Are you getting bombarded by investment managers in the media offering their opinions on what the next year will look like? This isn't one of those webinars! In this brief webinar, I share some brief highlights about what really happened in 2022 as well as a few different paths the

Tag: Market Update

Being a data driven, scientifically-minded investment manager, we've always been uncomfortable making decisions that did not have a solid basis. Our study of behavioral finance and market history, as well as nearly three decades of experience managing money tells us our brains often can play tricks on us. This realization

With the stock market calming down somewhat and the country looking at the next phase of the crisis, I wanted to take some time to walk through what we are seeing in the economy, the stock market, and SEM's investment models. I know many advisors and investors alike have questioned

As we enter either the final stages of the bull market or go through the early stages of the bear market (nobody will know until they have the benefit of hindsight WHEN the bear market began) we are witnessing in client and advisor meetings something that always occurs — confusion/angst

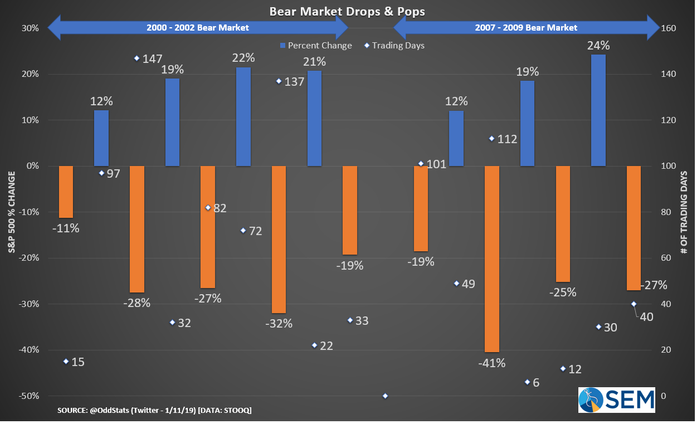

Despite the post-Christmas rally in the stock market, like death and taxes there is something investors cannot avoid — bear markets. The way our brains are programmed, the longer we go without experiencing something, the less likely we are to believe it can happen (this is called Availability bias or