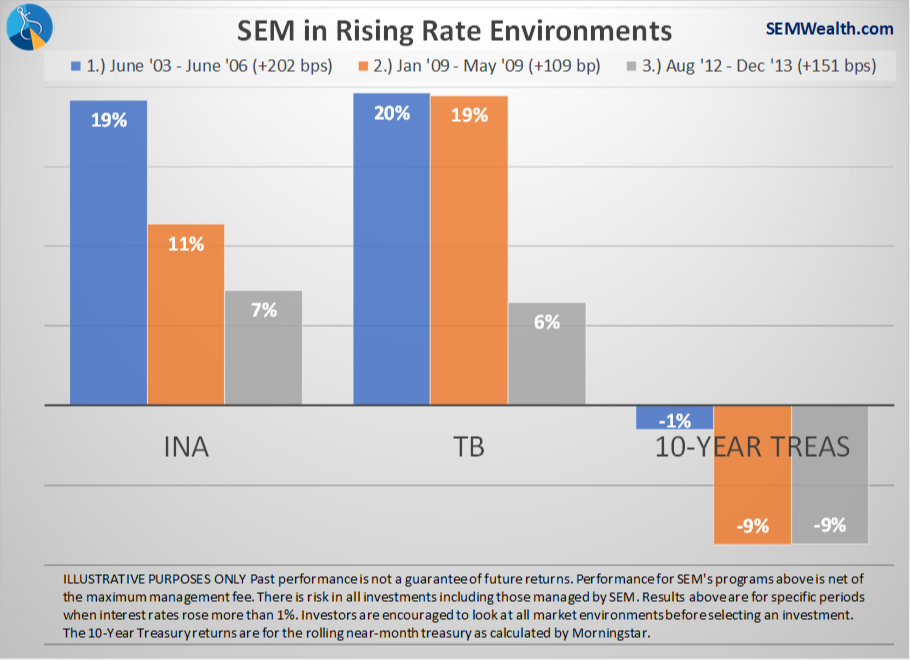

This week the Federal Reserve voted to raise interest rates again despite phantom inflation and lackluster economic growth. This has again brought out the “rising rates are bad for bonds” crowd. As expected this has caused our clients in our Income Allocator (INA) and Tactical Bond (TB) programs

This morning we are met with another tragic sign we are in the midst of the ugliest part of the Social Cycle with the shooting at a Republican Congressional baseball practice. For 10 years now I’ve been talking about this phase — the “crisis”, which is

The Department of Labor’s Fiduciary Rule has taken effect after a two month delay. Many brokers and advisors had hoped the election of Donald Trump and his promise of “slashing” regulation would mean the DOL’s rule would never become law. The problem with that

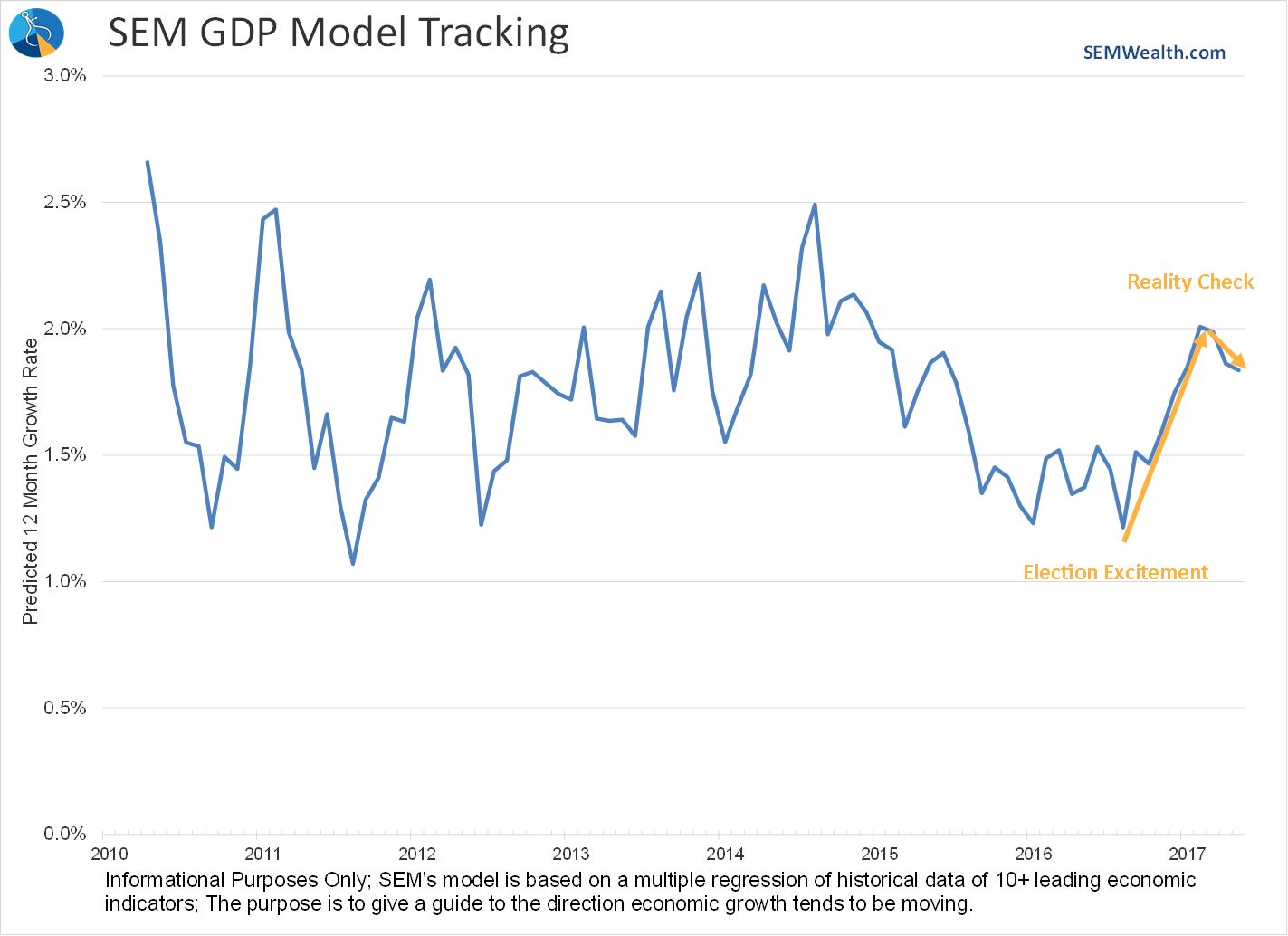

Following the election, the stock market staged a furious rally under the assumption President Trump and the Republican led Congress would implement “pro-growth” economic polices that would jump start an economy that has been unable to grow at even an average pace despite trillions of dollars being thrown

Maybe it was a coincidence, but before President Trump’s first international trip as president, the markets were in a panic as controversy swirled around his administration. Many were calling into question not only whether or not any of his “good” policies would ever become law, but