After 20 years with SEM I should not be surprised to see how many people get sucked into the late stages of a bull market. We all have heard the key to investing – “buy low, sell high.” Unfortunately, our brains typically trick us into forgetting this wisdom.

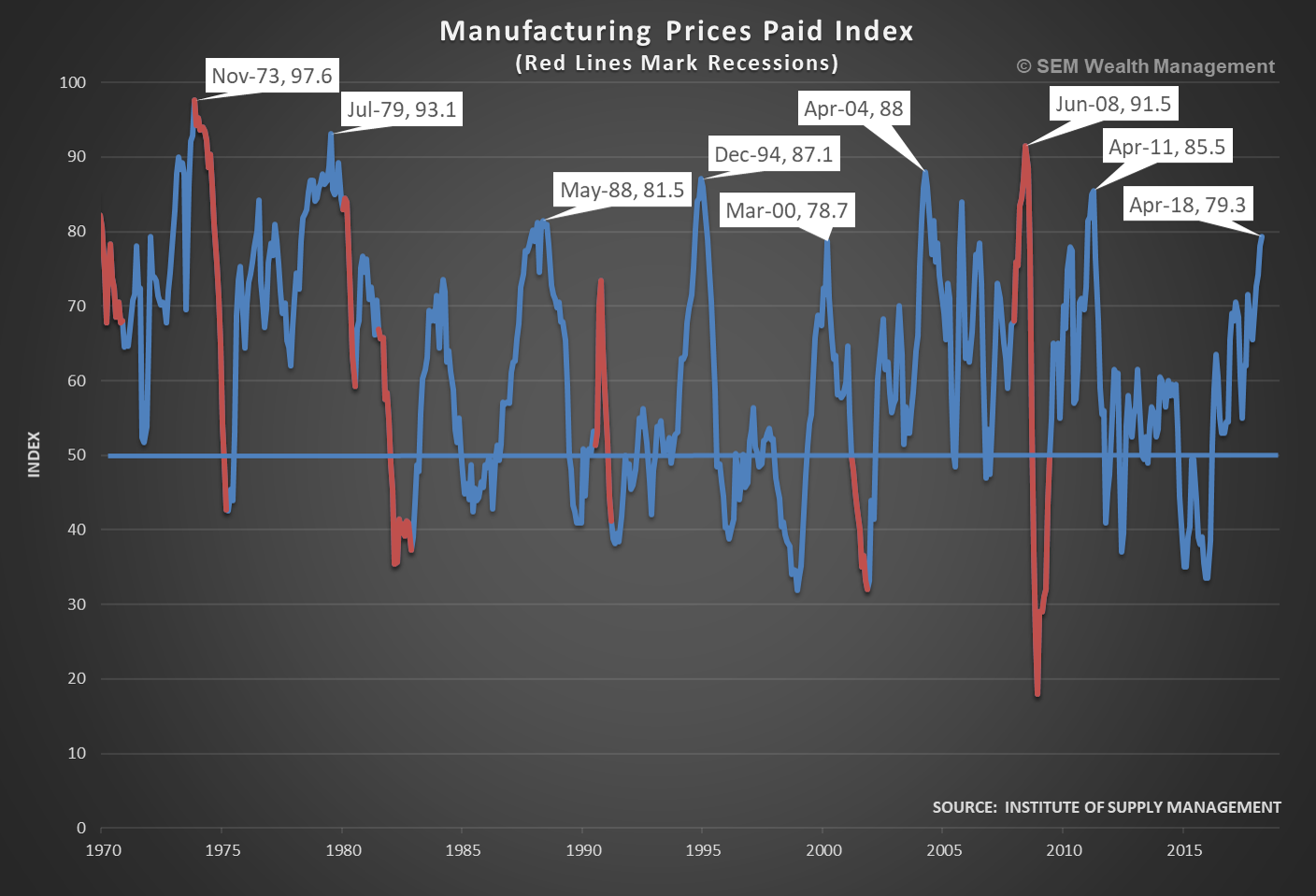

Unlike the January employment report, the April report did not have any blatant data points that caused a “crash”. With average earnings only rising 0.1% myopic market participants celebrated the lack of wage inflation, hoping this will allow the Fed to take a few more months off

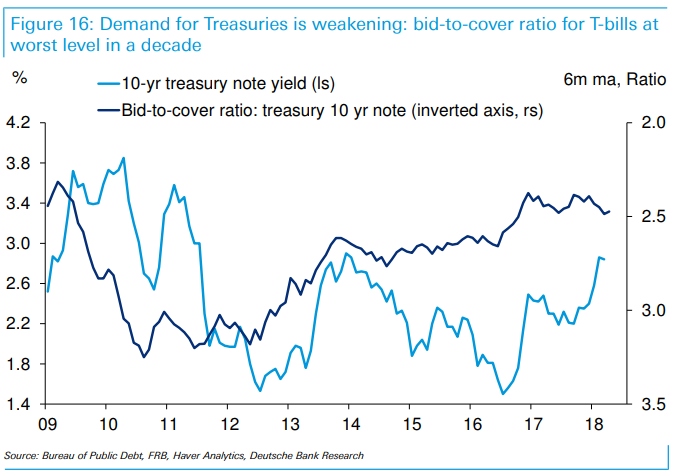

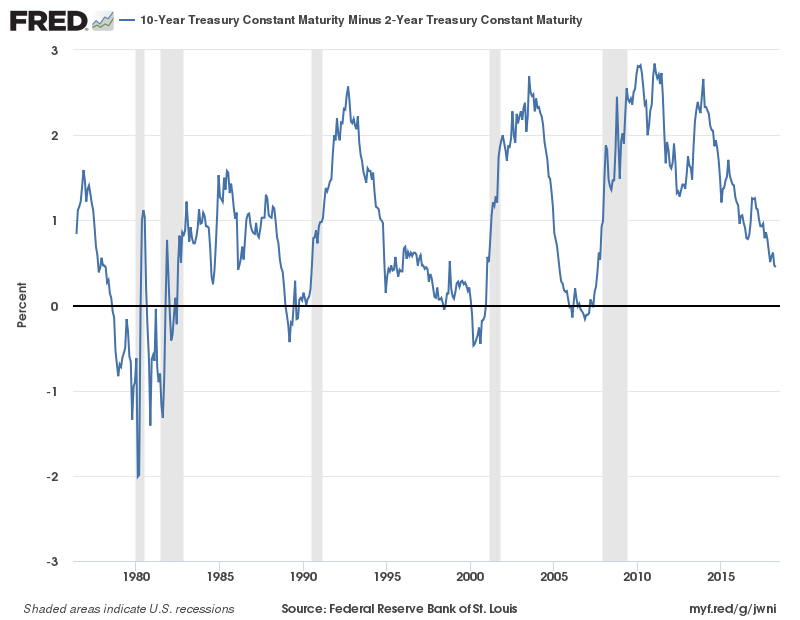

Last week’s Chart of the Week discussed “Conservatism” bias where we tend to fail to incorporate new information into our assessment of the current and future environments. I pointed out the tightening spread between long-term and shorter-term Treasuries as well as the jump in the TED

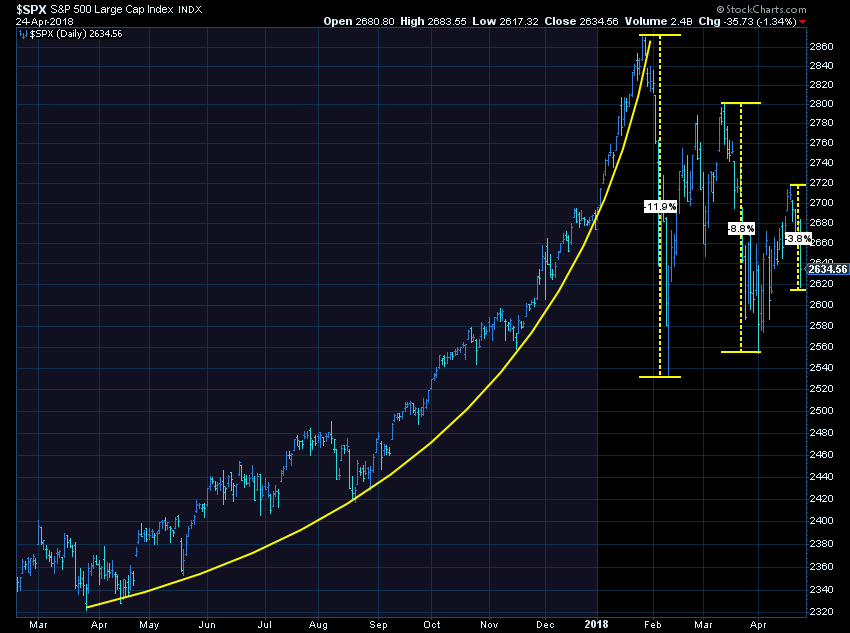

Just when I commented how the market had seemed to settle down (by not making 1%+ daily/hourly moves) volatility returned once again on Tuesday. Following the parabolic move that began last September, these sort of swings should be expected. That doesn’t make them any more comfortable.

From a

Conservatism Bias: A belief preservation bias in which people maintain their prior views or forecasts by inadequately incorporating new information. Conservatism causes individuals to overweight initial beliefs about probabilities and outcomes and under-react to new-information; they fail to modify their beliefs and actions to the extent rationally justified by the