Our brains are programmed to only factor in events we've either experienced or have studied. There's nothing wrong with that, but it's something we all need to understand as we deal with something NOBODY has experienced. Despite the best efforts of stock market "experts," we also have never seen anything like this in the history of the stock market.

We've already seen many "inconceivable" events in the last 2 months. We're also likely to see many more things that have us declaring "inconceivable" for the next few years. Yes, I said years. The first thing we need to do is stop comparing this to any other period (which is "representativeness" bias). The next thing we need todo is look beyond data and news that matches our own opinions (which is called "confirmation" bias). Finally, we all need to put aside our "overconfidence" bias and vow not to fall for "regret-aversion" (fear of missing out and/or fear of making a mistake) and especially to not use "hindsight" bias when this is over.

[For a primer on the various biases and how they impact our decision making, check out "Understanding our Behavioral Biases".]

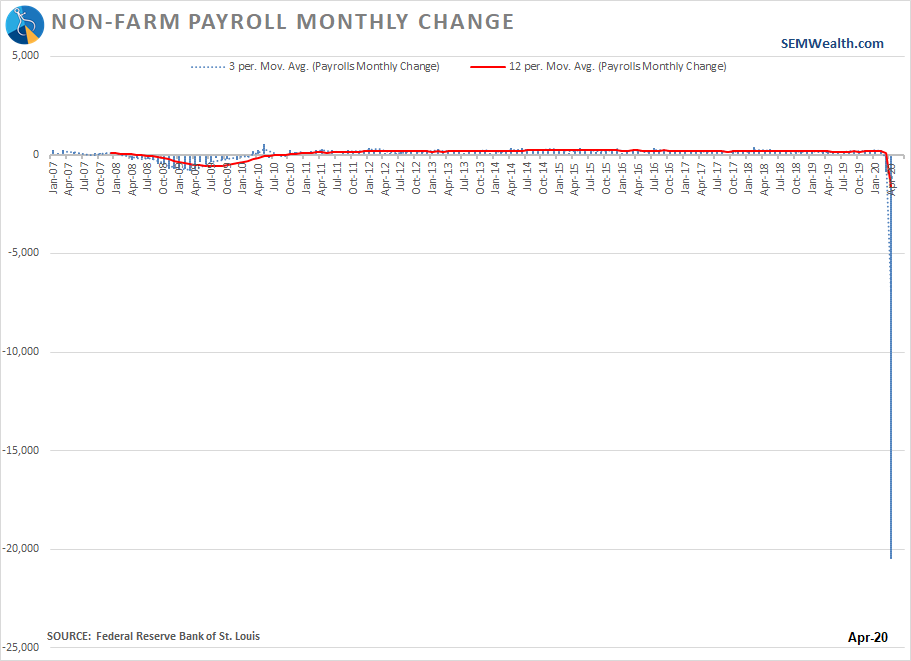

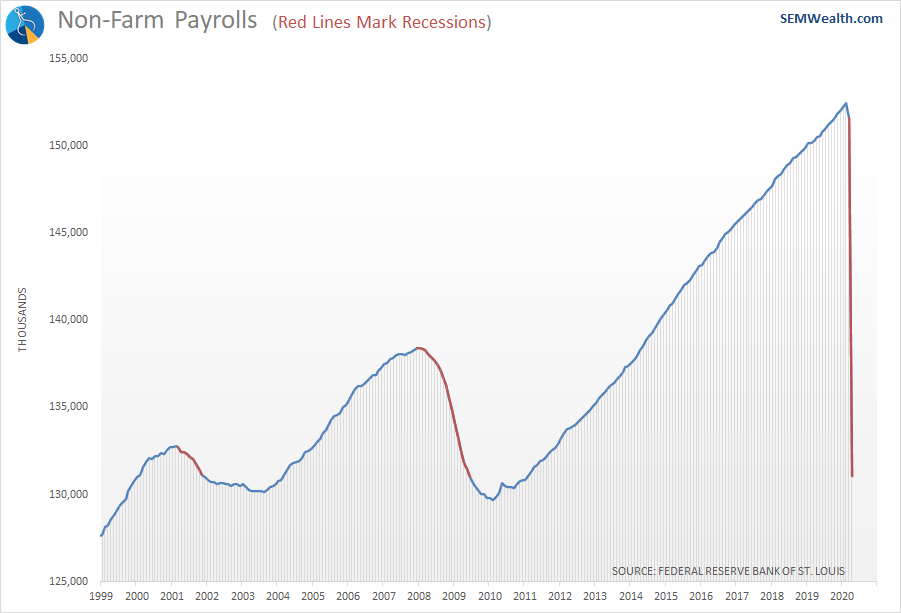

With our biases put aside (as best we can), let's look at the "inconceivable" damage that has been done to our labor market. I mentioned in this week's Monday Morning Musings how I had to expand the y-axis so much on my favorite employment chart that it rendered the chart essentially useless.

We've seen nearly every job added since the end of the Great Financial Crisis wiped out. Inconceivable.

Inside the employment report we learned 77% of the job losses were considered "temporary". I hope they are correct, but the data and logic tells me we won't see a large number of those jobs come back. But let's assume they are correct. This means we are still looking at 23% of the jobs lost in April being PERMANENTLY eliminated. That's not counting any additional losses we see in May, which are beginning to pile up. Inconceivable.

All told, the permanent elimination of those jobs would lead to an 8-12% long-term unemployment rate. That's worse than we saw following the Great Financial Crisis. I don't want to belabor this point. Inconceivable.

I'd encourage you to continue to read my Monday Morning Musings each week where I dive into a large range of thoughts and data points we all need to be looking at.

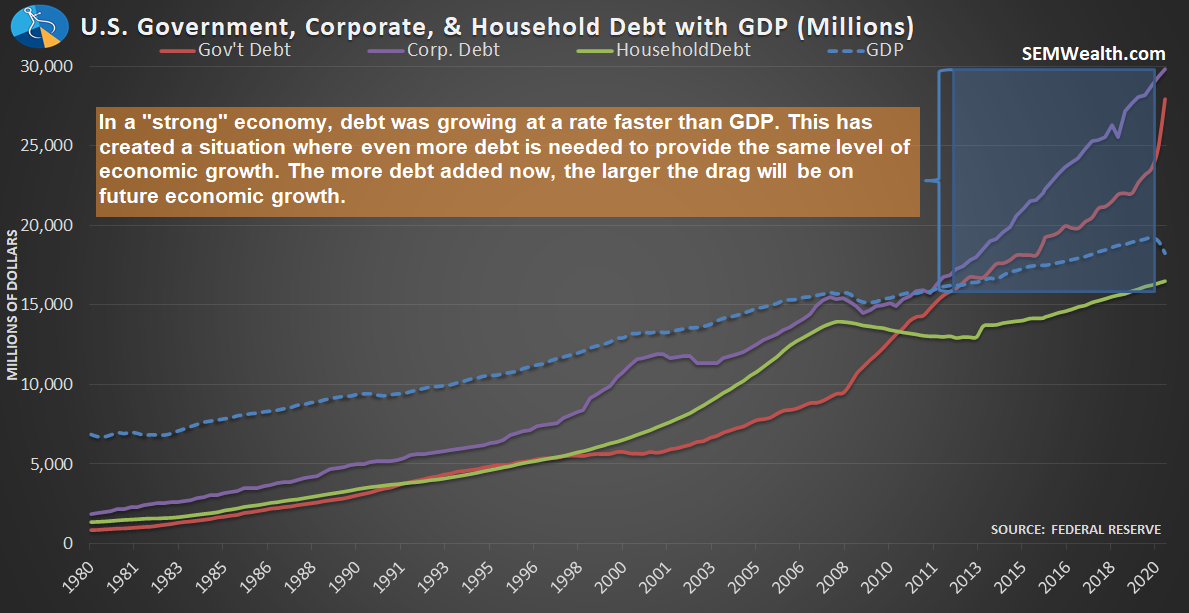

The Productivity of Debt

I do want to take a slight detour and circle back to last week's In Debt We Trust Chart of the Week. We've certainly seen some "inconceivable" actions by the Federal Reserve and Congress. Many have pointed to this action as a reason to support the current valuations of the stock market. They believe all of this money will cause enough of a bridge for the economy to return to normal. That may be true over the short-term, but what happens when consumers, businesses, and the financial system have to stand on their own?

You've heard me say "debt is future spending pulled forward". Debt can be productive if it is used to invest in things that create future growth. If it is used to fund consumption (or to buy back stocks and pay dividends), then it becomes a drag on growth. Consumers, businesses, and all levels of government for 20 years have been using debt to fund consumption (including paying pensions and other benefits to retired workers). This is money that has to be paid back and will be a drag on growth. The $3+ Trillion and counting of stimulus so far is all targeted towards consumption, not investment.

One way to illustrate the impact of all this debt is to look at the velocity of money. The velocity of money measures how often $1 entering circulation is spent. The higher the number, the more productive the new dollar was. What we can see is the Velocity of Money peaked in the late 1990s and continues to decelerate at a rapid pace.

Just before the Great Financial Crisis each dollar was turning into $2. During the last economic expansion, the velocity of money declined at a steady rate. This was a clear sign of a broken economy. This broken economy is now being attacked by an unprecedented shutdown. Like those in poor health he contract COVID19, the chance of survival is slim.

Not by coincidence, the velocity of money peaked at the same time we started to see an acceleration of debt. Corporations were the first to begin adding unproductive debt as they attempted to keep the tech bubble afloat. After the tech bubble burst we saw the use of government debt to support consumption, especially after the Great Financial Crisis accelerate. This is all money that has to be paid back, which causes the velocity of money to decline. The money isn't being spent on things that increase growth in the future because it's going back to the people they borrowed from.

Look, I want to be positive. It brings me no joy to point out all the things that are broken in our economy. I'm always optimistic for the very long-term, but I'm also a short-term realist.

Throughout the sell-off in March I was encouraging people to not give up on their long-term investments. It didn't make sense to sell then during the panic. The problem is the market bottomed so quickly without any real capitulation from investors. A real bear market has people hating stocks and thinking you're crazy to own them. We never saw that in March or April. When we do, you'll see me pointing out the positives in the market.

The market is pricing in a recovery that is "inconceivable". Maybe I'll be proven wrong. I actually hope I'm proven wrong. I seeing too many stories of people who have had their financial lives completely disrupted. They need the economy to come back like a rocket ship or they won't make it. I don't wish that on anyone.

That said, I can't let my hope for a quick return to the old economic output levels cloud my judgement. This is unlike anything we have seen in our lifetimes. We should be ready to adapt to an "inconceivable" new normal, which means much slower growth, lower income levels, less freedom, more saving, less consumption, fewer jobs, and more economic uncertainty. All of those things are terrible for stock prices. Once stock prices begin to accept this new reality, the sharp correction will indeed be a buying opportunity. Until then, extreme caution is warranted.

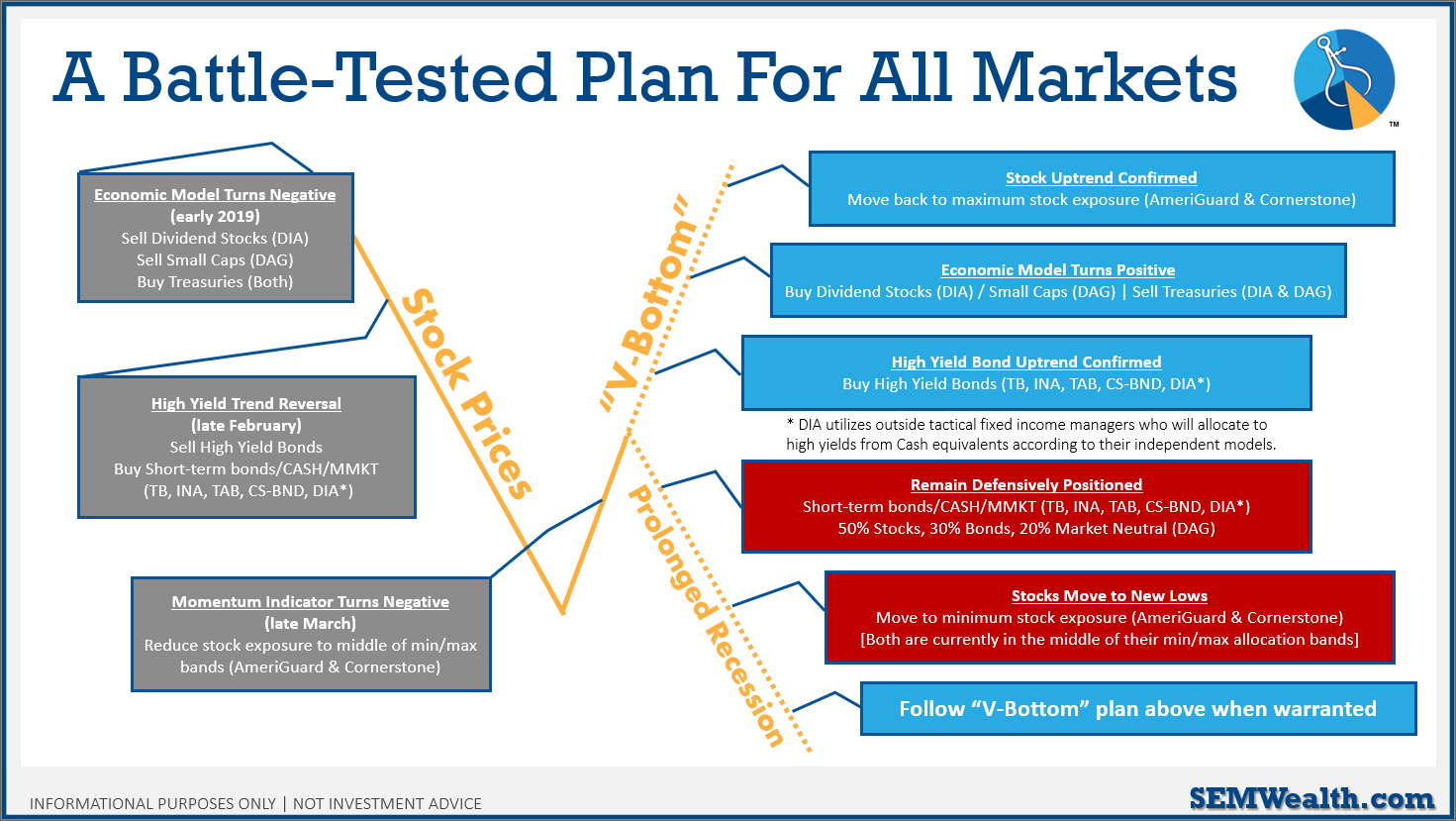

What's important to understand is I don't have to be right. No matter what "inconceivable" environment we end up in, we have a plan. We discussed this in detail in What's Next. Our plan is outlined below.

If you're not an advisor currently working with SEM, now is the time to take action. If you're an investor and would like to find an SEM advisor in your area, Contact Us and we'll put you in touch with somebody to talk about a way to invest without having to be right.