It's been exactly a year since investors woke up to the possibility that COVID19 could disrupt the "rocket ship" economy most believed we were experiencing. Investors saw little chance for anything to interrupt it. Readers of this blog and investors with SEM would have known the economy was artificially juiced by the tax cuts, but was fading with many cracks in the financial system emerging.

When our expectations are high, you get sharp (over)reactions if they need to be reduced. This is exactly what happened a year ago. The news of the virus was not new. I remember all through January commenting at home with the twins about the fact nobody in America was talking about this virus in Asian that had already spread to Europe. When deaths hit our shores, the reaction was fierce.

First off, I'm not a medical expert. I do have contacts who are in the medical and biotech fields who have given me some valuable insights on the Coronavirus. The spike in cases we are seeing is typical and expected. Their viewpoint is we could see this continue through late March or early April at which point we should see a fall-off in the number of cases. This is a seasonal virus. The real concern will be what happens next winter if a vaccine has not been found to eradicate the virus as it lays dormant around the world. Based on what we've seen with SARS, MERS, and other similar viruses, my money would be on the medical experts coming together and figuring this one out.

Later on and throughout the crisis I wrote that we would need to have grace with our leaders and be careful to not use the benefit of hindsight to question their decisions. Hindsight bias is dangerous to our decision making because we believe everything was "obvious" at the time, meaning next time we are faced with a difficult decision we will clearly see the right decision.

Obviously many mistakes were made in February and March and especially in April and May. Maybe this could have been contained, maybe not. That is done and in the past. What is more important is how I closed the blog a year ago:

The tactical models were fully invested a week ago. They've already taken some if not all of the allocation to more defensive strategies. As you would expect, our "strategic" AmeriGuard and Cornerstone models are designed for longer-term allocations and remain fully invested.

The reason SEM is so valuable inside the financial plan is our wide-ranging strategies which completely remove emotions from the equation. Nobody likes losing money, but it is part of investing. The key is having a plan in place for no matter what happens. We've seen 8 other sell-offs of 10% or more since 2010. Until proven otherwise we remain in an uptrend. When that changes, our models will adjust accordingly.

A year later we are again looking at investors expecting a "rocket ship" economy. Investors see little chance for anything interrupting this. Whenever this happens caution is certainly warranted.

The last few weeks, we've seen a huge spike in long-term interest rates. This has caused stocks to take a hit, especially the high-flying growth stocks. Most of us have probably never been in an environment where we are seeing this kind of money flood the economy. This does not change basic economic principles. I discussed this in our latest Market Musings video:

There are a lot of things that can derail the "rocket ship". Our tactical models have trimmed a bit of our higher risk allocations over the past few days, but are not yet to the point we were a year ago.

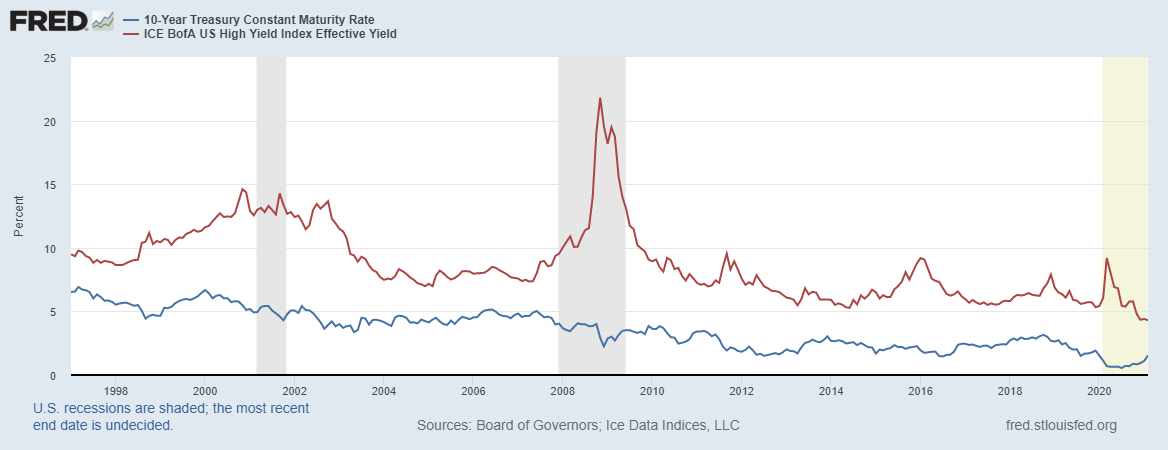

It is important to understand just because Treasury Bond yields are going higher and causing Treasury Bond prices to drop significantly, not all bonds are the same. This chart of yields shows the difference in the current environment.

High yield bond yields (the red line) have never been lower. Treasury Bond yields are only back to where they were at in January 2020. High yield bonds are sensitive to changes in the economic outlook, not the direction of interest rates. However, if interest rates get too high and cause the economic outlook to decline, high yield bonds can be hit — hard.

Again, caution is warranted. If the last year has proven anything, it is the value of SEM's approach in uncertain times. Our engineered models are designed to adapt to whatever environment is thrown there way. This may be a "new era", but what hasn't changed is the humans behind the buy and sell decisions. The behavioral biases of those humans allow us to get a read on what type of market we are in.