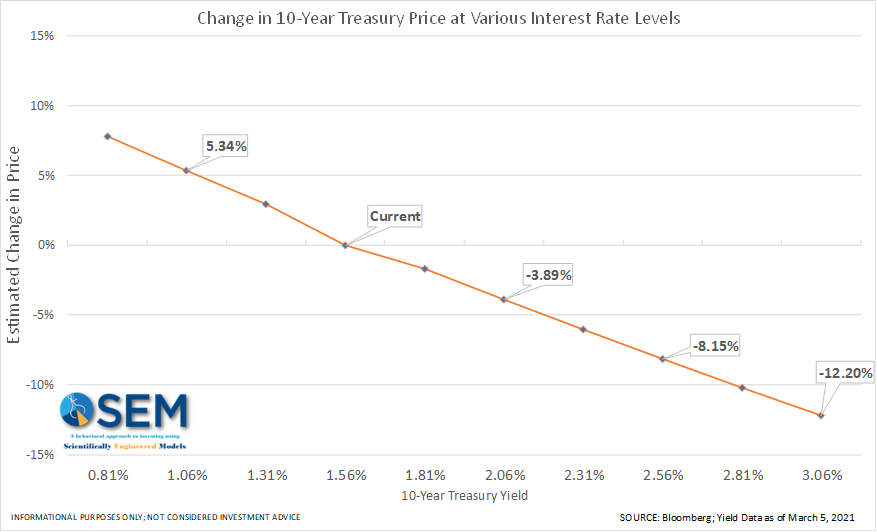

"The Fed controls short-term rates. The free market controls long-term rates. If the free market decides rates should be higher, they will go higher."

This is something I've said often since 2008. Most people believe the Fed can do whatever they want with interest rates. That is simply not true. They can try, but simple economic fundamentals and math tells us they cannot control every aspect of the bond market.

The market is waking up to the reality I've always warned about. Over the past three weeks, fear is creeping in that the Fed could let inflation get out of control. With another $2 Trillion stimulus about to enter our economy again, the fears are indeed legitimate, but my opinion is those concerns are overblown.

While many people have indeed spent their stimulus checks, I've spoken to over a dozen people who have said they've used their stimulus to pay down their debts, build emergency funds, and fund their retirement accounts. For each person doing this, it is a great idea. If too many people do this, it's bad for the economy (short-term). This is called "the paradox of saving" in economic circles. You want your neighbors to spend while you save.

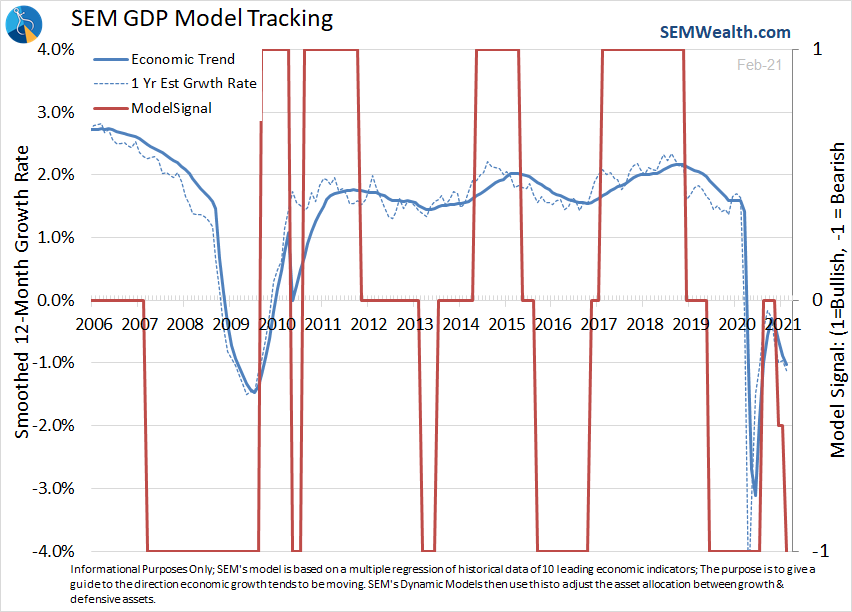

Our economic model also is currently not concerned about growth overheating. In fact, the February data led it back to a "bearish" signal. Looking ahead, I fully expect for this to be a short-term status. As spring rolls around not only will the comparisons be very weak, but a chunk of that stimulus will enter the economy at the same point vaccines are allowing states to fully re-open.

This led us to sell all of our small cap exposure in Dynamic Aggressive Growth (DAG) and our dividend growth stock exposure in Dynamic Income Allocation (DIA). It also led to a 10% position in Treasury Bonds on Friday. Subjectively that's a tough trade to take, but as always, we follow the models.

Not that this has anything to do with our model, but this chart shows an interesting set-up in Treasuries. At Friday's prices, the potential gains if rates move lower are higher than the losses if rates move higher. In other words, the panic in Treasury Bonds has caused a normally linear relationship to break a bit.

At the same time as our economic model is again getting concerned, Tactical Bond (TB) has trimmed some of its high yield exposure. Our longer-term models, AmeriGuard & Cornerstone (Balanced-Growth-Max) remain fully invested.

Having a plan is key. A year ago, the market was in a panic. We posted a video with this summary. These points can apply at any time:

-Stay Calm – Our brains don’t like uncertainty, which causes us to over-react.

-Real Issue is nobody knows what this will do to the economy and earnings ---What price should we pay for stocks? This scare can have real consequences and the Fed cutting rates will not help.

-Having a plan is key. If you don’t have one, go to SEMWealth.com and click on the Risk Questionnaire button at the top. Even if you do have one, a check-up is always helpful.

-Models are doing what they are supposed to –Dynamic models have been bearish since last summer, tactical models sold the last week of February, and AmeriGuard/Cornerstone are currently letting the sell-off happen, but are close to trimming some exposure as well.

-You still have a chance to make adjustments – markets have given back 4th quarter 2019 gains, but are also back to where they were at in October 2018. If you’ve been uncomfortable with your exposure, now is the time to act. SEMWealth.com – take the Risk Questionnaire and use the Secure Upload link to send us a copy of your statement

-Bottoms are a process not an event -- don't be fooled by all the moves up and down.

Given the uncertainty regarding interest rates and the ability of the market to sustain the rally, the timing of our Post-COVID SEM University couldn't be better.

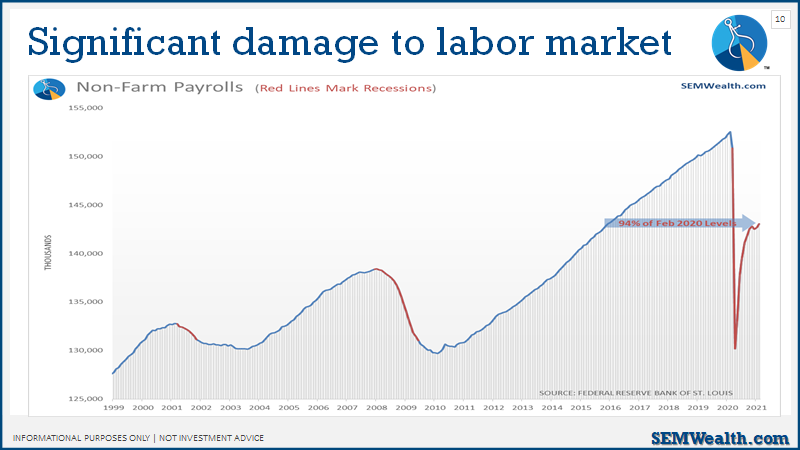

One of the things we'll talk about is the current economic update and areas we all should be watching. One of those is the labor market. While everyone is celebrating the February jobs report, from a big picture standpoint we have a very long way to go.

We'll also spend some time talking about the Fed and their possible next steps.

A year ago I was saying, "Stay calm". Today I'm saying "Be Ready". Part of being ready is making sure your investment portfolio is customized to your financial plan, cash flow strategy, and investment personality. SEM provides an easy way to do that via our online Risk Questionnaire.

We receive dozens of research reports each week from all the big name Wall Street firms. The consensus is this:

- Interest rates are going higher

- The economy will be a "rocket ship" in 2021 & carry into 2022

- Value stocks will outperform growth stocks

- Small stocks will outperform large stocks

- International will outperform the US

My question to all of them is this – "what if you're wrong?" They don't have an answer – they instead answer with data backing up their opinions. The nice part about working with SEM is we don't have to be "right". If the consensus view is wrong it can get ugly very quickly.

Confirmation bias (seeking information that backs up our already formed opinions) is dangerous. I would encourage you to be ready by looking for data that calls into question the consensus view. Our models are picking up on some of that.

Probably the best part of working with SEM is the reduction in stress. You don't have to have an opinion on what will happen in the markets or the economy. You just need to work on the financial plan and cash flow strategy. Keeping up with those things is hard enough without having to dissect all the swings in the markets.