Whether when investing or just life in general there are all kinds of things that can go wrong. We can often reduce the damage of those risks, but not all the time. However, it's usually the things we cannot see that hurt us the most.

With most of the country enduring some tough winter weather it is a good reminder of the importance of being prepared for anything – even the things you may not expect. This weekend in Virginia we had an ice storm. I used the storm and its damage as a metaphor for the stock market in my Market Musings 3 video. Check out the short video below:

Last week I took a look at some of the data driving the market rally. Everything seems to be falling in place nicely for the stock market, but that does not mean we shouldn't let our guard down.

There are 3 things driving the market:

- Stimulus

- Vaccines

- Federal Reserve

All of these things are emboldening people to increase their allocation to risky assets. The thought is with all of those things supporting the market and economy nothing can go wrong. The storm has passed and the coast is clear — or that's what people believe.

The problem with the three items is they all depend on one thing – perfect execution by politicians and bureaucrats. This includes not causing any collateral damage or neglecting key portions of the economy.

Stimulus could end up being too small, too big, not going to the portions of the economy that needs the most help, or cause problems with key industries in our economy.

The vaccine roll-out has already been chaotic. Continued issues and delays could allow the virus variants to take hold. The vaccine may not be as effective on a variant, which would not be good for the re-opening story.

The Federal Reserve could lose control of the long end of the yield curve. This could make the cost of the stimulus bills significantly higher. They could cause inflation in materials and commodities that are passed down to the end consumer. This will hurt those hurting the most and dampen the effectiveness of any stimulus.

All of this and I still haven't heard anybody willing to seriously address the damage the pandemic has done to the already fragile pension system. Nobody is talking about the huge losses commercial real estate investors are about to take or looking at the banks exposed to those investors. And while the Fed has mentioned the long-term problems caused by an under-skilled labor force I've yet to see any policies looking to actually address this.

Whether or not any of those issues come into play, I think it is naïve to think the market can continue along its current pace. Studying market history and a general understanding of economic fundamentals tells us this. The market WILL go through a huge correction at some point. There is no such thing as a free bull market. Money spent today to spur growth has to be paid back. Paying it back will hurt future growth.

Stocks are currently ignoring 2021 earnings and focusing on 2022. They are expecting strong growth and are priced accordingly. Whenever the strong growth reverts back to "normal", prices correct. Any missteps in the 3 supports of the market could cause a quick re-pricing.

All of that said, SEM is still heavily invested and enjoying another good start to the year. I find myself telling clients and advisors to not expect the returns we've had the first 6 weeks of the year to continue. It's been too easy.

We need to do no more than look at the compounded annual return based on the first 6 weeks to know this is unsustainable:

- Tactical Bond: 7.3%

- Dynamic Income: 10.4%

- AmeriGuard & Cornerstone - Growth: 76.4%

- Dynamic Aggressive: 88.7%

- Enhanced Growth: 108.2%

- S&P 500: +52.1%

Performance based on the overall model managed at E*Trade and is net of the maximum management fee. If there were ever a time where past performance is not a guarantee of future results, this is it. The purpose in showing the returns above is to illustrate the froth in the markets.

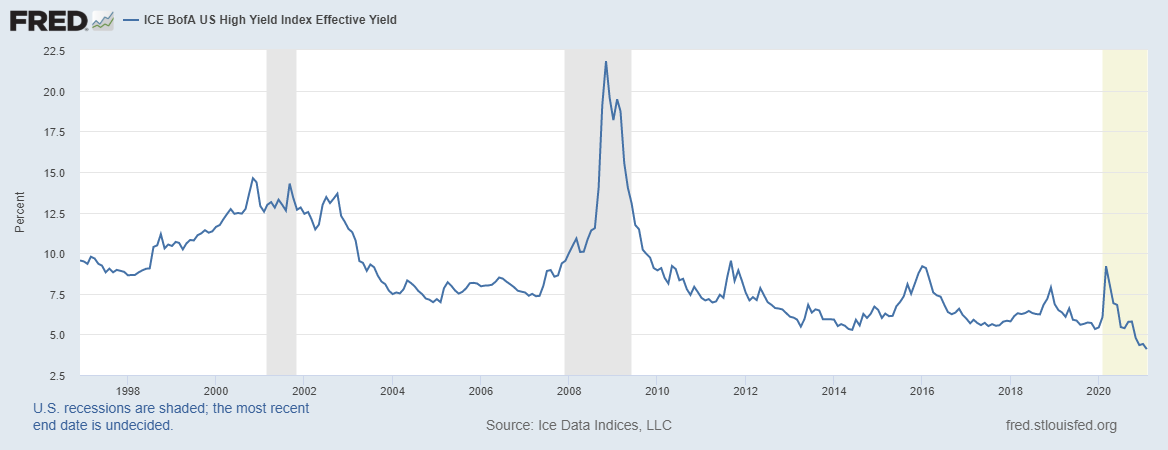

Tactical Bond makes the bulk of its returns by allocating to high yield bonds when they are trending higher and moving to lower risk bonds when the trend reverses. As yields go lower, prices go higher. After making over 9% last year, Tactical Bond's 7%+ pace would rely on high yield bond yields to continue moving lower. They are already at record lows.

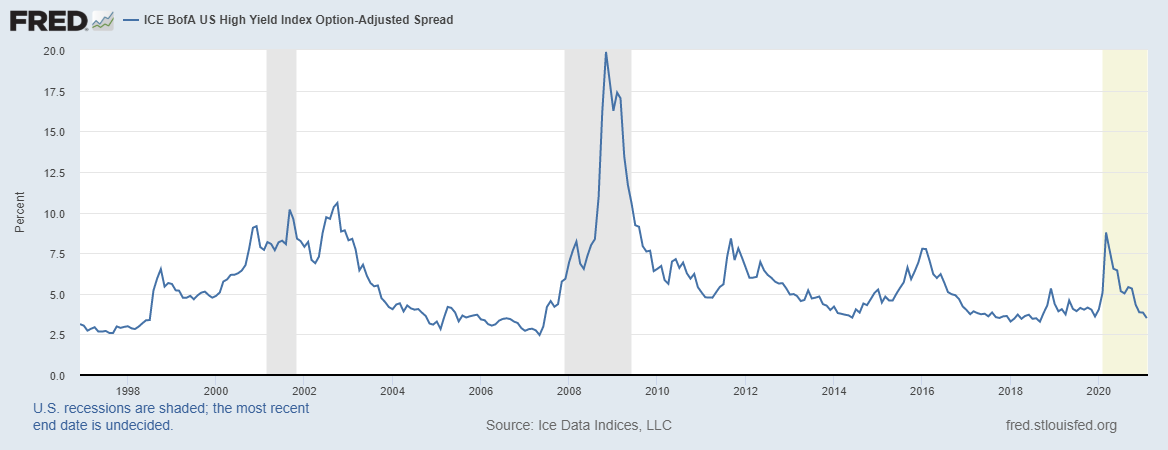

There is a little room to go looking at the spread between high yields and Treasury bonds, but not too much. The spread is back down to where it was at just before COVID struck last year. It is still about 100 basis points (1%) above the 2006 lows. Apparently the bond market believes there is very little risk on the horizon.

What is more likely to happen with Tactical Bond is a sell-off in high yields, giving back some of the gains before a sell signal, and then a much better re-entry point. When that happens is anybody's guess. For now the trend remains higher and we will take what we can get, which includes a 4% dividend yield.

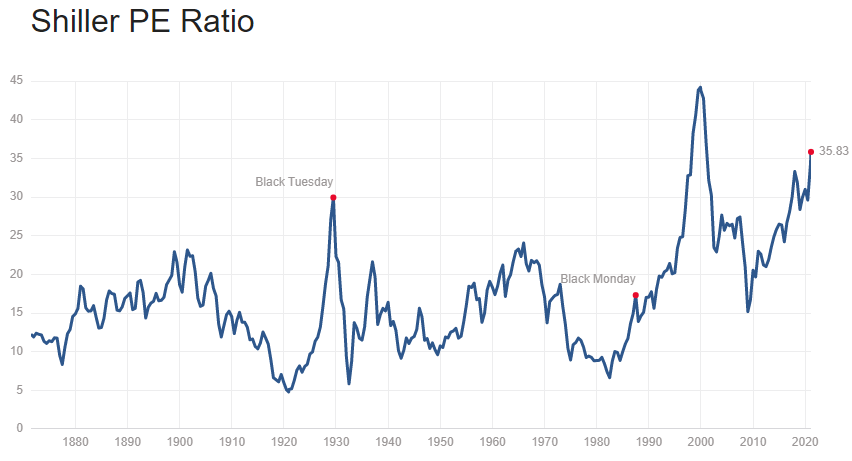

It's the stock market that should have us all concerned. Hopefully nobody expects AmeriGuard & Cornerstone Growth to make 76% in 2021 (or the S&P 500 to make 52%). The only time valuations have been higher was in the year 2000. At least back then there was a technology that was indeed making things better for businesses and consumers alike. Now what is the market basing its high valuations on? Free money? We know how it worked out in 2000 and we know how this will end.

If you have money outside of SEM, now is a good time to consider moving it to something that can adapt when the unexpected happens. 2021 could very well be a spectacular year, but what if it isn't? What if we have a policy misstep that causes a sharp drop in stock prices. At SEM, we will continue to do what we've always done – ride the trend as long as possible and when it reverses look to the models to re-allocate to lower risk assets.

Your portfolio is not meant to be a lottery ticket. Getting rich slowly has a much higher chance of working. If you're in an SEM portfolio, your allocations were designed around your financial plan, cash flow strategy, risk tolerance, and investment personality. The risk in models such as AmeriGuard or Cornerstone-Growth is considered as part of your total allocation.

Our goal is to help you stick to your plan and be ready for the hidden risks that will come up now and again.