Is it possible for the last 10 weeks to have flown by, but also to feel like the longest 10 weeks of your life? The last 10 weeks have been a whirlwind and have had seemingly inconceivable developments every single day. At the same time, they've also felt like this:

The Cornerstone Portfolios launched earlier this year to help investors align their investments with their Christian values and impact God’s kingdom. We understand there are some grey areas, and we won’t find a fund manager that perfectly aligns with everyone’s values; however, our goal is to work

Our brains are programmed to only factor in events we've either experienced or have studied. There's nothing wrong with that, but it's something we all need to understand as we deal with something NOBODY has experienced. Despite the best efforts of stock market "experts," we also have never seen anything

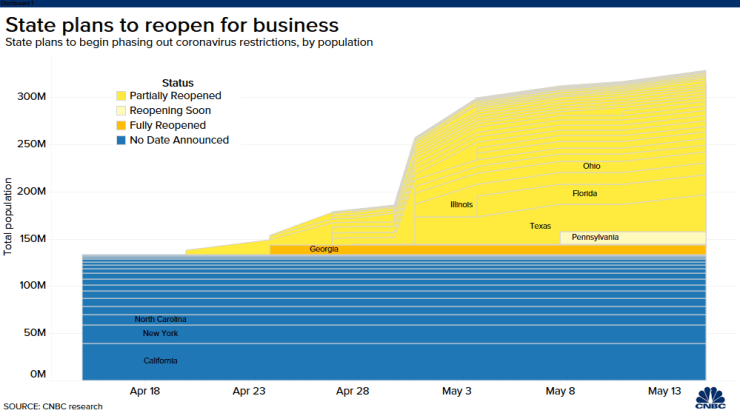

We are starting week 9 of the COVID19 Panic. Many more states opened up on Friday. Here in Virginia we have one more week (hopefully) before non-essential businesses with less than 10 people in their stores/shops at a time can re-open. As I said last week, we're going to

In the fall of 2019, the banking system froze due to the amount of new debt being auctioned by the Treasury Department to finance the budget deficit. The Federal Reserve had to step in and provide "temporary" emergency funding to save the banking system. At the time, the total issuance