Most of the country is experiencing the coldest temperatures of the winter, which is fitting given the current state of the economy.

The market is ignoring the current data and focusing on the months ahead. They are fully pricing in a tremendous recovery based on three things:

- Stimulus

- Vaccines

- Federal Reserve

Thankfully last week the focus on the Reddit stocks waned as most of them collapsed. I believe this is due to the vehicles they chose to use to send the stocks to the moon (options) expired last Friday, which means all of the hedges the options sellers had to have in place were no longer necessary so they could cover their positions. Easy come, easy go. This doesn't mean we won't see the Reddit bubble resume. I have talked to plenty of people wanting to get in on the "next Gamestop". Enough of them to post this short video:

Back to the actual stock market. For the time being, the only thing that matters will be changes in any of those three things listed at the top (Stimulus, Vaccines, & the Federal Reserve). At some point, the actual pace of economic growth and what it means to corporate earnings will matter.

1.) Stimulus

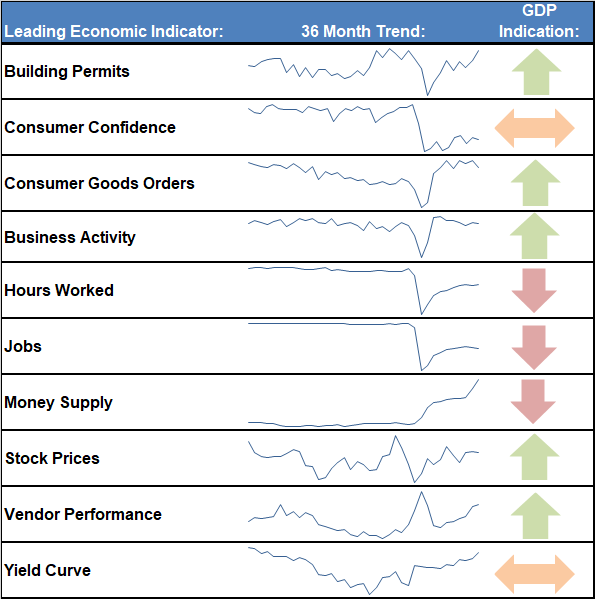

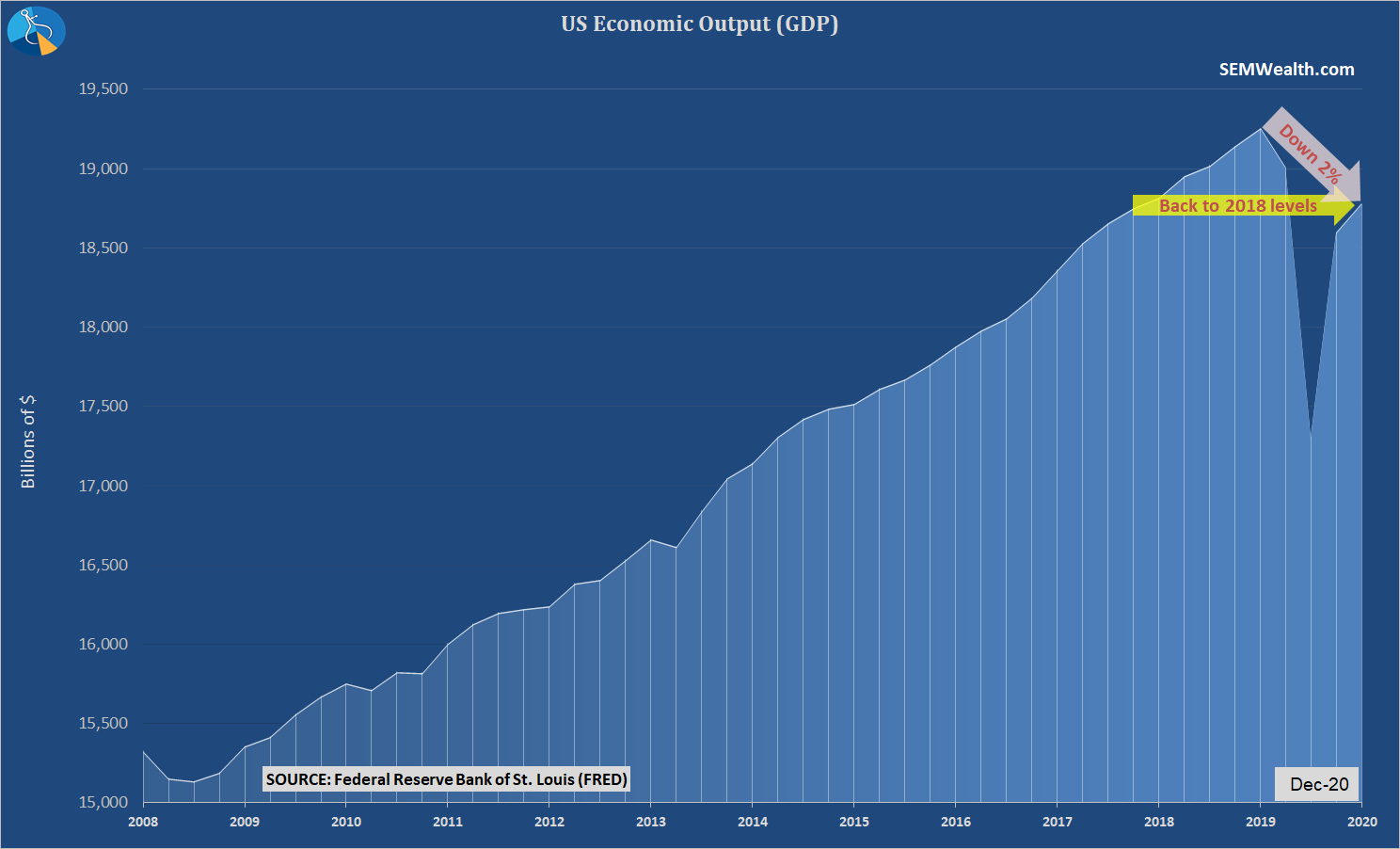

The overall economy is still weak enough to justify a big stimulus bill. Here's the latest monthly update to our economic dashboard:

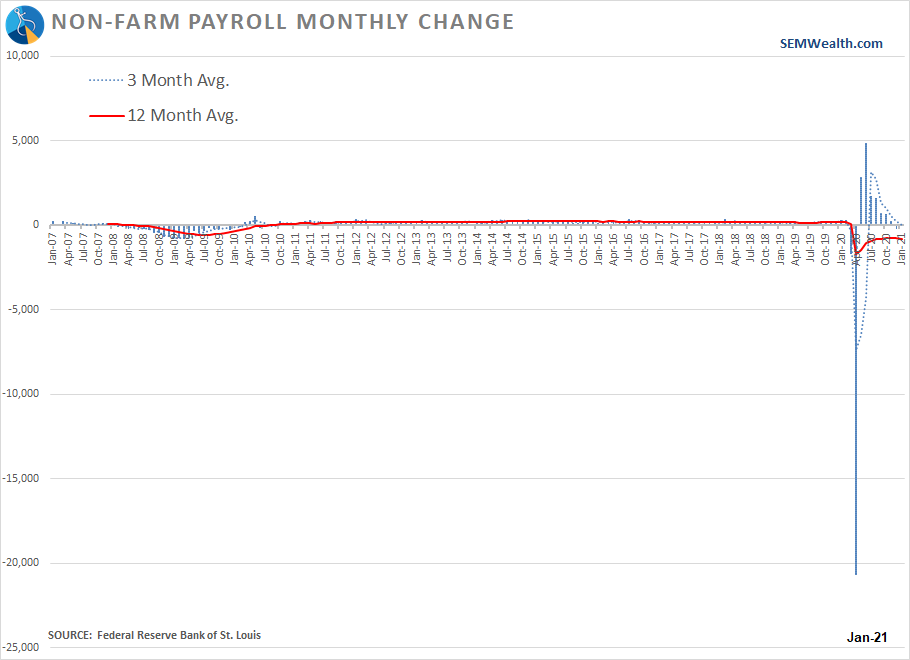

One of the biggest drivers in our economic model is related to the labor market. Last Friday's Payrolls report was another disappointment. The scale on the monthly chart is obviously skewed with the steep losses last spring, but I think it tells an important story......the pace of job growth has ground to a halt.

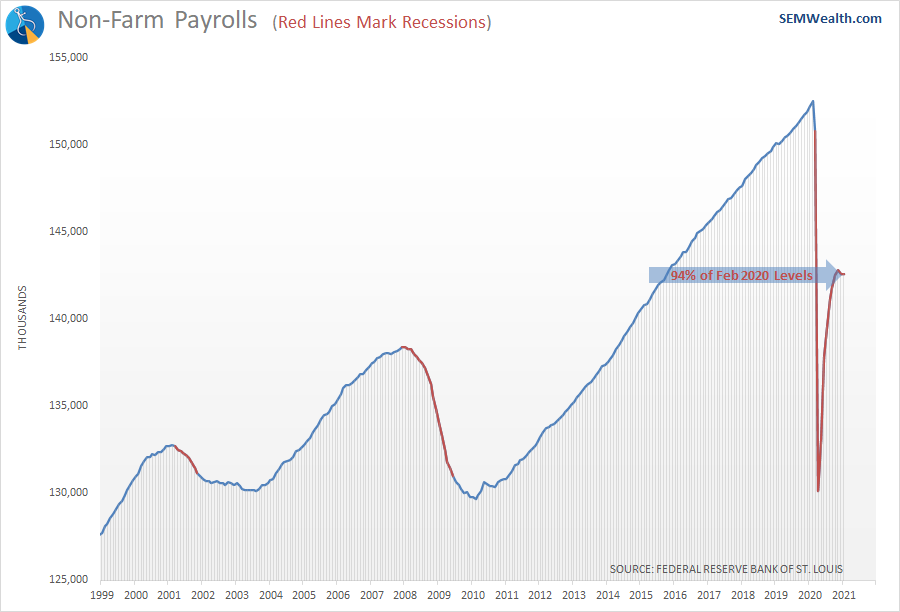

And the damage done to the labor market is severe.

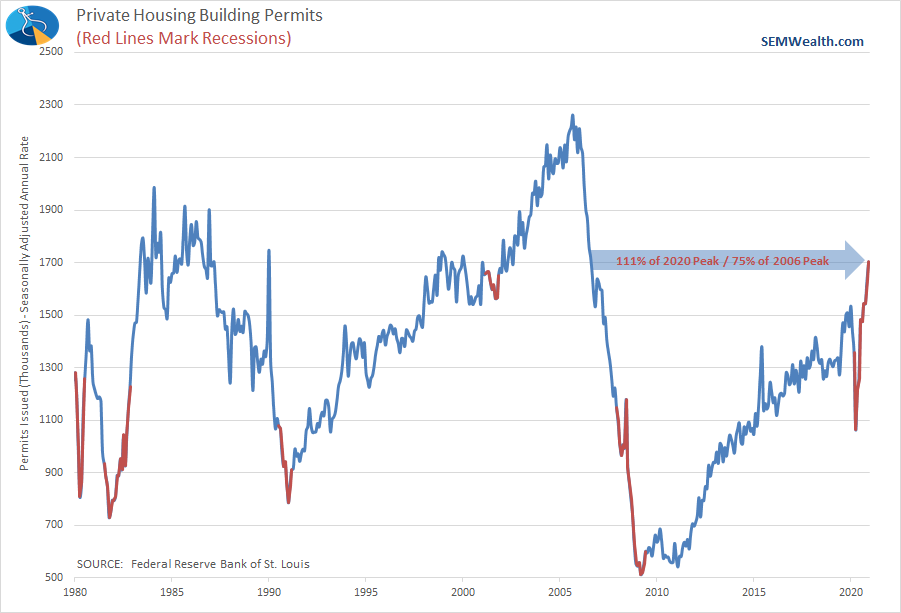

On the plus side we have Building Permits, which illustrates the future housing activity. I'm not ready to call this a bubble yet, but it is getting close. There are more and more stories of bidding wars, offers made sight unseen, and armatures wanting to get into the house flipping game. From a fundamental stand point it is a function of the large shift to work-from-home capabilities, the large Millennial generation entering the housing market in size, and historically low interest rates. Add to that stimulus going out to people who didn't lose their income and you have plenty of juice for the housing market.

In aggregate we can see the hit the economy has taken.

As long as we see underlying weakness in the economic data, the push for more stimulus will continue, which will help support stock prices. The thought from market participants is this will be enough to smooth over any long-term damage, making stocks attractive. In reality nobody knows, but that is the current consensus.

2.) Vaccines

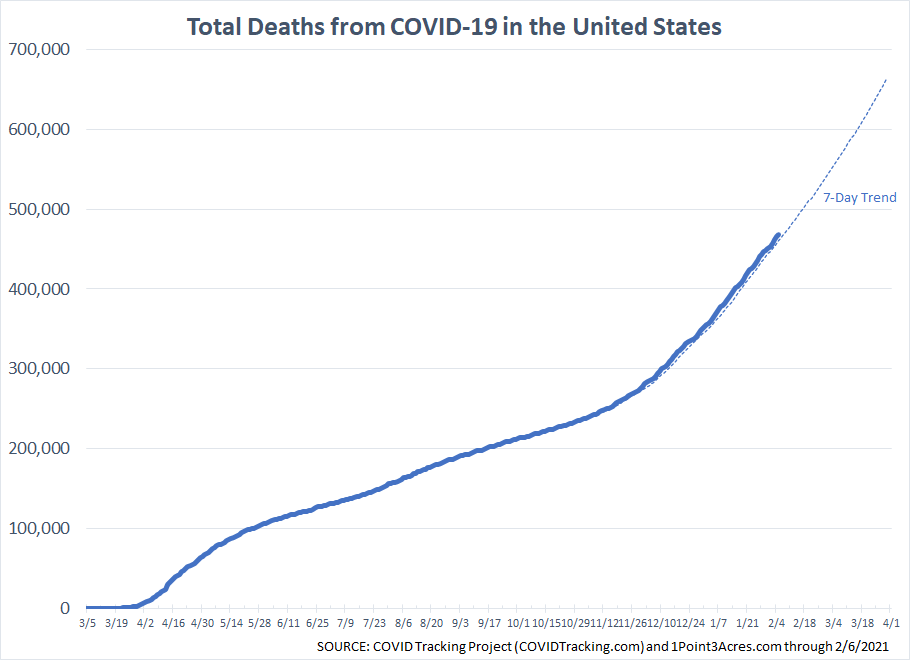

Since last spring, the thought was the economy would struggle until we had a vaccine. The speed and number of effective vaccines has been impressive. They could not have come fast enough. The much feared winter spike following the move indoors and the holiday season has come to fruition.

Even with the vaccine roll-out and the drop in the number of new cases, the daily number of deaths remains high. At the current pace we could have 670,000 deaths by March 31. This would be on the anniversary of when Donald Trump warned about the possibility of 400,000 deaths if we didn't act quickly enough (before backing off on his warnings a week later after the stock market lost 7%).

The rollout, to put it mildly has been less than efficient. We've heard too many stories from clients struggling to get the first dose of the vaccine. That said, we've also had many report successfully getting it. In our small county, every employee of the school district who wanted the vaccine has been able to get it. There are reports, however only 40% of the staff took them up on the offer.

This interactive chart shows the rate of vaccinations. It's a nice start. Here's hoping the vaccines are effective against the new variants.

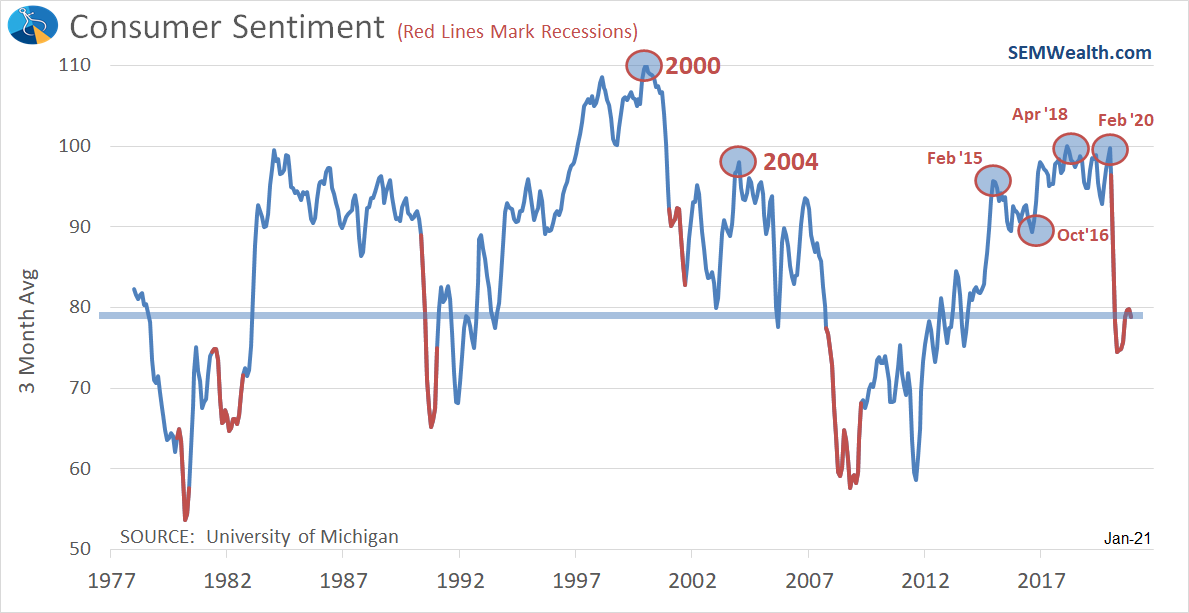

Whatever your opinion is on the virus and the response, the key will be getting consumer confidence higher. Vaccines will help do that. As long as we do not go backwards or find out the vaccines do not work on the new variants, we should see confidence begin to move higher. More confident consumers means more spending, which means (theoretically) justification to own stocks.

3.) Federal Reserve

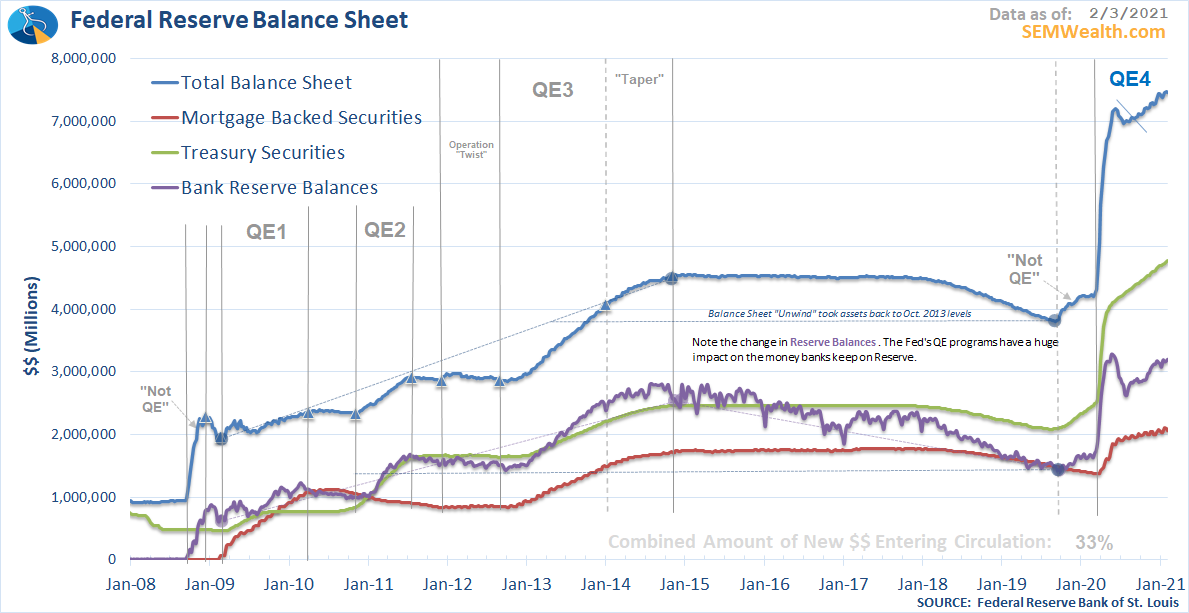

Last March the Federal Reserve proved they would do "whatever it takes". With funding from the Treasury Department, the Fed was able to buy all kinds of securities never thought possible. In practice, the Fed being able to buy risky bonds was enough. They ended up not buying too many bonds which led to the Trump administration to pull back the money from the Fed. It will take another act of Congress to allow the Fed to again have those powers.

The Fed has been able to keep the financial system afloat by using their 2008-2013 tools – Quantitative Easing. This is helping support the runaway stimulus already put into practice. The way it works is simple: The Government issues bonds. The Wall Street banks buy the Treasury Bonds at auction. The Fed creates electronic currency to purchase those bonds from the Wall Street banks. Here's the latest look at what this has done to the Fed's Balance Sheet.

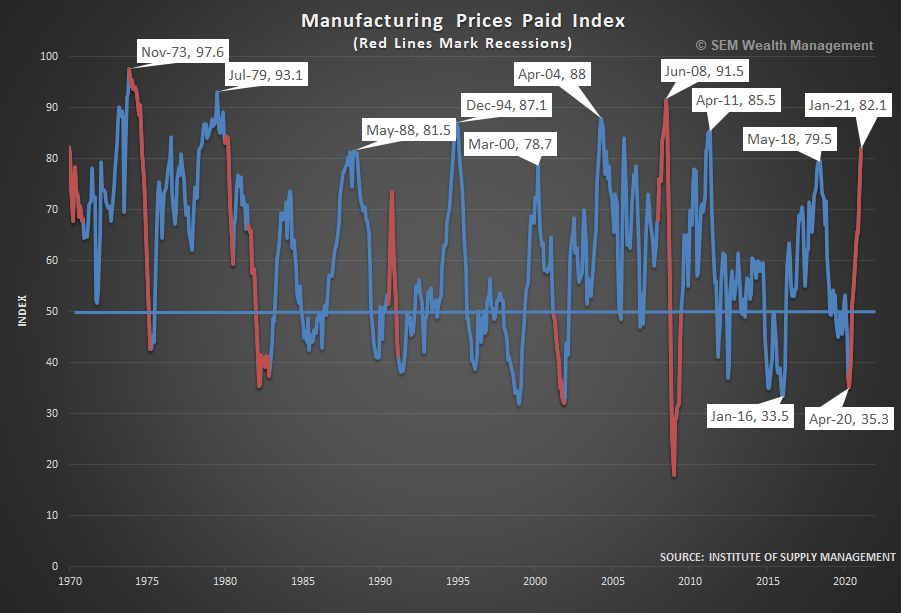

While that is currently supporting stocks, the fear is the combination of the unprecedented spending supported by the Fed will lead to inflation. This is already showing up in the latest ISM Manufacturing survey.

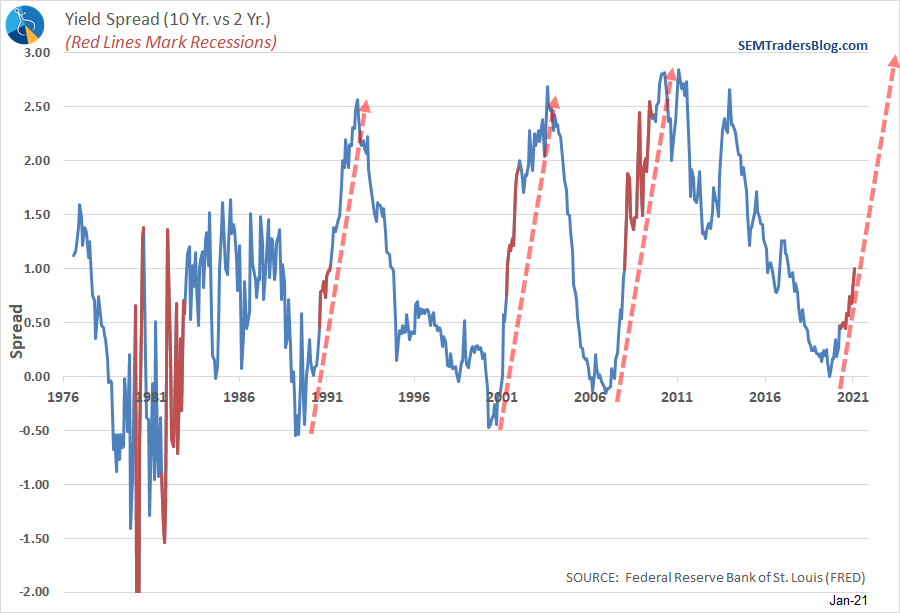

In a normal environment, inflation due to economic growth is a good thing for stocks. When this happens, long-term interest rates typically move higher faster than short-term interest rates. This shows up in the chart of the yield spread between 2 year and 10 year rates.

I drew some arrows on the chart. They are all the exact same length and slope. This means if we see a similar spike in the spread, by the end of 2021 the 10-year Treasury could be close to 3% (given the Fed is unlikely to raise short-term interest rates.)

The real question is whether the economy could handle that type of spike in rates. Remember, one of the strongest indicators is Building Permits, which has been supported by historically low interest rates. The Fed has had little success controlling the longer portion of the yield curve.

SEM Positioning

As I said in the video at the top, we will follow the money. For now, Wall Street is confident in the 3-legged stool supporting the stock market, so our AmeriGuard and Cornerstone models remain fully invested (as do our Tactical models, EGA and TB). We are also overweight small and mid-cap stocks as Wall Street continues to put money towards the "recovery" trade.

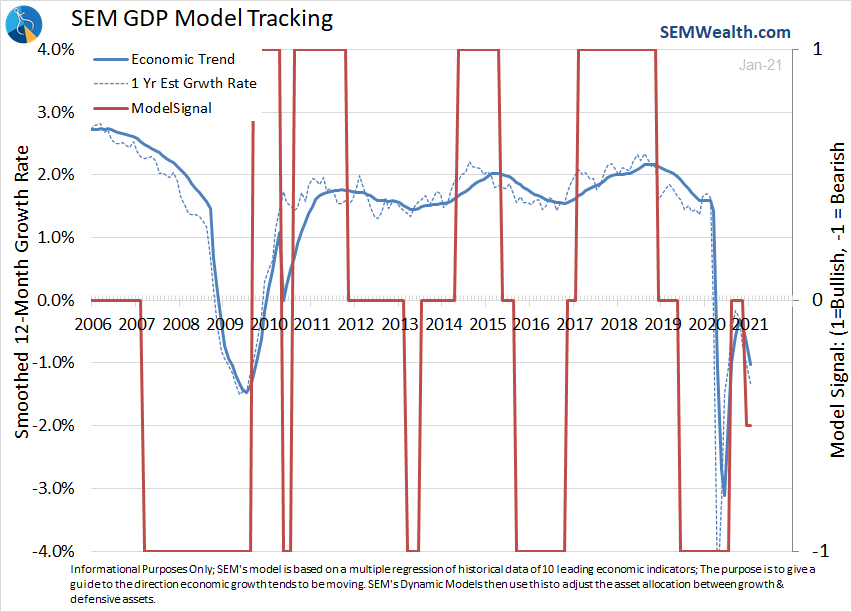

Our economic model is concerned about the latest weakness. This model drives our Dynamic model allocations. This leaves us with a partial allocation to small caps and emerging markets on the growth side, and a small allocation to dividend paying stocks on the income side. We have no long-term Treasury bond exposure.

Investing is the most dangerous when things seem easy. Based on conversations I continue to have, a lot of people think it's easy right now. SEM has been around for nearly 30 years because we have the ability to participate in the "easy" times while having a plan to protect our gains when things become much more difficult. There are a lot of things that can go wrong in 2021. Please be careful.