Over the past week, the consensus has been built that the US economy is about to embark on a historic boom. The parallel many are using is the Post World War II boom where the government had a "blank check" to rebuild the country's economy. Treasury Secretary Janet Yellen was making the rounds last week pushing for mass stimulus. On top of the nearly $2 Trillion "COVID Relief" package Congress is working on, Secretary Yellen suggested a $2-3 Trillion infrastructure package is also necessary.

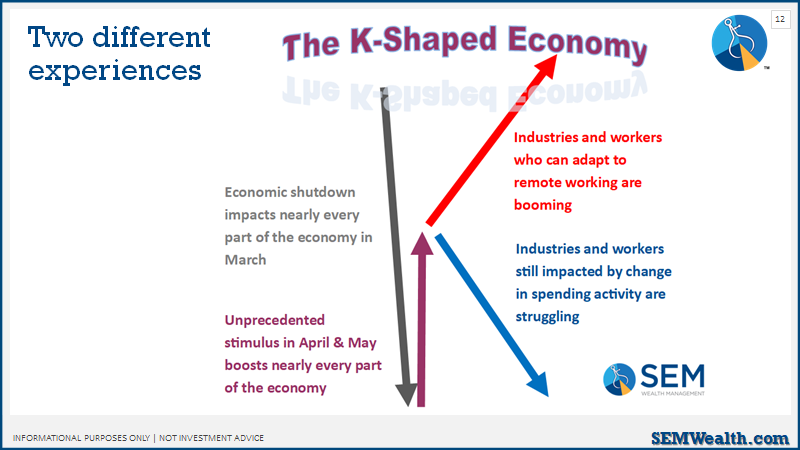

I have mixed opinions on this stance. For those following the blog the past year, I've detailed the "K-shaped" economy that is turning into a long-term problem for future growth. Figuring out how to help the bottom half of the K, those impacted the most economically by the pandemic needs to be a top priority. Without support from that portion of the economy the top half of the K, those who have prospered during the pandemic will take a hit. The problem is how do you help the bottom half without chopping down the top half too much.

I detailed the current environment in January:

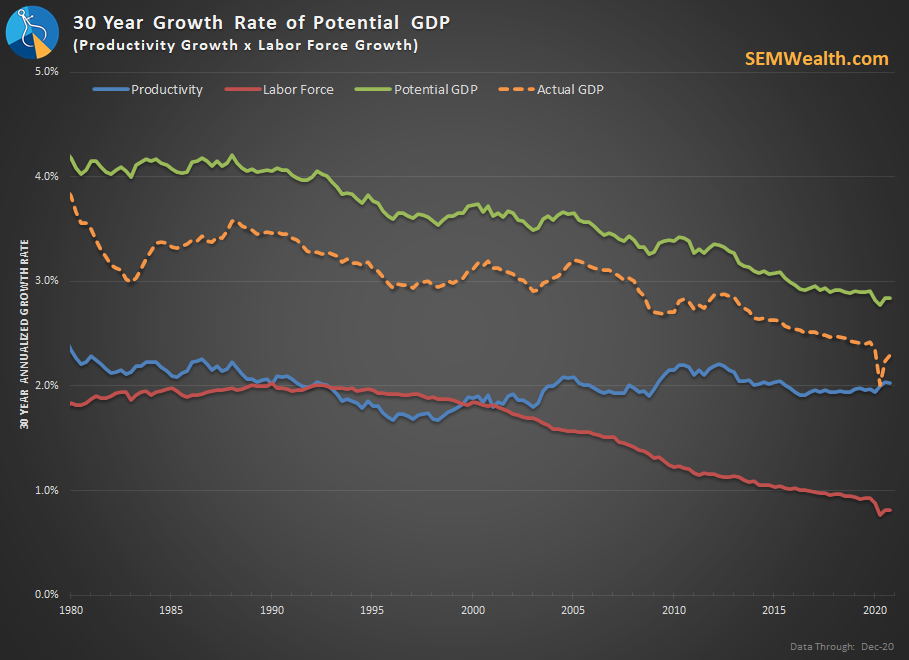

On the infrastructure side really long-time readers will know I've been an advocate for mass STRUCTURAL changes in our economy. Long-term economic growth potential is calculated by multiplying the growth in the labor force by the growth in productivity. The Labor Force has been declining for years. Productivity growth has been hovering around 2% for the last three decades.

We need both ways to increase the labor force AND to boost productivity. If the infrastructure bill is structured to target those things then it could lead to strong GDP growth. If not, it will only create more future problems.

Notice how long the economy has failed to grow at its potential growth rate. This is the result of our budget and trade deficits. Debt is ok if it creates higher future growth, but that hasn't happened. When you combine that with our large trade deficit you get an economy that simply cannot grow at its potential because too much of the current growth is going to pay for past growth.

There is a lot of angst right now in the market about inflation. The concern is all the spending will cause a jump in prices. This is indeed a "new era" in terms of joint efforts by the Federal Reserve and Treasury Department to spark strong economic growth. One chart I'll be watching is the Velocity of Money. This is a measure of how one unit of currency is used to purchase domestically produced goods and services.

Back in 1981, $1 put into the economy was spent 3.8 times. By 1990 $1 was only spent 2.73 times and by 2000 it was only spent 2.3 times. It has continued to plummet throughout this century to the point of $1 put into the economy is spent once. Then it's gone. No future growth or spending is generated.

When I say we have STRUCTURAL ISSUES, this is what I'm describing.

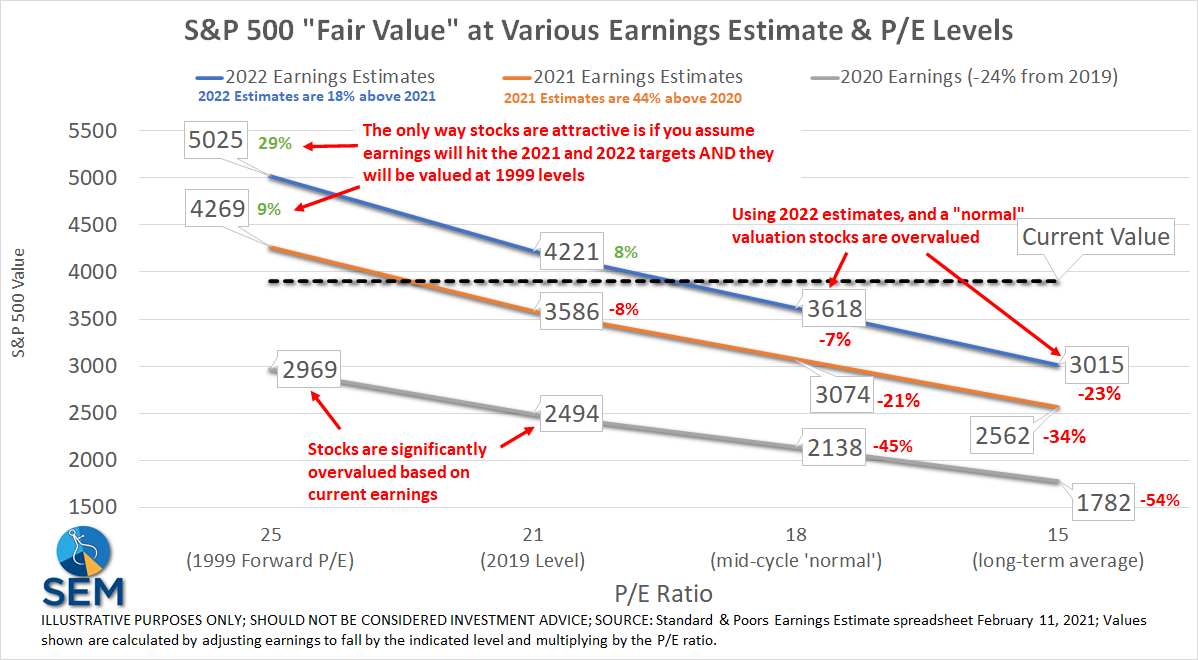

Economic theories are going to be put to the test over the next few years. Wall Street is betting on a boom like no other, but looking at valuations the risks are high we could see a huge bust in the stock market. After giving companies a pass for disappointing earnings in 2020, market analysts are saying companies are getting a pass for 2021 as well. Stocks are now being evaluated based on their 2022 earnings potential. This is unprecedented.

Here's the "Cliff Notes" explanation of the chart — If 2021 & 2022 earnings are as spectacular as the market expects AND the market continues to value those earnings like they did during the tech bubble, you should expect to make 9 - 29% over the next two years in the S&P 500. If that doesn't happen, stocks are due for a drop of 8 to 54%.

If you are buying and holding stocks or trusting an advisor who follows a "fundamental" or passive approach you are taking a tremendous amount of risk. At least in 1999 there was a new technology that had the potential to improve all businesses (although the lack of productivity growth proves it wasn't as game-changing as we all thought).

If you're buying (or holding) stocks now you are betting Congress & the Federal Reserve will be able to completely shift our STRUCTURAL issues. I may be jaded, but that's not a bet I'm willing to take.

As for us, we'll continue to do what we always do – follow the trends and money flows and adjust accordingly. We may be fully invested right now across the board, but stand ready to cash in our gains and move to lower risk assets when the trends reverse. This may be a "new era", but there is one common denominator that never changes – human behavior.

In case you missed it, here's a short video discussing how we use this to our advantage.

If you're already retired or planning on retiring in the next 10 years, we need to talk. If you're an advisor working with those types of clients, we need to talk. If you've found yourself the past few months saying some version of, "it's different this time", we REALLY need to talk.