It was 2010 when I first began having to answer concerns about rising interest rates. The media had picked up on the Wall Street story that rates were destined to rise which was bad for bonds. Their recommendation was to sell bonds and buy stocks. Focusing only on returns this seems like it was good advice. Of course Wall Street has conditioned nearly everyone in our industry and therefore most investors to be return-centric. SEM’s behavioral approach to investing is RISK-centric because we understand there are very few people that have both the financial personality AND the financial ability to handle the type of risk this advice from Wall Street will bring.

We know from history the stock market can lose over half its value in a bear market. Despite popular sentiment right now, the economic and thus market cycle has not been eliminated, so we should expect buy & hold stock portfolios to lose half their value. The role bonds play in a portfolio should be to reduce risk. Even though the Morningstar Multisector Bond category index lost 18% during the 2008 bear market, that is still better than losing 50% or more. With rates crossing 3% this month, Wall Street once again has programmed into most people’s mind that rates are destined to rise significantly. The only option, in their opinion, is to buy stocks.

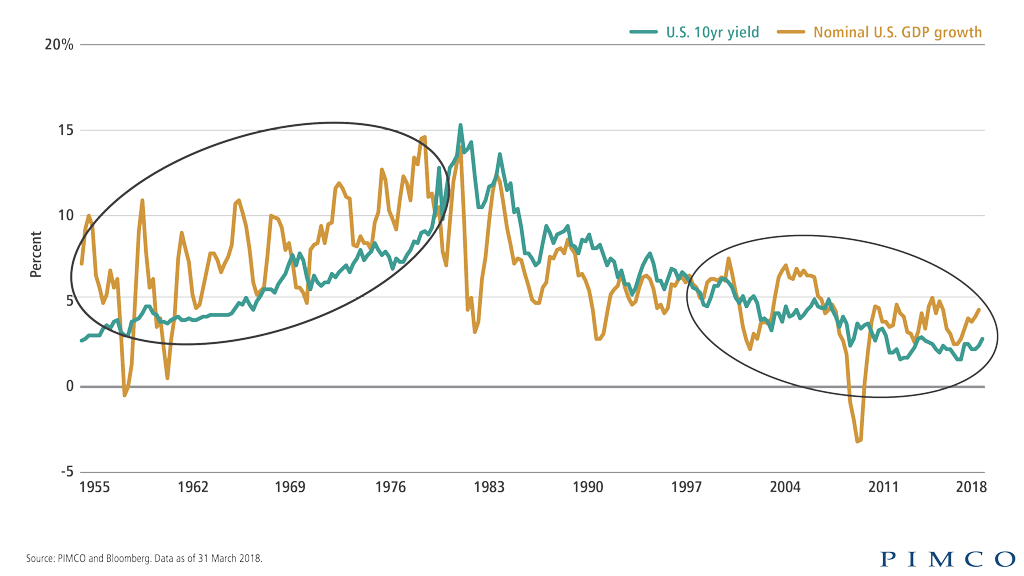

I came across a chart this week from Pimco that may throw cold-water on the higher rates argument. They studied the correlation between Nominal GDP growth (not adjusted for inflation) and 10 year Treasury yields. There were two conclusions:

-

The trend in bond yields tracked the trend in Nominal GDP Growth

-

Except for the high inflation years of the 1970s, most of the time 10 year yields were LOWER than Nominal GDP Growth.

I don’t have time to go into all of the reasons this should be the case, but it is founded on economic fundamentals. In addition, while some will argue we are about to see run-away economic growth due to the tax cuts, economic fundamentals will prevent sustainable long-term growth above 3%. (For more see “Will Tax Cuts Create Economic Growth?) Another argument is rates will be going higher because of inflation. I think that is true for short-term rates, but longer-term rates are likely to fall if inflation gets too high and the Fed accelerates their tightening cycle. This will likely cause a recession (and thus lower long-term interest rates due to a flight to quality.)

Another argument (including one I’ve made) is the unfathomable amount of debt that must be refinanced from both governments and corporations in the next 3 – 5 years will force rates higher. (See “Watch this closely” & “Source of the next crisis?“) While this is true for corporate and other non-Treasury debt, what is likely to happen is to see Treasury yields fall (again flight to quality) and all other yields rise significantly. Again, this will most likely spark a recession (possibly a severe one).

The main take-away — saying “bond yields are going to rise” is misleading. Some will rise & some will fall. The historical DATA and scientifically based models back this up. Ignore opinions (especially those that have become wide-spread and taken as a given) and focus on the DATA. That’s what we’ve done for the past 26 years and plan on doing for the next 26 and beyond.