No Reason to Panic

Investors don’t like surprises. Especially when everybody was having such a good time. In January our lead article was titled “Party Like It’s 1999!” We discussed the extreme valuations in the market and the euphoria we saw creating significant amounts of risk in the market. We of course did not expect a global pandemic to literally shut down the economy, but we did expect some sort of exogenous shock to cause the market to panic at some point. That’s just how the market works.

We’re obviously not medical experts, but we don’t need to be. We are being bombarded by financial analysts telling us how this is going to play out. We respectfully ignore their advice and do what we always do — follow the data and the trends. We’ve had quite a few “unprecedented” events in the history of SEM and every time our data-based quantitative approach has helped us navigate the on-going panic that was occurring at the time.

Thus far this “unprecedented” event has again proven the value of our Scientifically Engineered Models. There is no reason to panic, but this is something we are watching closely. For the latest information, stay tuned to SEMTradersBlog.com.

The Value of a Bucket Strategy

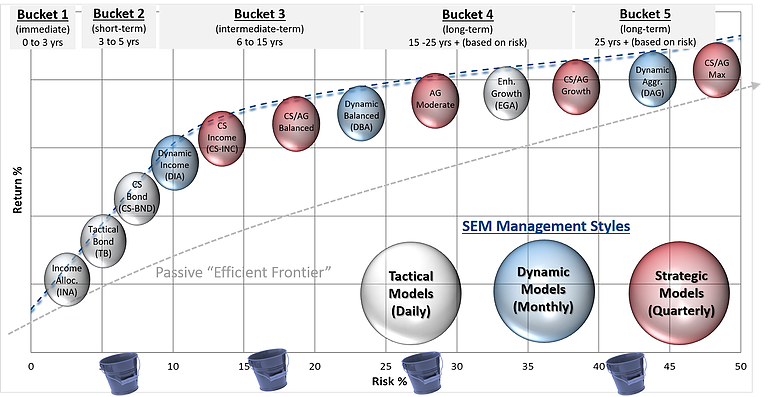

Separating your investments into “buckets” is a valuable way to keep your investments on track regardless of the market environment. SEM has a wide-range of investment models that can be incorporated, each of them filling a different role in the overall financial plan. When we go through a market panic such as what we saw in the first quarter, having your shorter-term money in models which have lower risk (or the ability to quickly move to the sidelines) allows you to stick to your longer-term investments. While our longer-term models do have mechanisms in place to take money out of the market, they are designed to stay invested as much as possible. If you’re unsure of where each model fits in your overall plan or if you’d like SEM to take a look at your current investment portfolio, go to risk.semwealth.com

Huge Opportunities Ahead!

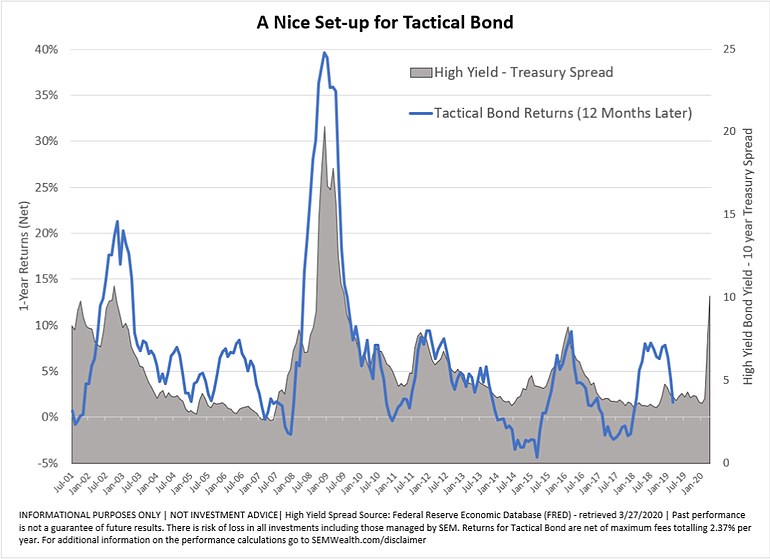

For several years in this newsletter (and in our blog) we’ve said, “your starting point matters.” We were referring to the concept of how the valuation of an investment determines the long-term returns for that investment. Stocks were significantly overvalued as we entered 2020 (and remain so even after the 1st quarter sell-off). The same is true for bonds, especially high yield bonds. The best measure of valuation for bonds is the difference in yield between the bond and Treasury bonds.

As recently as the end of January, you only would have received 3% more yield for owning junk bonds versus Treasury Bonds. As of this writing, junk bond yields are now 10% higher than Treasury Bonds! We do not recommend buying and holding these bonds. Inside our Tactical Bond and Income Allocator models , we allocate to high yield bonds when the trends are favorable, and when they reverse we sell them and move to lower risk investments such as money market funds.

While the spread can certainly go higher depending on how long and how large the economic impact of the COVID-19 pandemic ends up, the chart below illustrates the increasing potential for Tactical Bond (and a lessor extent Income Allocator and Dynamic Income) has to make some significant gains over the next year. The larger the spread, the more potential gains we have. The opportunity can come quickly, so we encourage everyone to speak to their advisor about this key portion of your investment portfolio. As always, for the most up-to-date information on the current market environment and our models go to SEMTradersBlog.com.

Download / Print version of the newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money. To learn more about ENCORE Portfolios, please contact your financial advisor.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Program Reports for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.