Being human means we are not always completely rational. There is nothing wrong with that. This is what makes life interesting and makes each person unique. If everyone behaved rationally we would have a world full of robots. When it comes to investing, however, our natural human traits can cause us to receive far lower returns than a completely rational person would.

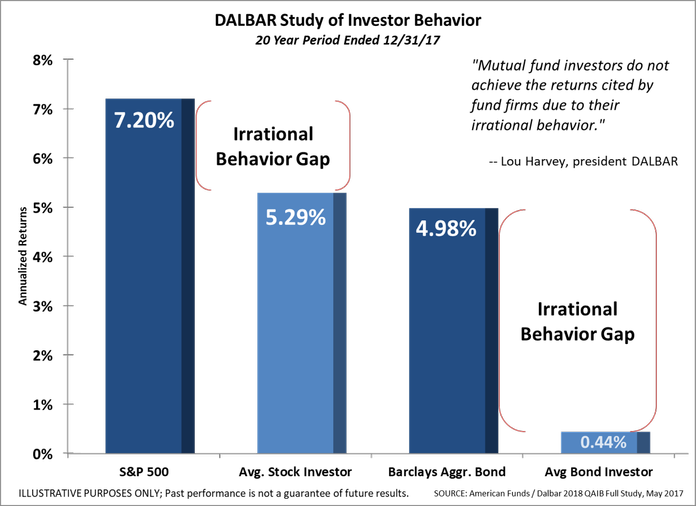

The Dalbar study of Investor Behavior was recently updated. As has been the case every year I’ve looked at it the average investor continues to lag a buy & hold benchmark. The reason is simple — we as humans are not always completely rational. When markets start falling it is human nature to want to protect their assets. Ultimately most people end up bailing at the wrong time. Conversely, for those out of the market, they typically wait until very late in the bull market cycle to jump back into the market.

What is even more astounding is the gap for fixed income investors. This is likely due to the same emotions that cause most people to sell stocks and buy bonds at inopportune times then waiting for too long to reverse that move.

SEM’s Behavioral Approach to Investing is designed to help overcome our natural biases by designing portfolios to meet each client’s specific risk personality. It may not always be exciting, but it is important to have somebody on your side allowing you to be human.

We recently hosted a webinar discussing ways to overcome these biases. Click here for the link to the replay.