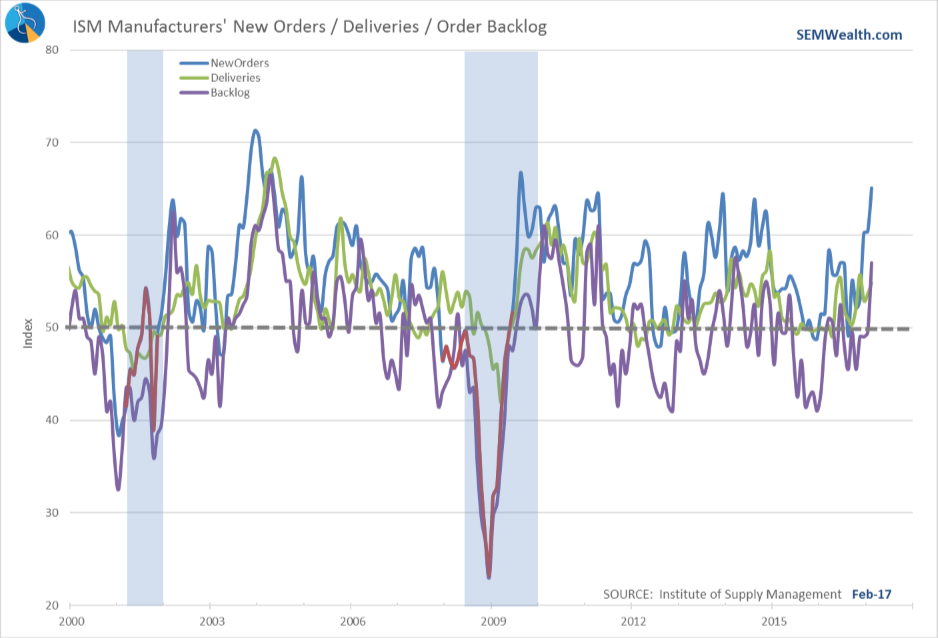

The Fed says the economic data has “not noticeably picked up.” I’m not quite sure what she is looking at or what I’m missing because my economic indicators are showing a strong escalation in the pace of economic growth. This week we take a

The S&P 500 suffered its worse loss since the election. Small cap stocks were crushed as were financials & health care stocks. What changed on Tuesday? The “Freedom Caucus” spoke up causing a massive chain reaction.

What is the Freedom Caucus & how can a

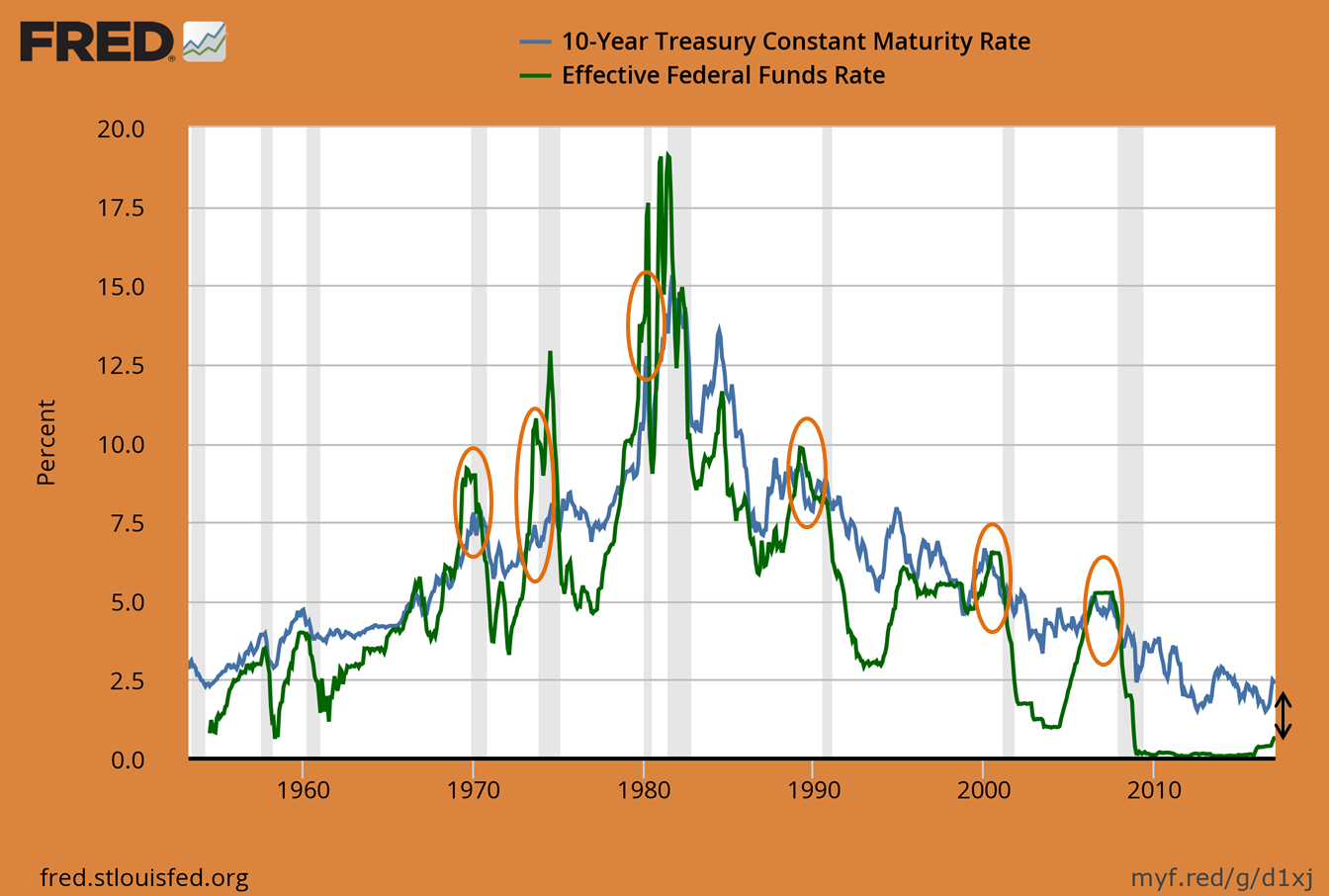

The Fed raised interest rates at their meeting this week, just the 3rd time since the recession ended nearly 8 years ago. Over the past two weeks market participants have worried the Fed would push rates up too far and too fast. Stocks rallied during Fed Chair’s press

SEM has always been about “Continuous Improvement”. In 2016 we put everything on the table and asked our advisors the things they & their clients do not like about SEM. As we evaluated the list we realized we had to make some major changes.

Last month one of our largest

Last week we saw an increase in the pace of job creation. This week the Fed is expected to raise interest rates. Depending on your vantage point, things are looking up or they are about to turn lower.

We will delve deeper into the Fed decision later in the