The market is pricing in a perfect execution of Donald Trump’s positive plans and ignoring any possible negative outcomes despite his inconsistent behavior. Many are expecting a return of the Reagan years without factoring in the differences between the situation Ronald Reagan inherited relative to the situation

The Federal Reserve raised interest rates this week for the first time in a year. Unlike previous expectations of the Fed pulling back their “stimulus”, the market has not only shrugged its shoulders, but rallied in the face of these rate hikes. This is a welcome development as

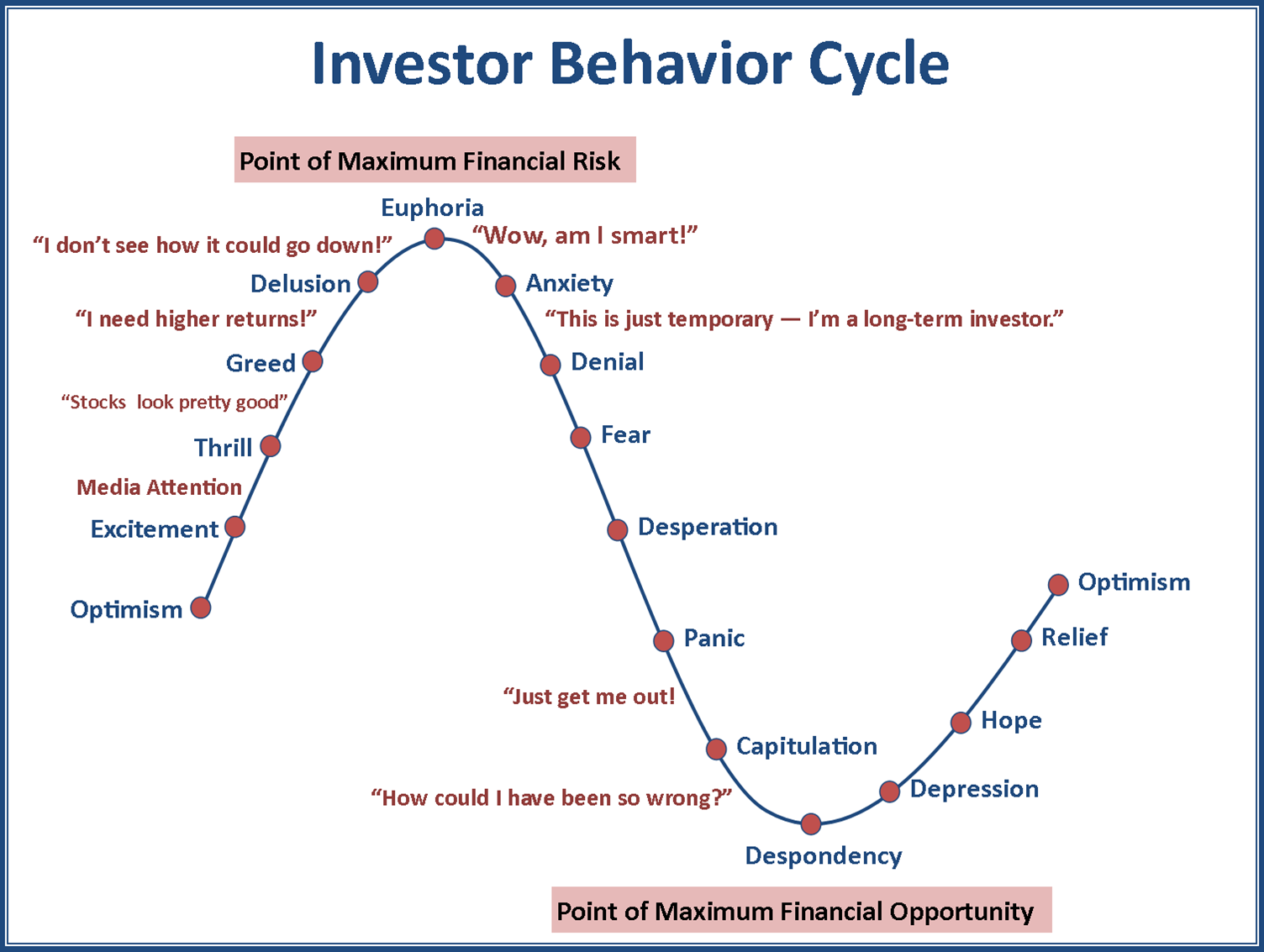

Human nature does not change. Going back at least to the time of Moses we see humans letting their emotions getting in the way of sound decision making. The Israelites were slaves in Egypt for hundreds of years and saw miracles from God that led to their release from Egypt.

“The intelligent investor is a realist who sells to optimists and buys from pessimists.”

― Benjamin Graham, The Intelligent Investor

This weekend while browsing the “Nerd Links” I came across the monthly update on valuations from Advisor Perspectives. I found myself thinking, “what’s the

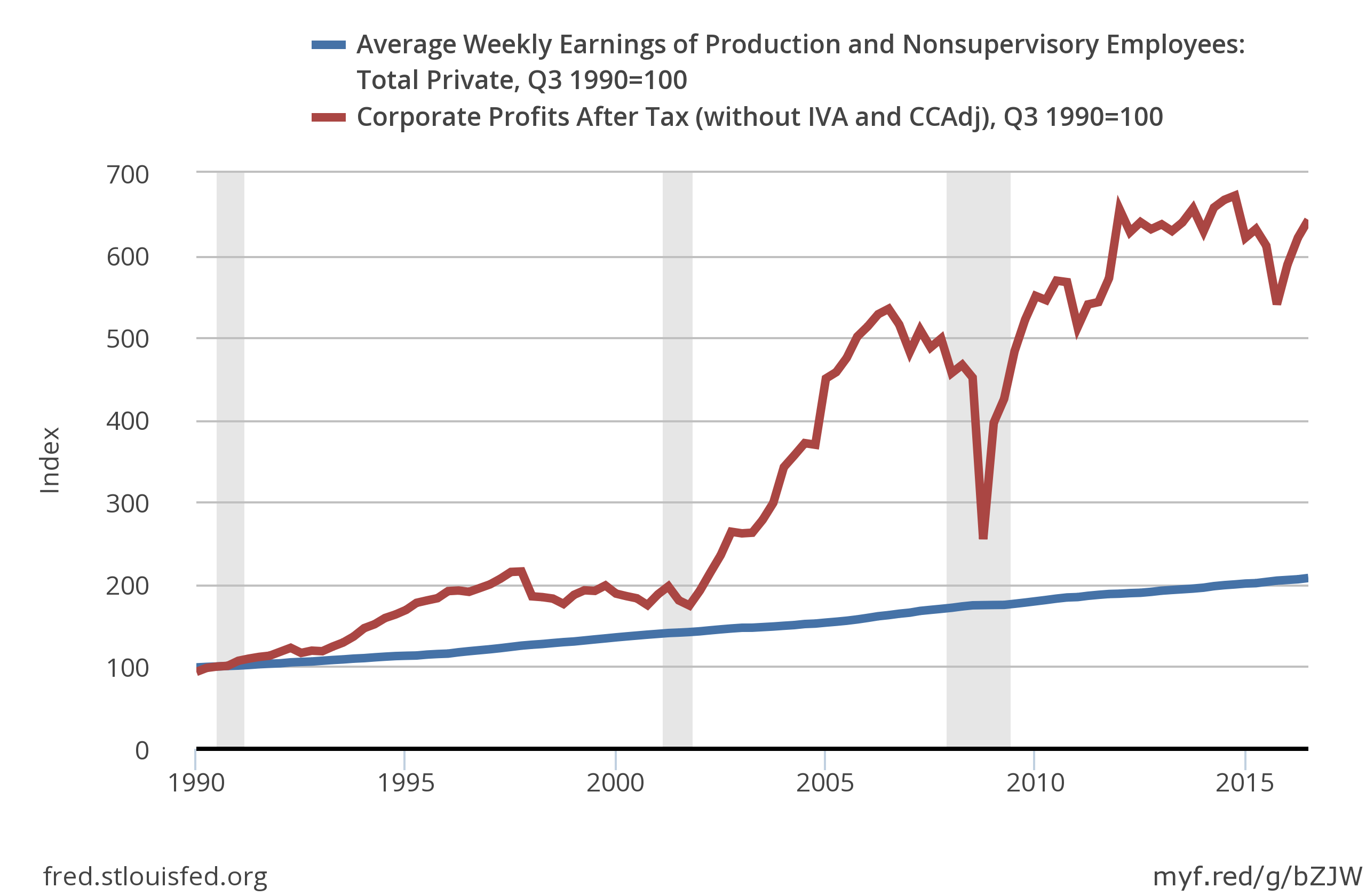

While the news media celebrates a drop in the unemployment rate & the stock market continues to party like it’s 1999 (or 1982), it seems most pundits, politicians, and Wall Street executives continue to be disconnected from what is happening on Main Street.

It is true, we