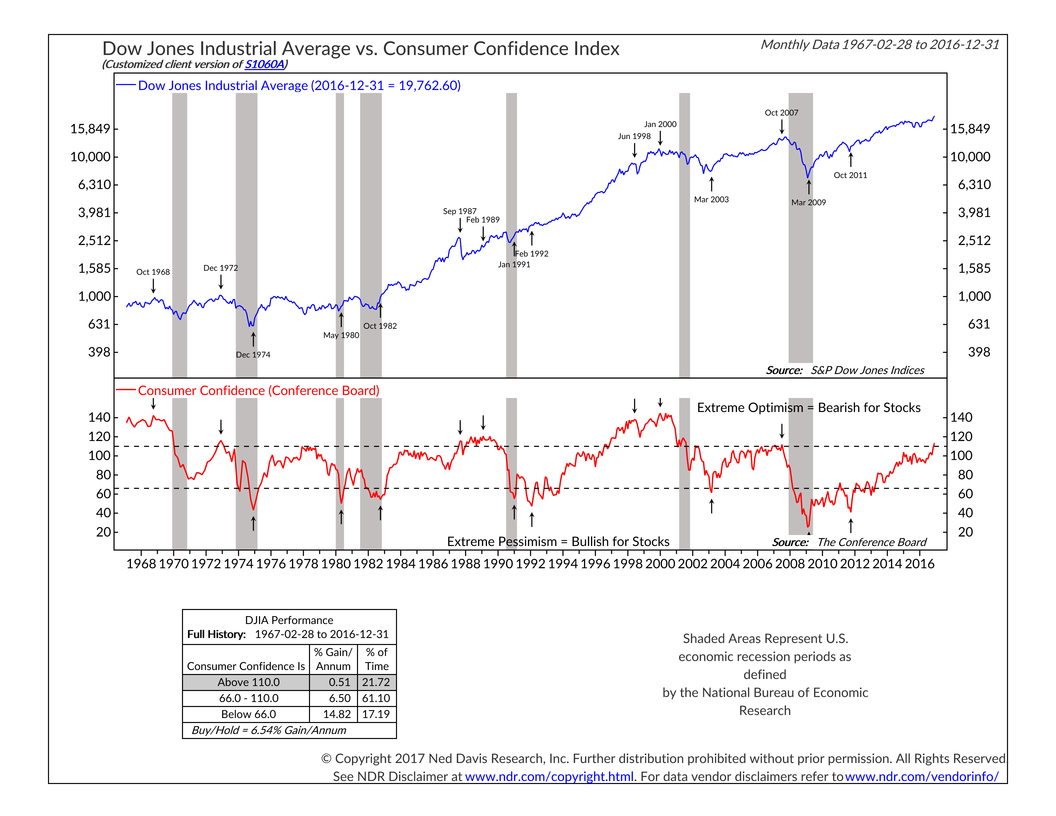

For the most part investors have been focusing on all of Donald Trump’s “good” policies since his election. Things such as mass tax cuts, infrastructure spending, and cuts in regulation in theory would provide a strong boost to the economy. (I say “in theory”

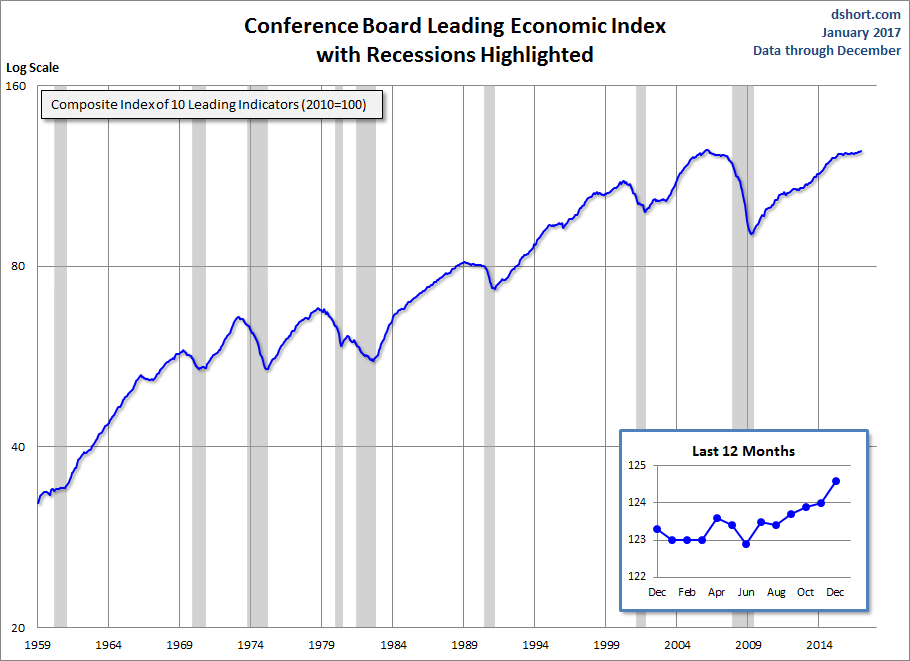

While many people (including this writer) have been too quick to dismiss the “animal spirits” following the election of Donald Trump, something has been happening beneath the surface — economic growth has been accelerating. The Conference Board Leading Economic Indicators have shown a strong pick-up in recent months,

Last week we went through what I believe will be looked back at a major change in the political structure of our country. History books are always written with the benefit of hindsight, cherry-picking specific events to make it seem that the way history played out was predictable. (It’

I know everyone; don’t fall out of your chair because you are reading a blog from me. Jeff is alive and well.

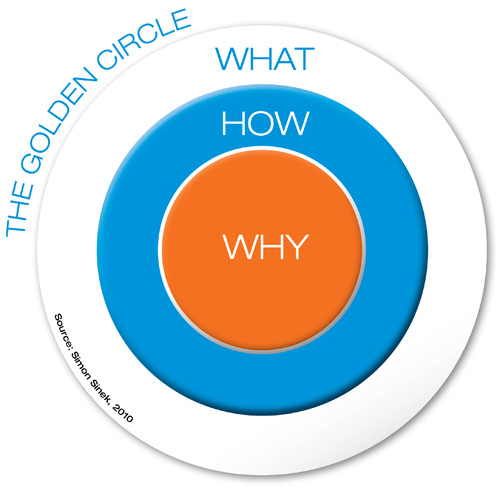

Over the past several months, we have been thinking through the “Golden Circle”, by Simon Sinek. Essentially, his thoughts are centered on having

Today is the day half the country has looked forward to for 8 years, while the other half has been dreading for the past 2 1/2 months. We’ve all spent far too long guessing what the new President & Congress will mean for the economy & the