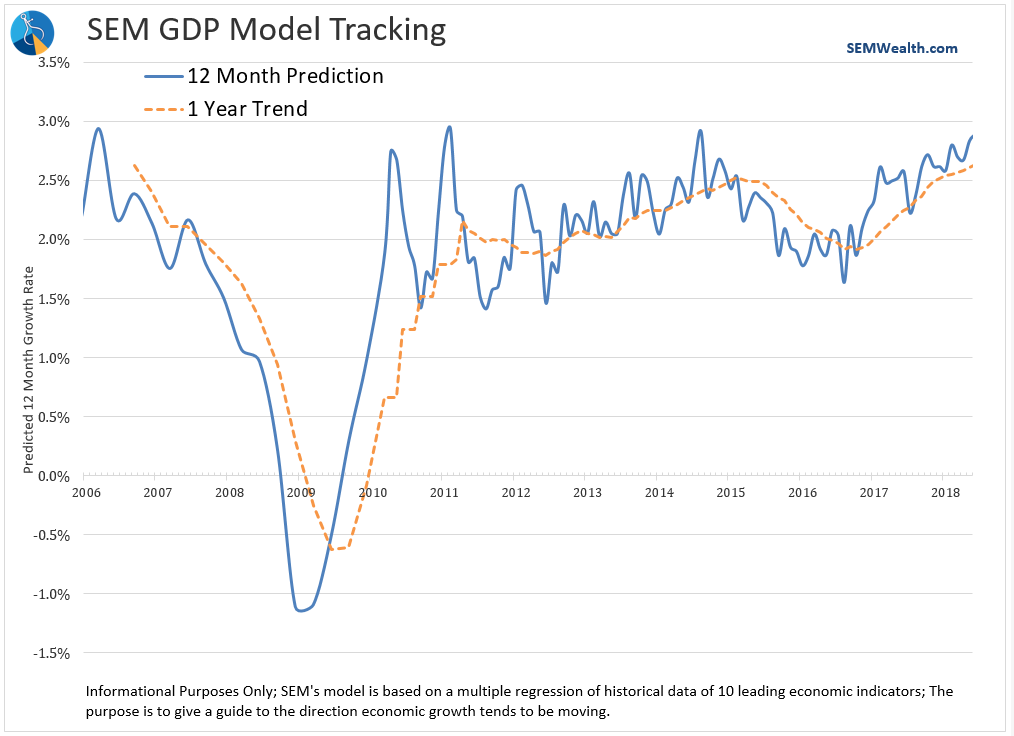

It seems the only thing the market focused on in June was the impact the heated trade talks was having on the economy. Each day seemed to have a fresh warning about the damage the Trump Administration’s trade policies would do to our economy. While it will take time to filter through a $17 Trillion economy, the economic data included in SEM’s economic model is picking-up steam. What is really interesting about this is the fact the “soft” or survey based data included in our model accelerated in June. This data, which is a leading, leading indicator (since it can adjust rapidly) does not show any impact on the underlying economy so far.

When something as emotional as the term “trade war” is floating around we as humans tend to not think well. The best way to overcome emotional reactions is to use the data. With new tarriffs going into effect this week, we should expect a renewed focus on the impact this will have on the economy. We’ve attempted to give you some perspective in these recent posts:

-

A Necessary War? – a look at the bigger picture issues the Trump Administration is attempting to address

-

How Trade Impacts the Economy – a quick glimpse at the total impact exports & imports have on the overall economy (hint: it’s quite small)

-

Trade Wars – a short video explaining why the market is so concerned about a trade war

-

Tariffs: The Expected Unexpected – An interesting take from my son Cody (a millennial) who is new to our industry.

At SEM, our Behavioral Approach to investing means focusing on the data. SEM’s economic model is the key driver of the asset allocation in our Dynamic Programs. With the pick-up in data in June the allocation of these programs shifted from “neutral” (meaning an allocation that matches the benchmark) to “growth” mode. If the model is right, riskier assets such as small cap stocks in our Dynamic Aggressive Growth model or dividend growth stocks in our Dynamic Income model should thrive. Of course the nice thing about using these Scientifically Engineered Models is they can always shift to more defensive allocations should the data weaken.

We will not know until years down the road the outcome the shift in our trade policies will have on our economy. We have survived the last 26 years by leaving the opinions to the “experts” and doing what matters most — taking the DATA in the current environment and adjusting our allocations accordingly.