Leading up to the Super Bowl there has been an exhaustive discussion on the success of Patriot’s coach Bill Belichick (appearing in his 8th Super Bowl as head coach & 10th overall. He’s won 5 as a head coach & 2 more as an assistant). One side of the argument has been that the success of Belichick is due to his star quarterback Tom Brady, who has been the starting QB in all of his Super Bowl appearances as head coach. Others have argued Brady’s success is entirely owed to his head coach being Belichick. [My take is both are individually skilled in their given roles. They have used those skills to their advantage and have been able to pull everyone around them to a higher level.]

What does this have to do with investing? At this stage in the bull market we are hearing many people asking what value their advisor brings to the relationship. The longer stocks go up, the more investors say they do not need assistance with their portfolios. Vanguard has been one of the most vocal proponents of warning investors to watch the fees they are paying and to utilize a passive, “buy & hold” approach. Over the weekend I read an article that said, “Vanguard CEO says Advisors’ Jobs are in Jeopardy.

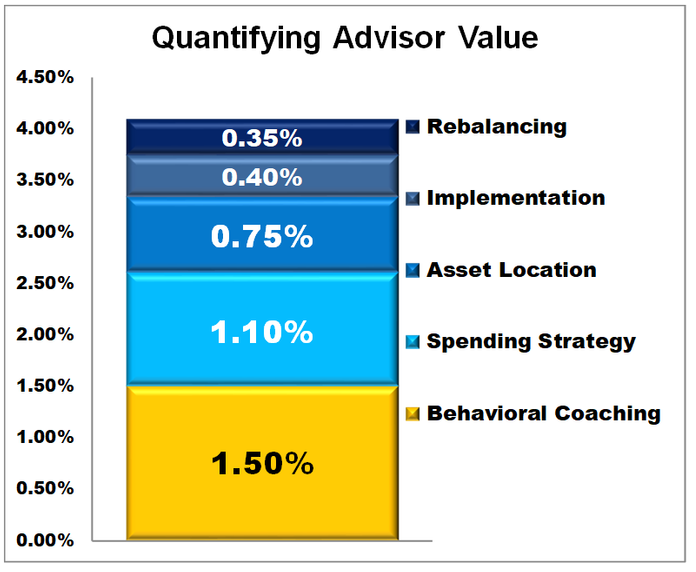

You may be surprised to hear I agree with his assessment. One of the major contributors in our re-branding the last two years has been a shift to a “Behavioral Approach to Investing”. I firmly believe finding ways to overcome both individual clients and their advisors’ behavioral biases is critical to the long-term success of any financial plan. Vanguard went as far as quantifying the value an advisor brings to the client relationship on an annualized basis.

As you can see, the largest value an advisor brings is in “behavioral coaching”. SEM’s platform at Trust Company of America is designed to provide this in an easy to use fashion. We can adapt every portfolio to a specific client’s risk tolerance, objectives, & personal behavioral biases. At SEM we work with the advisors to implement a spending strategy in the most appropriate mix of models. The other items in Vanguard’s list above are all included in our TCA platform.

All told, Vanguard estimates the value of a full-service Advisor at 4.1% per year. Over a 30 year investment horizon, that can add $233,827 on an initial $100,000 investment! Even just the “behavioral coaching” value adds an additional $56,000 on a $100,000, 30 year investment. SEM’s behavioral approach to investing gives both our clients and advisors an opportunity to achieve significantly higher returns.