As Cody mentioned last week, we are finally officially in election season (even though it seems like we've been there for two years now.) The strength of the economy is likely to be a major talking point. I even heard one fringe candidate during the Democratic debate last week call

Tag: debt

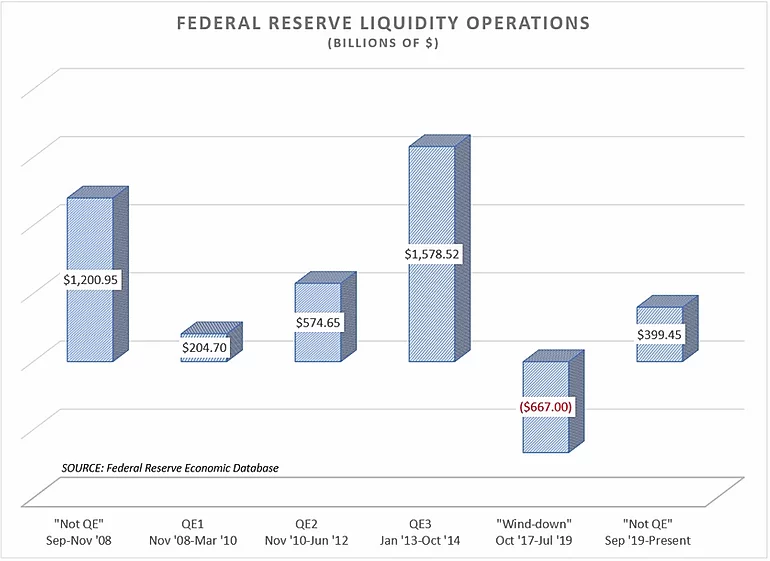

As we start a new decade it appears we will continue to have "unprecedented" measures by the Federal Reserve to keep the markets rising. While the Fed refuses to call the huge influx of cash into the banking system "Quantitative Easing (QE)," the fact the banking system still needs the

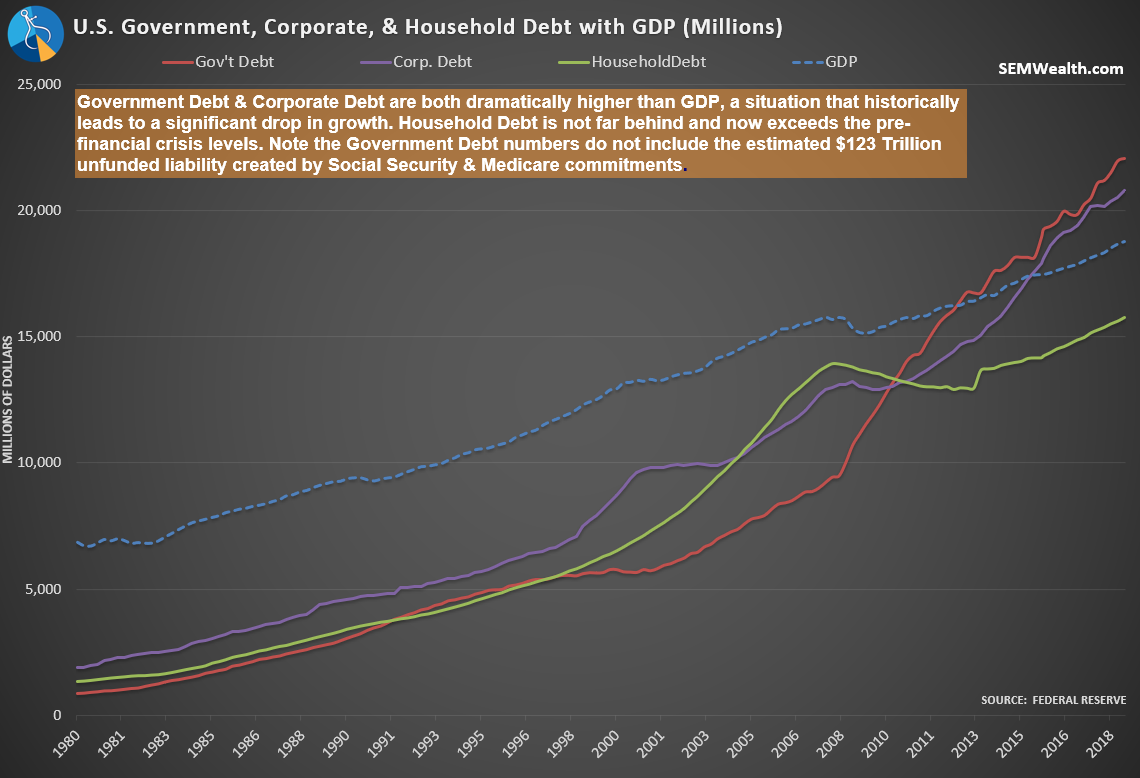

GDP growth surprised nearly everyone in the 1st quarter rising 3.2% in the past year. The president of course pointed to his economic policies as the cause of this “great” increase. Never mind the fact the long-term average growth rate is 3.1%. This has been the

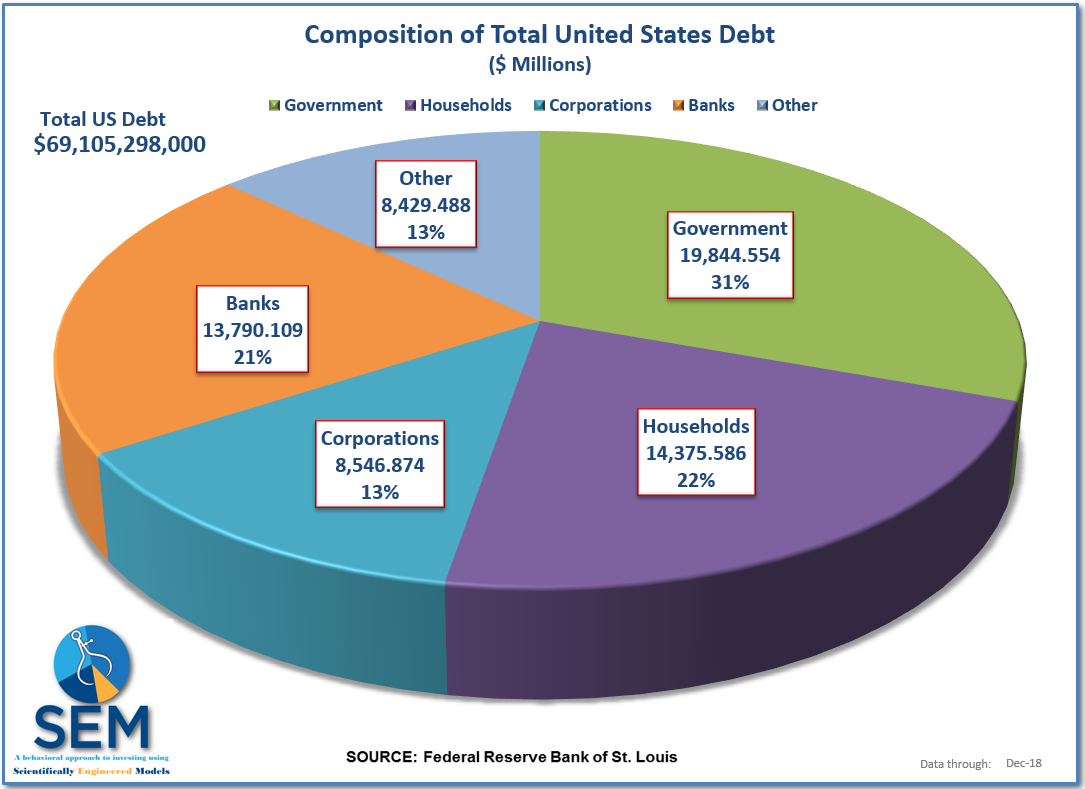

Debt is future spending brought forward. Another way to think about it, debt will hurt future spending. As I was talking to several advisors and clients this week after the end of tax season I couldn’t help but think of our country’s debt problems. Few people want to

I’m currently a senior at the University of Arizona in the Eller College of Management. This semester I am taking a Macroeconomics class; however, this class hasn’t been structured like most of my other classes throughout my time at the U of A (especially the ones that have