I realize in a 9-year old bull market talking about risk management will not generate a lot of clicks to our site. For whatever reason, the past few weeks have seen a large number of portfolio reviews from prospective clients that included “Target Date” funds. These funds have gained wide popularity in recent years. The idea is to automate the asset allocations, tying them to the “target date” the investor selected. Often times it is the year of retirement, but these types of funds are also available in 529 plans with the target being the year the child starts college.

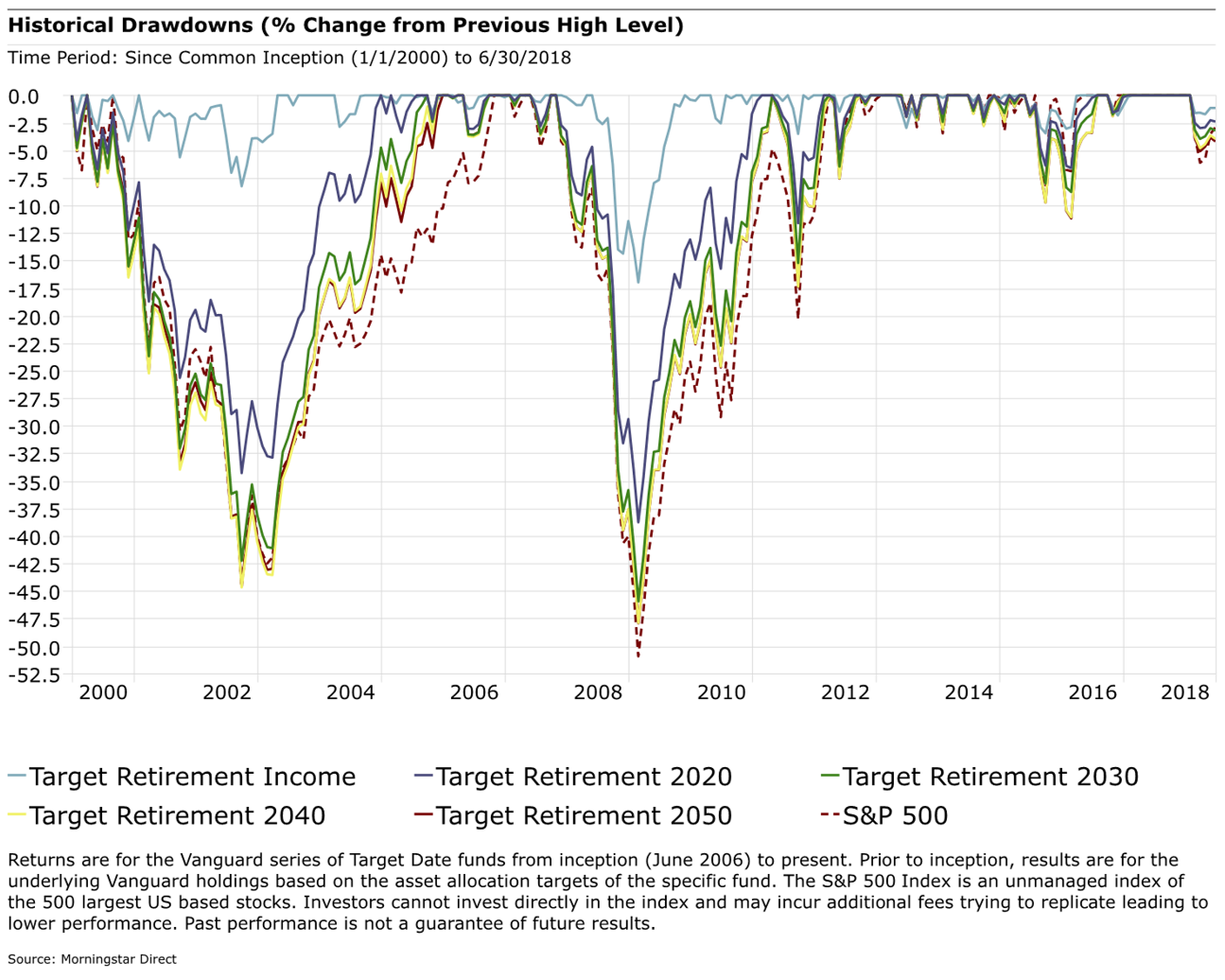

In all the reviews I conducted, the investors were shocked how much risk these target date funds actually had. They thought having the investment spread out to different asset classes would help mitigate the downside. They were wrong. Looking at the data from Morningstar we can see the downside these portfolios have had during other market drops.

Now take the losses of the various Target Date funds and convert them to the dollars in your account. For instance, if you saved $500,000 in your 401k, your 2020 Target Date fund could cost you $190,000. Even if the losses are half as bad as they were in 2008, would you be comfortable losing $80,000 when you’re retiring in a year and a half? If there’s one thing I’ve seen completely derailing retirement plans, it is losing too much money just before or in the early years or retirement.

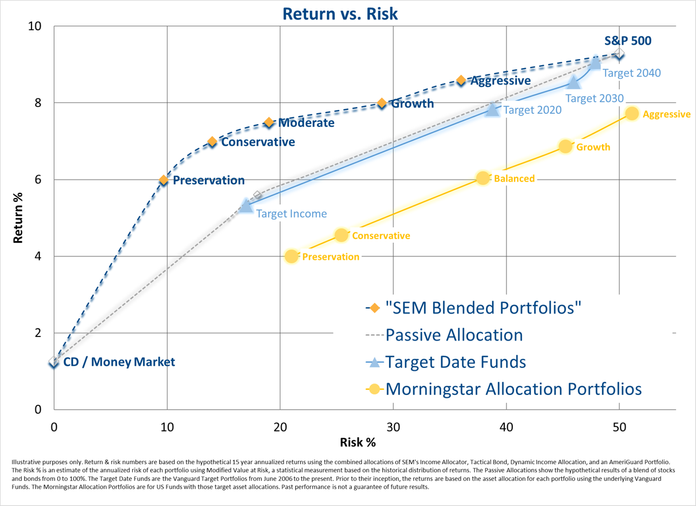

Investing is supposed to be about capturing as much return as possible within the stated risk tolerance parameters. This is either determined by the client’s financial plan or the client’s comfort level with risk. The easiest way to picture this is to look at a risk/return chart, with downside risk on the bottom of the chart. This chart shows a linear relationship inside the Morningstar Allocation Portfolios and the Target Date Funds. While the Target Date funds appear to be significantly better than the Morningstar Allocation Portfolios, the data shows the value of SEM’s Scientifically Engineered Models. Those sample blends at the top of the chart are a combination of our Tactical, Dynamic, and AmeriGuard portfolios.

The real key is how much value SEM’s portfolios have brought for those investors who cannot stomach or afford losses in excess of 30%. In my experience the last 20 years, most people fall into this category. If you would like a free portfolio review of your current holdings, whether they are Target Date funds or not, drop me a note.