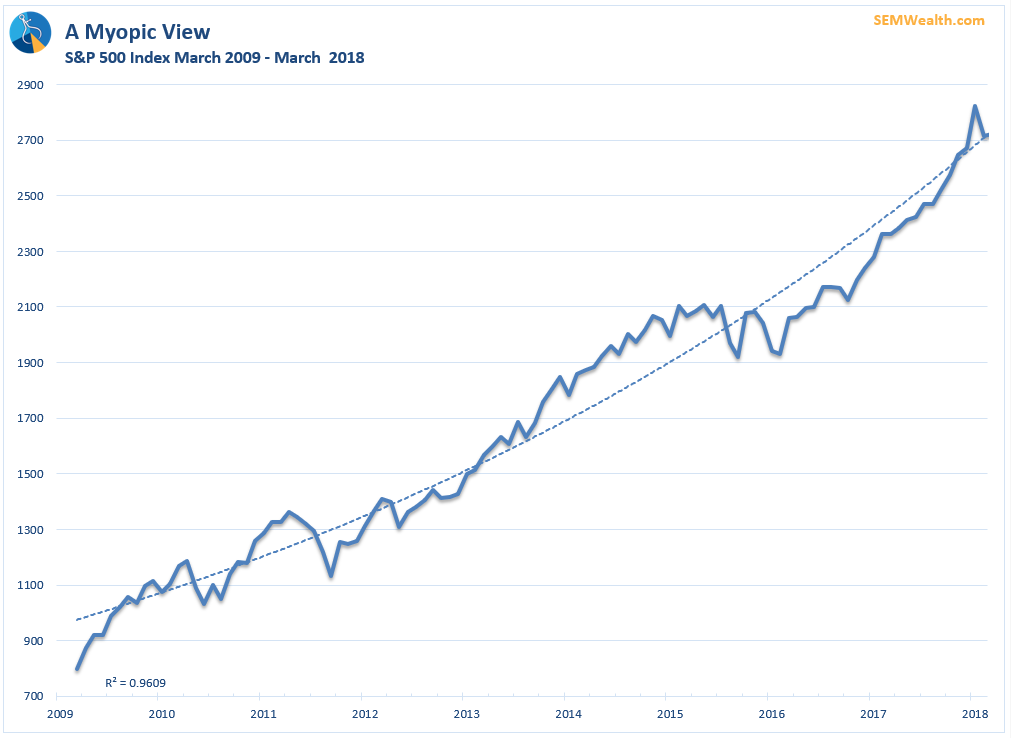

Today is the 9 year anniversary of the “bottom” of the financial crisis. The S&P 500 lost over 50% of its value during the crisis, falling to a level of 673. It has since rallied over 300% from the depths of the crisis. The only bump

Tag: Weekend Reading

85% of Wall Street Banks expect the S&P 500 to end higher in 2018. The S&P 500 was up every month in 2017 (first time ever). It has been up 14 consecutive months (also the first time ever). It has not had a 3% correction in

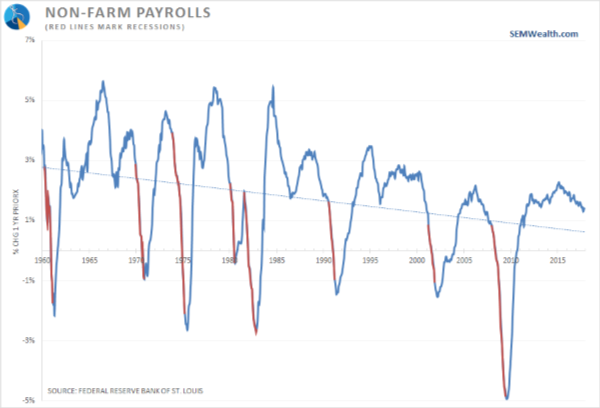

The key talking point as Republicans attempt to accomplish one of their key campaign promises, tax cuts, has been the promise the corporate tax cuts will create strong economic growth, higher wages, and more jobs. The economic text books tell us if corporations are allowed to keep more of their

A common theme in my conversations with advisors across the country is frustration with the move towards passive, “free” investment solutions. In four years $1 Trillion has flowed into passively managed Exchange Traded Funds, with Vanguard sucking up 90% of those assets. Vanguard and many others are now

I rarely do this, but I’m going to encourage our readers to take some time to read an article by one of our competitors (more on that later). I’ve been reading John Mauldin since a client directed me to his weekly e-mail letter in early 2000.