Depending on how the last part of December plays out, we could be bombarded with doomsday headlines. Already I’ve seen articles talking about the “worst start to December since the Great Depression” from both CNBC and CNN. The market losses are showing up on local news stations and in local papers. While long-time readers know I have had major concerns about many big picture issues our country, economy, and the markets must address in the years ahead, whenever I see mainstream media stories talking about the market, we enter a realm where emotional responses can take over our decision making.

This short video discusses how our various investment models have performed during the market sell-off. Understanding this may help you better understand the performance of your overall portfolio whether or not you have investments with SEM.

Here's a few highlights from the video:

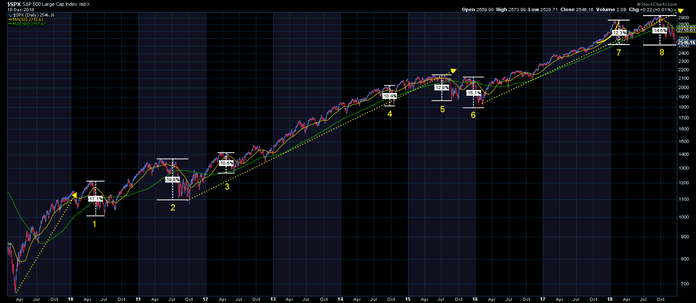

- Going back to the 1920’s, the stock market has a 10% loss (from high to low) an average of one time a year. Remember, to get to an average you have periods above and below that average. This is the second 10% loss in 2018, but the last time we experienced this was late 2015 & early 2016. That was the 2nd 10% loss in 10 months.

- The stock market and most of SEM’s investment models finished the year negative in 2011, 2015, and of course 2008. Losses can happen. It is very likely most of our investment models finish 2018 in negative territory.

- Not to make predictions on 2019, but 2012, 2016, and of course 2009 ended up being very strong years for the stock market and SEM’s investment models. Abandoning an investment simply because it lost money is almost never a good idea.

- Overall, nothing has fundamentally changed since the end of 2017 when stocks were at euphoric highs. Economic growth is still expected to be strong. Scroll to the bottom for a couple of videos explaining how just a slight change in the growth outlook can cause severe losses for the market. This helps put the recent losses in perspective.

- Finally and most importantly, each investment should play a specific role in your overall financial plan. If you are uncomfortable with the current performance of your portfolio, PLEASE discuss this with your financial advisor. If you don’t have a financial plan, let me know and we can help you put one together (for free). At that point we can then review your investment allocations and see if any adjustments are needed.

The Good:

- The economy is still growing (just maybe slightly slower than most people already priced in.)

- The more the markets go down, the more opportunities are created for those with cash on the sideline (like SEM). Valuations are still high, but are no longer in “extremely overvalued” territory as they were in September.

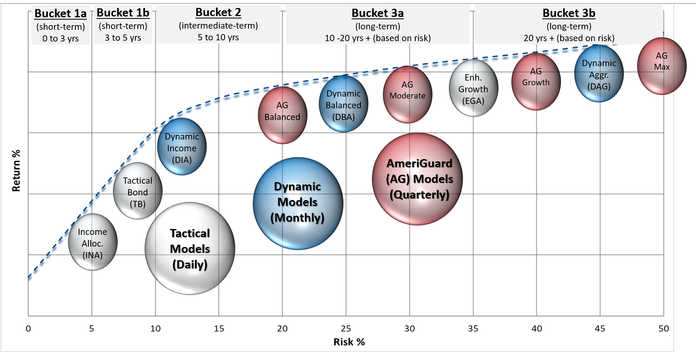

- SEM’s TACTICAL models are already in “defensive mode”, which means losses in the weeks/months ahead should be relatively small.

- SEM’s DYNAMIC models are in “neutral mode”, meaning they already took some risk assets off the table in November. They could got to “bearish mode” if the economic indicators begin pointing towards recession.

- SEM’s AMERIGUARD models will re-adjust at the beginning of the year. If necessary they will pull money out of riskier assets if it appears likely the 1st quarter of 2019 is likely to continue the current downtrend.

The Bad:

- We’re 10 years into the economic recovery and bull market. We are long overdue for a recessionary bear market, which typically brings a loss of 35-55% for the stock market.

- Small adjustments in the expected growth rate causes an increase in the risk premium means significant declines in the stock market. The videos at the bottom of the page explain how that works.

- During the recovery individuals, businesses, and the government all accumulated massive amounts of debt. As interest rates rise (which could be a bullet point by itself) it will be more difficult for them to refinance this debt, creating stress in the credit markets.

- The social mood in our country is volatile. The mid-term elections basically showed a 50-50 split between the two parties, making the chances for stalemates in Washington the next 2 years highly likely.

What you should be doing now:

Remember each investment belongs in a specific “bucket”. Each bucket has a different purpose, which means needing to have a longer time horizon for the riskier buckets. If you do not know where each investment fits in your overall financial plan or if you are uncomfortable with your current portfolio DO NOT PANIC. SEM has a wide range of options to cover the entire return-risk spectrum. In other words, we can customize a solution for you that meets your financial plan, true risk tolerance, and your investment personality.

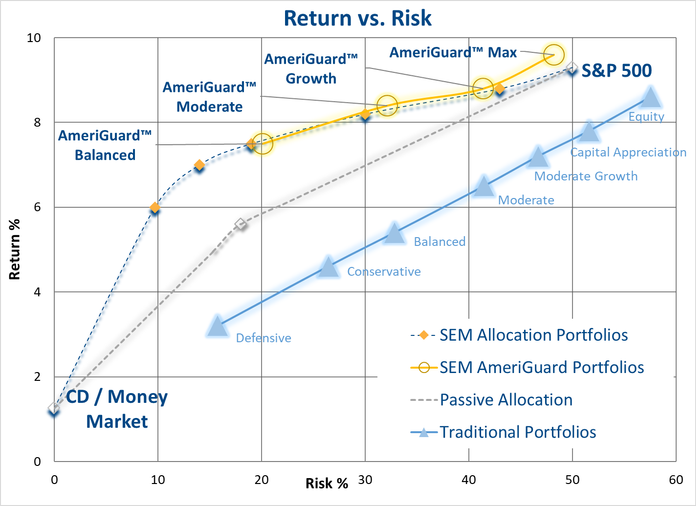

Finally, if you are NOT an SEM client (or you have assets at some of the big name managers), I want to highlight the advantage SEM’s active approach has over most traditional managers. (Click here for more information)