It's hard to believe this is the 5th year of 'Monday Morning Musings'. This all started back in 2020 when there was so much happening I would post a 'brain dump' of all the things crossing my desk which I thought were important. Eventually the chaos of 2020 slowed down a bit and some weeks the Musings turned into more 'thought pieces' where we took a deeper look into some big picture concepts. Along the way we had periods where again, everything seemed to happen in a matter of weeks so the 'musings' covered more topics with shorter paragraphs.

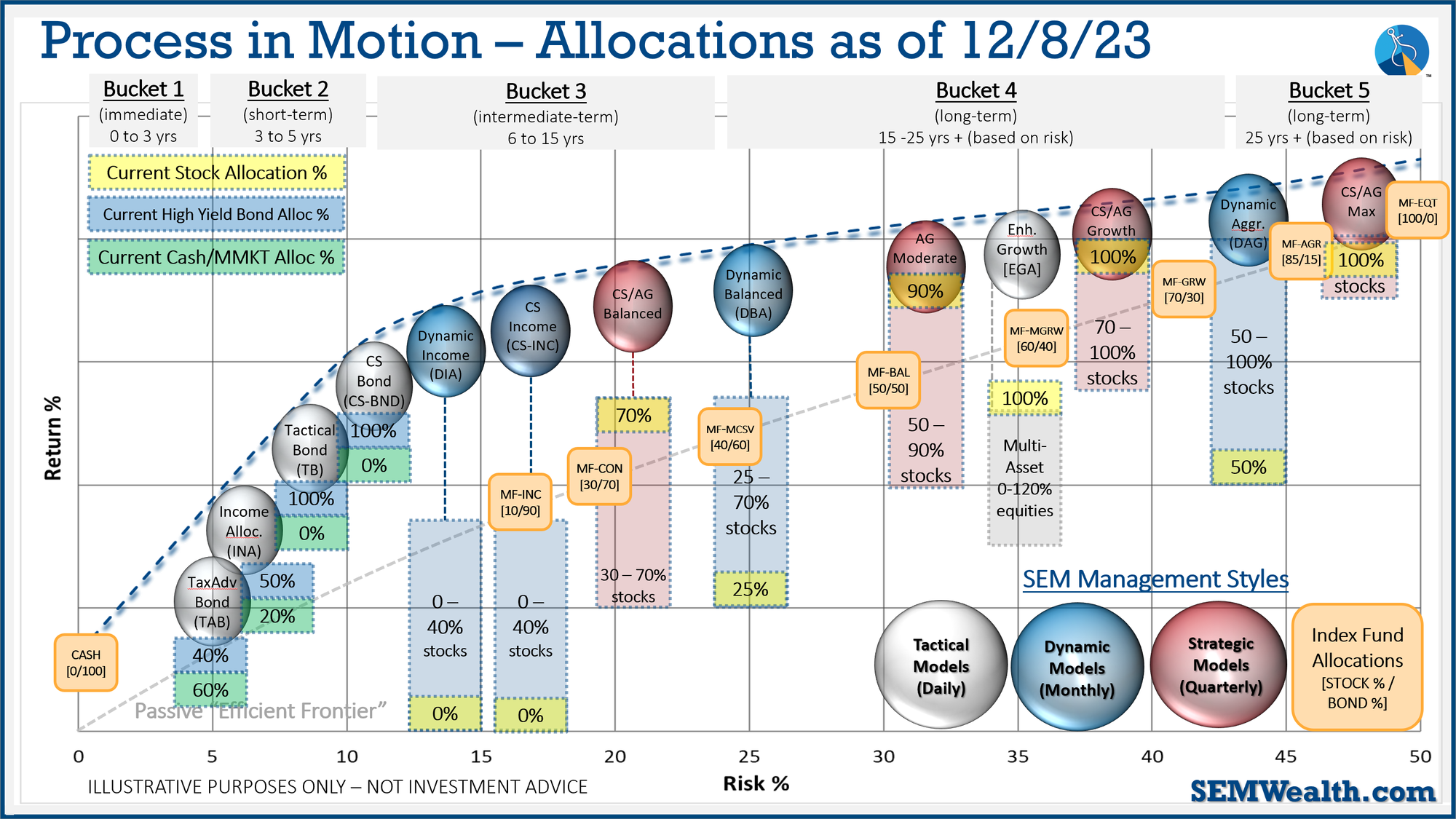

The middle of last year we also started a new segment at the bottom of every page showing the current positioning of all 3 of our management styles and a short discussion of their positioning.

With today being the start of an already busy week, I'll return the musings back to its original roots with a random list of all the things that have crossed my mind as we flip the calendar:

- The S&P 500 couldn't quite get to an all-time high – closing 0.6% below it's all-time closing high from December 2021. This is an important thing to understand – the S&P was up 25% in 2021, down 20% in 2022, and up 26% in 2023 yet it is simply back to where it was 2-years ago. That's how the mathematics of losses work.

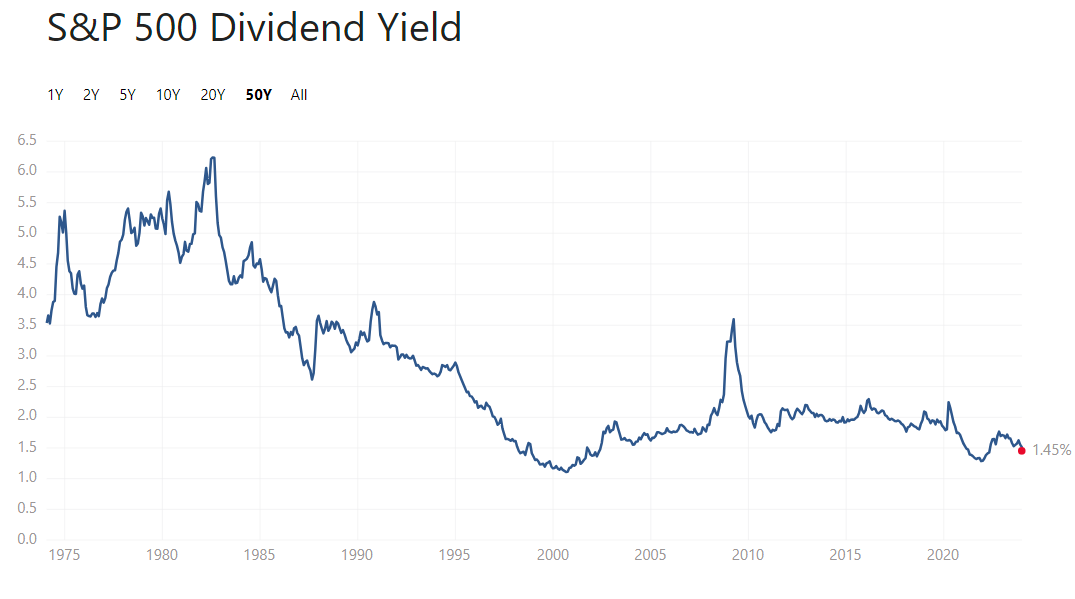

- Looking at total return, the S&P 500 has compounded at 1.4% over the past 2-years. With the index doing a 2-year round trip, that entire return is dividends. I used to use 2% as the 'average' dividend yield for the S&P 500 because that's what it has been since 1990. Given that it's a meager 1.45% perhaps it's time we lower that assumption?

- Speaking of averages – over the very long-term the stock market has compounded at 10% per year. There are always times where the market is well above average followed by periods of time where it is below average. Mathematically, the formula for any stock market's long-term growth rate is: Economic Growth + Inflation + Dividends. The long-term average back to 1950 for each is 3%, 3%, and 4%.

- Looking forward our economy will have a hard time growing at 3%, the Fed believes inflation will trend back to 2%, and we already mentioned dividends now running below 2%. If Growth, Inflation, and Dividends all average 2%, the potential return for the market is 6%.

- I haven't seen Wall Street and investors alike more optimistic to start a year since.......2022. Everyone was equally pessimistic when 2023 started. When it is hard to find anybody who believes things could go wrong it is probably time to worry about things going wrong.

- On the positive, we are starting to see outflows from money markets and savings accounts ahead of the Fed hinting they may start lowering interest rates. That money flowing into stocks could lead to another strong year.

- Another positive as we noted throughout the 4th quarter was the "broadening" of the market to small and mid-cap stocks along with 'value' companies. Those groups all still underperformed the mega-cap growth dominated 'stock market', but a healthy market is one with many companies participating, not just a handful of them.

- One interesting thing to watch will be rebalance activity to start the year. Most 'strategic' (basically buy & hold/passive) portfolios are massively overweight large cap growth and massively underweight small cap stocks. If they are simply trying to track a "total market" index which is capitalization weighted they won't ever rebalance. However, if these portfolios have a mandate of a specific weight to these categories (many have 8-12% small cap stocks, which are down to 4% of the Vanguard Total Stock Market Index) there could be large scale sell orders in Large Cap Growth with the money flowing to Small Caps. I wouldn't read into this too much the first few weeks.

- In fact, it would be a very positive sign if large cap growth underperforms and small caps outperform. This would be a hint that the economy is 'ok' and the smaller, more fragile companies are not running into earnings trouble.

- The issue I have comes back to averages and logic – the economy grew at 3% in 2023, essentially 'average'. S&P earnings are set to grow right around 10% in 2023, again essentially 'average'. The consensus of economists and the Federal Reserve is the economy is only going to grow at 1.5% in 2024, yet Wall Street is expecting corporate earnings to grow at 14%. I'm not sure what world allows for the economy to grow at half the long-term average, but earnings to grow 40% faster than average.

- We're not supposed to talk performance of our models in here, so I'll be very general in discussing the impressive 2-years from our Dynamic models. Despite being 'wrong' about the economy (the economic model has been essentially 'bearish' since April 2022), both posted not only an impressive 2023, but after reducing losses significantly in 2022 have really proven the value of having these unique investment models in most portfolios.

- Even more impressive to me is our 'income' models, weathering the worst bond market drop in our lifetimes and then still participating in the 4th quarter 'come-back'. Past performance is not indicative of future results, but those people who stuck it out in those models obtained similar 2-year returns with about 1/4 of the volatility.

- Conspiracy theories are already running rampant about the Fed and Congress doing everything possible to keep the Democrats in control. I don't buy that with the Fed, but we should fully expect Congress to be pushing 'growth' (spending) initiatives in the upcoming year. This is one reason markets are typically up in Presidential election years (regardless of who is in control).

- I cannot say this enough, but especially this year – DO NOT LET YOUR POLITICAL OPINIONS INTERFERE WITH YOUR INVESTMENT DECISIONS.

- Speaking of Politics, have you seen the above headline predicting the 'worst crash of our lifetime?' I've been asked about it so many times, I had to add a section to our online client newsletter. Click here to read my thoughts.

- Our social and political climate in the US is unstable, which could cause more volatility in the stock market this year. Please do not take unnecessary risks simply because you feel like you are missing out. Remember the S&P 500 returns the past 3 years – +25, -20, +26. Can you afford and/or stomach another 20% (or bigger drop)? Some people can, some people can't. Nobody can give you blanket advice about your personal investments nor can they predict what is going to happen this year.

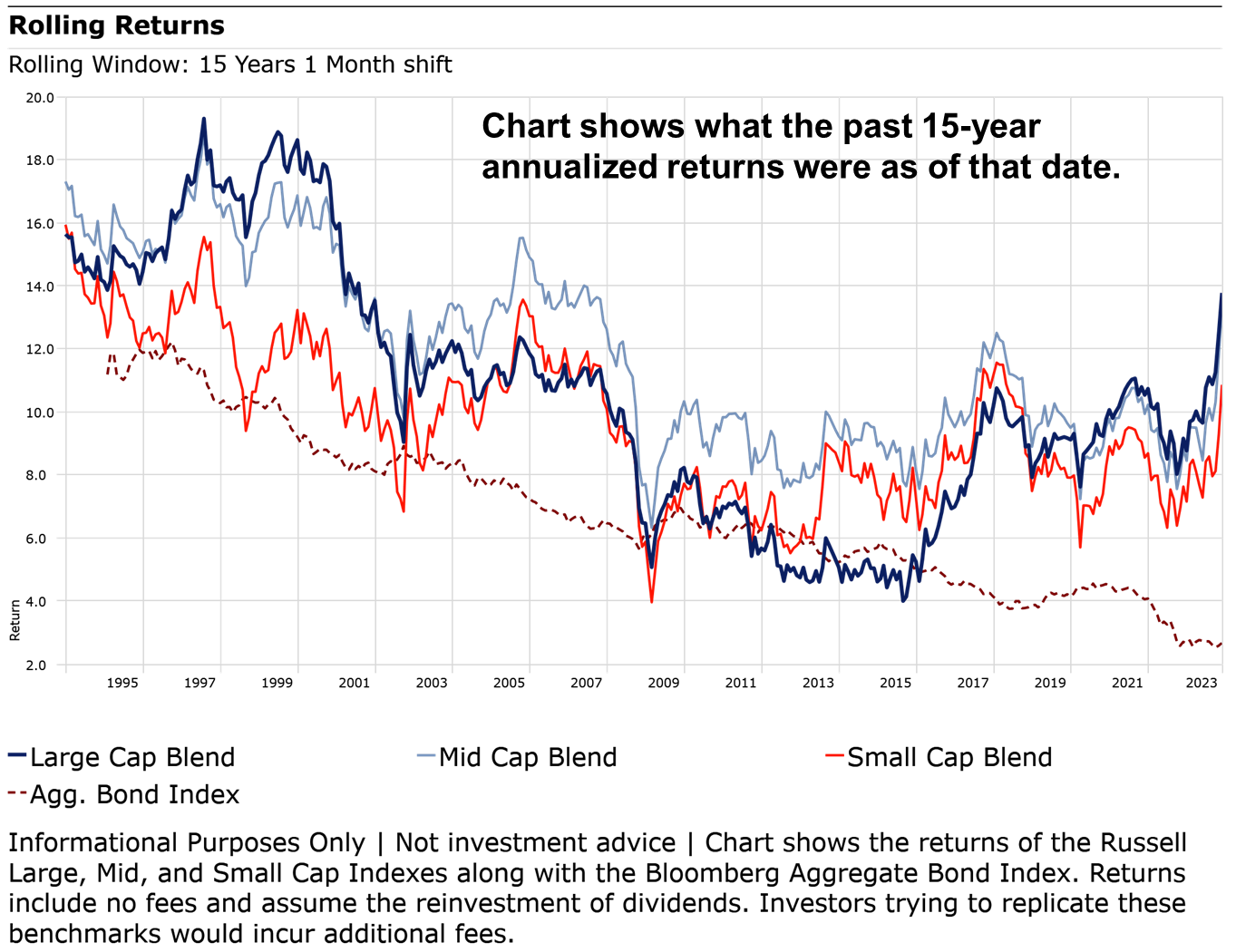

- I've spoken about this before and featured this chart in our newsletter. The 'historic' return numbers you use to make decisions will vary greatly which could lead you to make the WRONG decision. I remember in the late 1990s there were advisors using 13% or bigger return assumptions for stocks. As far as I know, Dave Ramsey is the only one who still believes this is possible. When 'historic' returns are well above average, the next 10-15 years are likely to be below average. Can your plan/investment portfolio handle this?

- Speaking of our Newsletter, it posted over the weekend. Lots of good charts helping put the market performance in perspective.

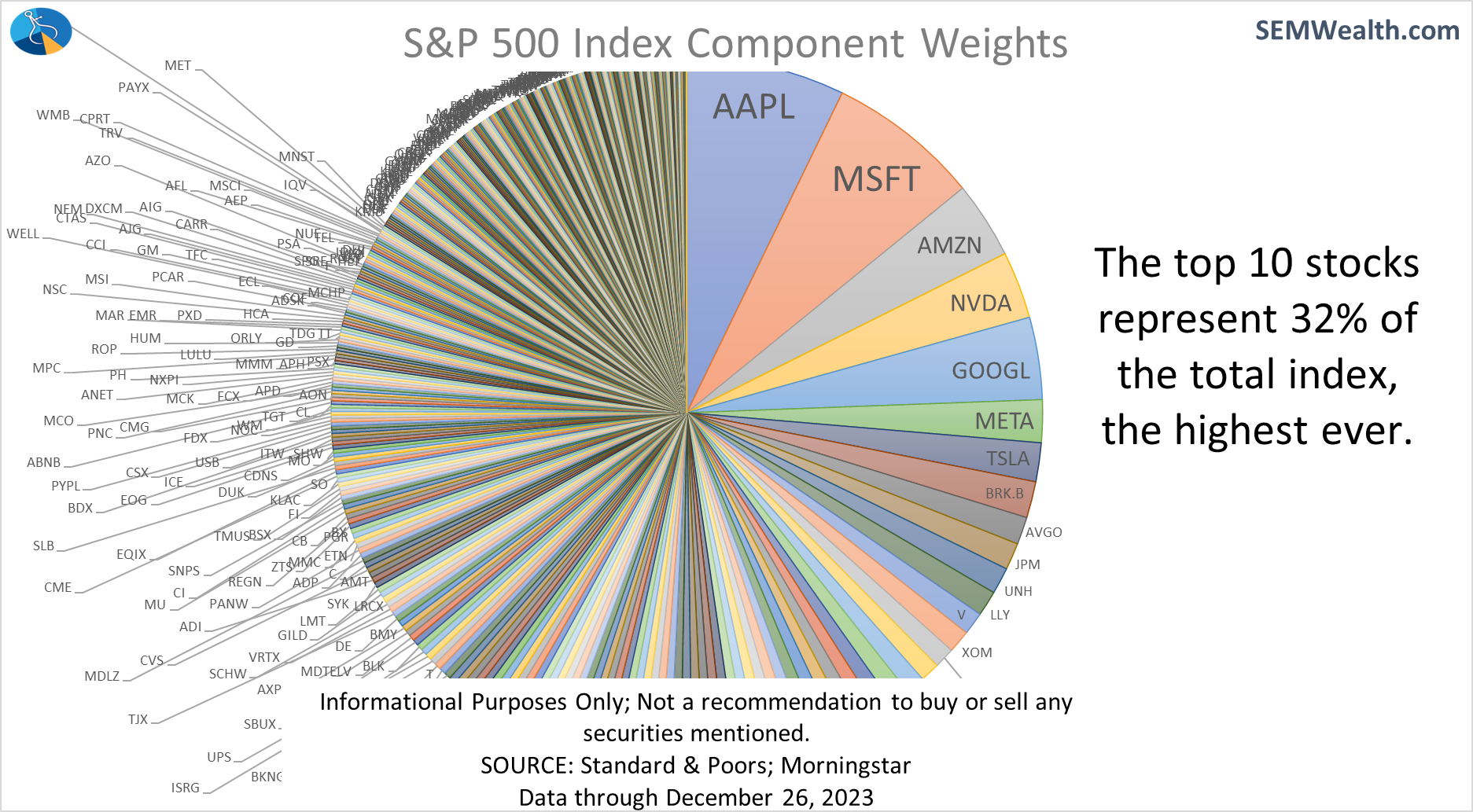

- One of my favorites is the S&P 500 allocation chart. I think it really frames what you are actually investing in when you buy a low cost index fund. 32% of your money is in 10 stocks with 26% of the money in 6 technology stocks.

- AI is very cool, will change how all of us live, work, and play. Who will make money from it and who will be the ultimate winners? Nobody knows. The winners may have not even been formed yet. We also don't know what impact the government will have in restricting this growth.

- Think about the chart above and what we knew about them in 1994 – Apple was a niche company selling very expensive computers, Microsoft was basically giving away their operating system to gain dominance on the PC, Amazon was in the planning stage to become an online bookseller , Nvidia was a new graphics chip maker for PCs, Google, Meta, and Tesla weren't even around yet. The chances of anybody successfully identifying the top companies who will be the dominate players this early is nearly impossible.

- Do people still 'hate' bonds? I've heard a lot more positive talk about investing in bonds recently. I'm not sure how I feel about them following the 6% rally in the 4th quarter. I was excited about the current yields and potential for gains in September, now with a slowing economy and the continued high use of debt by consumers, businesses, and our government I'm less confident.

- I guess the best way to summarize how I feel at this point is – I'm really glad we don't have to subjectively decide when, where, and how much to invest.

Buckle up! 2024 could be a wild ride!

Market Charts

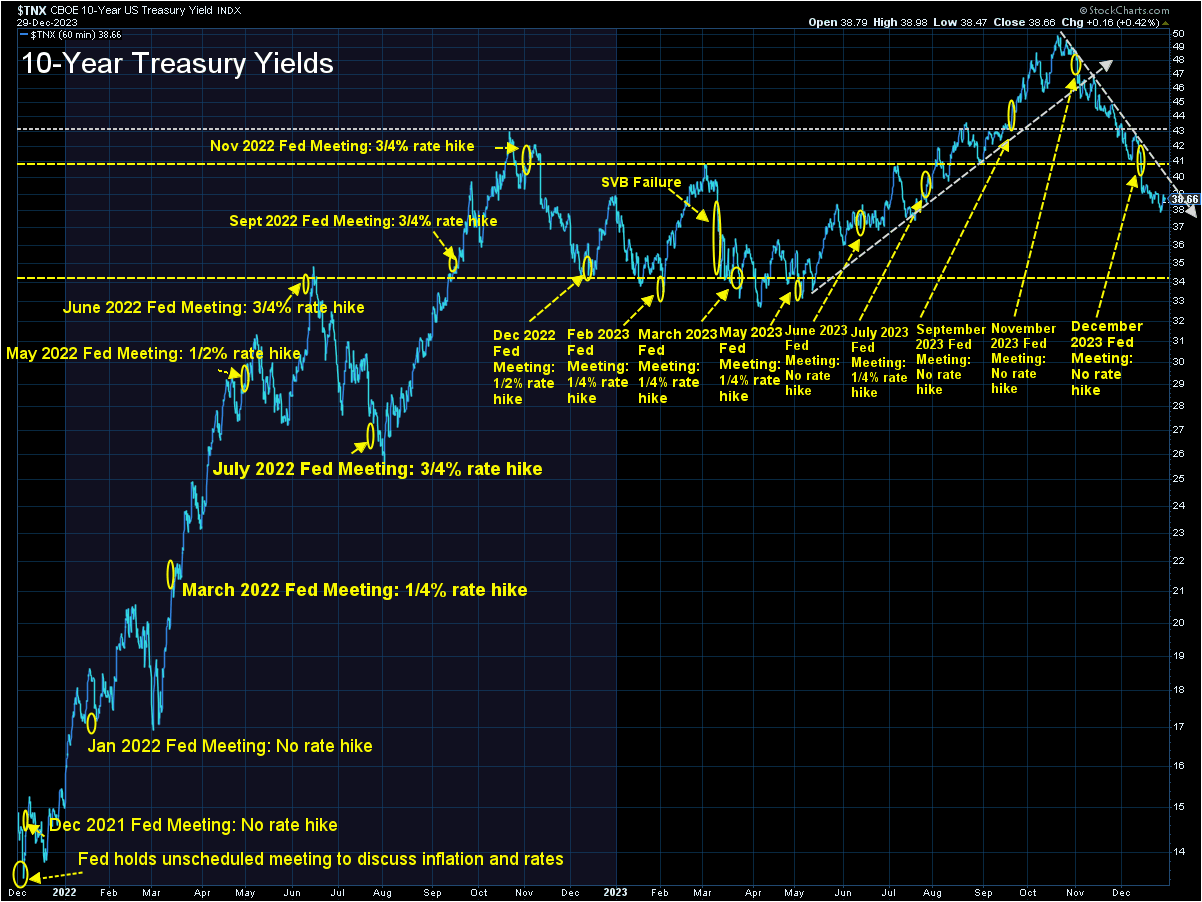

2-years ago this week, the Federal Reserve 'shocked' everyone by saying, 'uh guys we need to raise interest rates to fight inflation'. Now we find the S&P 500 right back to the point it was when they said they were starting their inflation fight with the market expecting them to aggressively cut interest rates in 2024 (7-8 times for a total of 1.75-2% according to the Fed Funds Futures Market). Based on the big rally since the Fed was thought to declare the end of the inflation fight, it won't take much to spook the stock market.

The thing I can't (subjectively) get past is shown here. You're simply paying too high of prices for growth that is likely not going to happen. Successful investors do not chase stocks higher. Buy low/sell high is easy to say, but very difficult to do.

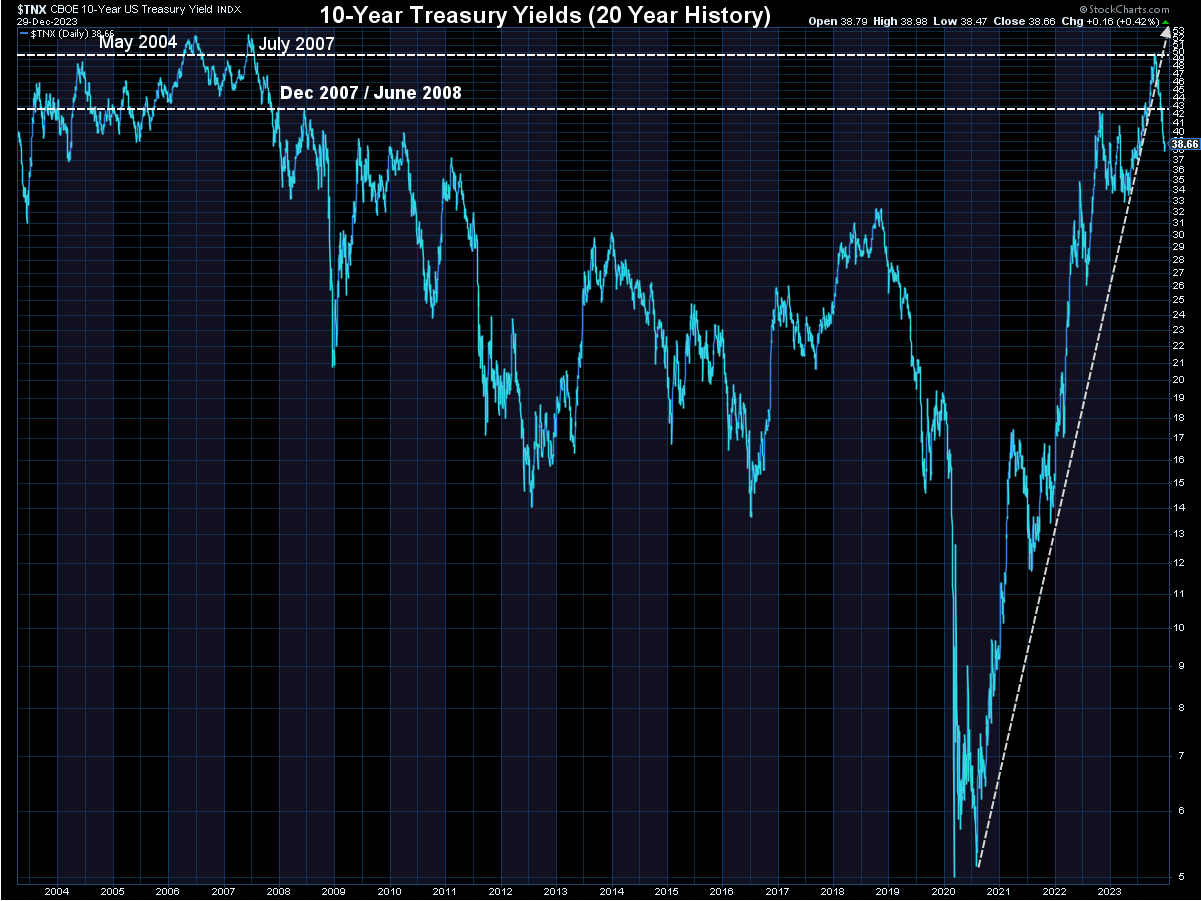

The story of the quarter was the big drop in Treasury yields. Was this the end of the bond bear market or will rates shoot back higher if inflation cannot get back to the Fed's 2% target and/or the Fed is not able to cut rates as aggressively as everyone believes they will?

More importantly, what is the 'normal' range of interest rates? We spent most of the 2010s with 10-year rates between 1.5-2.9%. However, the 2000s saw rates range from 3% to 5%. The government is going to continue borrowing money at an increasing rate. What will the market demand they pay in interest to cover this non-stop borrowing? I have a hard time without any Fed intervention imagining the market would be ok lending money to the US government for 10 years at 2% again.

SEM Model Positioning

-Tactical High Yield went on a buy 11/3/2023

-Dynamic Models reverted back to 'bearish' 12/8/2023

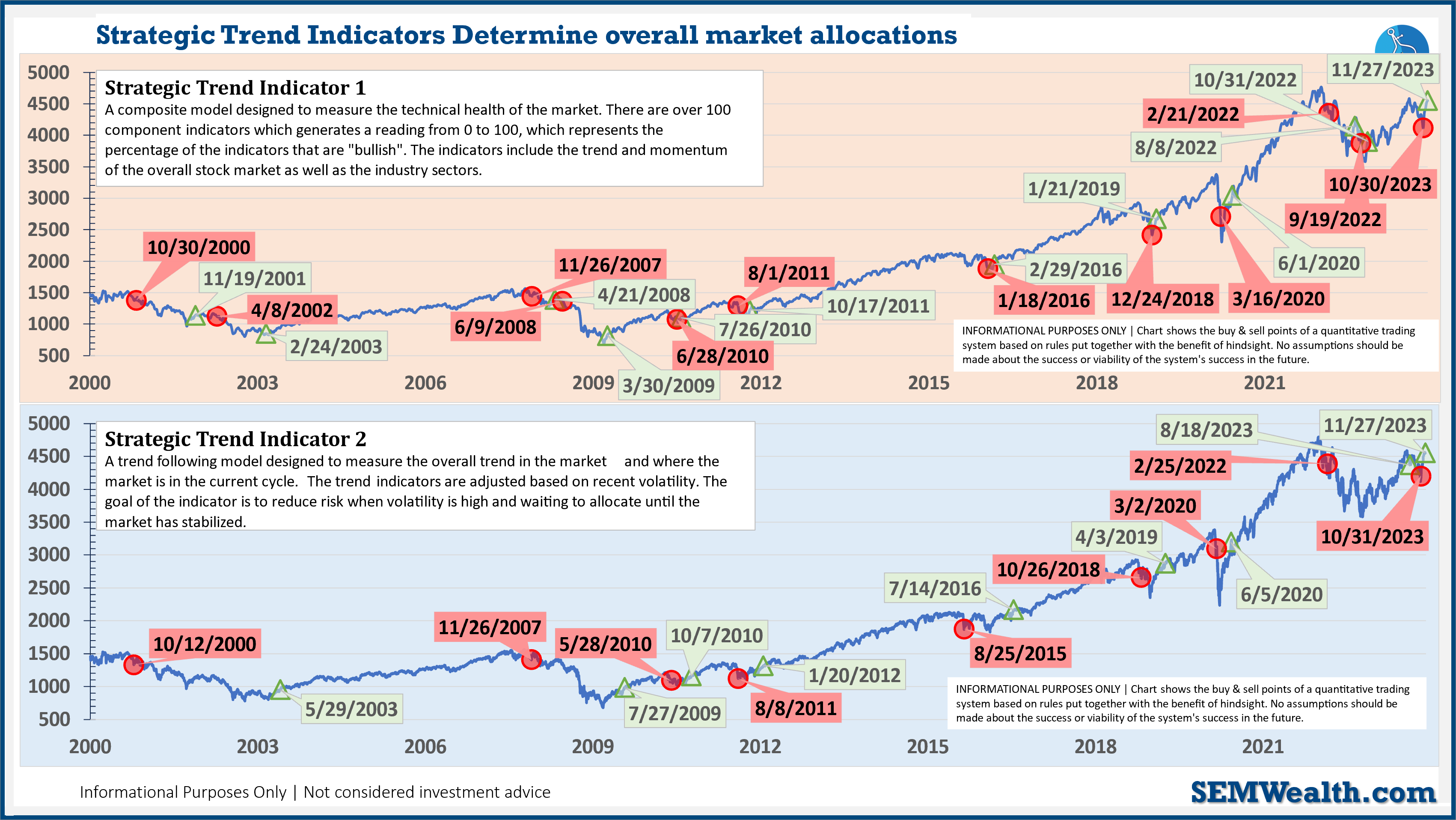

-Strategic Trend Models went on a buy 11/27/2023

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

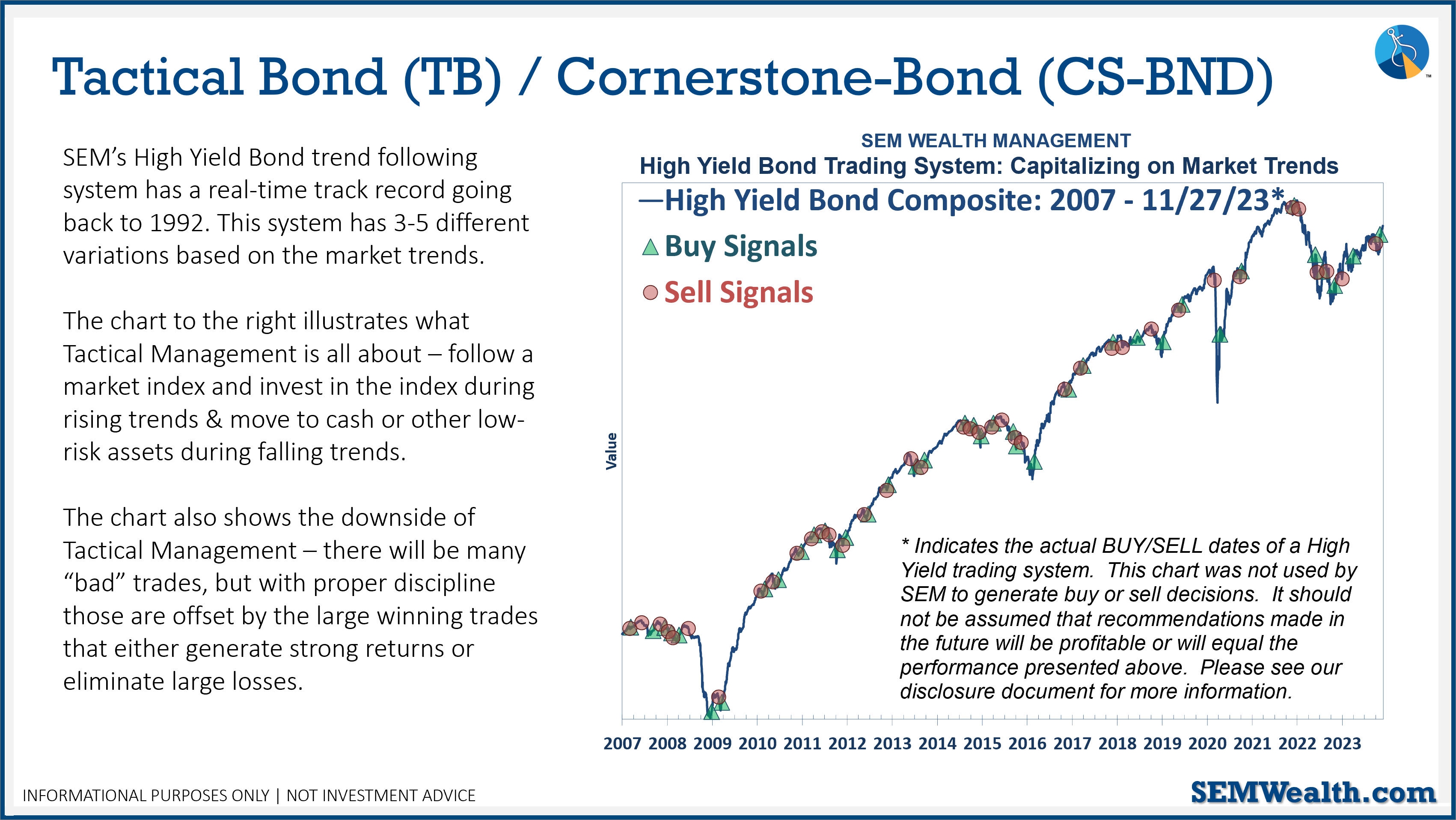

Tactical (daily): The High Yield Bond system bought the beginning of April and issued all 3 sell signals 9/28/2023. All 3 systems were back on buy signals by the close on 11/3/2023. The bond funds we are invested in are a bit more 'conservative' than the overall index, but still yielding between 7.5 -8.5% annually.

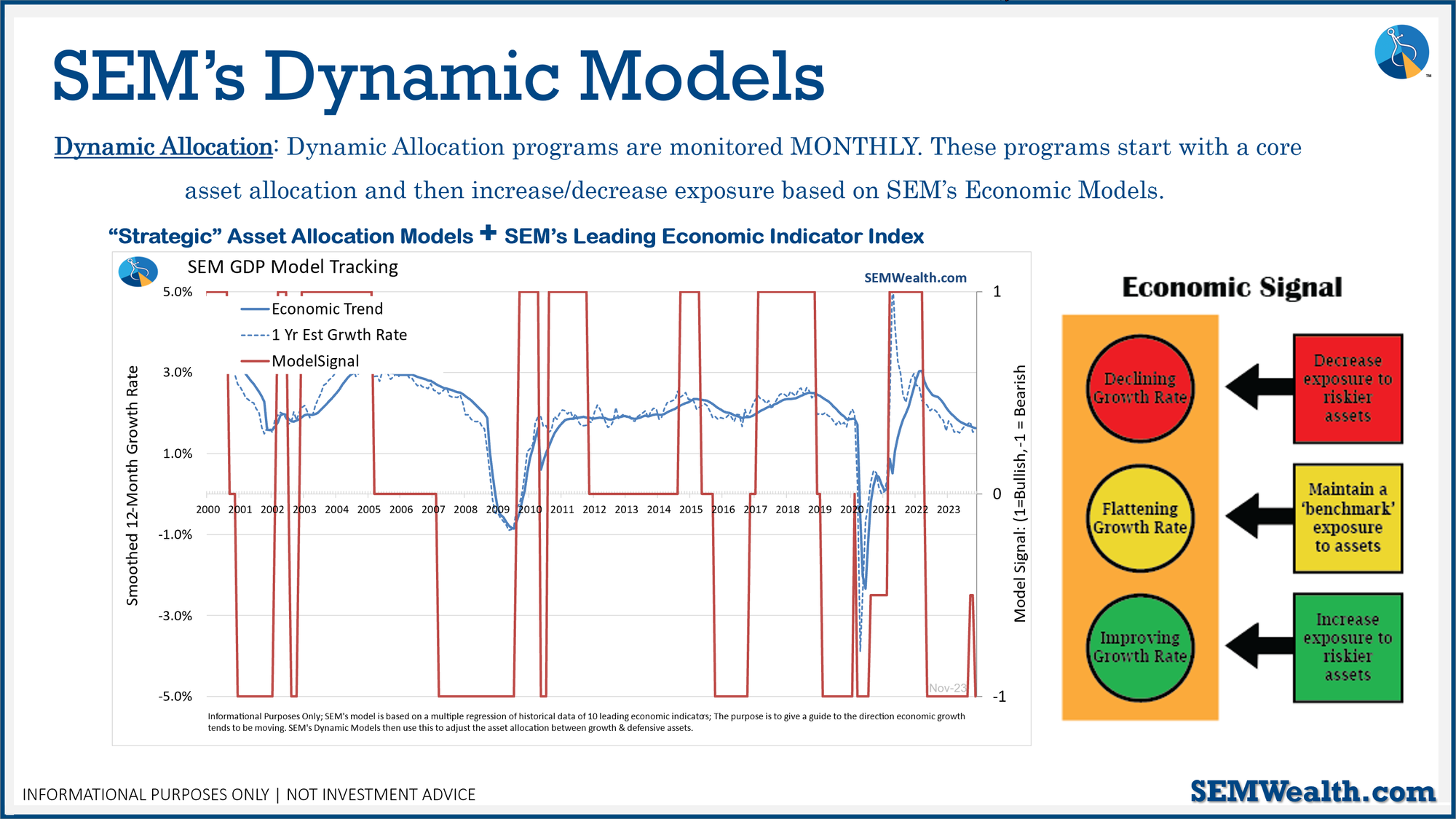

Dynamic (monthly): At the beginning of October the model moved slightly off the "bearish" signal we've had since April 2022. At the beginning of December it reverted back to "bearish". This means no positions in dividend stocks (Dynamic Income) or small cap stocks (Dynamic Aggressive Growth).

Strategic (quarterly)*:

BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.)

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stock up: