The time around Christmas and New Years can be stressful for many people. Thankfully for me, my wife is well organized and takes care of most of the holiday prep work throughout the year. Our workload at SEM is always much busier, but our systematized approach and heavy use of

Tag: Risk Management

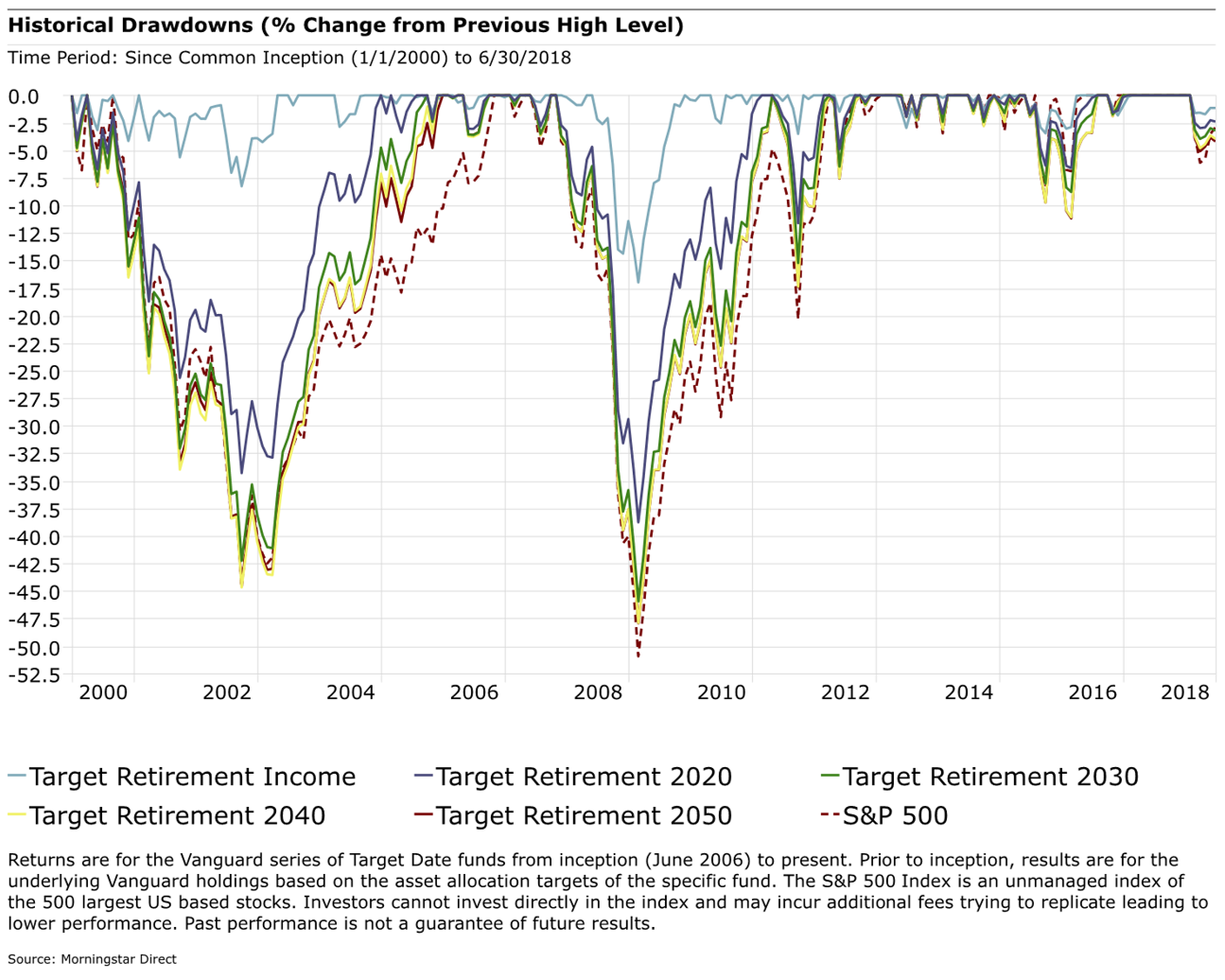

I realize in a 9-year old bull market talking about risk management will not generate a lot of clicks to our site. For whatever reason, the past few weeks have seen a large number of portfolio reviews from prospective clients that included “Target Date” funds. These funds have

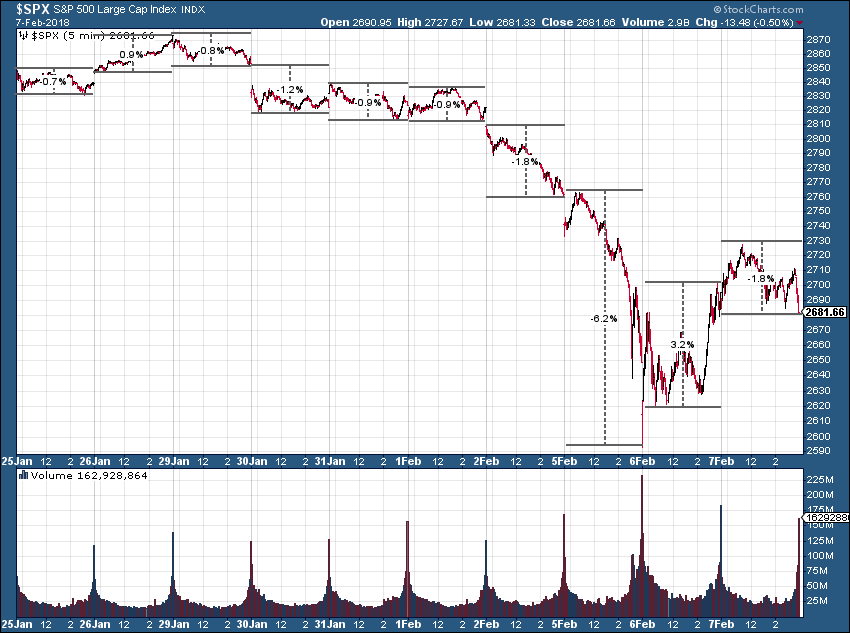

A couple weeks ago when the market “crashed”, falling 10%+ in less than 8 days I introduced an analogy to describe what happened:

Too many people were speeding

The analogy I often use is this. If you’re on a road trip, you may decide

[Scroll to bottom for latest update]

Another Hollywood script was being written for Tom Brady & the New England Patriots. Down by 5 with under 3 minutes to play. Most people expected the Patriots to drive down the field, score a touchdown and claim their 6th Super Bowl victory.

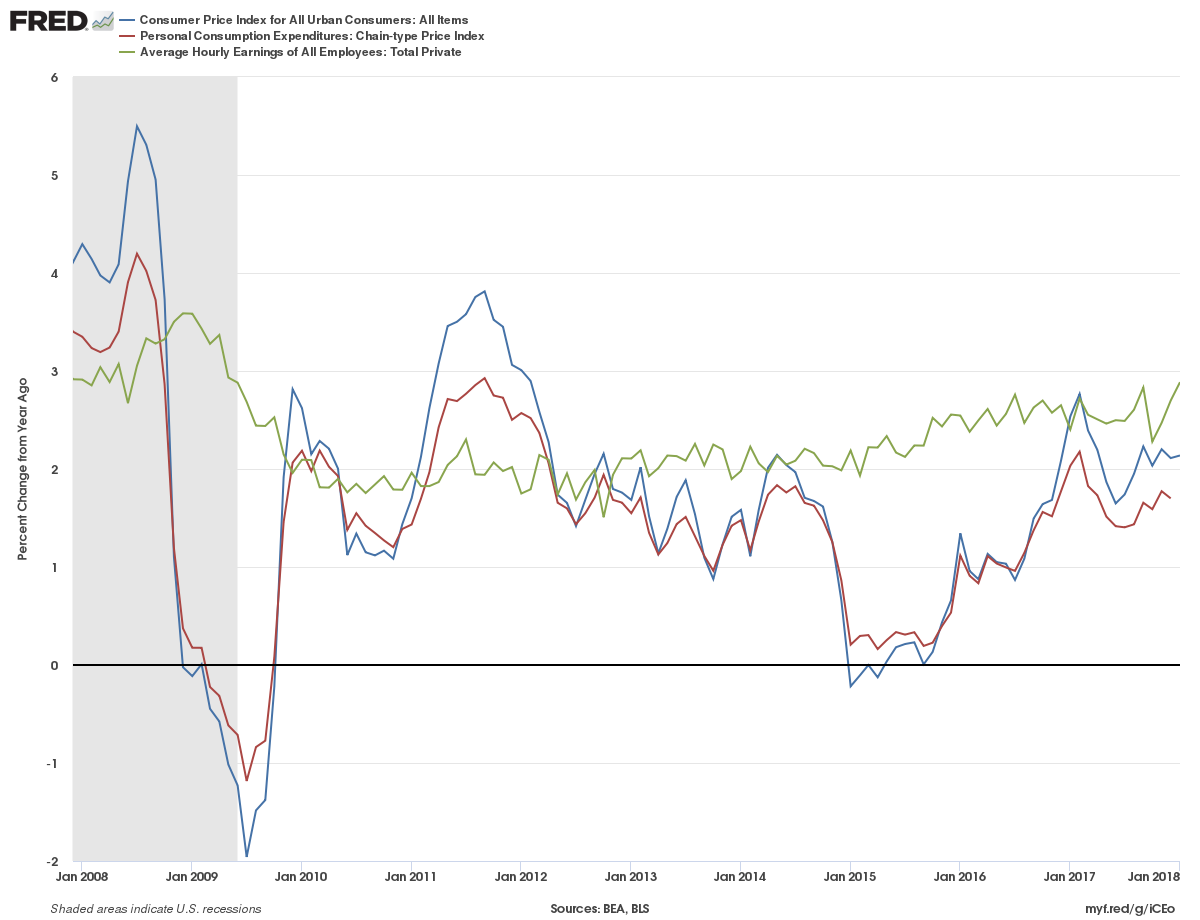

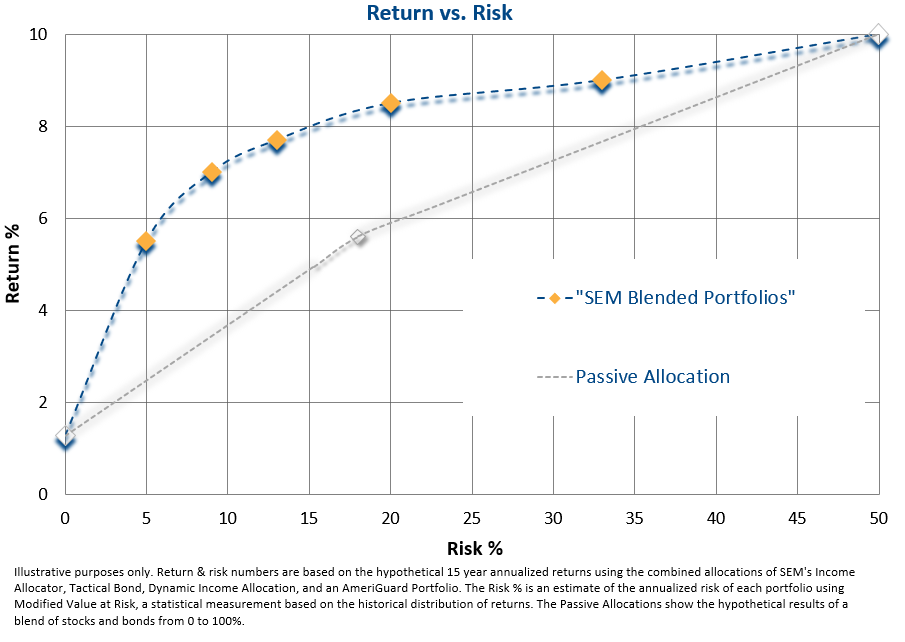

One of the fundamental laws of investing is the more return you seek, the more risk you must take on. While short periods of time may make it appear this law is no longer in place, over the long-run it always ends up being true. The longer the bull market