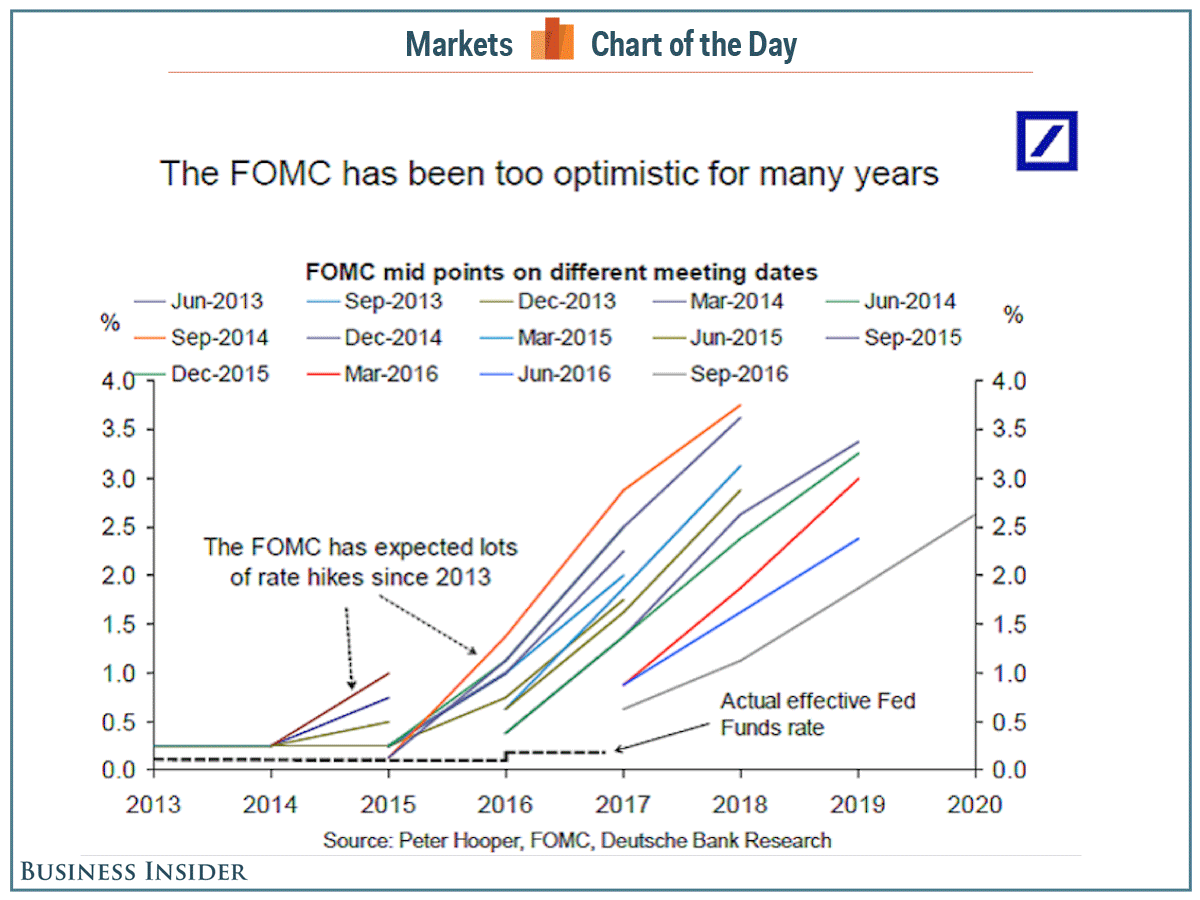

This week Business Insider had a chart illustrating just how bad the Fed has been at predicting where interest rates will be (you know the very thing the Fed controls). Keep in mind, their interest rate forecasts are based on their predictions for the economy, so

After celebrating the “no rate hike” announcement from the Fed Wednesday afternoon and Thursday morning, market participants seem to be shifting their attention to the REASON the Fed didn’t raise rates — economic growth is again decelerating.

While the fact remains my economic indicators

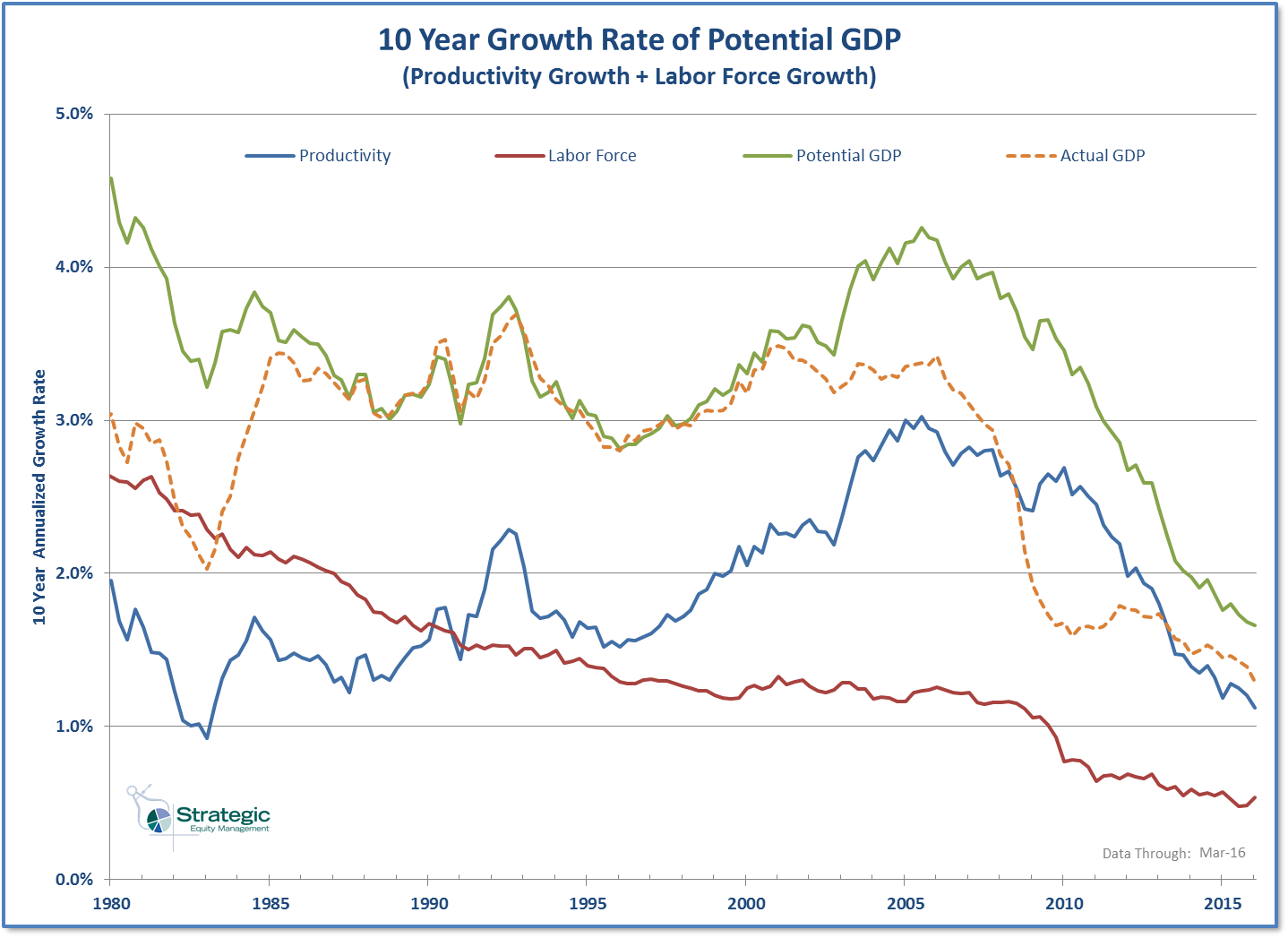

During Fed Chair Janet Yellen’s press conference on Wednesday a question came up regarding Productivity. Chair Yellen expressed the committee’s frustration and concern over the lack of productivity growth in our economy. She cited the lower productivity growth as a reason for the Fed’

It’s another week where the highlight will be the “much anticipated” Fed meeting. I’m not sure how we got here or what will happen to get away from this focus on the Fed, but it’s not normal for a central bank to

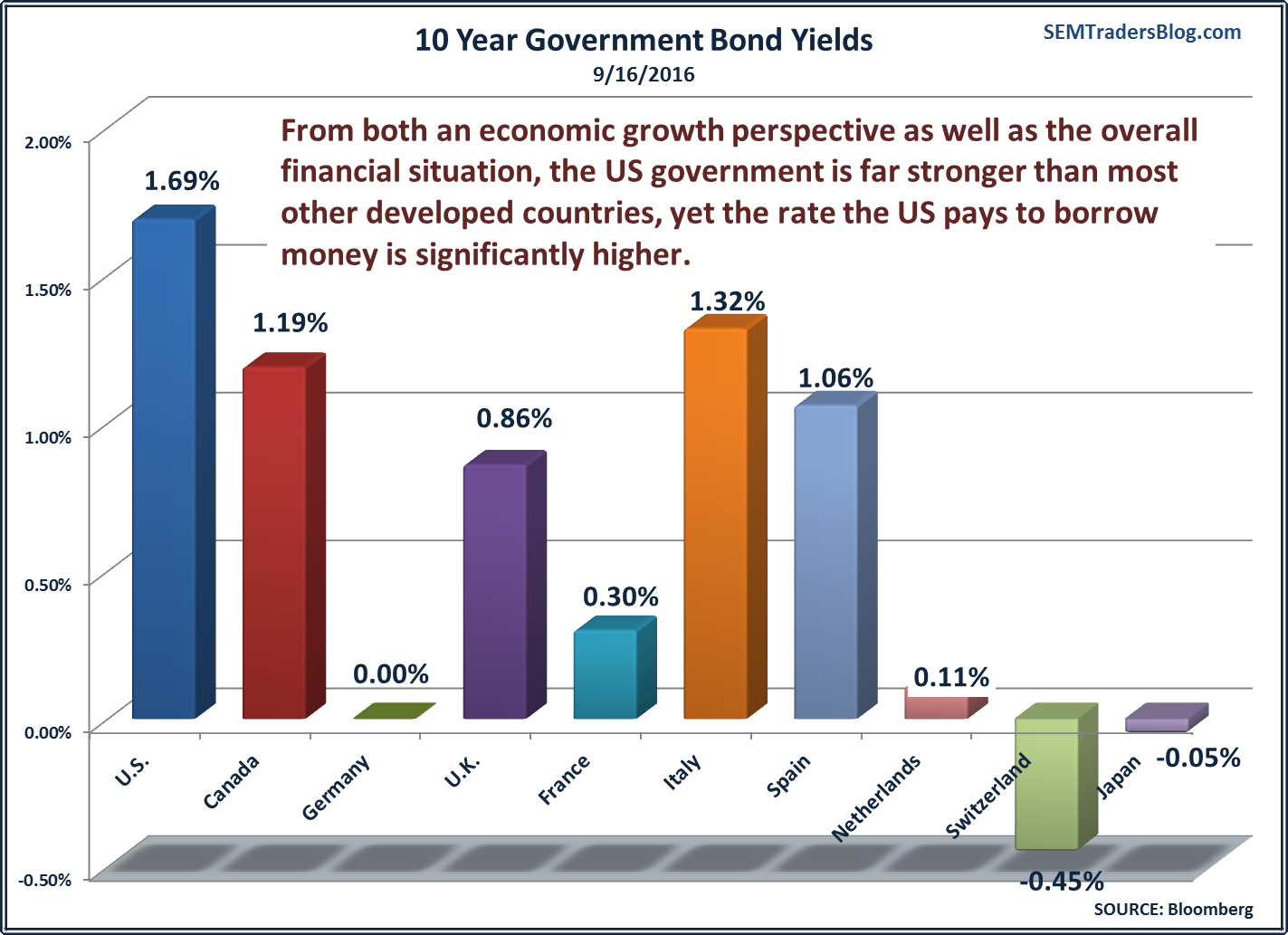

While numerous analysts are calling for US 10 Year Treasury bond yields to surpass 2% by year end, the fact remains US Treasuries are still far more attractive than any other developed country in the world. Investors should be careful believing interest rates MUST go up simply because they