I used to manage individual stock portfolios......back in the 1990s. I described myself as a Warren Buffett/Peter Lynch style manager. Buy companies you understand with good business models selling products people want at a fair price. This was the philosophy I followed. I felt like I was a

Tag: market bubble

Back in February during the 10 day S&P 500 correction I introduced an analogy about speeding (click here to read it.) Back then the “car in the median” was inflation. My conclusion then was it was not a cop, but enough people were racing along at

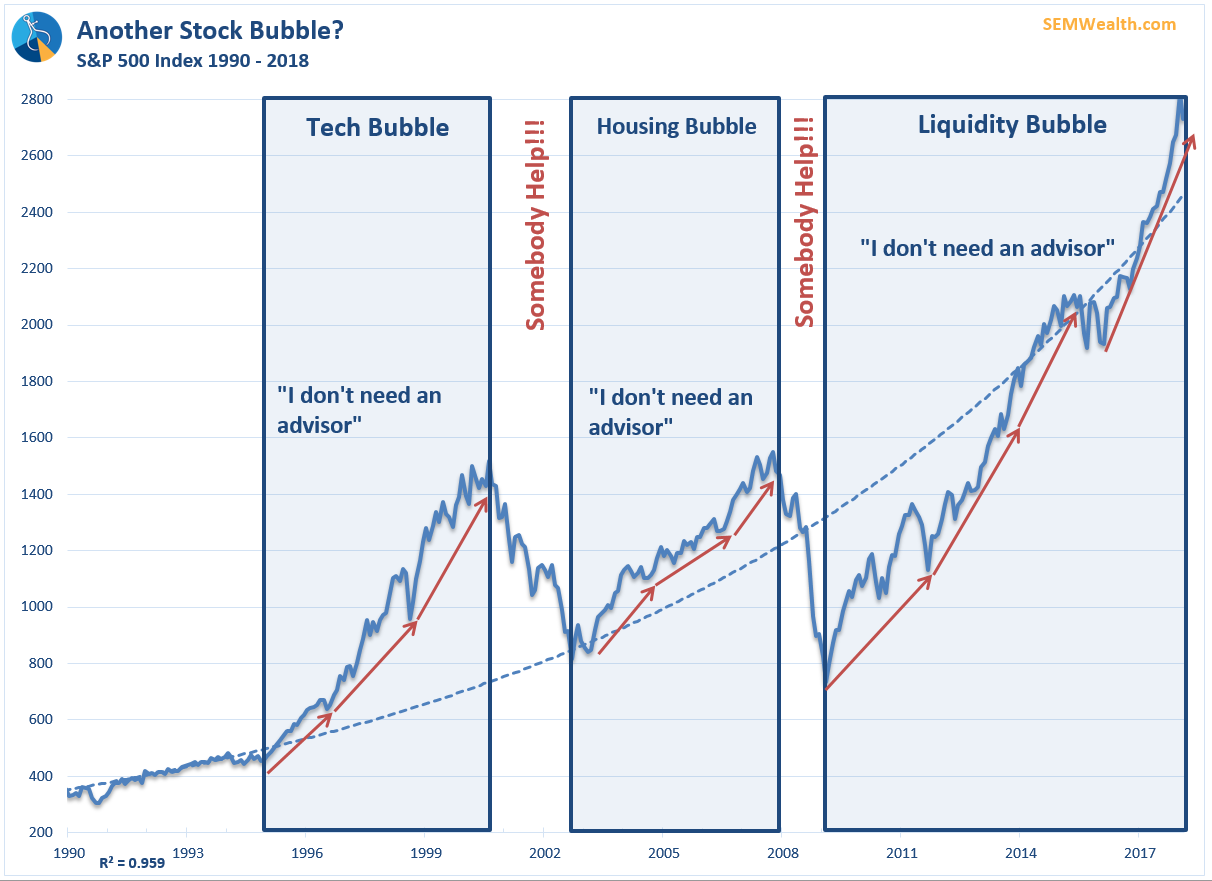

Today is the 9 year anniversary of the “bottom” of the financial crisis. The S&P 500 lost over 50% of its value during the crisis, falling to a level of 673. It has since rallied over 300% from the depths of the crisis. The only bump

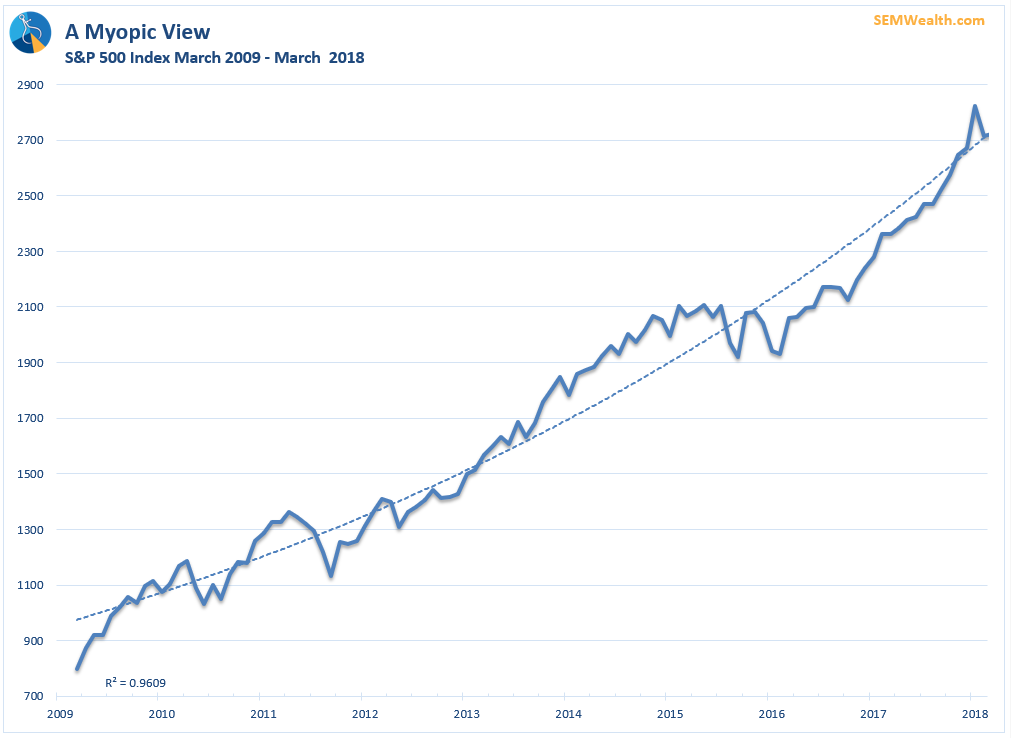

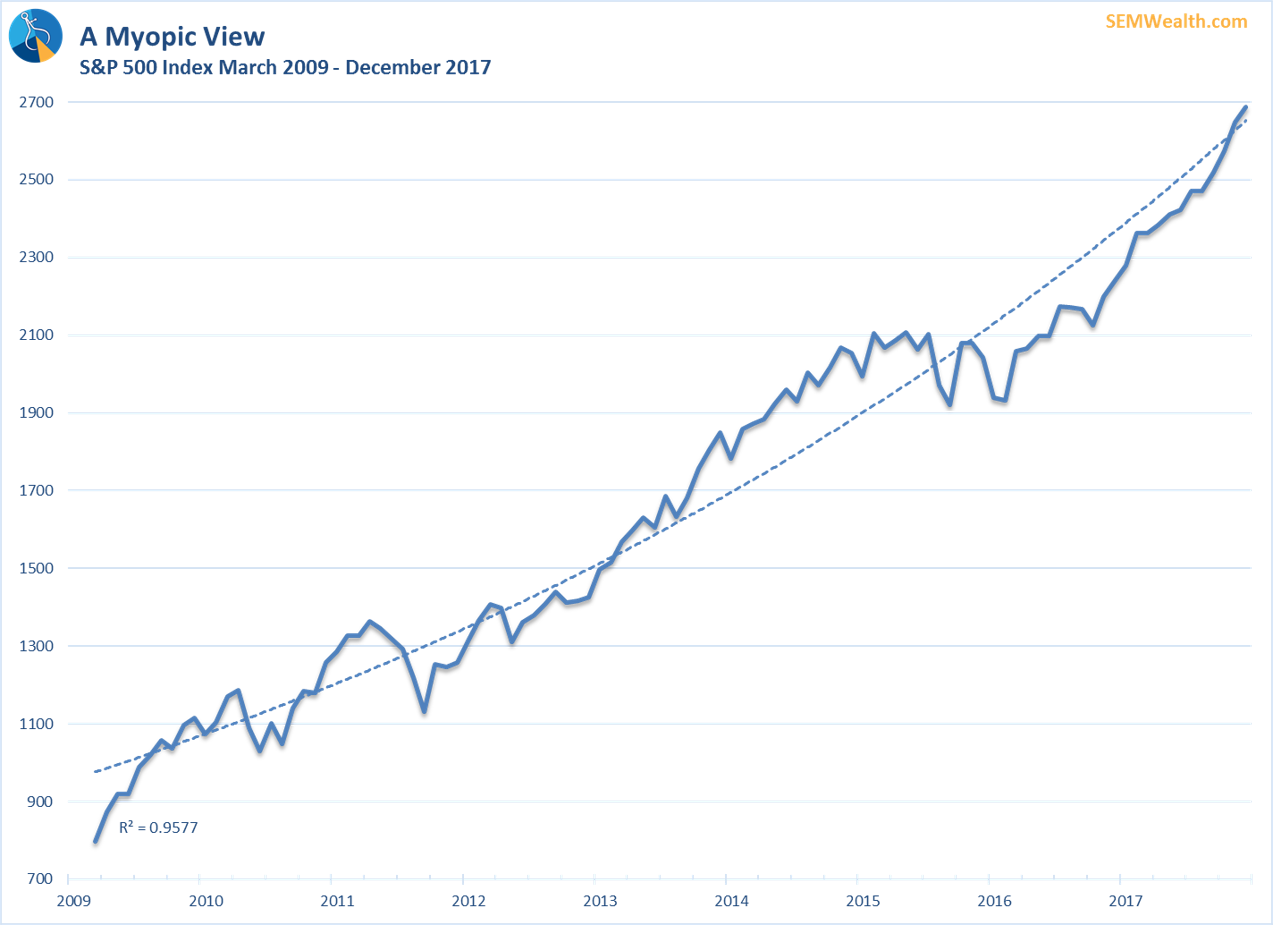

The market is racing back to the highs following the early February 10% correction. I’ve seen a wide range of emotions from investors and advisors the past three weeks. Their current perspective of the market seems to be based on how far their “look-back” period goes.

The S&P 500 is up nearly 5% the first 3 weeks of the year. Following the euphoria of 2017’s 20% rally in the US stock market, market participants are buzzing with the prospects of another 20%+ gain. Few people see any possibility for the market to