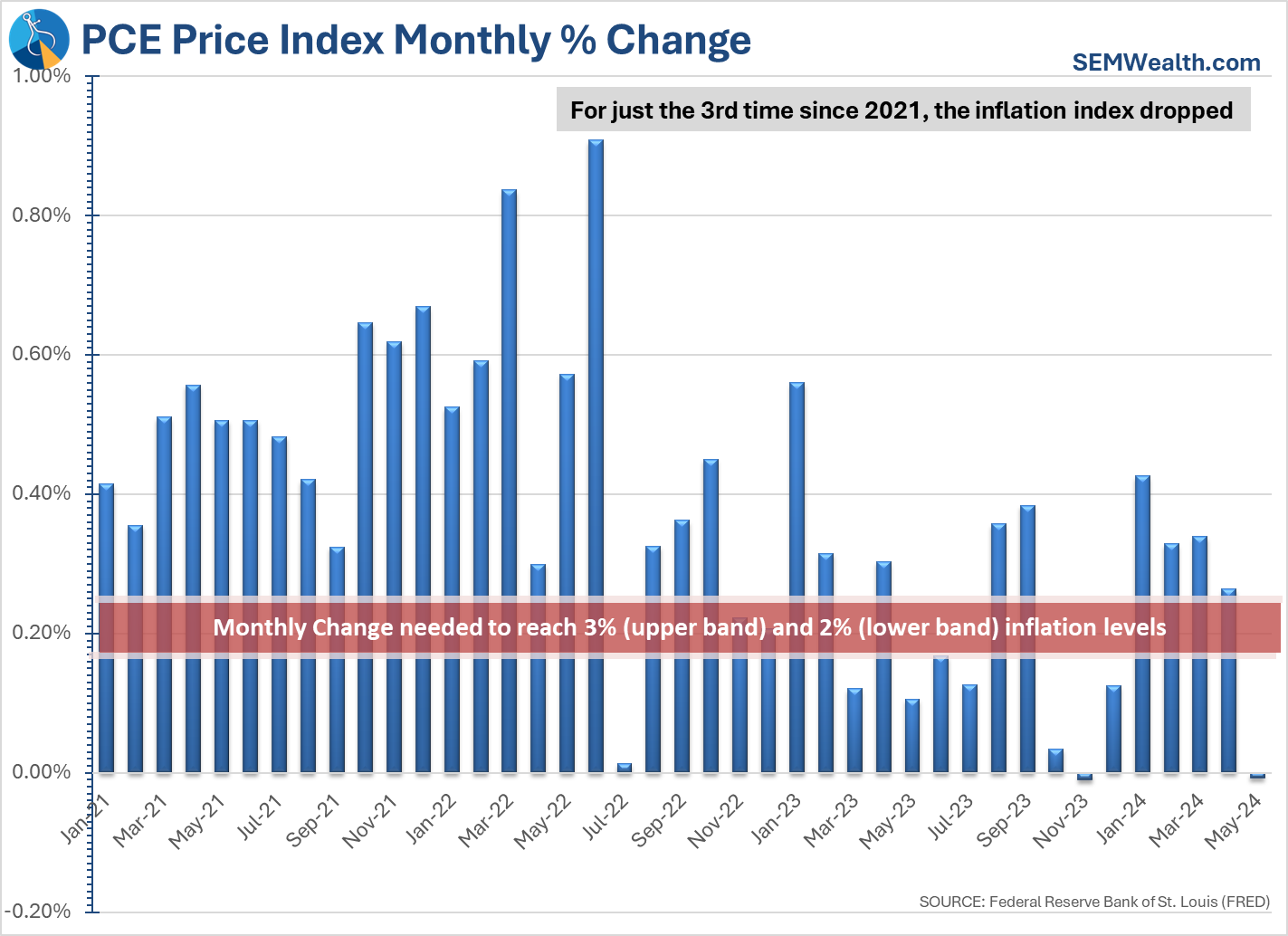

On Friday there was a piece of data that prior to Thursday night's debacle could have helped President Biden. He has been broadly criticized from even his own party for the high levels of inflation in our country. Last month, the Fed's preferred measure of inflation, the PCE Price Index actually dropped slightly. One month does not make a trend, but it is nice to see the overall price index stop going up each month.

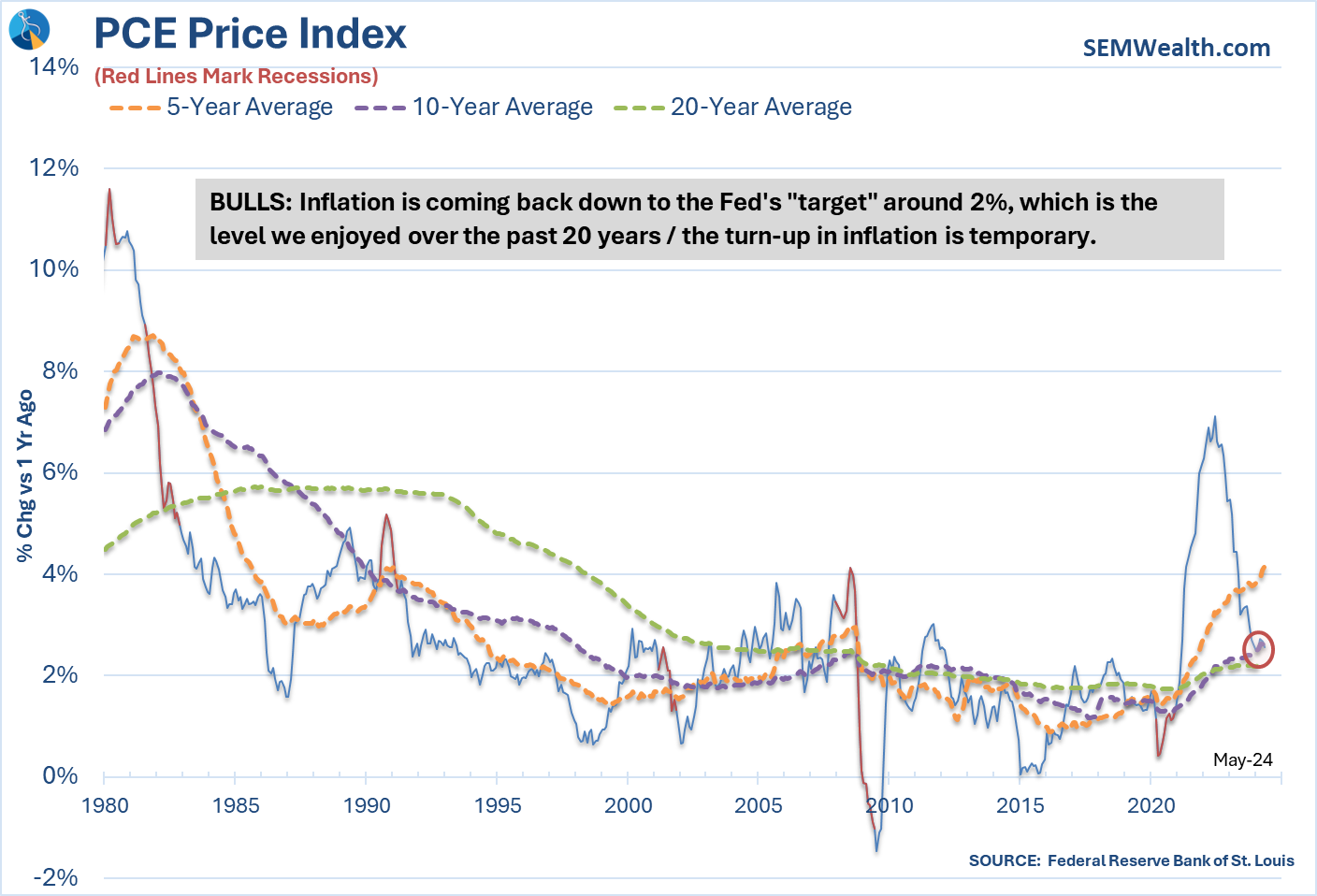

Overall inflation is still too high and is still a problem. I like looking at this chart to keep things in perspective as it shows the 1-year inflation rate along with 5, 10, & 20 year averages. While the 5-year average is obviously high, the 10 & 20 year levels are simply back to where they were in 2005. We all got used to very low inflation levels which makes the last 18 months difficult for the average American.

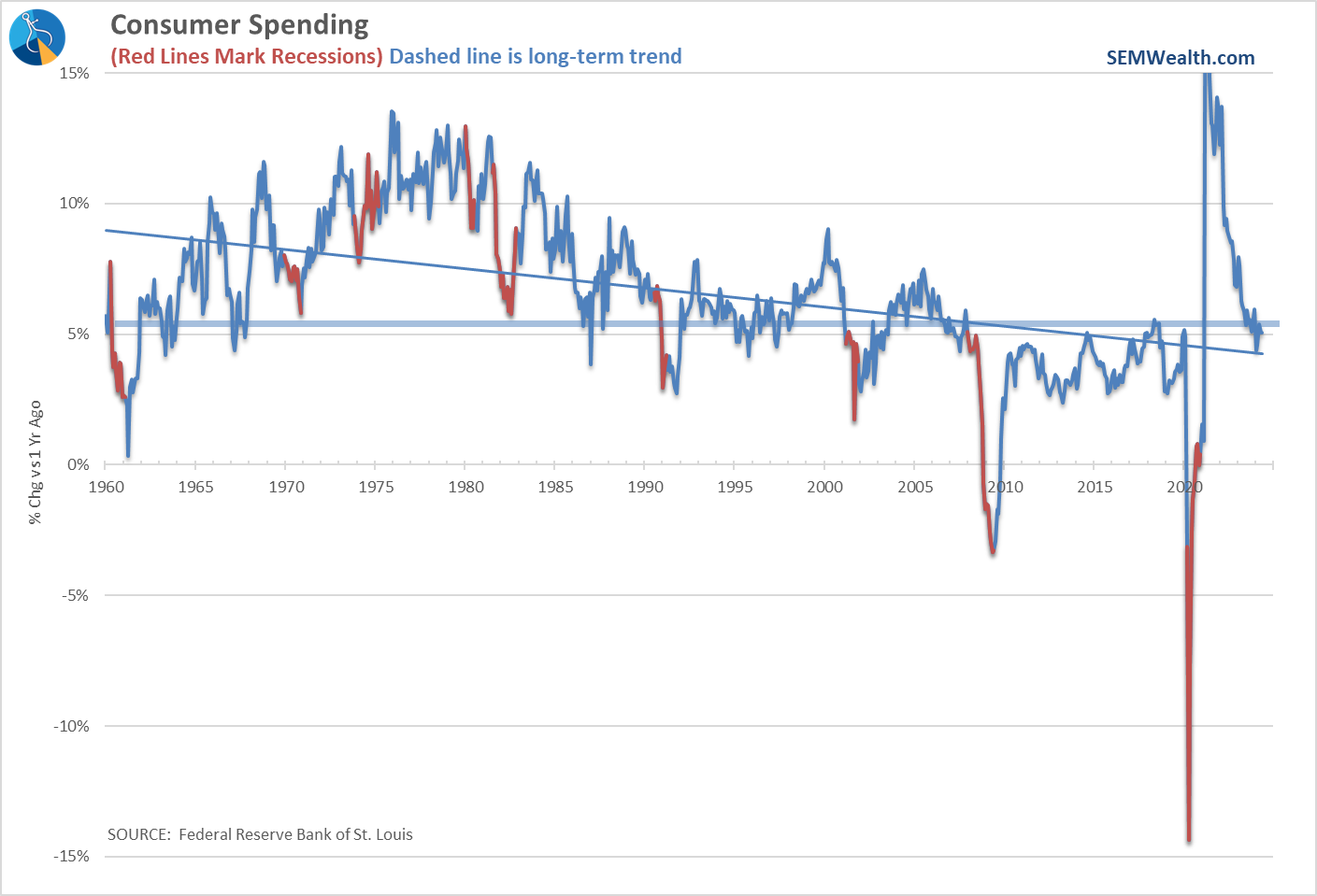

Despite disappointing retail sales numbers in May, consumer spending (overall) still continues to run around a 5% pace.

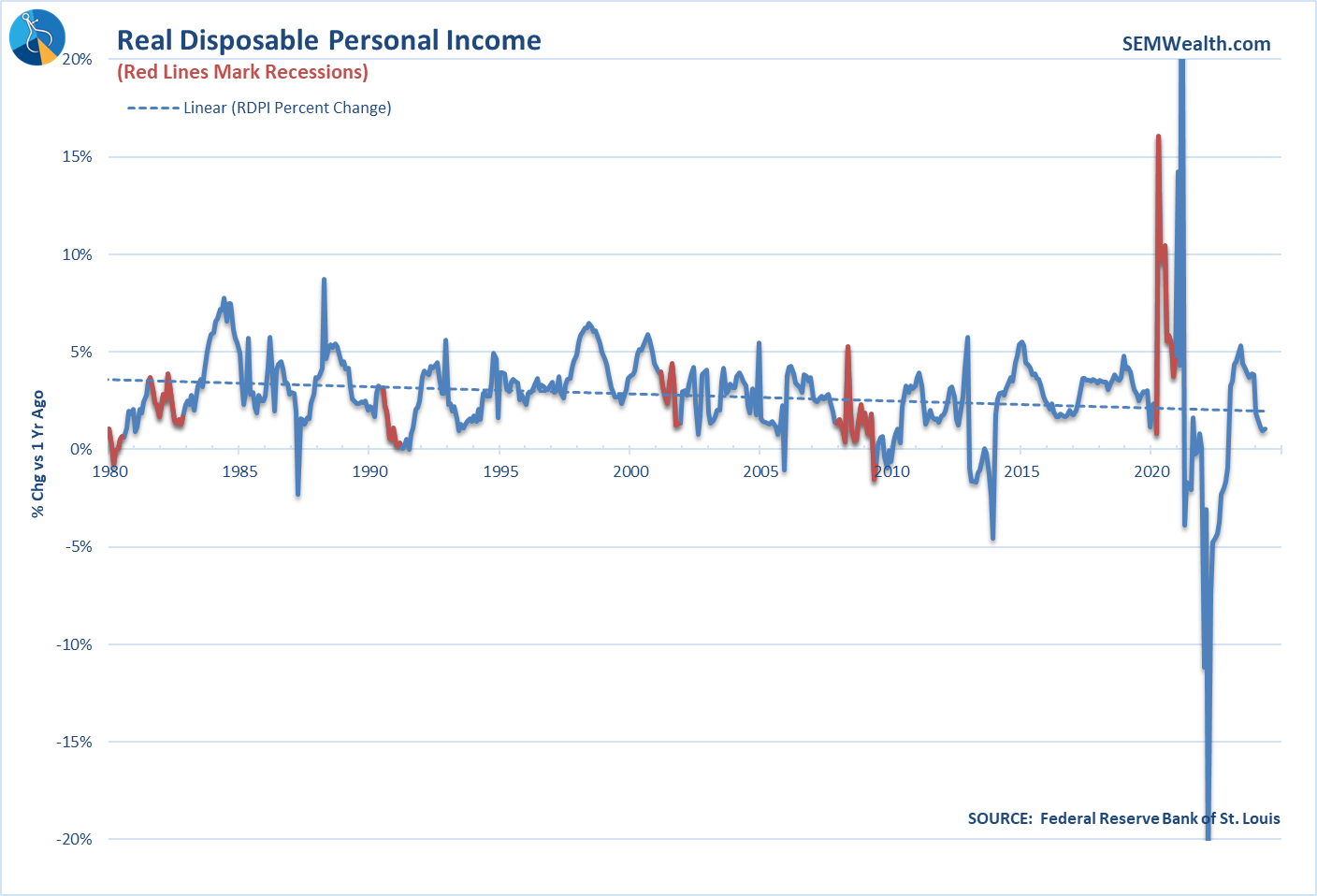

The problem continues to be that Personal Income is not keeping pace with spending growth, which means Americans continue to either dip into their savings or use debt to finance their spending.

As I said in our webinar last week, the economy is 'ok', but there are some signs of weakness. We will have a full economic update next week.

Market Charts

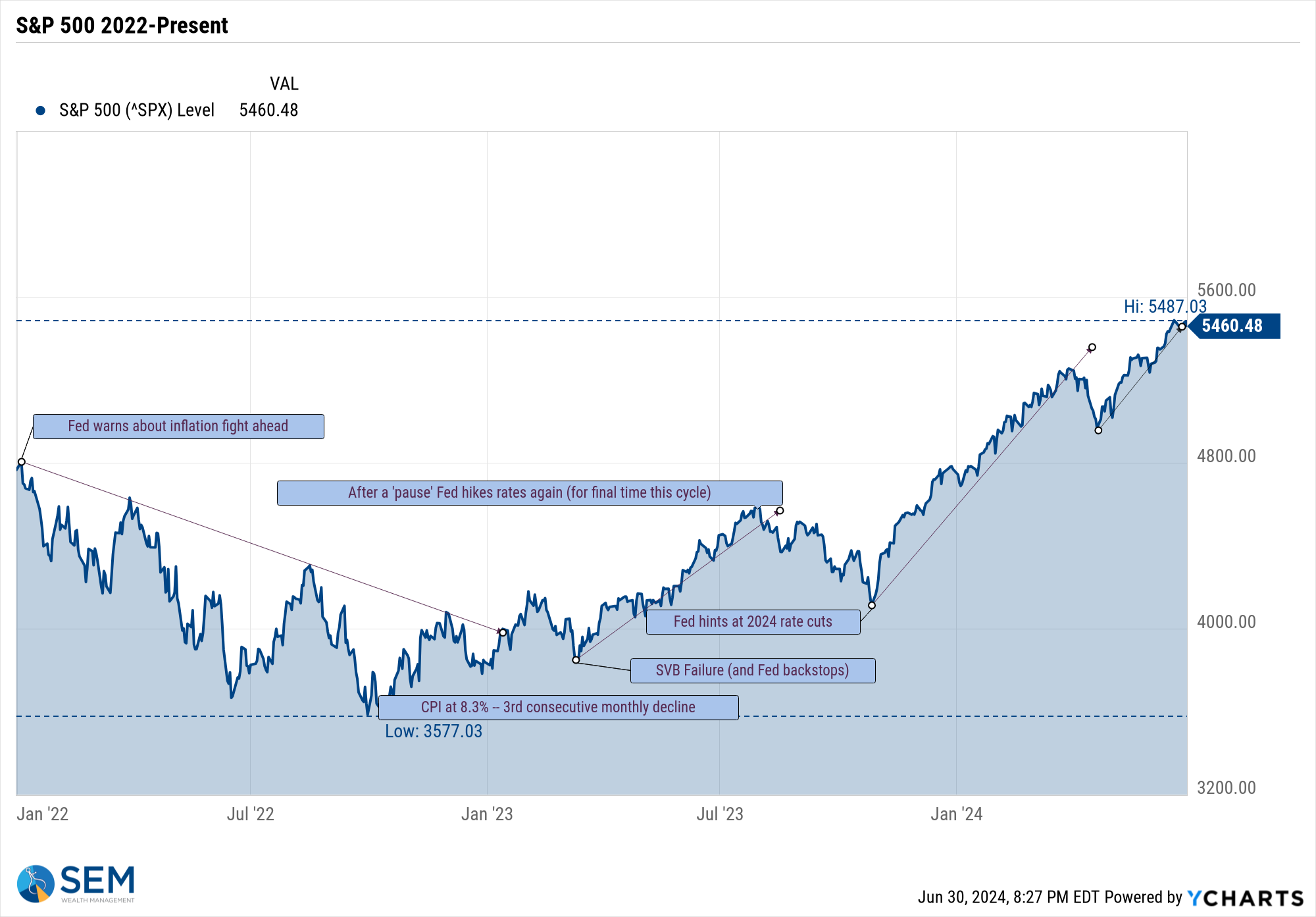

Not to sound like a broken record, but higher highs tend to lead to higher highs, until something significantly changes the trend. That could be something surrounding the election and possible outcome, social unrest surrounding the election, changes in Fed policies, geopolitical fires, or something we haven't even thought of. Until then, the trend is up, but unless you have a solid, data-driven, unemotional exit strategy (like SEM does) chasing a market this overextended could be dangerous.

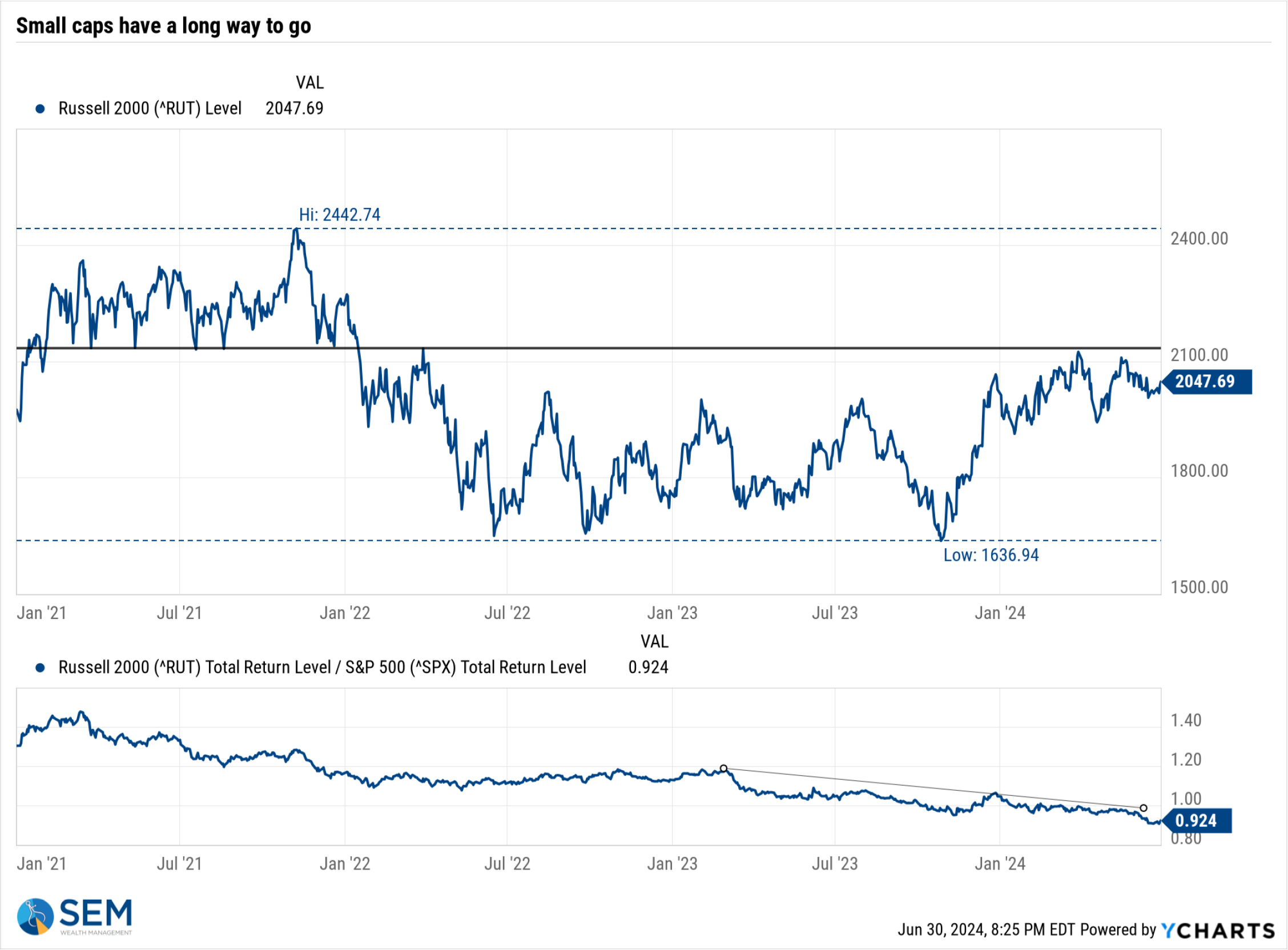

A healthy market and economy has small cap stocks participating along with large cap stocks. It was a terrible quarter for small and mid caps (and value stocks). If everything was actually so great, those companies would also be participating. Because of this, I continue to watch this indicator for signs the market is broadening out beyond mega cap growth as a sign for on-going strength.

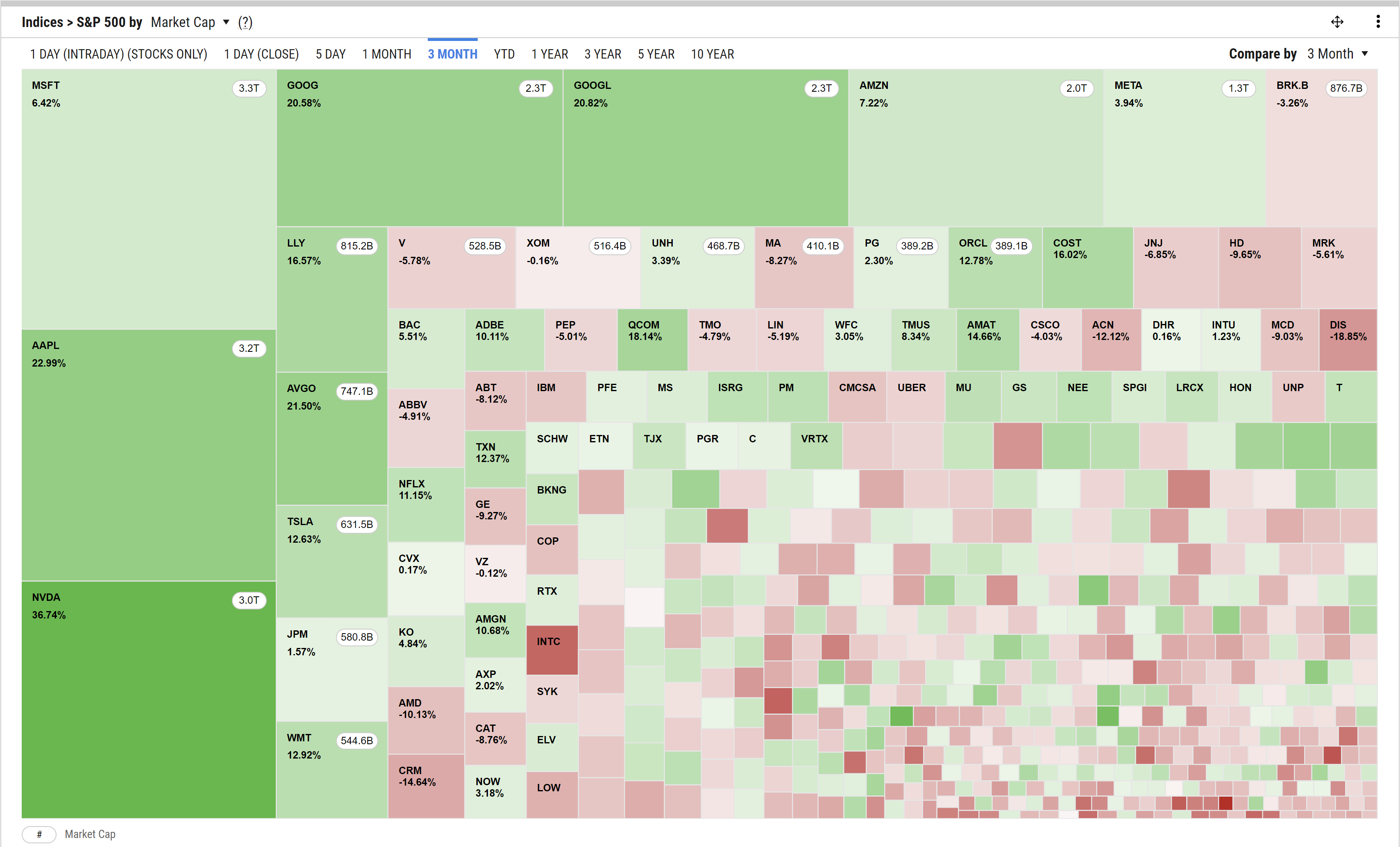

Check out the heatmap of the S&P 500 for the 2nd quarter. There is much more red on the chart than green meaning. The average stock LOST money for the quarter, but the mega cap companies pulled the index higher.

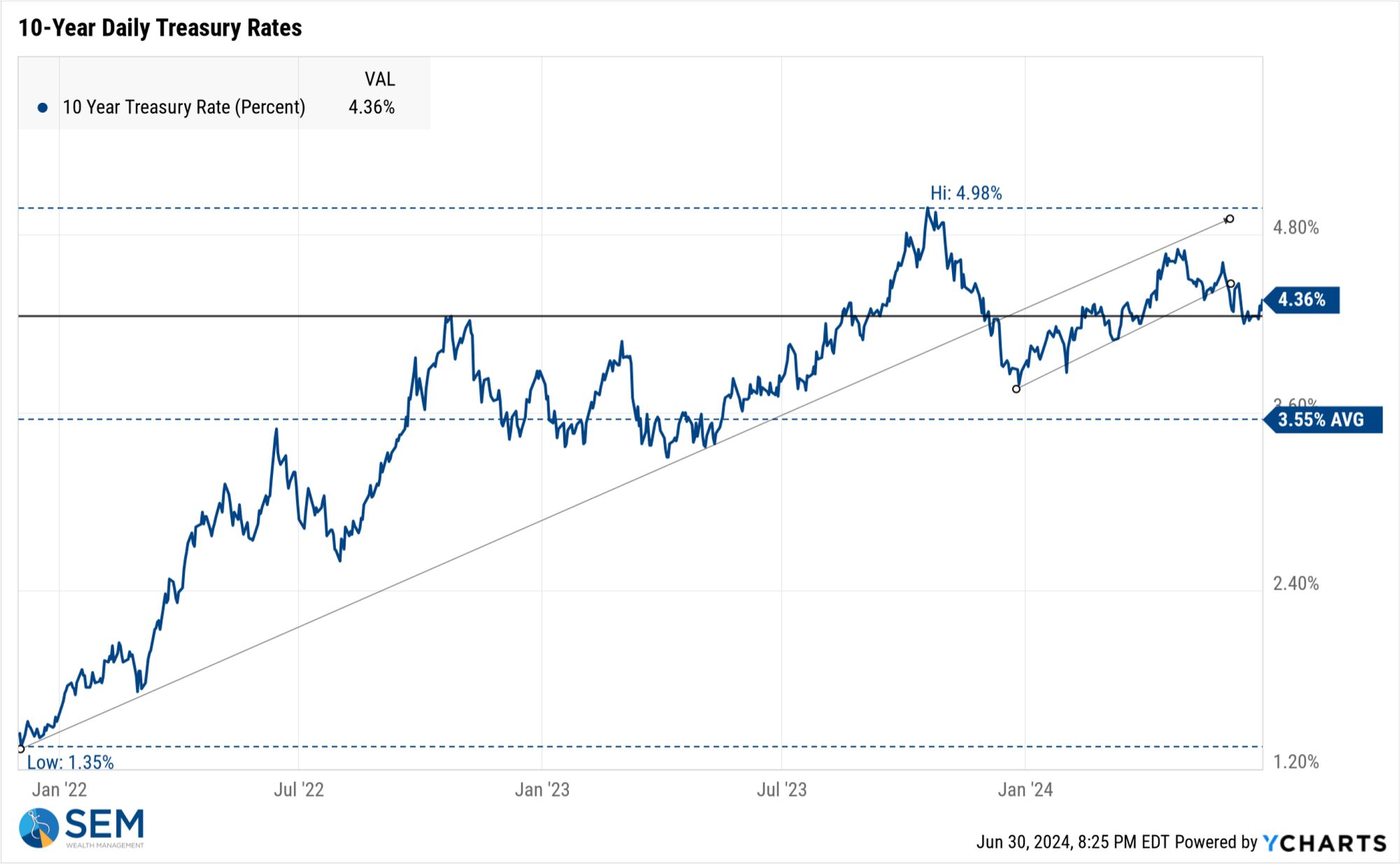

Turning to bonds, interest rates moved higher again last week. Based on the talking points from both Biden and Trump, whomever is President is going to be terrible for the deficit which means the US will have to continue to borrow more and more money. With rates where they are, interest expense as a percentage of GDP are about to skyrocket to unsustainable levels.

SEM Model Positioning

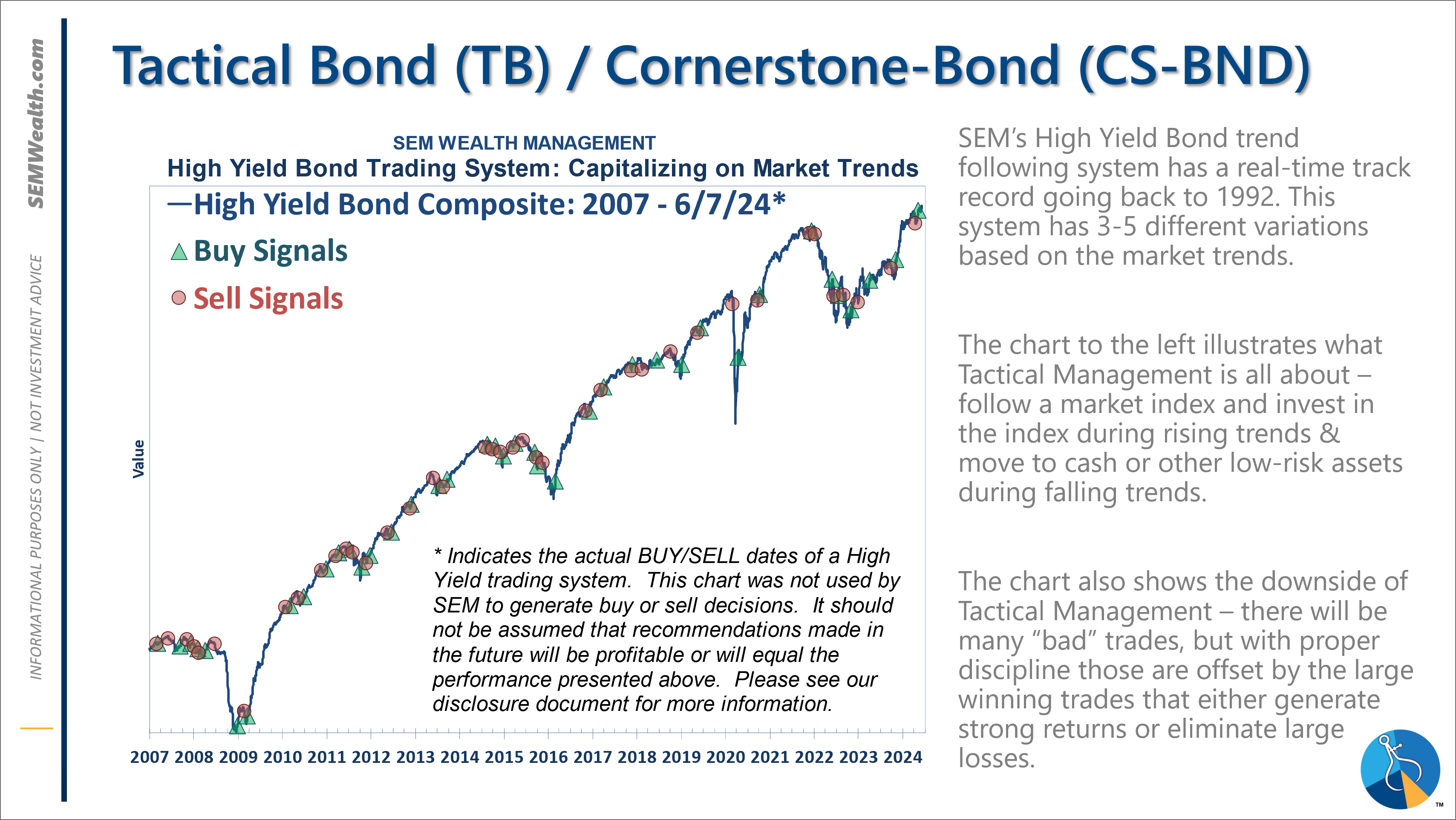

-Tactical High Yield had a partial buy signal on 5/6/24, reversing some of the sells on 4/16 & 17/2024 - the other portion of the signal remains on a sell as high yields continue to oscillate.

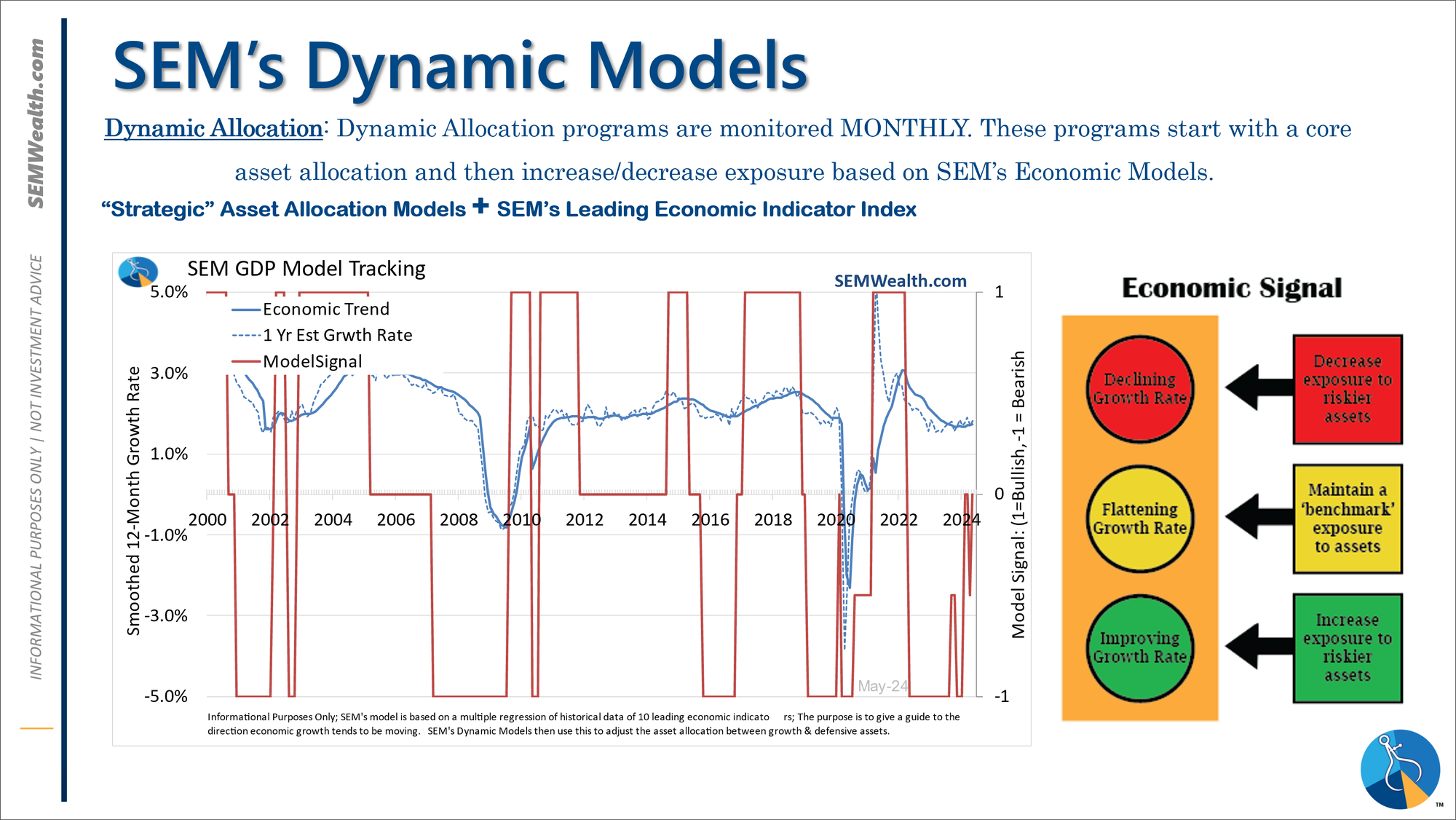

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024

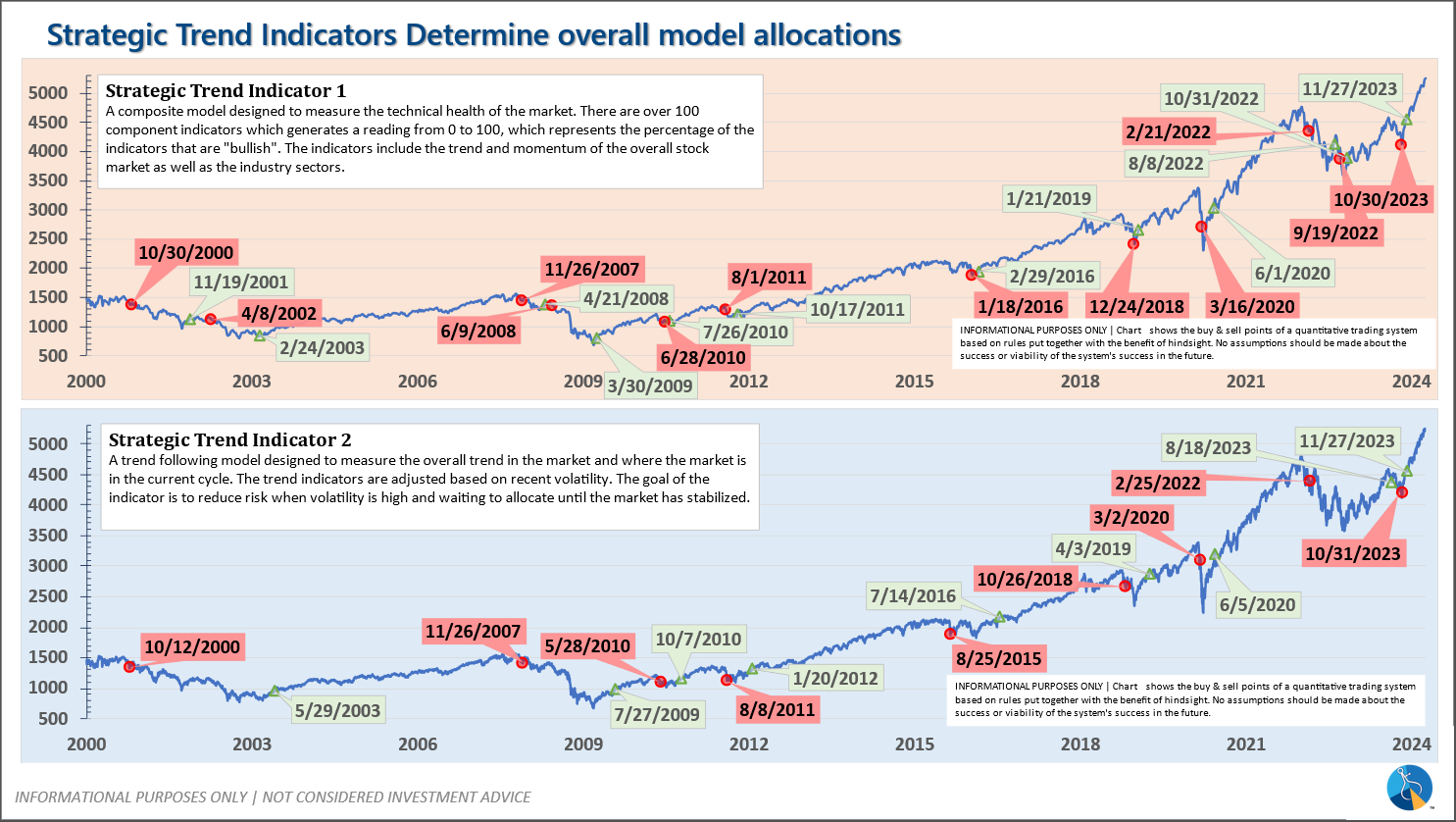

-Strategic Trend Models went on a buy 11/27/2023

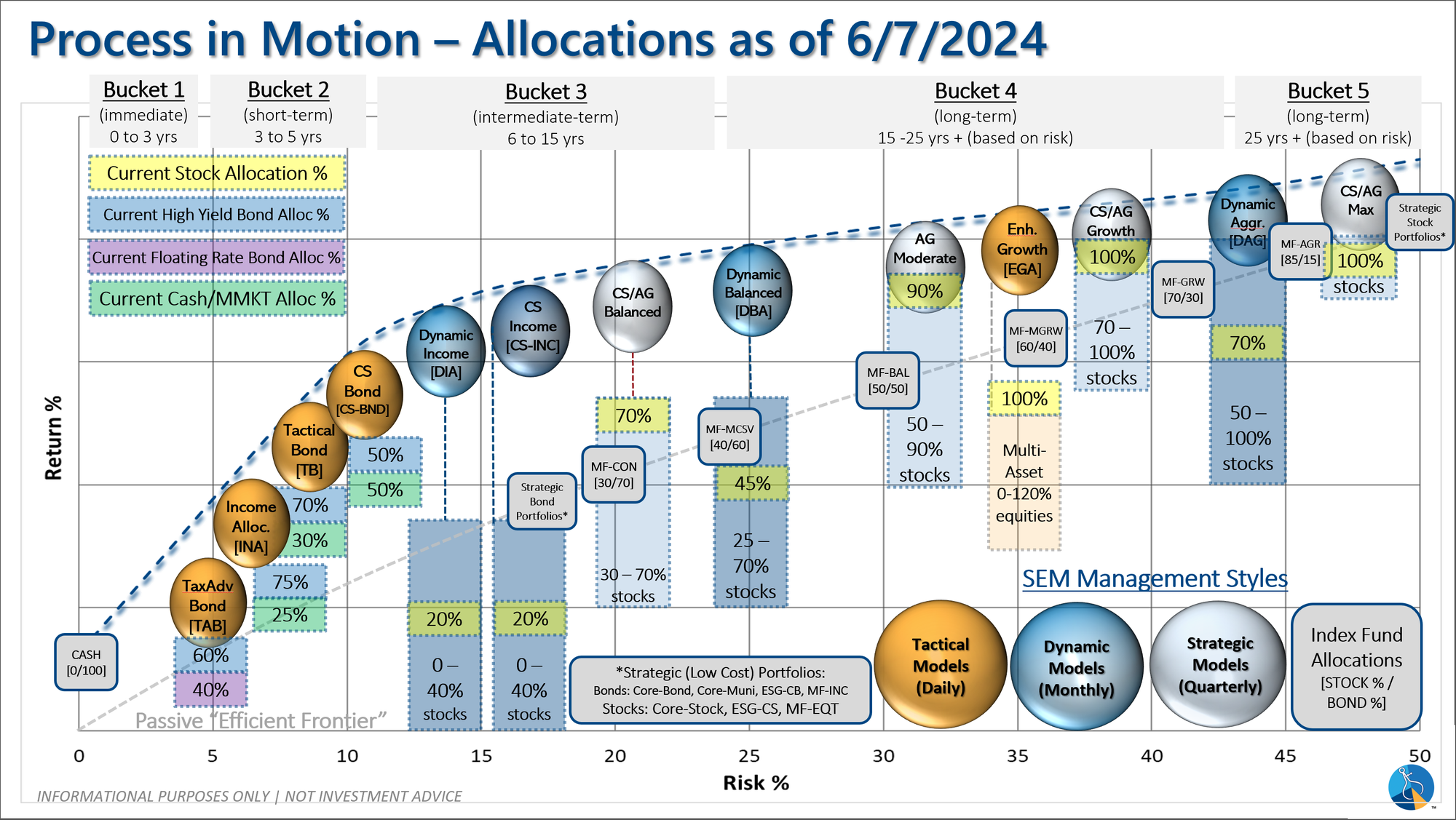

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 5/6/24 about half of the signals in our high yield models switched to a buy. The other half remains in money market funds. The money market funds we are currently invested in are yielding between 4.8-5.3% annually.

Dynamic (monthly): The economic model was 'neutral' since February. In early May the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth.

Strategic (quarterly)*:

BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change: