For the second week in a row we are greeted with some very positive COVID-19 vaccine results. Don't mistake the rest of the article as me not being extremely excited about this development. As I've said from the outset, I have full confidence in the American people, our scientists, and

This morning we woke up to some encouraging news on a Coronavirus vaccine. 35 weeks after the US began to panic, it seems investors/speculators are banking on a huge economic comeback. We'll leave the speculation to them and stick to the data.

A quick assessment from SEM founder and CEO Rick Gage on the current market action and SEM's positioning/response:

The pre-election sell-off last week was interesting in that Treasury Bonds did not rally as they typically do when there is a “risk-off” trade. It will be something to keep on

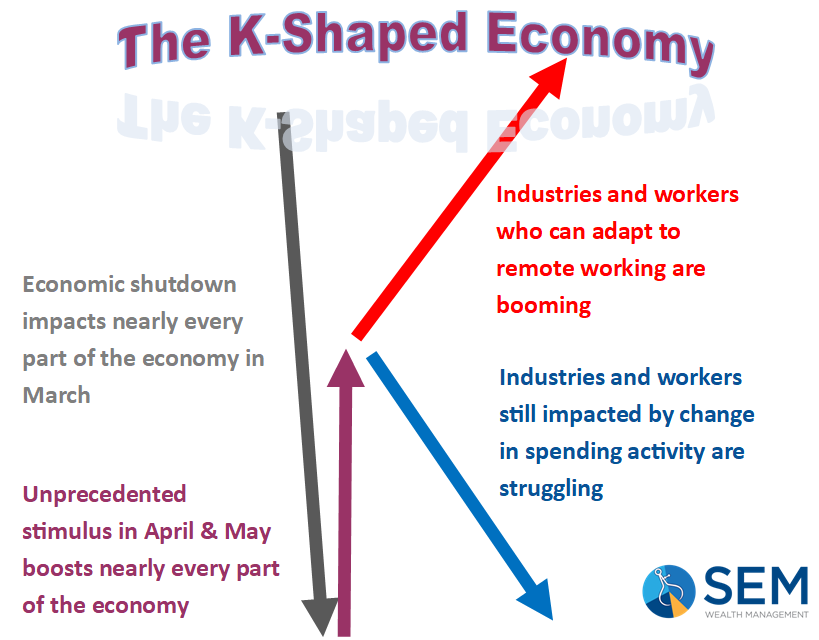

Where you personally sit often determines your assessment of a situation. That is certainly the case with the economy. COVID19 turned our economy into a K-shaped economy, but we've had problems for quite some time, well before COVID.

A big part of the imbalance is our two deficits – trade and

We're just ONE week from the Presidential Election! Are you ready? This short webinar discusses:

- The latest polling numbers and what Wall Street is betting on

- The economic policies of each candidate and what it means for the markets

- The financial planning items that may need addressed relatively quickly