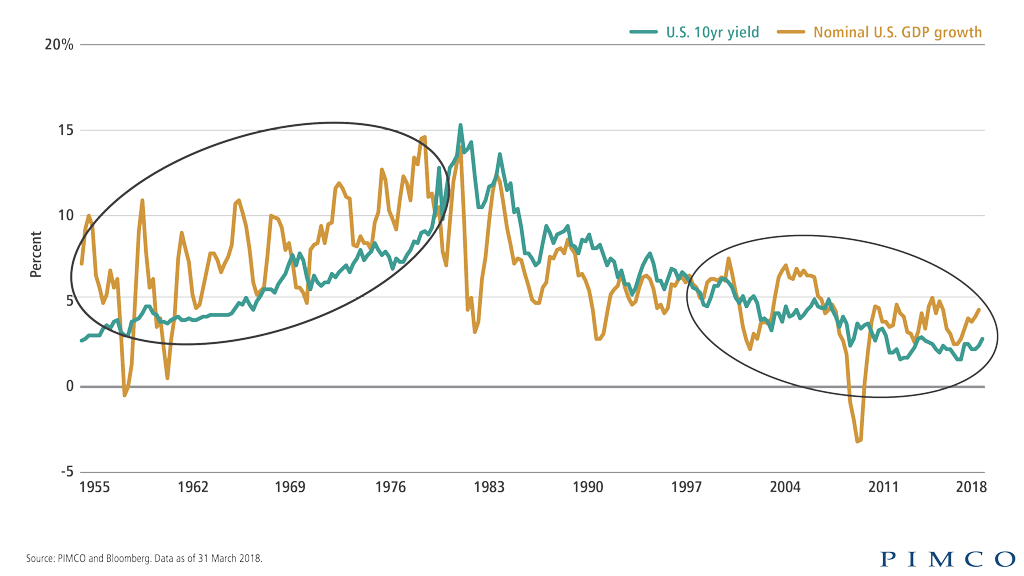

It was 2010 when I first began having to answer concerns about rising interest rates. The media had picked up on the Wall Street story that rates were destined to rise which was bad for bonds. Their recommendation was to sell bonds and buy stocks. Focusing only on returns this

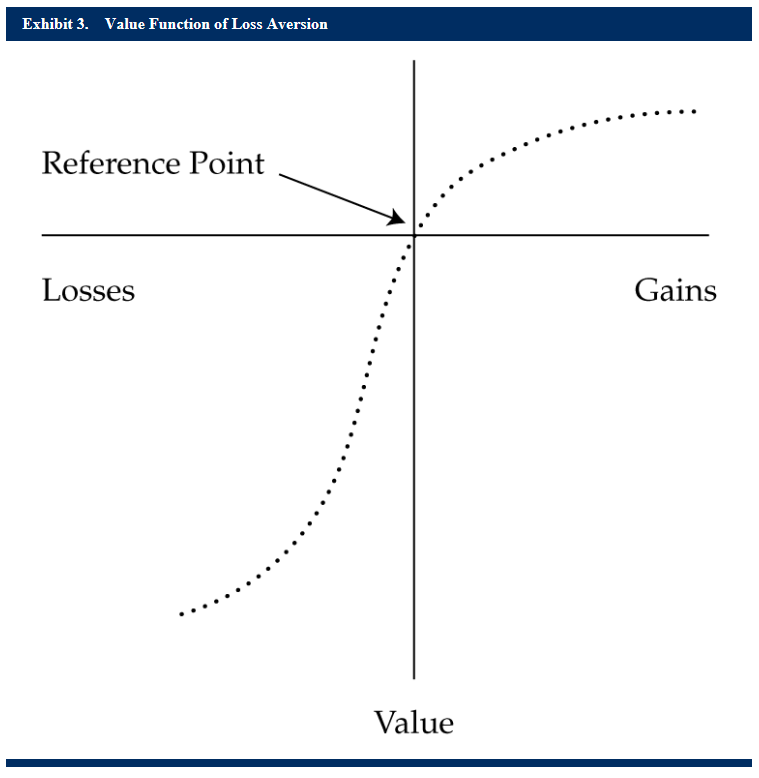

SEM applies a Behavioral Approach to Investing. Our total portfolio approach is designed to overcome the most common behavioral biases. To understand the importance of this we need to first understand the biases. About two years ago I posted a video clip from one of our client seminars where I

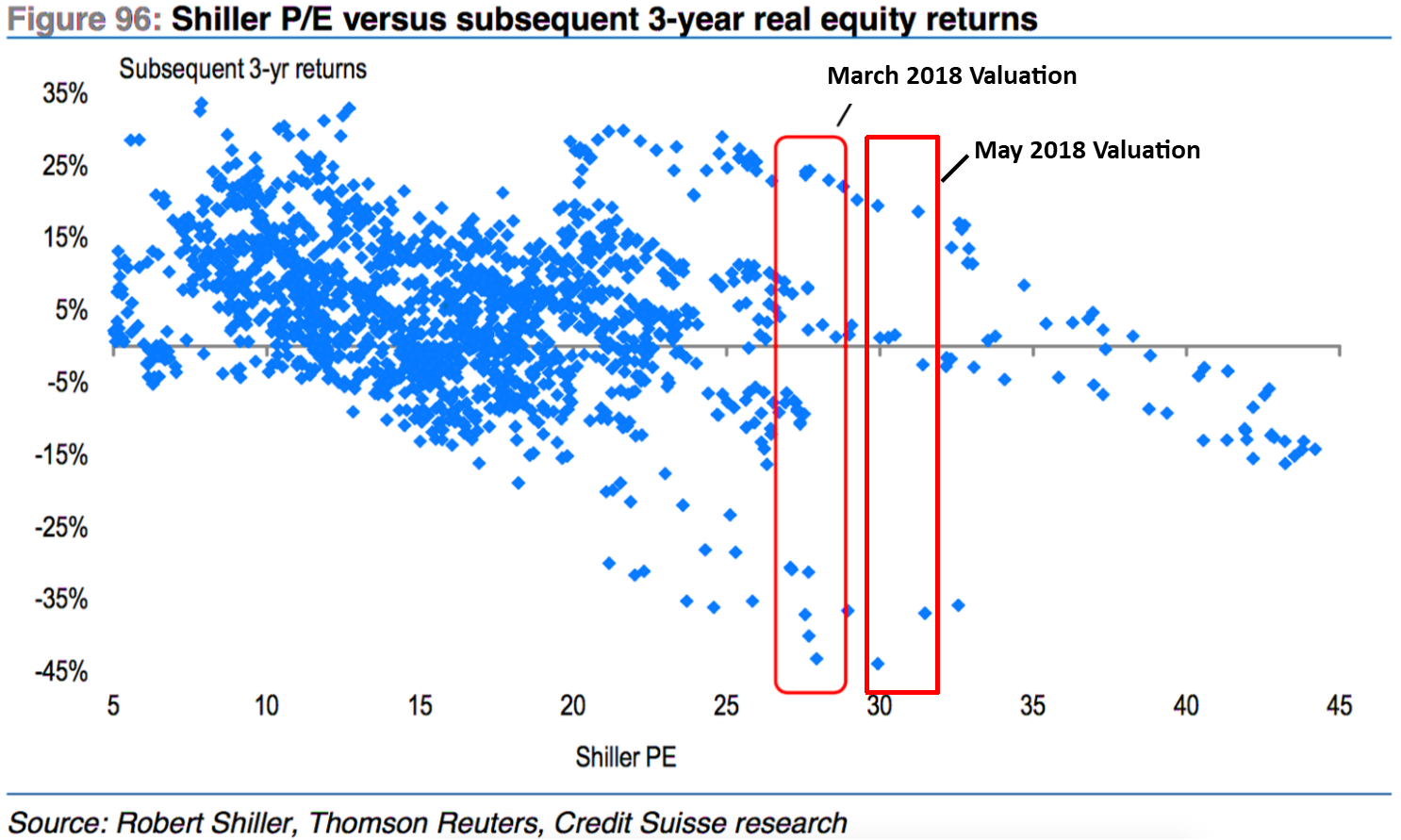

After 20 years with SEM I should not be surprised to see how many people get sucked into the late stages of a bull market. We all have heard the key to investing – “buy low, sell high.” Unfortunately, our brains typically trick us into forgetting this wisdom.

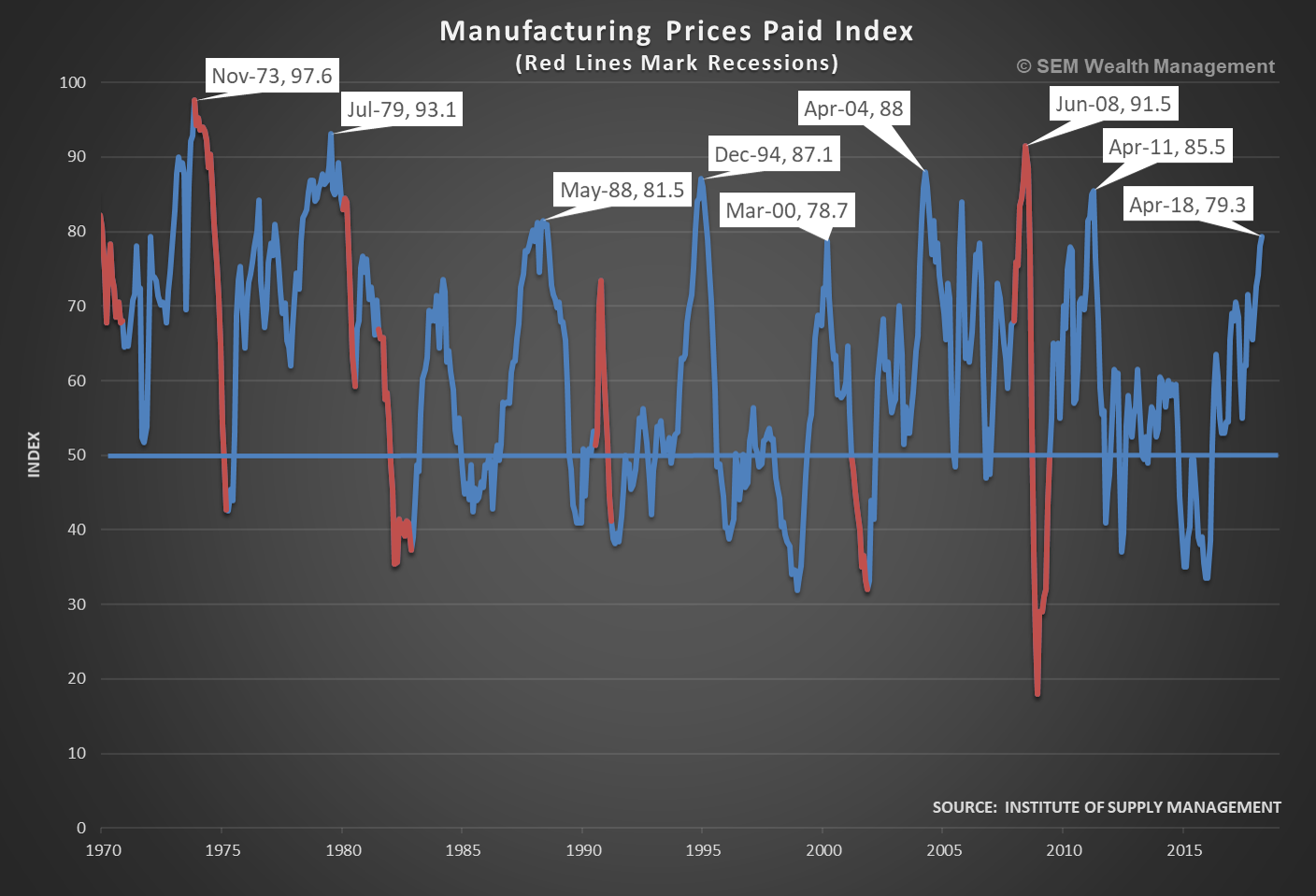

Unlike the January employment report, the April report did not have any blatant data points that caused a “crash”. With average earnings only rising 0.1% myopic market participants celebrated the lack of wage inflation, hoping this will allow the Fed to take a few more months off

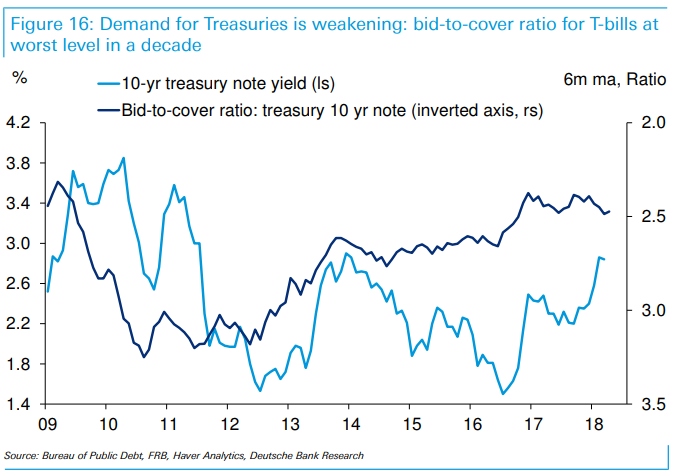

Last week’s Chart of the Week discussed “Conservatism” bias where we tend to fail to incorporate new information into our assessment of the current and future environments. I pointed out the tightening spread between long-term and shorter-term Treasuries as well as the jump in the TED